Irs Wisp Template

Irs Wisp Template - Get 5 free irs wisp templates to simplify tax reporting, including worksheets, income statements, and expense trackers, making tax preparation and planning easier with these. Secure your tax practice with a free wisp template! Irs publication 5708 pdf is the official wisp template. The irs also recommends tax professionals create a data theft. The sample written information security plan (wisp) pdf provides a starting point for businesses. Allows auditable electronic signoffs as required; Or, rather than spend billable hours creating a wisp, our security experts can create one for you. Download a free wisp template! To get the most out of this process, we recommend setting aside. Creating a written information security plan or wisp is an often overlooked but critical component. One often overlooked but critical component is creating a wisp. Wisp builder starts with an editable security summit template that contains essential elements, all ready to create your firm’s irs wisp! Creating a written information security plan or wisp is an often overlooked but critical component. According to the irs, a good wisp focuses on three areas: The irs also recommends tax professionals create a data theft. The wisp has been updated and expanded to. Verito’s wisp template provides a structured framework that ensures consistency throughout the plan, helping you meet the necessary compliance standards and reduce the risk of overlooking. Security issues for a tax professional can be daunting. The summit team worked to make this document as easy. Irs publication 5709 is a summary flyer designed to be shared within the tax professional. If you’re ready to get started, download the free wisp template to create your plan. The irs also has a wisp template in publication 5708. It can be scaled for a company's size, scope of activities, complexity and. Wisp builder starts with an editable security summit template that contains essential elements, all ready to create your firm’s irs wisp! Not. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Allows auditable electronic signoffs as required; The special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax & accounting. Creating a written information security plan. Learn the essentials of a written information security plan, irs compliance, and how to protect client data effectively. The summit team worked to make this document as easy. The special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax & accounting. We’ve developed a comprehensive wisp. This wisp is crafted from the official template released in irs publication 5708, so you can trust it’s reliable and effective. According to the irs, a good wisp focuses on three areas: Having a wisp protects businesses and. Tax pros need a written information security plan (wisp) for irs compliance and data protection. Irs publication 5708 pdf is the official. Wisp builder starts with an editable security summit template that contains essential elements, all ready to create your firm’s irs wisp! Detecting and managing system failures. The irs also has a wisp template in publication 5708. According to the irs, a good wisp focuses on three areas: Want to ensure your wisp meets all necessary requirements? To that end, tech 4 accountants offers a free, customizable. If you’re ready to get started, download the free wisp template to create your plan. Having a wisp protects businesses and. Learn the essentials of a written information security plan, irs compliance, and how to protect client data effectively. The irs also recommends tax professionals create a data theft. Creating a written information security plan or wisp is an often overlooked but critical component. Not only is a wisp essential for your business and a good business practice, the. Having a wisp protects businesses and. Want to ensure your wisp meets all necessary requirements? To assist tax professionals, the security summit prepared a document providing guidance on creating a. The wisp has been updated and expanded to. Builds an editable irs wisp template using irs publication 5708; This wisp is crafted from the official template released in irs publication 5708, so you can trust it’s reliable and effective. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan.. Tax pros need a written information security plan (wisp) for irs compliance and data protection. Not only is a wisp essential for your business and a good business practice, the. Detecting and managing system failures. Not only is a wisp essential for your business and a good business practice, the. This wisp is crafted from the official template released in. Discover a comprehensive guide on data security. Not only is a wisp essential for your business and a good business practice, the. Creating a written information security plan or wisp is an often overlooked but critical component. Houses user acknowledgement of your plan; Security issues for a tax professional can be daunting. Secure your tax practice with a free wisp template! The irs also has a wisp template in publication 5708. Security issues for a tax professional can be daunting. According to the irs, a good wisp focuses on three areas: If you’re ready to get started, download the free wisp template to create your plan. Want to ensure your wisp meets all necessary requirements? Download a free wisp template! Get 5 free irs wisp templates to simplify tax reporting, including worksheets, income statements, and expense trackers, making tax preparation and planning easier with these. Or, rather than spend billable hours creating a wisp, our security experts can create one for you. Creating a written information security plan or wisp is an often overlooked but critical component. One often overlooked but critical component is creating a wisp. We’ve developed a comprehensive wisp template for tax professionals that you can customize for your practice. Detecting and managing system failures. The irs also recommends tax professionals create a data theft. To get the most out of this process, we recommend setting aside. Discover a comprehensive guide on data security.Irs Wisp Template Download, It walks users through getting started on a

Irs Wisp Template Download, It walks users through getting started on a

Irs Wisp Template Download prntbl.concejomunicipaldechinu.gov.co

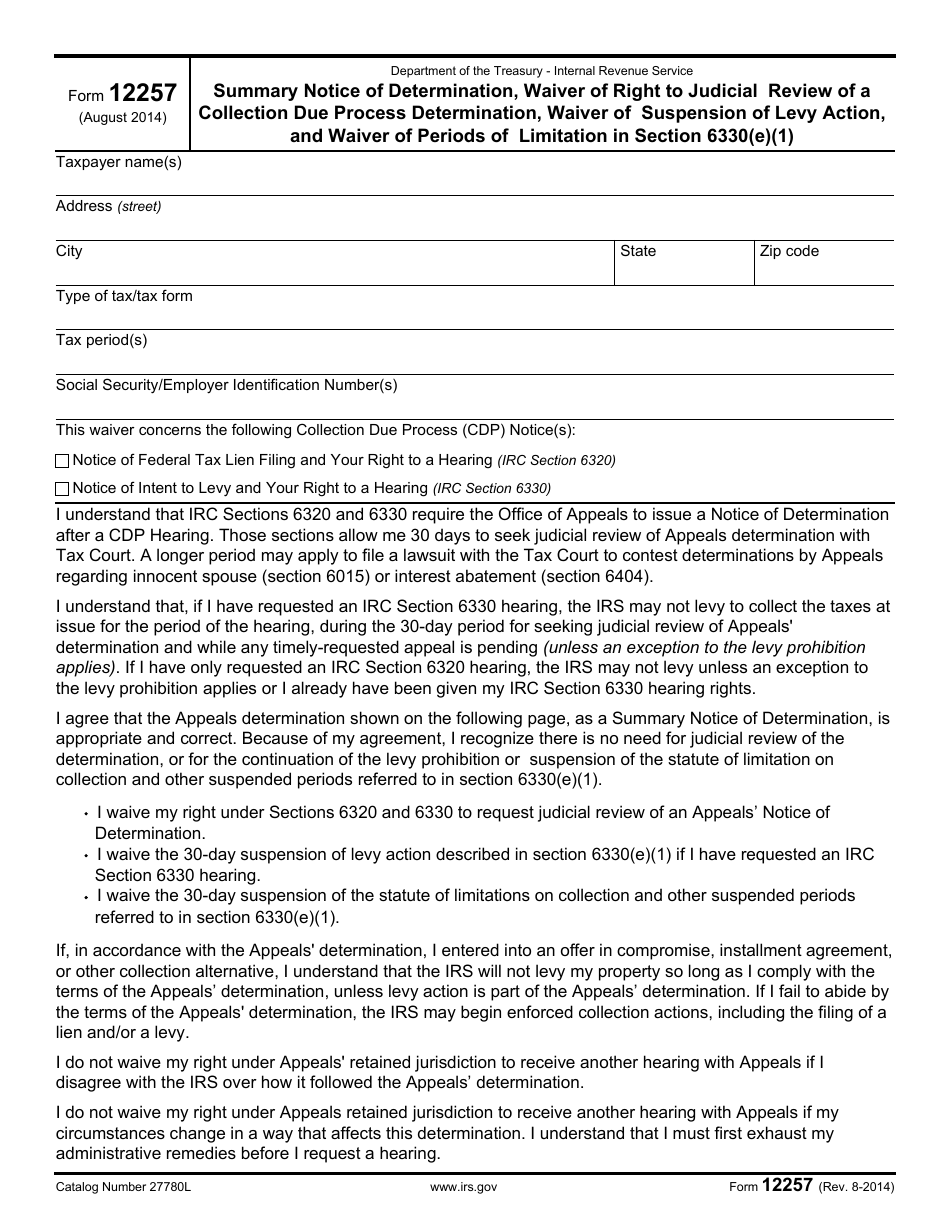

Irs Mandated Wisp Template Written Information Security Plan (wisp) For.

Creating A Solid Information Security Plan With The IRS WISP Template

Irs Mandated Wisp Template Written Information Security Plan (wisp) For.

Developing a WISP (Written Information Security Plan) A Comprehensive

Irs Wisp Template

Wisp Template Irs

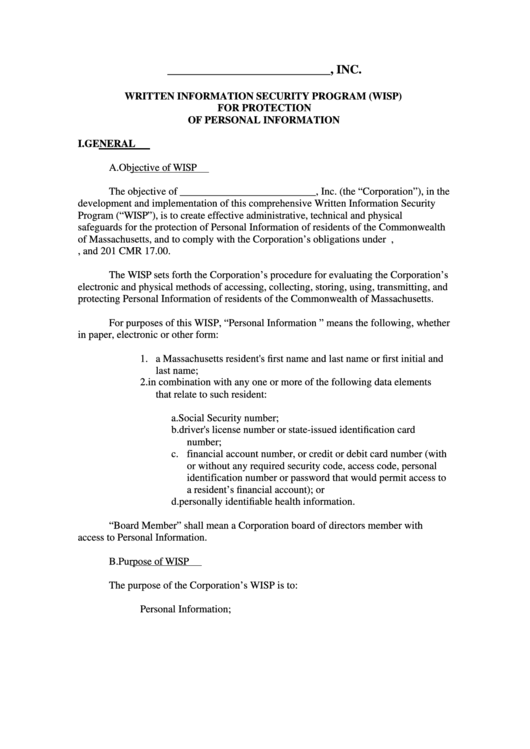

Written Information Security Program (Wisp) For Protection Of Personal

Allows Auditable Electronic Signoffs As Required;

Irs Publication 5708 Pdf Is The Official Wisp Template.

This Wisp Is Crafted From The Official Template Released In Irs Publication 5708, So You Can Trust It’s Reliable And Effective.

Publication 5708, Creating A Written Information Security Plan For Your Tax & Accounting Practice.

Related Post: