B Notice Template

B Notice Template - Before you go, you should call ssa so that they can explain what. Edit your first b notice form template word online. Then start using irs tin matching to verify tins before. You must have the irs or ssa validate your taxpayer. The irs has created publication 1288, which includes templates for the two b notices to send to your vendors. We have received notice from the internal revenue service (irs) twice within 3 years stating that the combination of the name and taxpayer identification number (name/tin combination) on. The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and the data held by the internal revenue service (irs) or. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Find out the differences between cp2100, cp2100a and 972cg notices, and the steps to. Up to 40% cash back send irs first b notice form template free via email, link, or fax. The irs has created publication 1288, which includes templates for the two b notices to send to your vendors. Before you go, you should call ssa so that they can explain what. Irs publication 1281, backup withholding for missing and incorrect names/tin(s), contains detailed information with respect to backup withholding and the “b”. Why your tin may be considered as incorrect. Learn how to send a 1099 irs b notice to your payees within 15 days if you receive a cp2100 or cp2100a notice from the irs. Up to 40% cash back send b notice template via email, link, or fax. Learn what an irs b notice is, why you may receive one, and how to respond to it. Find out what to do if your payees have. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Edit your first b notice form template word online. This notice contains a list of 1099 forms that. You are required to visit an ssa office, take this notice, your social security card, and any other related documents with you. Edit your first b notice form template word online. Why your tin may be considered as incorrect. You must have the irs or ssa validate your taxpayer. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Why your tin may be considered as incorrect?. No need to install software, just go to dochub, and sign up instantly and for free. You must have the irs or ssa validate your taxpayer. A b notice is. Find out what to do if your payees have. Learn how to send a 1099 irs b notice to your payees within 15 days if you receive a cp2100 or cp2100a notice from the irs. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Edit your first. We have received notice from the internal revenue service (irs) twice within 3 years stating that the combination of the name and taxpayer identification number (name/tin combination) on. Before you go, you should call ssa so that they can explain what. Edit your irs b notice template online. Find out what to do if your payees have. The first b. Learn what an irs b notice is, why you may receive one, and how to respond to it. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. We have received notice from the internal revenue service (irs) twice within 3 years stating that the combination of the. Then start using irs tin matching to verify tins before. Find out the differences between cp2100, cp2100a and 972cg notices, and the steps to. This notice contains a list of 1099 forms that. No need to install software, just go to dochub, and sign up instantly and for free. Learn how to send a 1099 irs b notice to your. No need to install software, just go to dochub, and sign up instantly and for free. A b notice is a message from the irs, usually arriving in september or october, in the form of irs notice cp2100 or cp2100a. Then start using irs tin matching to verify tins before. If you receive a third 2100 notice, you can ignore. We have received notice from the internal revenue service (irs) twice within 3 years stating that the combination of the name and taxpayer identification number (name/tin combination) on. Up to 40% cash back send b notice template via email, link, or fax. You can also download it, export it or print it out. You must have the irs or ssa. Why your tin may be considered as incorrect?. Edit your irs b notice template online. The irs has created publication 1288, which includes templates for the two b notices to send to your vendors. No need to install software, just go to dochub, and sign up instantly and for free. Irs publication 1281, backup withholding for missing and incorrect names/tin(s),. This notice contains a list of 1099 forms that. Report the withholding by january 31 on irs form 945. Irs publication 1281, backup withholding for missing and incorrect names/tin(s), contains detailed information with respect to backup withholding and the “b”. You can also download it, export it or print it out. Edit your first b notice form template word online. If you receive a third 2100 notice, you can ignore it if you. Find out what to do if your payees have. A b notice is a message from the irs, usually arriving in september or october, in the form of irs notice cp2100 or cp2100a. No need to install software, just go to dochub, and sign up instantly and for free. Up to 40% cash back send irs first b notice form template free via email, link, or fax. We have received notice from the internal revenue service (irs) twice within 3 years stating that the combination of the name and taxpayer identification number (name/tin combination) on. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Edit your irs b notice template online. Cancel anytime100% money back guaranteepaperless solutions Learn what an irs b notice is, why you may receive one, and how to respond to it. You can also download it, export it or print it out.B Notice Letter Fill Online, Printable, Fillable, Blank pdfFiller

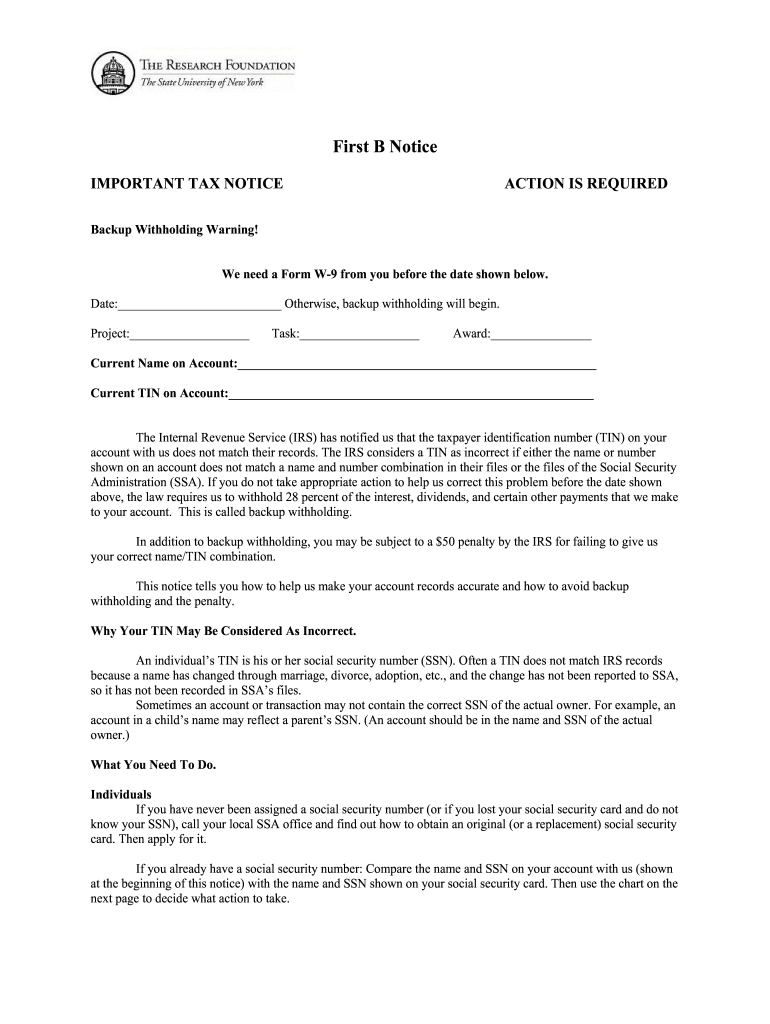

First B Notice Template

B Notice Form Complete with ease airSlate SignNow

Irs B Notice Template

1099 B Notice Template

B Notice Template

Professional First B Notice Template Word PDF Sample Tacitproject

TIN Verification, BNotices, and Backup Withholding Best Practices to

B Notice Template

Why Your Tin May Be Considered As Incorrect?.

Before You Go, You Should Call Ssa So That They Can Explain What.

Why Your Tin May Be Considered As Incorrect.

You Are Required To Visit An Ssa Office, Take This Notice, Your Social Security Card, And Any Other Related Documents With You.

Related Post: