Return On Investment Template

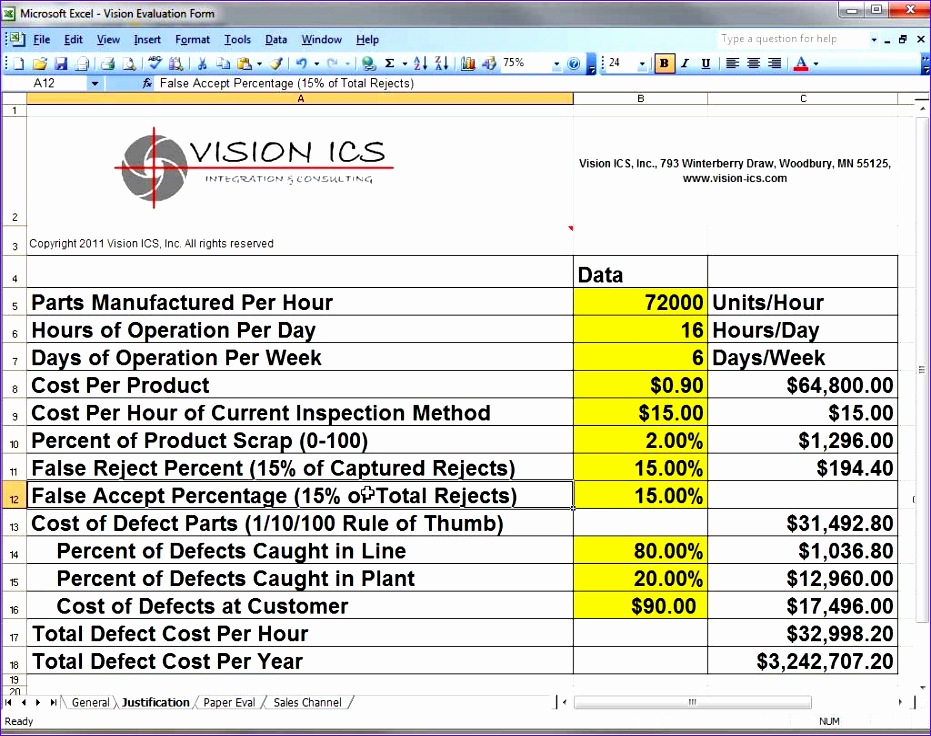

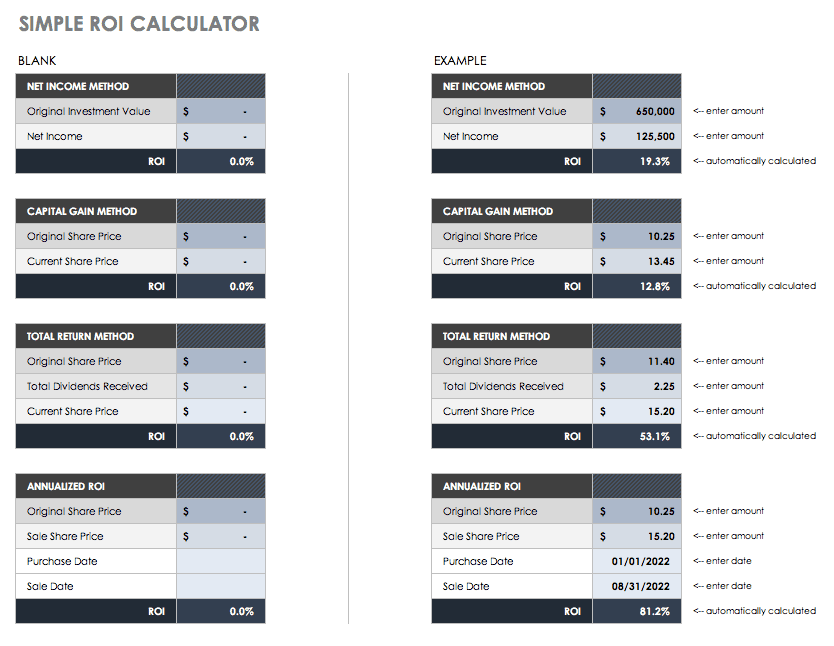

Return On Investment Template - It is useful for measuring return on investment, especially for investors who prioritize dividend payouts over capital gains. Bank deposit agreements are not the same as certificates of deposit (cds) for two reasons. Return on investment example #1. The amount of money you begin your account with is called the initial balance. Although compound annual growth rate is often confused with annualized return, there are several differences. It highlights the value of dividends that shareholders receive for each dollar of company stock they own. Because it’s money being returned and not earned, it’s not considered taxable income. A general account gic's return typically increases with the length and size of the investment. It requires you to provide only five pieces of information: In general, a bank deposit agreement's return increases with the length and size of the investment. It is useful for measuring return on investment, especially for investors who prioritize dividend payouts over capital gains. Bank deposit agreements are not the same as certificates of deposit (cds) for two reasons. Return on investment example #1. Dividend yield measures a company's annual dividend payout in relation to its stock price. Present value (pv) is the current value of a future cash flow, given a specific rate of return. Analysts and investors are able to account for the time value of money, which states that an amount of money today is worth more than that same amount in the future (due to its future earning potential). For example, if you earn a 4% apy on your account, your rate of return is 4%. In general, a bank deposit agreement's return increases with the length and size of the investment. The following year, your investment falls 50%, taking you back to your original amount. This year, your $10,000 grows 100%, leaving you with $20,000. It requires you to provide only five pieces of information: Dividend yield measures a company's annual dividend payout in relation to its stock price. The amount of money you begin your account with is called the initial balance. Present value (pv) is the current value of a future cash flow, given a specific rate of return. A general account gic's. Rate of return (interest rate) rate of return is the percentage earned on your investment. The following year, your investment falls 50%, taking you back to your original amount. This year, your $10,000 grows 100%, leaving you with $20,000. Once returns exceed the original initial investment, it counts as a capital gain and is therefore taxable. Analysts and investors are. For example, if you earn a 4% apy on your account, your rate of return is 4%. Because it’s money being returned and not earned, it’s not considered taxable income. Return on investment example #1. Dividend yield measures a company's annual dividend payout in relation to its stock price. An investor buys $1,000 worth of stocks and sells them 1. A general account gic's return typically increases with the length and size of the investment. The amount of money you begin your account with is called the initial balance. Rate of return (interest rate) rate of return is the percentage earned on your investment. The return on investment calculator is one of the simpler calculators in the financial space. Understanding. Return on investment example #1. The return on investment calculator is one of the simpler calculators in the financial space. For example, if you opened your investment account with $500, your initial balance would be $500. The amount of money you begin your account with is called the initial balance. For example, if you earn a 4% apy on your. How a withdrawal strategy can help you save for retirement. Analysts and investors are able to account for the time value of money, which states that an amount of money today is worth more than that same amount in the future (due to its future earning potential). It requires you to provide only five pieces of information: For example, if. The return on investment calculator is one of the simpler calculators in the financial space. Although compound annual growth rate is often confused with annualized return, there are several differences. In general, a bank deposit agreement's return increases with the length and size of the investment. A general account gic's return typically increases with the length and size of the. A general account gic's return typically increases with the length and size of the investment. How a withdrawal strategy can help you save for retirement. Return on investment example #1. The amount of money you begin your account with is called the initial balance. The following year, your investment falls 50%, taking you back to your original amount. For example, if you earn a 4% apy on your account, your rate of return is 4%. It is useful for measuring return on investment, especially for investors who prioritize dividend payouts over capital gains. Return on investment example #1. Once returns exceed the original initial investment, it counts as a capital gain and is therefore taxable. In general, a. It requires you to provide only five pieces of information: In general, a bank deposit agreement's return increases with the length and size of the investment. Understanding the method of withdrawing funds is an important part of calculating your retirement number. This year, your $10,000 grows 100%, leaving you with $20,000. In the meantime, the bank attempts to earn a. Return on investment example #1. It highlights the value of dividends that shareholders receive for each dollar of company stock they own. Once returns exceed the original initial investment, it counts as a capital gain and is therefore taxable. In general, a bank deposit agreement's return increases with the length and size of the investment. Analysts and investors are able to account for the time value of money, which states that an amount of money today is worth more than that same amount in the future (due to its future earning potential). For example, if you earn a 4% apy on your account, your rate of return is 4%. Rate of return (interest rate) rate of return is the percentage earned on your investment. The following year, your investment falls 50%, taking you back to your original amount. Although compound annual growth rate is often confused with annualized return, there are several differences. Bank deposit agreements are not the same as certificates of deposit (cds) for two reasons. How a withdrawal strategy can help you save for retirement. A general account gic's return typically increases with the length and size of the investment. For example, if you opened your investment account with $500, your initial balance would be $500. The return on investment calculator is one of the simpler calculators in the financial space. Because it’s money being returned and not earned, it’s not considered taxable income. In the meantime, the bank attempts to earn a higher return on the investment than it has agreed to pay to the investor.12 Return On Investment Excel Template Excel Templates Excel Templates

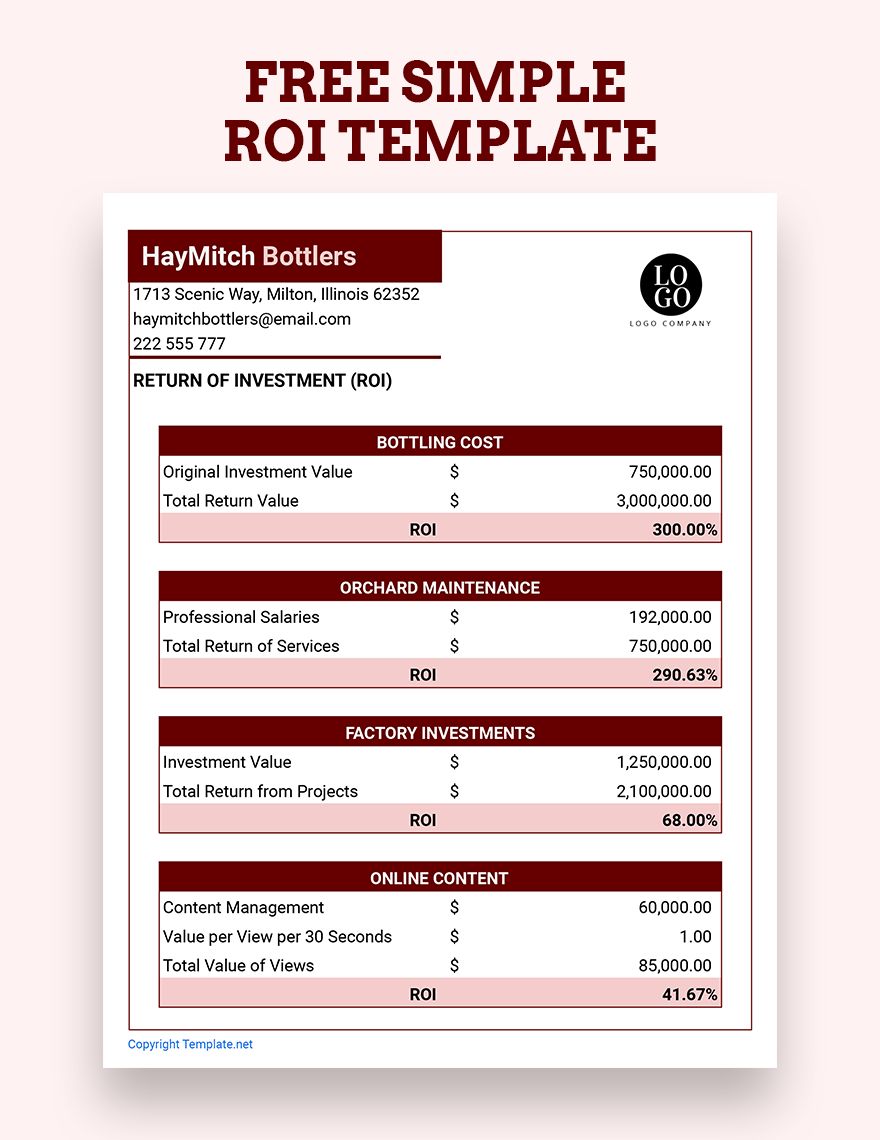

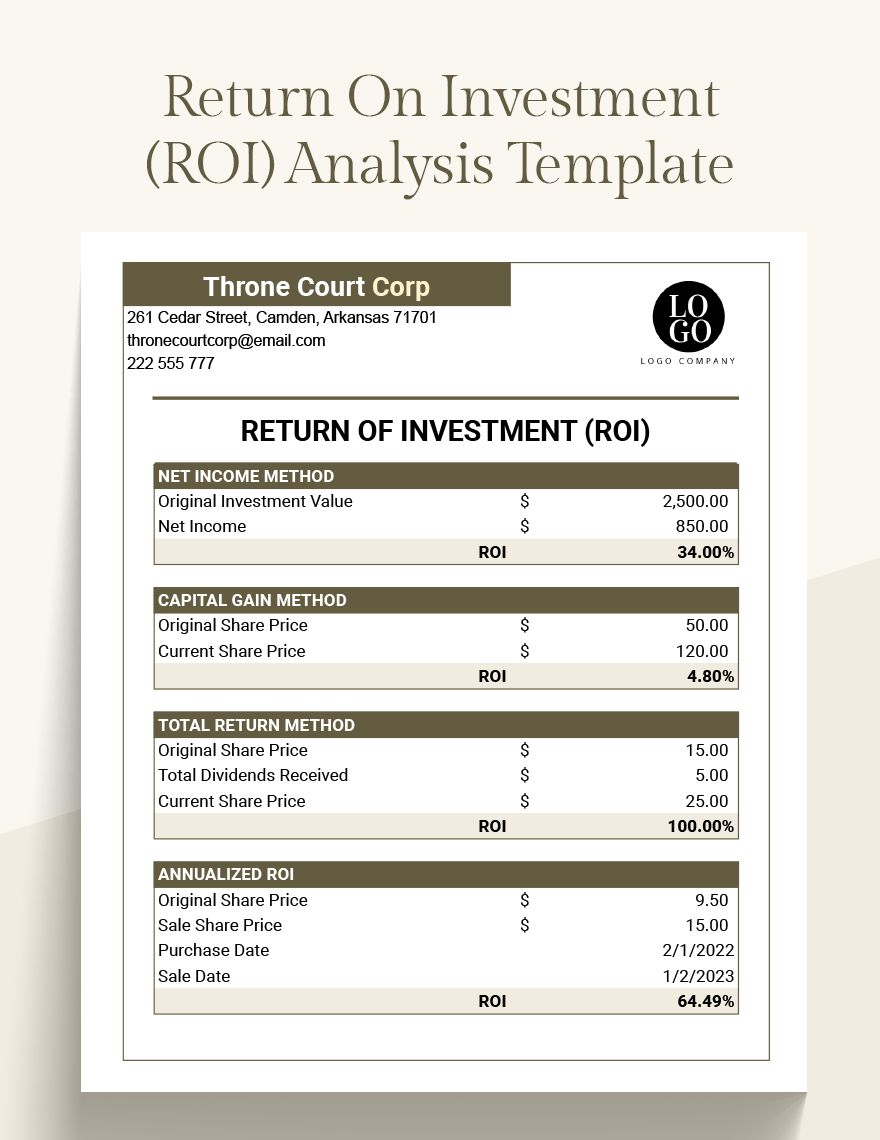

Return On Investment (ROI) Analysis Template Google Sheets, Excel

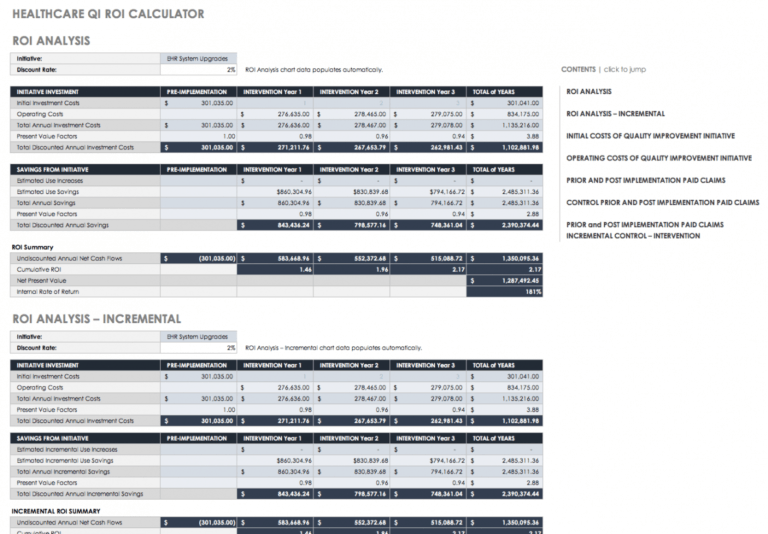

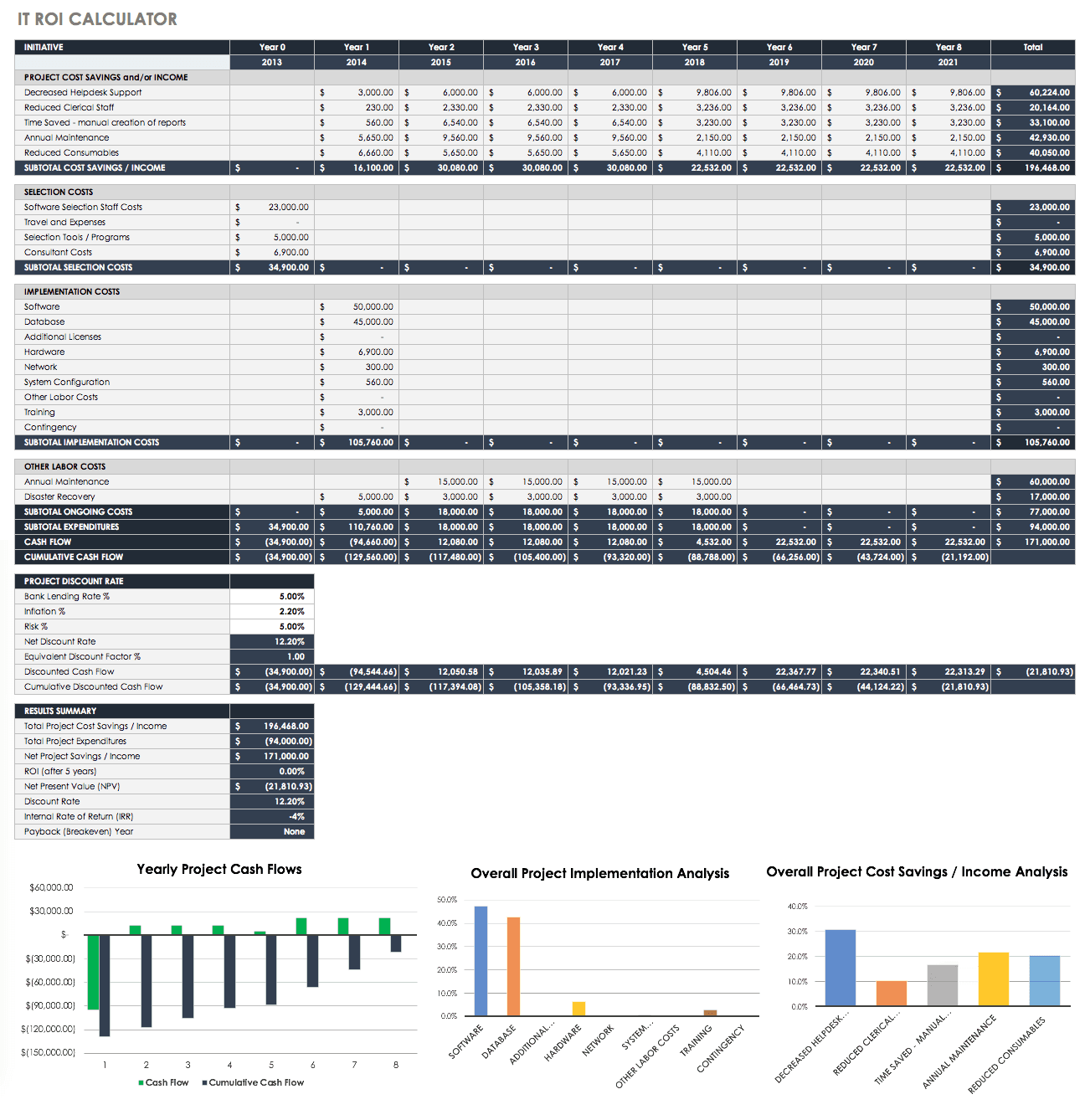

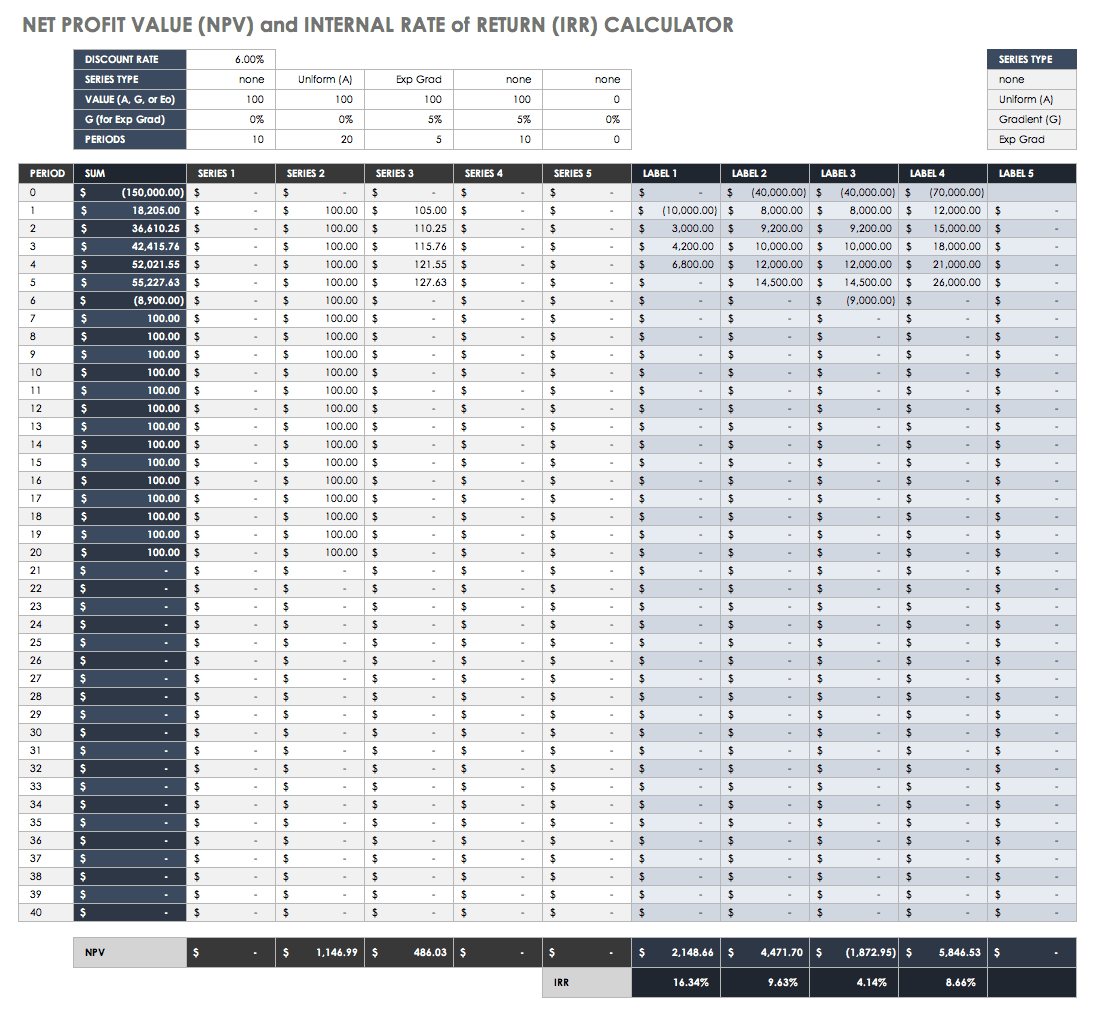

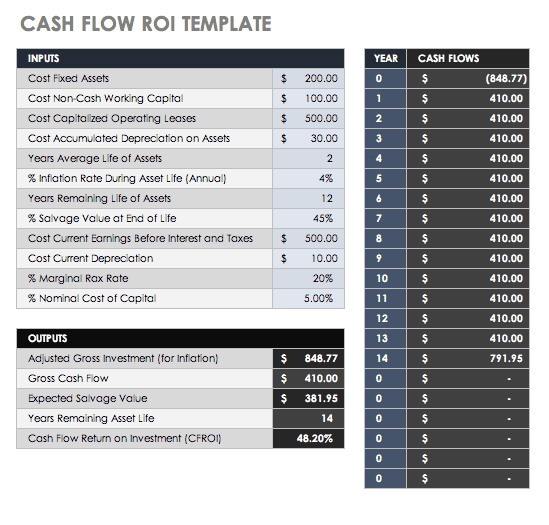

Free ROI Templates and Calculators Smartsheet

Return On Investment (ROI) Analysis Template Google Sheets, Excel

Editable Free Roi Templates And Calculators Smartsheet Return On

Free ROI Templates and Calculators Smartsheet

Free ROI Templates and Calculators Smartsheet

Investment Template Free

Free ROI Templates and Calculators Smartsheet

Free ROI Templates and Calculators Smartsheet

Understanding The Method Of Withdrawing Funds Is An Important Part Of Calculating Your Retirement Number.

It Is Useful For Measuring Return On Investment, Especially For Investors Who Prioritize Dividend Payouts Over Capital Gains.

An Investor Buys $1,000 Worth Of Stocks And Sells Them 1 Year Later When Their Value Reaches $1,500.

Dividend Yield Measures A Company's Annual Dividend Payout In Relation To Its Stock Price.

Related Post: