Private Foundation Restricted Grant Template

Private Foundation Restricted Grant Template - Since 1989, etcf has served individuals, families, nonprofits businesses and private foundations. The grant qualifies as a prize or award that is excludible from gross income under internal revenue code section 74(b), if the recipient is selected from the general public. Increasingly we are seeing restricted gifts from donor advised funds. Last year, the foundation made 106 grants. Permitted purposes are religious, charitable, scientific, literary or. These documents and submittals describe the grantee’s. Without added irs language this is sample letter for a grant from a private foundation to a section 501(c)(3) charitable. Example of an unrestricted grant. The source is most likely from a private foundation or a governmental entity or agency. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the internal revenue code. Increasingly we are seeing restricted gifts from donor advised funds. Our legal resources team is available to provide members with sample documents and templates that can be customized to fit your foundation’s work or help guide your thinking. Permitted purposes are religious, charitable, scientific, literary or. The grant qualifies as a prize or award that is excludible from gross income under internal revenue code section 74(b), if the recipient is selected from the general public. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the internal revenue code. Example of an unrestricted grant. The internal revenue code only prohibits “partisan political activities” that support or oppose candidates. The letter is one example of how to include Even if the 501c3 is a public charity, then it must. Clients can use the community foundation to. The following is a sample grant agreement letter from a private foundation to a section 501(c)(3) public charity. A grant agreement that bars all “political activities” can unnecessarily limit nonprofits. The kinsman foundation and the grantee are entering into this agreement to establish the terms of a foundation grant to the grantee. These documents and submittals describe the grantee’s. If. Increasingly we are seeing restricted gifts from donor advised funds. The source is most likely from a private foundation or a governmental entity or agency. The grant qualifies as a prize or award that is excludible from gross income under internal revenue code section 74(b), if the recipient is selected from the general public. This grant agreement (agreement) is effective. These documents and submittals describe the grantee’s. Acknowledge that the foundation has not earmarked grant funds to support lobbying activities or to otherwise support attempts to influence legislation. Foundation grant proposal template [your organization’s name] proposal to [foundation name] [date] i. The source is most likely from a private foundation or a governmental entity or agency. The kinsman foundation and. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the internal revenue code. The kinsman foundation and the grantee are entering into this agreement to establish the terms of a foundation grant to the grantee. Some foundation executives, boards or counsel may feel more comfortable with. Last year, the foundation made 106 grants.. Since 1989, etcf has served individuals, families, nonprofits businesses and private foundations. The grant qualifies as a prize or award that is excludible from gross income under internal revenue code section 74(b), if the recipient is selected from the general public. The letter is one example of how to include This grant agreement (agreement) is effective as of _____ (the. Increasingly we are seeing restricted gifts from donor advised funds. Clients can use the community foundation to. These documents and submittals describe the grantee’s. Activities will be conducted consistent. The internal revenue code only prohibits “partisan political activities” that support or oppose candidates. The source is most likely from a private foundation or a governmental entity or agency. The grantee will treat the grant amount as a restricted asset and will keep accurate records to document the expenditure of funds and the activities supported by the grant. Sample fund agreements & policies. Increasingly we are seeing restricted gifts from donor advised funds. Acknowledge. Since 1989, etcf has served individuals, families, nonprofits businesses and private foundations. A grant agreement that bars all “political activities” can unnecessarily limit nonprofits. The kinsman foundation and the grantee are entering into this agreement to establish the terms of a foundation grant to the grantee. The grantee will treat the grant amount as a restricted asset and will keep. Without added irs language this is sample letter for a grant from a private foundation to a section 501(c)(3) charitable. The source is most likely from a private foundation or a governmental entity or agency. Permitted purposes are religious, charitable, scientific, literary or. Even if the 501c3 is a public charity, then it must. The grant qualifies as a prize. Even if the 501c3 is a public charity, then it must. Activities will be conducted consistent. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the internal revenue code. Some foundation executives, boards or counsel may feel more comfortable with. The kinsman foundation and the grantee are entering into this agreement to establish. Our legal resources team is available to provide members with sample documents and templates that can be customized to fit your foundation’s work or help guide your thinking. Oftentimes, grantmakers can rely on the rules applicable to private foundations or even their state’s nonprofit corporation law when seeking answers to thorny grantmaking questions. The letter is one example of how to include A grant agreement that bars all “political activities” can unnecessarily limit nonprofits. The following is a sample grant agreement letter from a private foundation to a section 501(c)(3) public charity. Last year, the foundation made 106 grants. Sample fund agreements & policies. The kinsman foundation and the grantee are entering into this agreement to establish the terms of a foundation grant to the grantee. Activities will be conducted consistent. This grant agreement (agreement) is effective as of _____ (the effective date), between the following parties (individually party and collectively the parties): If the endowment is held by a 501c3, and that 501c3 is a private foundation, then such a loan would be a self dealing violation. Foundation grant proposal template [your organization’s name] proposal to [foundation name] [date] i. Example of an unrestricted grant. Since 1989, etcf has served individuals, families, nonprofits businesses and private foundations. Without added irs language this is sample letter for a grant from a private foundation to a section 501(c)(3) charitable. Permitted purposes are religious, charitable, scientific, literary or.40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab

10 Foundations that Give Grants to Nonprofit OrganizationsGrant

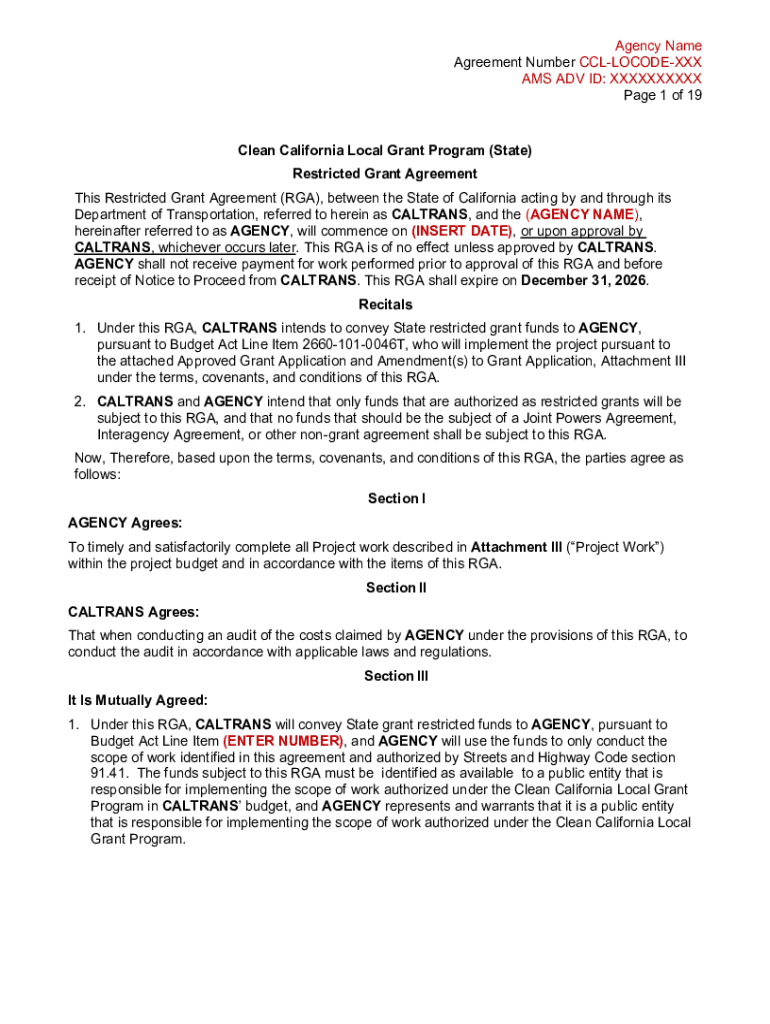

Fillable Online Cycle 2 Restricted Grant Agreement Template. Cycle 2

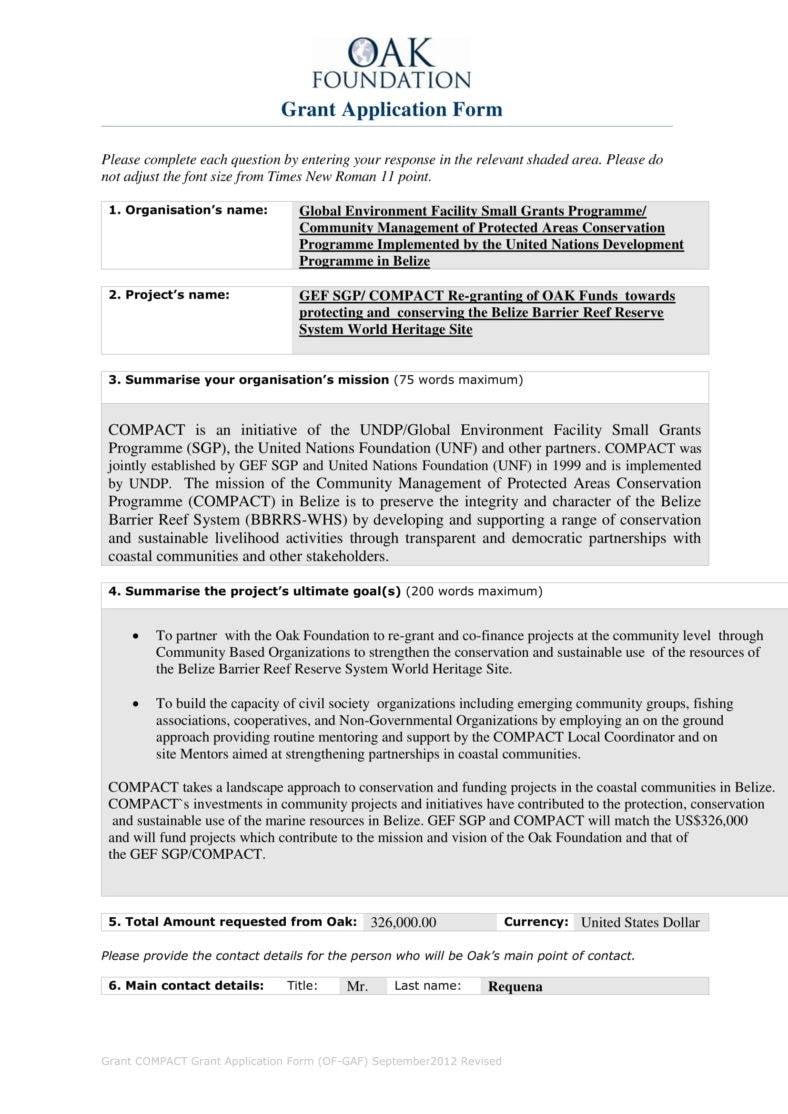

12+ Grant Application Form Templates PDF, Docs, Pages, Google Docs

Nonprofit Restricted Grant Tracker Google Sheets Spreadsheet Template

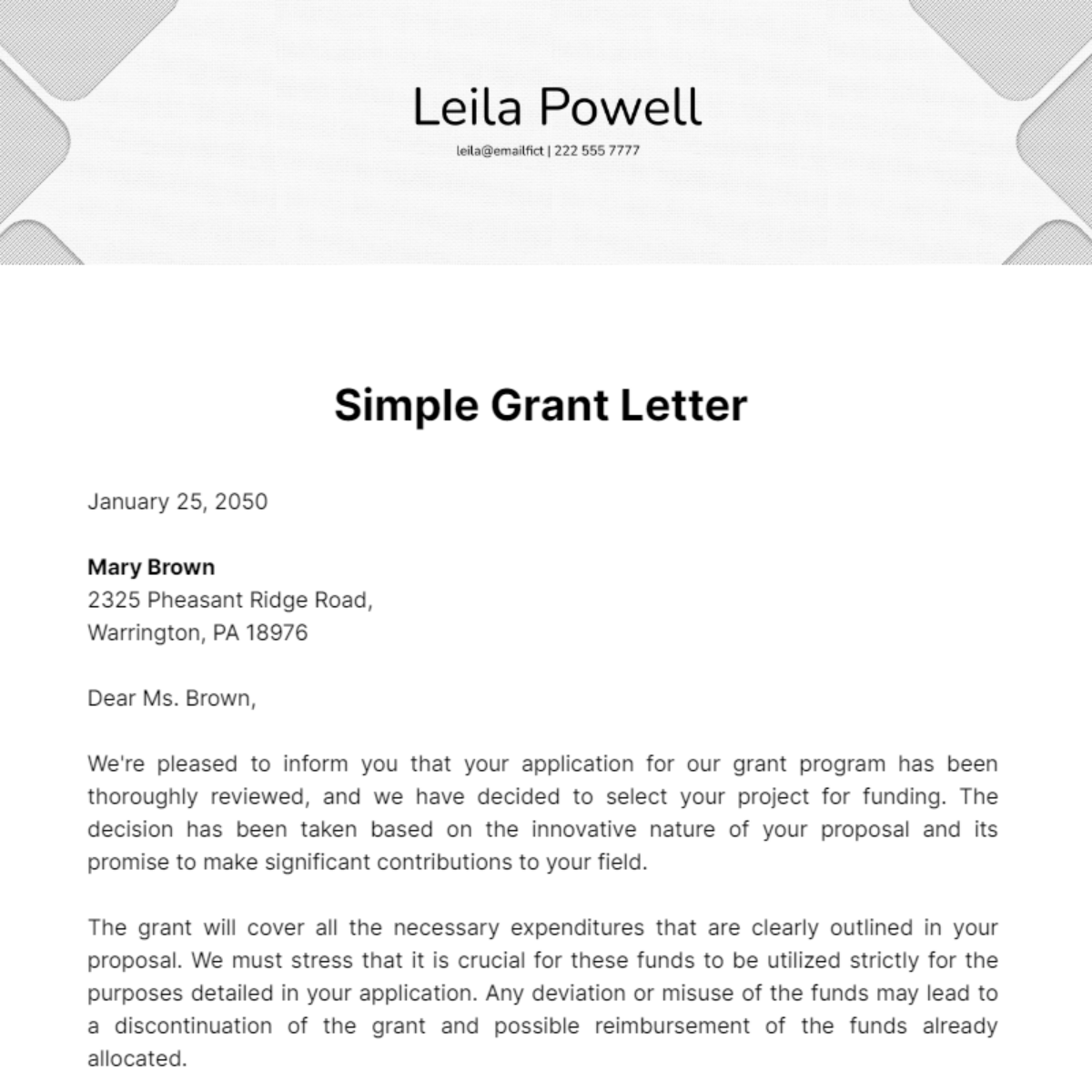

FREE Grant Letter Templates & Examples Edit Online & Download

FREE 20+ Sample Grant Proposal Templates in PDF MS Word Pages

40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab

40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab

FREE 20+ Sample Grant Proposal Templates in PDF MS Word Pages

The Grantee Will Treat The Grant Amount As A Restricted Asset And Will Keep Accurate Records To Document The Expenditure Of Funds And The Activities Supported By The Grant.

Even If The 501C3 Is A Public Charity, Then It Must.

The Grant Qualifies As A Prize Or Award That Is Excludible From Gross Income Under Internal Revenue Code Section 74(B), If The Recipient Is Selected From The General Public.

The Internal Revenue Code Only Prohibits “Partisan Political Activities” That Support Or Oppose Candidates.

Related Post:

![40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/08/grant-proposal-template-13.jpg?w=320)

![40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/grant-proposal-template-27.jpg?w=395)

![40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/08/grant-proposal-template-16.jpg?w=395)