Template Safe With Valuation Cap And Discount

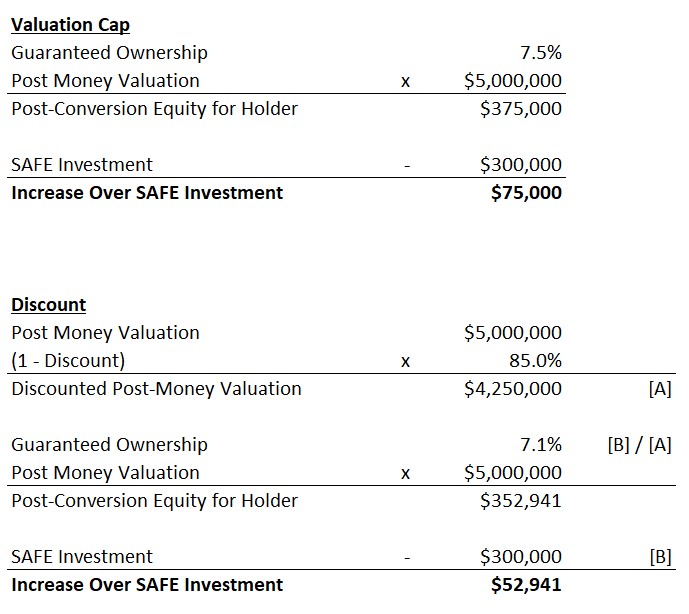

Template Safe With Valuation Cap And Discount - Safe notes can include a discount that is applied to a future valuation when it is time to convert. Safe, or simple agreement for future equity (also referred to as safe note), is a type of investment contract used by startups to raise capital from investors. You can have a safe note with/without a cap and a discount. There is a little switch which says “a cap is used”. In the case of a liquidation, the conversion of the safe is the same as a standard safe with a valuation cap and no discount rate. Discount rates typically range between 10% and 25%, and. It allows the safe investor to convert to equity at a discounted price in the course of a subsequent round of financing. Link to the cap discount: For whatever reason, removed between aug 13 and aug 26. Generally, safe notes have no maturity date and no interest rate. The valuation cap is a maximum valuation at which the safe can convert into equity. There is a little switch which says “a cap is used”. Safe, or simple agreement for future equity (also referred to as safe note), is a type of investment contract used by startups to raise capital from investors. Discount rates typically range between 10% and 25%, and. Safe notes can include a discount that is applied to a future valuation when it is time to convert. Link to the cap discount: Valuation caps imply that both sides have a rough understanding of a number of factors, including when a priced round is likely to happen,. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your seed round). For whatever reason, removed between aug 13 and aug 26. Generally, safe notes have no maturity date and no interest rate. An investor has bought a safe for $. Offer higher discount rates to investors;. It can also have a valuation cap that sets the. In the case of a liquidation, the conversion of the safe is the same as a standard safe with a valuation cap and no discount rate. Yes, i have a copy of it, but i'm. This specific template includes provisions related to the valuation. Safe, or simple agreement for future equity (also referred to as safe note), is a type of investment contract used by startups to raise capital from investors. Yes, i have a copy of it, but i'm. It allows the safe investor to convert to equity at a discounted price in the. The valuation cap is a maximum valuation at which the safe can convert into equity. Safe notes can include a discount that is applied to a future valuation when it is time to convert. Valuation caps imply that both sides have a rough understanding of a number of factors, including when a priced round is likely to happen,. In the. Discount rates typically range between 10% and 25%, and. Valuation caps imply that both sides have a rough understanding of a number of factors, including when a priced round is likely to happen,. You can have a safe note with/without a cap and a discount. In the case of a liquidation, the conversion of the safe is the same as. Valuation caps imply that both sides have a rough understanding of a number of factors, including when a priced round is likely to happen,. Use a cap if you can forecast valuation. Offer higher discount rates to investors;. It allows the safe investor to convert to equity at a discounted price in the course of a subsequent round of financing.. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your seed round). It allows the safe investor to convert to equity at a discounted price in the course of a subsequent round of financing. In the case of a liquidation, the conversion of the safe is the. An investor has bought a safe for $. In the case of a liquidation, the conversion of the safe is the same as a standard safe with a valuation cap and no discount rate. Link to the cap discount: It can also have a valuation cap that sets the. Yes, i have a copy of it, but i'm. This specific template includes provisions related to the valuation. Valuation caps imply that both sides have a rough understanding of a number of factors, including when a priced round is likely to happen,. Discount rates typically range between 10% and 25%, and. Yes, i have a copy of it, but i'm. If you don’t have a cap, then it will. It can also have a valuation cap that sets the. Use a cap if you can forecast valuation. Yes, i have a copy of it, but i'm. The valuation cap is a maximum valuation at which the safe can convert into equity. An investor has bought a safe for $. An investor has bought a safe for $. Yes, i have a copy of it, but i'm. Generally, safe notes have no maturity date and no interest rate. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your seed round). For whatever reason, removed between aug 13. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your seed round). There is a little switch which says “a cap is used”. This specific template includes provisions related to the valuation. Yes, i have a copy of it, but i'm. Generally, safe notes have no maturity date and no interest rate. Safe notes can include a discount that is applied to a future valuation when it is time to convert. An investor has bought a safe for $. They can help avoid fundraising gridlocks; Offer higher discount rates to investors;. Use a cap if you can forecast valuation. For whatever reason, removed between aug 13 and aug 26. Safe, or simple agreement for future equity (also referred to as safe note), is a type of investment contract used by startups to raise capital from investors. The valuation cap is a maximum valuation at which the safe can convert into equity. If you don’t have a cap, then it will always be a discount and vice versa. Link to the cap discount: It can also have a valuation cap that sets the.The Complete Guide to SAFEs Josh Ephraim Medium

SAFE Notes Explained Video, Guide, and Excel File

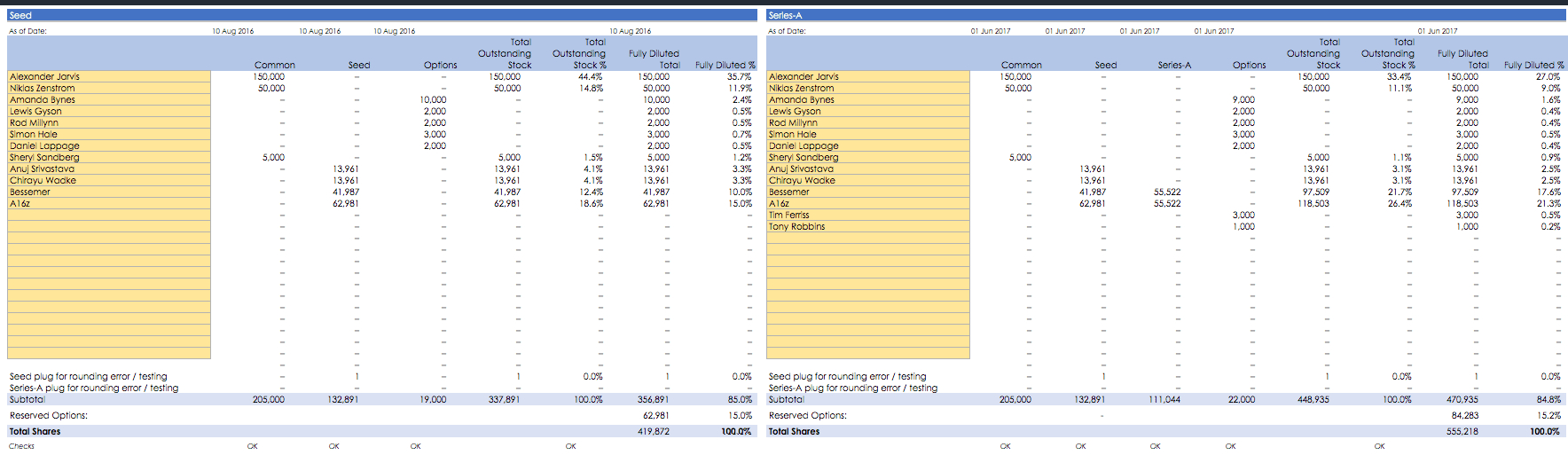

What is a cap table for a startup? [+ Free Google Sheets Template]

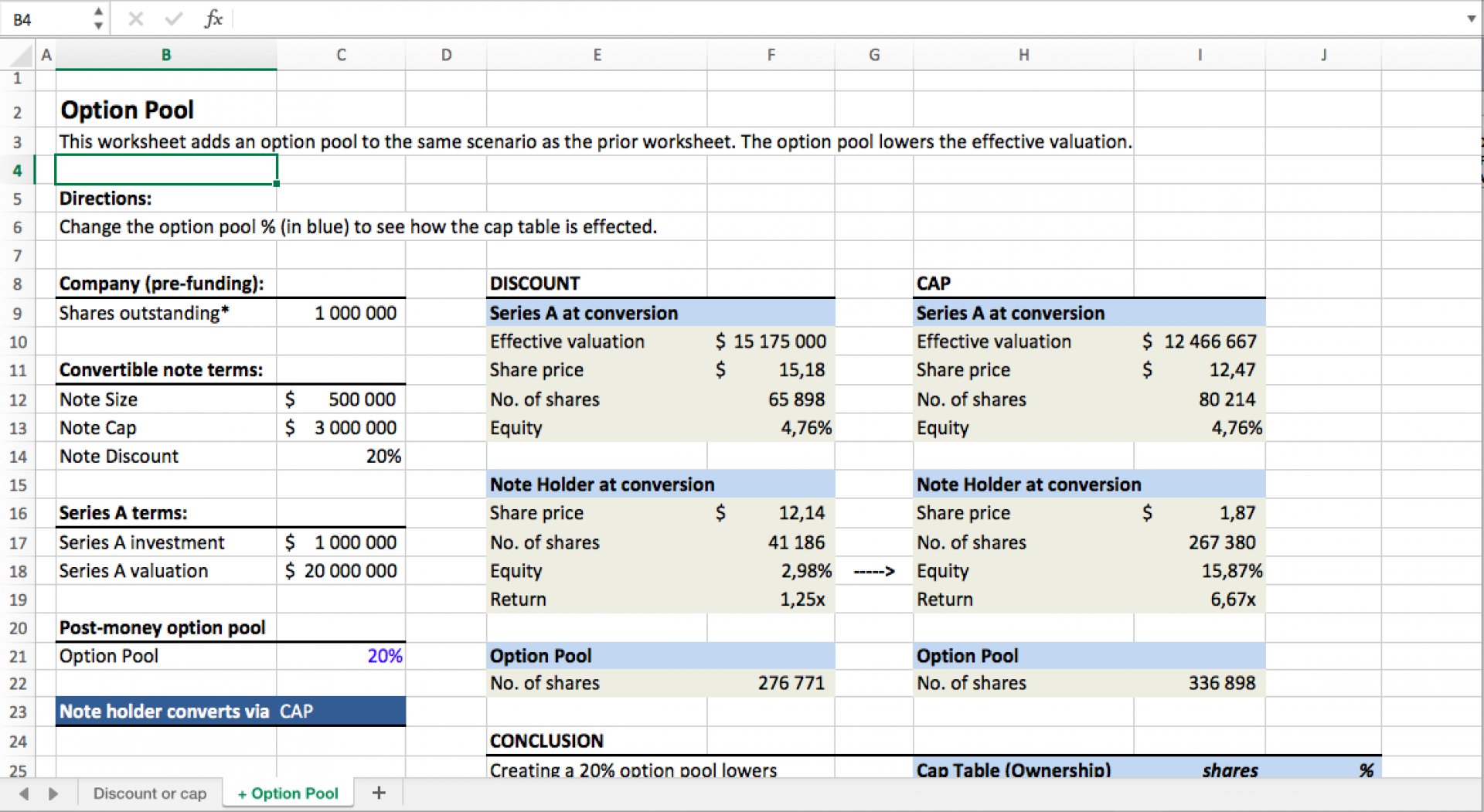

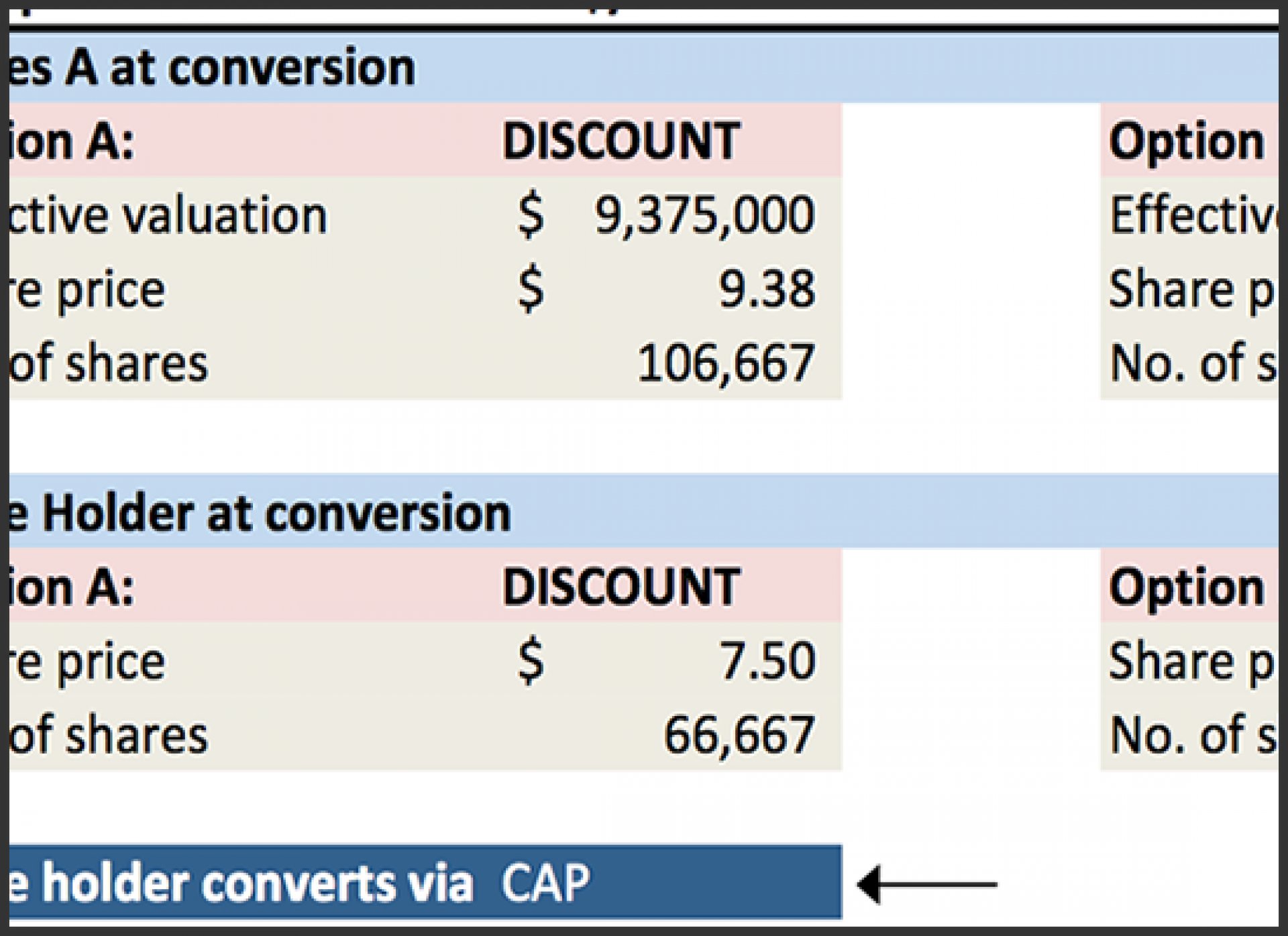

Note Discount Cap Worksheet Eloquens

Note Discount Cap Worksheet Eloquens

Understanding SAFEs and their Impact on 409A Valuation CLA

Post Money Safe Agreement Valuation Cap and Discount Doc Template

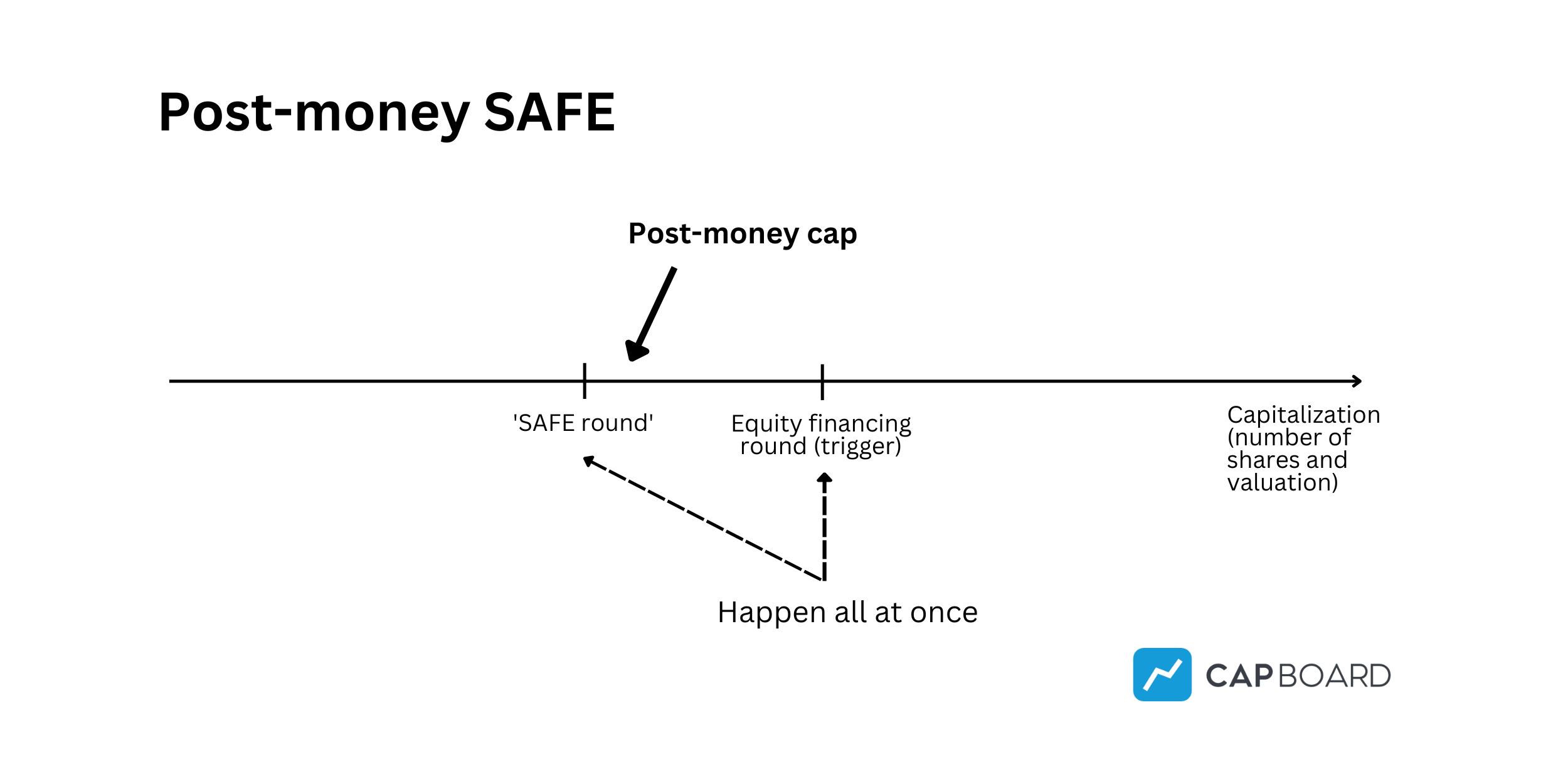

PreMoney SAFE vs PostMoney SAFE explanation and examples Capboard

How Convertible Notes Convert, Template David Kircos

Pre And Post Money Valuation Spreadsheet inside Ultimate Free Cap Table

You Can Have A Safe Note With/Without A Cap And A Discount.

Discount Rates Typically Range Between 10% And 25%, And.

In The Case Of A Liquidation, The Conversion Of The Safe Is The Same As A Standard Safe With A Valuation Cap And No Discount Rate.

The Valuation Cap Is A Maximum Valuation At Which The Safe Can Convert Into Equity.

Related Post:

![What is a cap table for a startup? [+ Free Google Sheets Template]](https://global-uploads.webflow.com/5e9451ac176f31e759c9fd0c/6343daf9456e3882177ae8ec_Cap Table Shareholdings.jpg)