Company Valuation Template

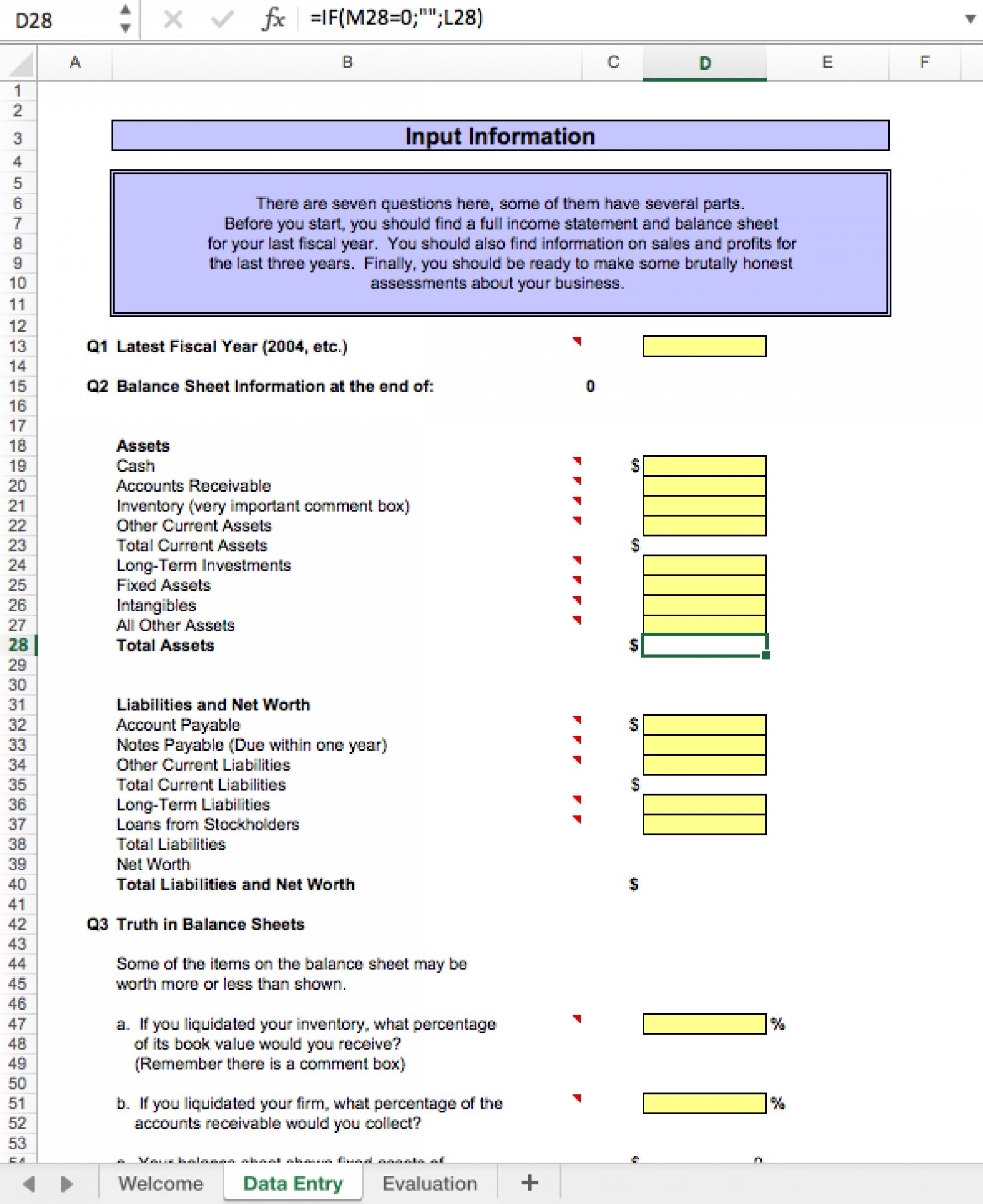

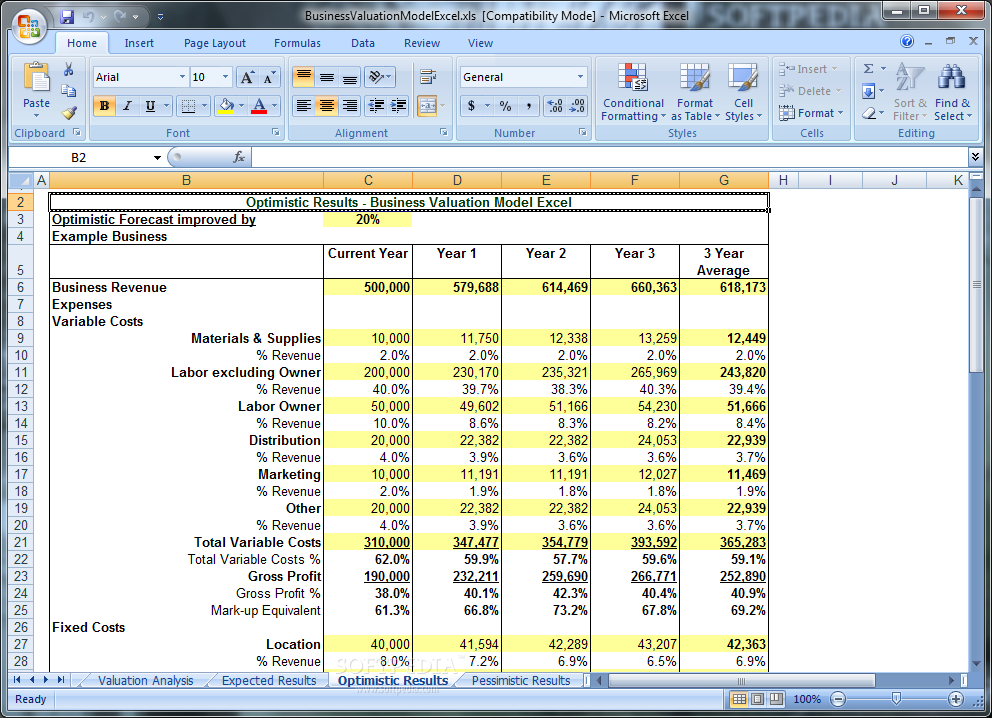

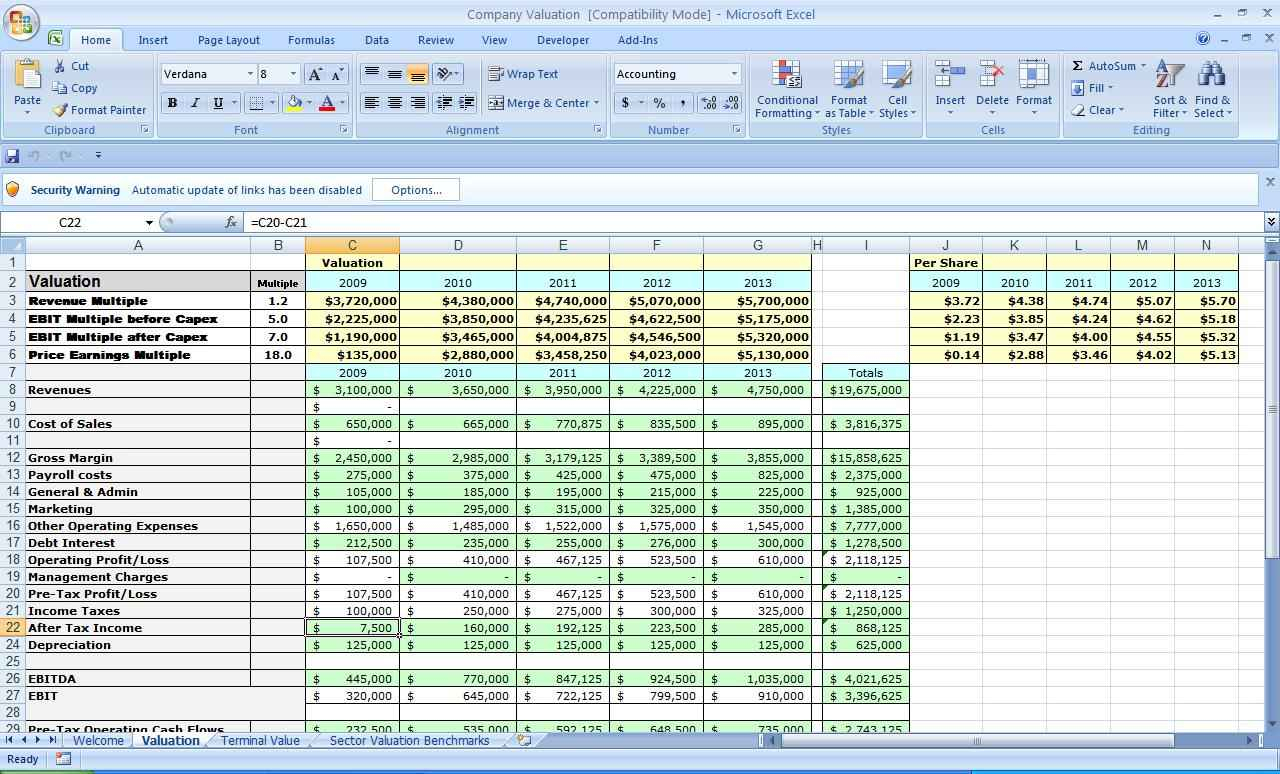

Company Valuation Template - The mission statement is generally more. Also, additional factors worthy of understanding a company's value are included in a typical. Unlock the potential of business valuation with sourcetable's innovative excel template generator. This powerful tool combines excel's functionality with chatgpt's ai capabilities, enabling. A mission statement explains the purpose of a business, while a value proposition describes how the business stands out to customers. Estimate the market value of a company, or company valuation, with this free excel template. Click here or visit valuadder.com for more information. Calculate an estimated valuation of a business or company based on the discounted cash flow method with the weighted average cost of capital as a discount rate. Identify a business' health and future based on profitability and other key metrics with our business valuation template for excel and google sheets. Sending our best wishes this valentine’s day and reaffirming our commitment to your goals. Download any of the given templates to your advantage. A business valuation template includes net income, sales, equity, and company cash flow. What to consider to get realistic. Business valuation is in editable, printable format. This post utilizes report templates that you can use in determining the value of your business. A mission statement explains the purpose of a business, while a value proposition describes how the business stands out to customers. Dcf analysis is a staple of financial modeling and can be performed with a basic. Calculate an estimated valuation of a business or company based on the discounted cash flow method with the weighted average cost of capital as a discount rate. Also, additional factors worthy of understanding a company's value are included in a typical. Estimate the market value of a company, or company valuation, with this free excel template. Also, additional factors worthy of understanding a company's value are included in a typical. Sending our best wishes this valentine’s day and reaffirming our commitment to your goals. Accounting document from southern new hampshire university, 31 pages, the walt disney company: The mission statement is generally more. The excel business valuation template provides an adaptable framework for the valuation of. A business valuation template includes net income, sales, equity, and company cash flow. Click here or visit valuadder.com for more information. Valuation modeling in excel may be performed by using existing templates or by creating a model from scratch. Customize and download this business valuation report. Also, additional factors worthy of understanding a company's value are included in a typical. Find examples of the company valuation method in excel here. This powerful tool combines excel's functionality with chatgpt's ai capabilities, enabling. Also, additional factors worthy of understanding a company's value are included in a typical. What to consider to get realistic. Business valuation is in editable, printable format. Click here or visit valuadder.com for more information. This powerful tool combines excel's functionality with chatgpt's ai capabilities, enabling. Unlock the potential of business valuation with sourcetable's innovative excel template generator. This post utilizes report templates that you can use in determining the value of your business. The file accommodates calculations for up to five. What to consider to get realistic. This powerful tool combines excel's functionality with chatgpt's ai capabilities, enabling. This post utilizes report templates that you can use in determining the value of your business. Identify a business' health and future based on profitability and other key metrics with our business valuation template for excel and google sheets. Accounting document from southern. Estimated company value after a theoretical 20% equity. A business valuation template includes net income, sales, equity, and company cash flow. Business valuation nadia dante southern new hampshire university acc. Customize and download this business valuation. This powerful tool combines excel's functionality with chatgpt's ai capabilities, enabling. Dcf analysis is a staple of financial modeling and can be performed with a basic. Estimated company value after a theoretical 20% equity. Business valuation is in editable, printable format. The excel business valuation template provides an adaptable framework for the valuation of proposed investments and business models by analyzing net present value,. A business valuation template includes net income,. Estimate the market value of a company, or company valuation, with this free excel template. Identify a business' health and future based on profitability and other key metrics with our business valuation template for excel and google sheets. The file accommodates calculations for up to five. Download any of the given templates to your advantage. Business valuation nadia dante southern. Download any of the given templates to your advantage. Valuation modeling in excel may be performed by using existing templates or by creating a model from scratch. Estimate the market value of a company, or company valuation, with this free excel template. This file enables you to effortlessly compute the estimated business valuation using net present value (npv) and projected. This post utilizes report templates that you can use in determining the value of your business. This file enables you to effortlessly compute the estimated business valuation using net present value (npv) and projected annual cash flow. We value your business and look forward to achieving great things together. Dcf analysis is a staple of financial modeling and can be. This powerful tool combines excel's functionality with chatgpt's ai capabilities, enabling. Unlock the potential of business valuation with sourcetable's innovative excel template generator. The file accommodates calculations for up to five. Find examples of the company valuation method in excel here. Estimated company value after a theoretical 20% equity. A business valuation template includes net income, sales, equity, and company cash flow. What to consider to get realistic. Business valuation nadia dante southern new hampshire university acc. Download any of the given templates to your advantage. This file enables you to effortlessly compute the estimated business valuation using net present value (npv) and projected annual cash flow. Sending our best wishes this valentine’s day and reaffirming our commitment to your goals. Valuation modeling in excel may be performed by using existing templates or by creating a model from scratch. We value your business and look forward to achieving great things together. The mission statement is generally more. Customize and download this business valuation. The excel business valuation template provides an adaptable framework for the valuation of proposed investments and business models by analyzing net present value,.Business Valuation Template Excel Free Printable Templates

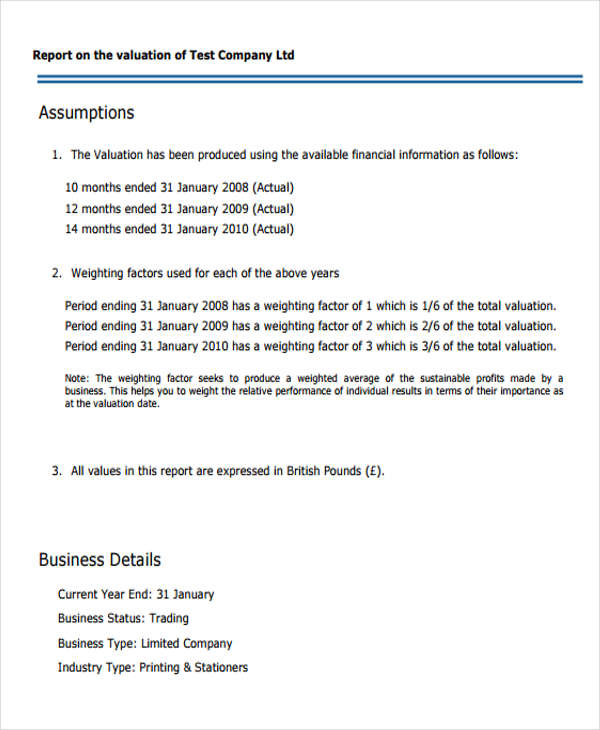

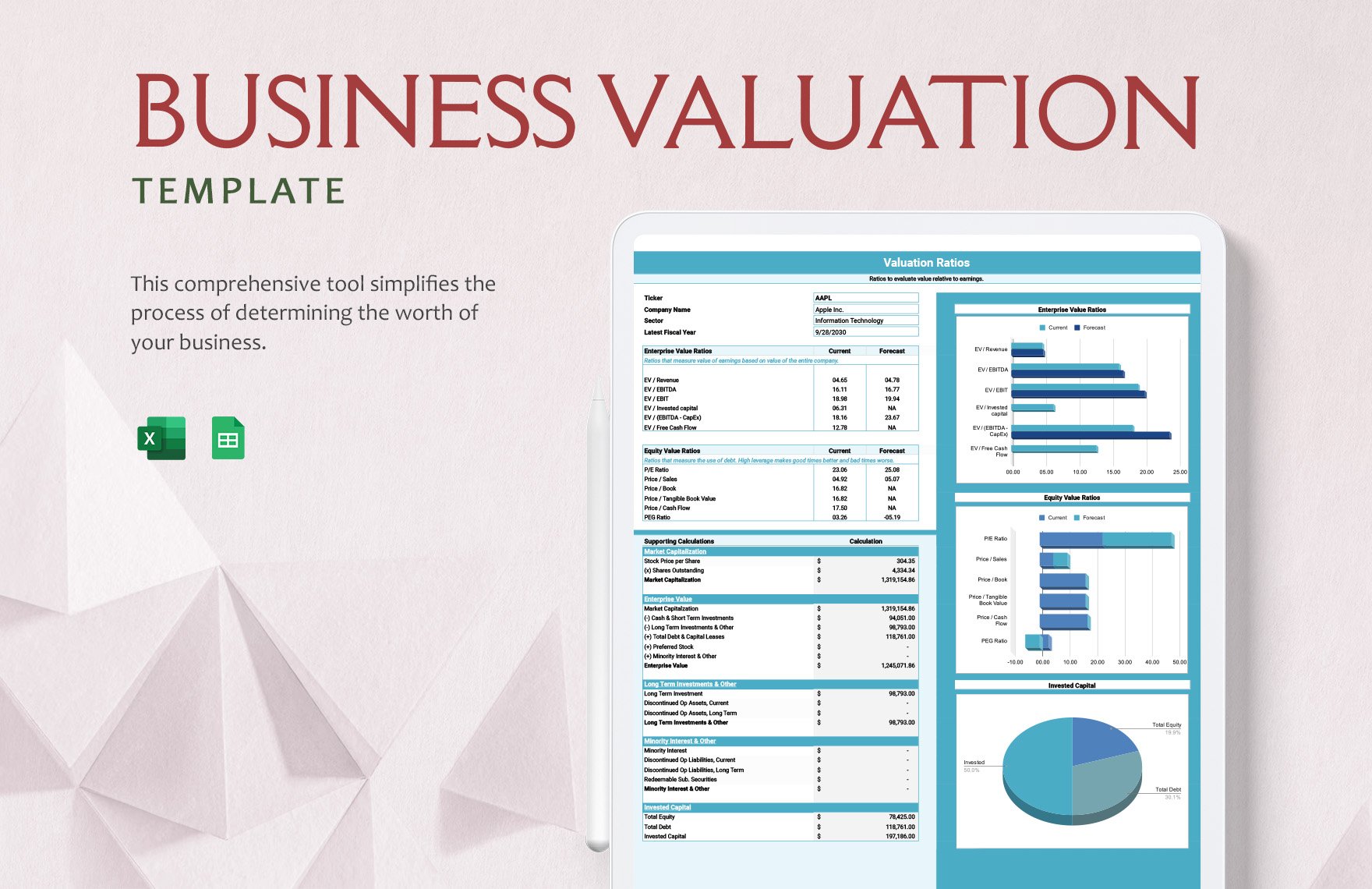

Business Valuation Report Template

Business Valuation Excel and Google Sheets Template Simple Sheets

Business Valuation Excel Template

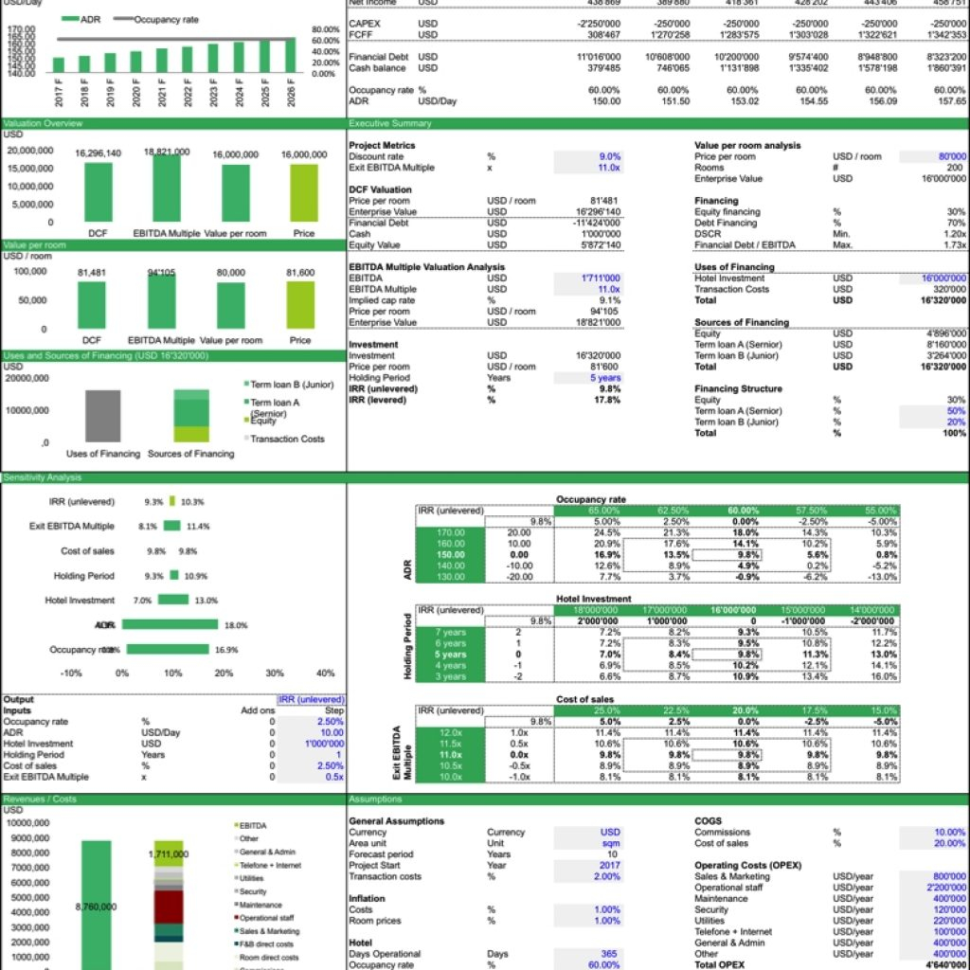

Company Valuation Excel Template Oak Business Consultant

Business Valuation Model Excel Free Download Printable Templates

12 Business Valuation Excel Template Excel Templates

Valuation Report Templates 17+ Free Word, PDF, Apple Pages, Google

Company Valuation Excel Spreadsheet —

Business Valuation Template in Excel, Google Sheets Download

This Is A Sample Business Valuation Report Created By Valuadder® Business Valuation Report Builder.

Enhance This Design & Content With Free Ai.

Calculate An Estimated Valuation Of A Business Or Company Based On The Discounted Cash Flow Method With The Weighted Average Cost Of Capital As A Discount Rate.

This Is Your Estimated Company Value Before Any New Investment.

Related Post: