Tax Donation Letter Template

Tax Donation Letter Template - When putting together an engagement letter for tax services, following some best practices can make the process. This customizable document, available for download in ms word and google docs formats,. We'll walk you through how to write a donation request letter and share. As nonprofits are faced with higher. When you make a charitable. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. Crafting a professional donation receipt can make all the difference in maintaining. It allows you to create and customize the draft of your receipt contents. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. Tips to write the perfect appeal letter and keep them donating. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. As nonprofits are faced with higher. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. When putting together an engagement letter for tax services, following some best practices can make the process. It allows you to create and customize the draft of your receipt contents. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Crafting a professional donation receipt can make all the difference in maintaining. Not only is it important to gain new donors for your cause, but it’s also key to keep the support of the donors you already. We will populate it automatically with all the necessary donation details and organization info. Not only is it important to gain new donors for your cause, but it’s also key to keep the support of the donors you already. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. It allows you to create and customize the draft of your receipt contents. Charity organizations, such. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. We'll walk you through how to write a donation request letter and share. Best practices for creating an engagement letter for tax services. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. This customizable document, available for download in ms word and google docs formats,. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. Using a (501)(c)(3) donation receipt template helps the donor captures all the. When putting together an engagement letter for tax services, following some best practices can make the process. As nonprofits are faced with higher. The donation receipt can be sent via email or postal mail. Donations to crs are tax deductible to the full extent allowable under the law. Not only is it important to gain new donors for your cause,. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. Tips to write the perfect appeal letter and keep them donating. In order for a donor to take a tax deduction for a contribution of $250 or more, the donor must receive a contemporaneous written acknowledgement of the donation from the organization. We'll walk you through how to. Not only is it important to gain new donors for your cause, but it’s also key to keep the support of the donors you already. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. In order for a donor to take a tax deduction for a contribution of $250 or more, the donor must receive a contemporaneous. We'll walk you through how to write a donation request letter and share. We will populate it automatically with all the necessary donation details and organization info. When you make a charitable. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. Best practices for creating an engagement letter for tax services. In order for a donor to take a tax deduction for a contribution of $250 or more, the donor must receive a contemporaneous written acknowledgement of the donation from the organization. As nonprofits are faced with higher. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. Donation receipts are quite simply the act. We'll walk you through how to write a donation request letter and share. Best practices for creating an engagement letter for tax services. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. The donation receipt can be sent via email or postal mail. Crafting a professional donation receipt can make all the difference in. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. This form provides details about the donated items,. As nonprofits are faced with higher. Here are some free 501(c)(3) donation receipt templates for you to. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. Not only is it important to gain new donors for your cause, but it’s also key to keep the support of the donors you already. When putting together an engagement letter for tax services, following some best practices can make the process. This customizable document, available for download in ms word and google docs formats,. Donations to crs are tax deductible to the full extent allowable under the law. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. Crafting a professional donation receipt can make all the difference in maintaining. Tips to write the perfect appeal letter and keep them donating. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. When you make a charitable. We'll walk you through how to write a donation request letter and share. We will populate it automatically with all the necessary donation details and organization info. As nonprofits are faced with higher. Best practices for creating an engagement letter for tax services. This form provides details about the donated items,. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions.13+ Free Donation Letter Template Format, Sample & Example

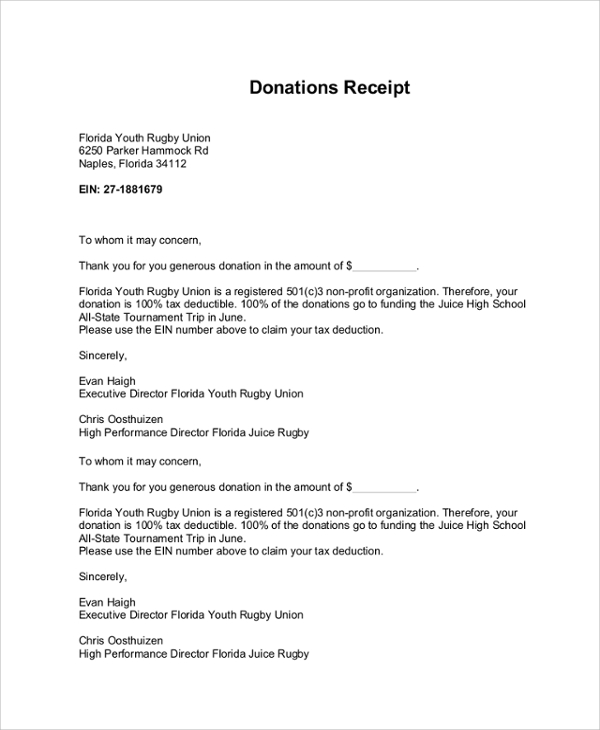

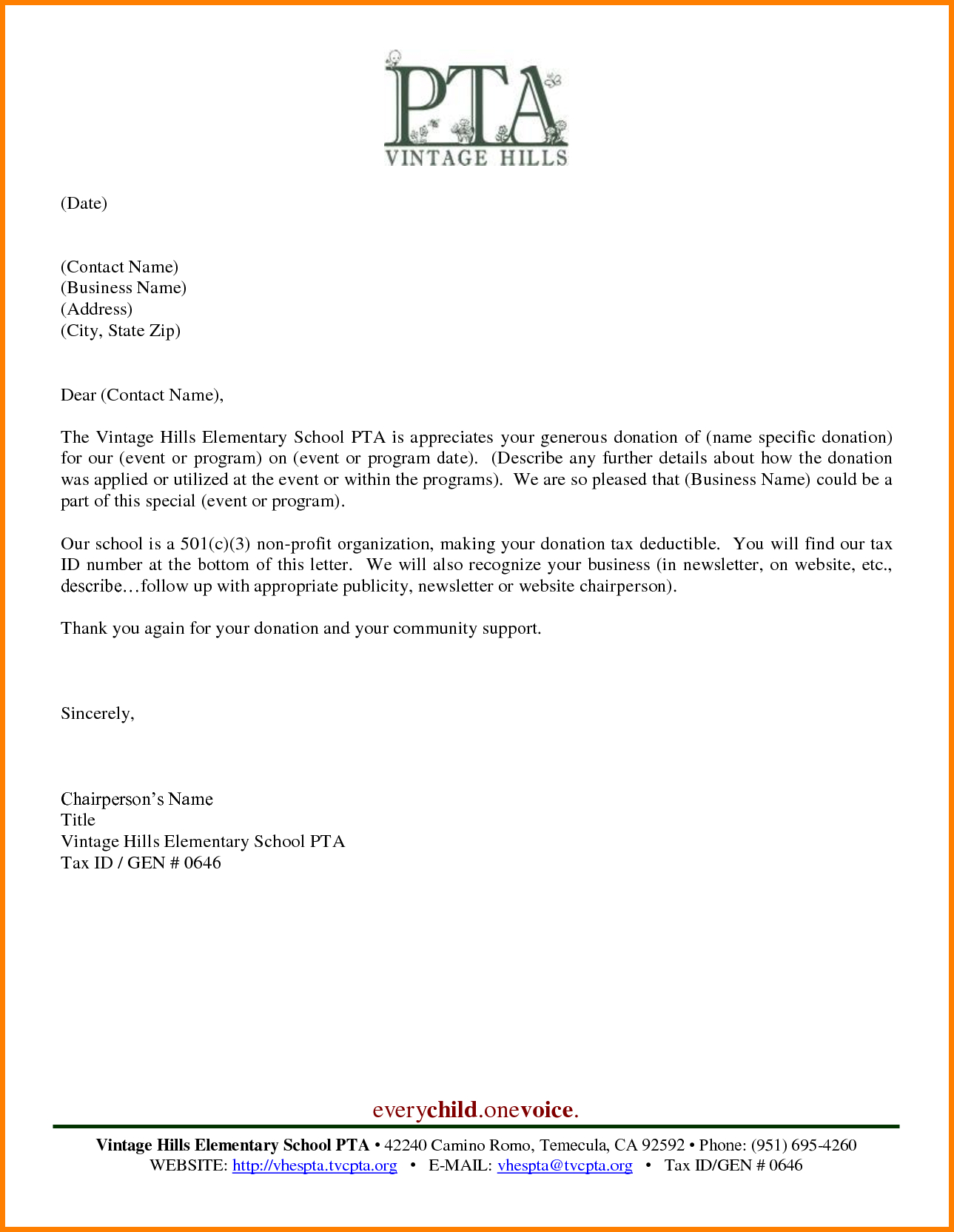

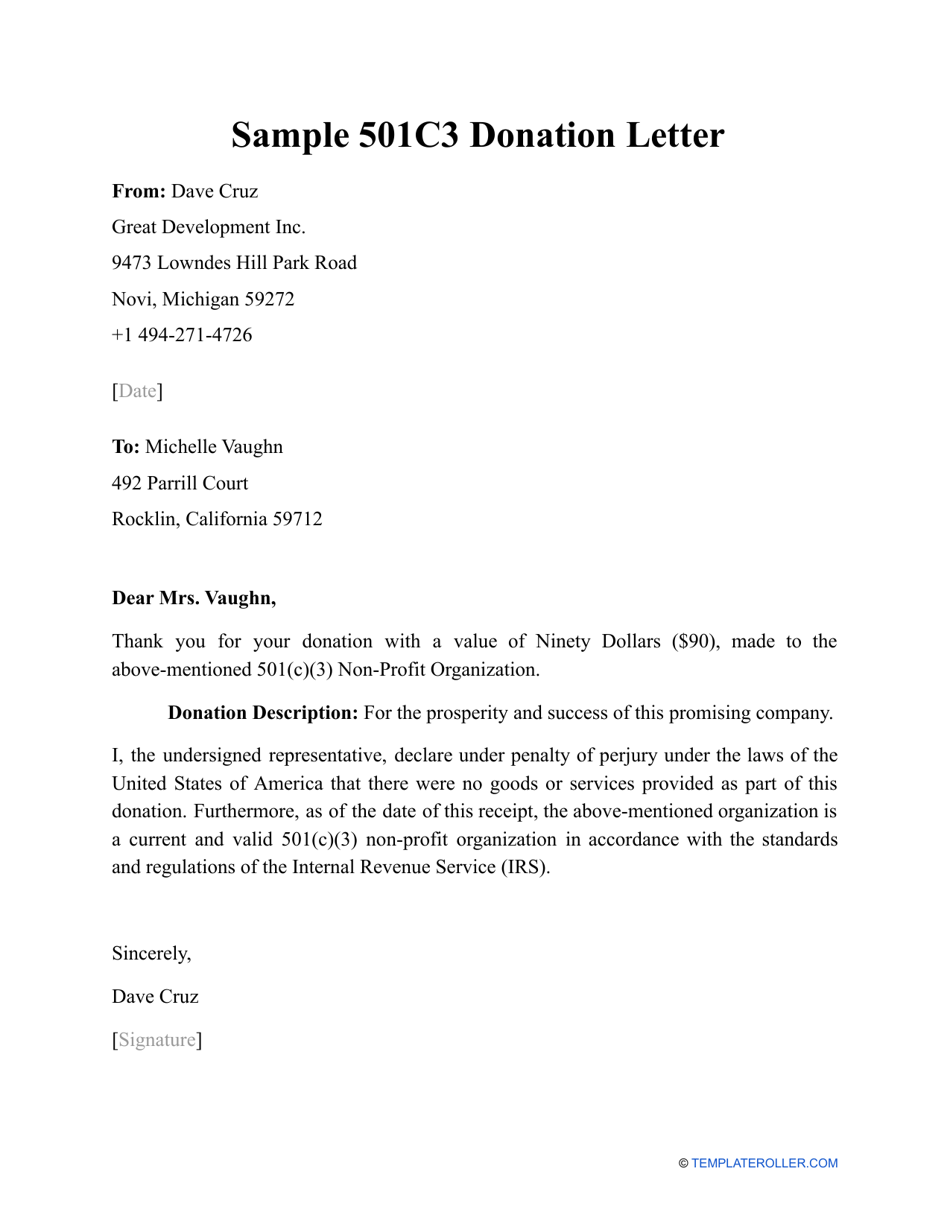

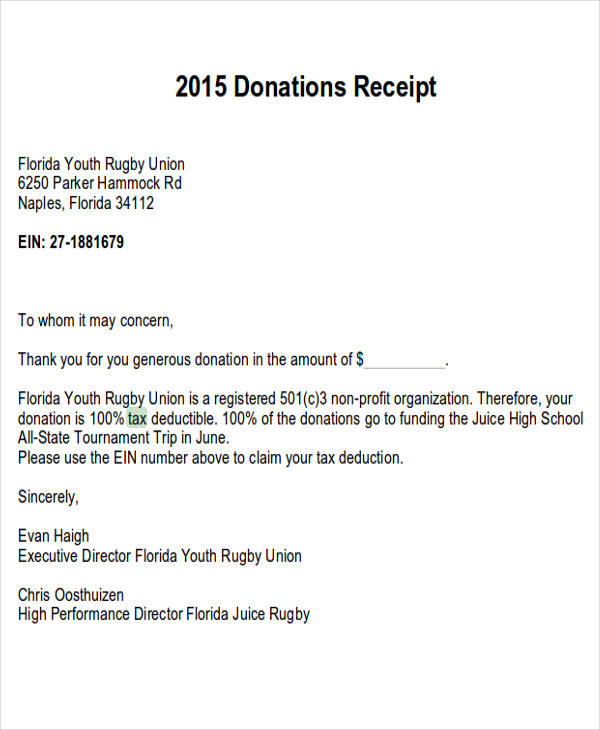

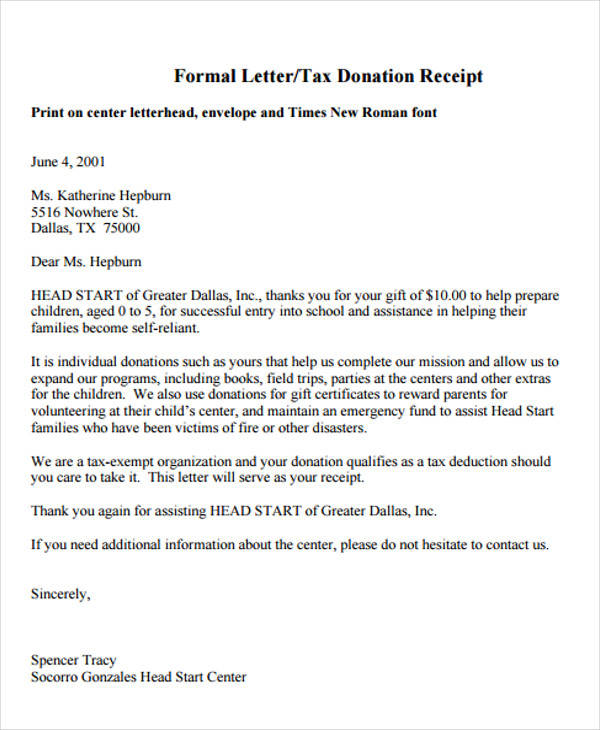

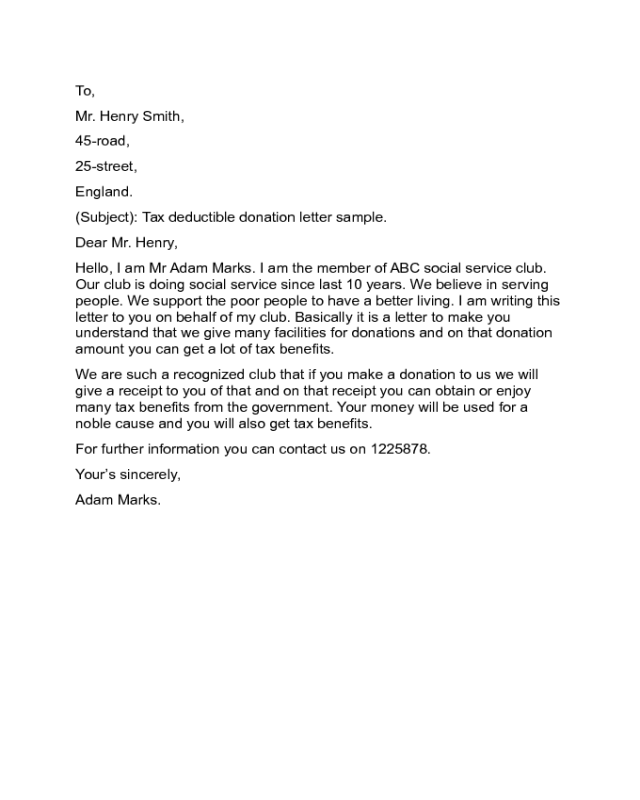

501c3 Tax Deductible Donation Letter Sample with Examples

Sample 501c3 Donation Letter Fill Out, Sign Online and Download PDF

Sample Acknowledgement Receipt For Donation

FREE 40+ Donation Letter Templates in PDF MS Word Pages Google

2025 Donation Letter Templates Fillable, Printable PDF & Forms Handypdf

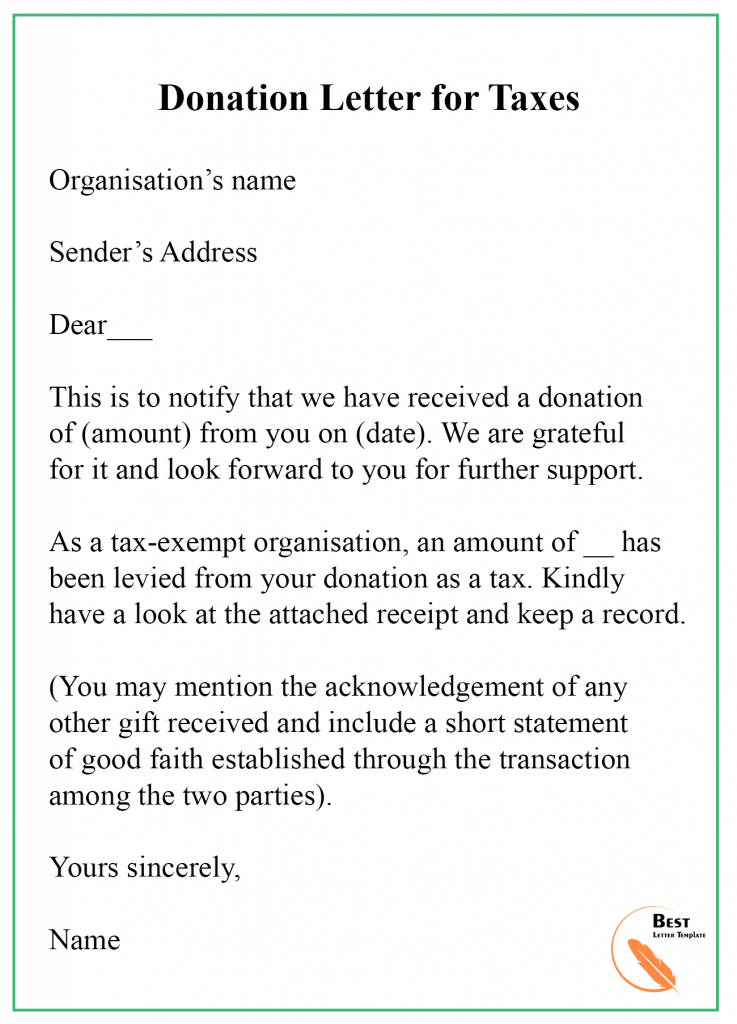

Donation Letter for Taxes Sample and Examples [Word]

Donation Letter for Taxes Sample and Examples [Word]

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

Tax Deductible Donation Thank You Letter Template Examples Letter

It Allows You To Create And Customize The Draft Of Your Receipt Contents.

The Donation Receipt Can Be Sent Via Email Or Postal Mail.

Donation Receipts Are Quite Simply The Act Of Providing A Donor With A Receipt For Their Monetary Contribution To An Organization, Such As A Charity Or Foundation.

Using A (501)(C)(3) Donation Receipt Template Helps The Donor Captures All The Relevant Information For The Donor’s Tax Returns.

Related Post:

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1)

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/donation-letter-for-tax-purpose-pdf.jpg?fit=1414%2C1999&ssl=1)