Payroll Journal Entry Template

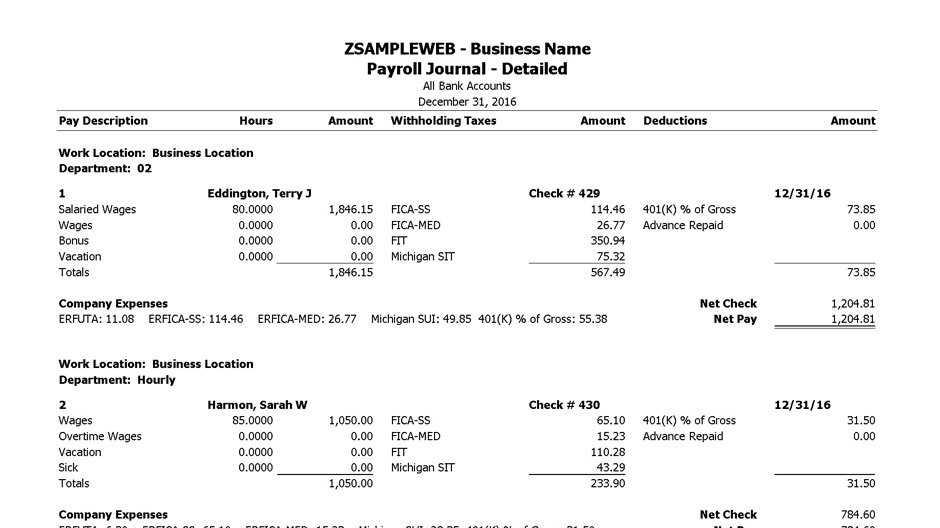

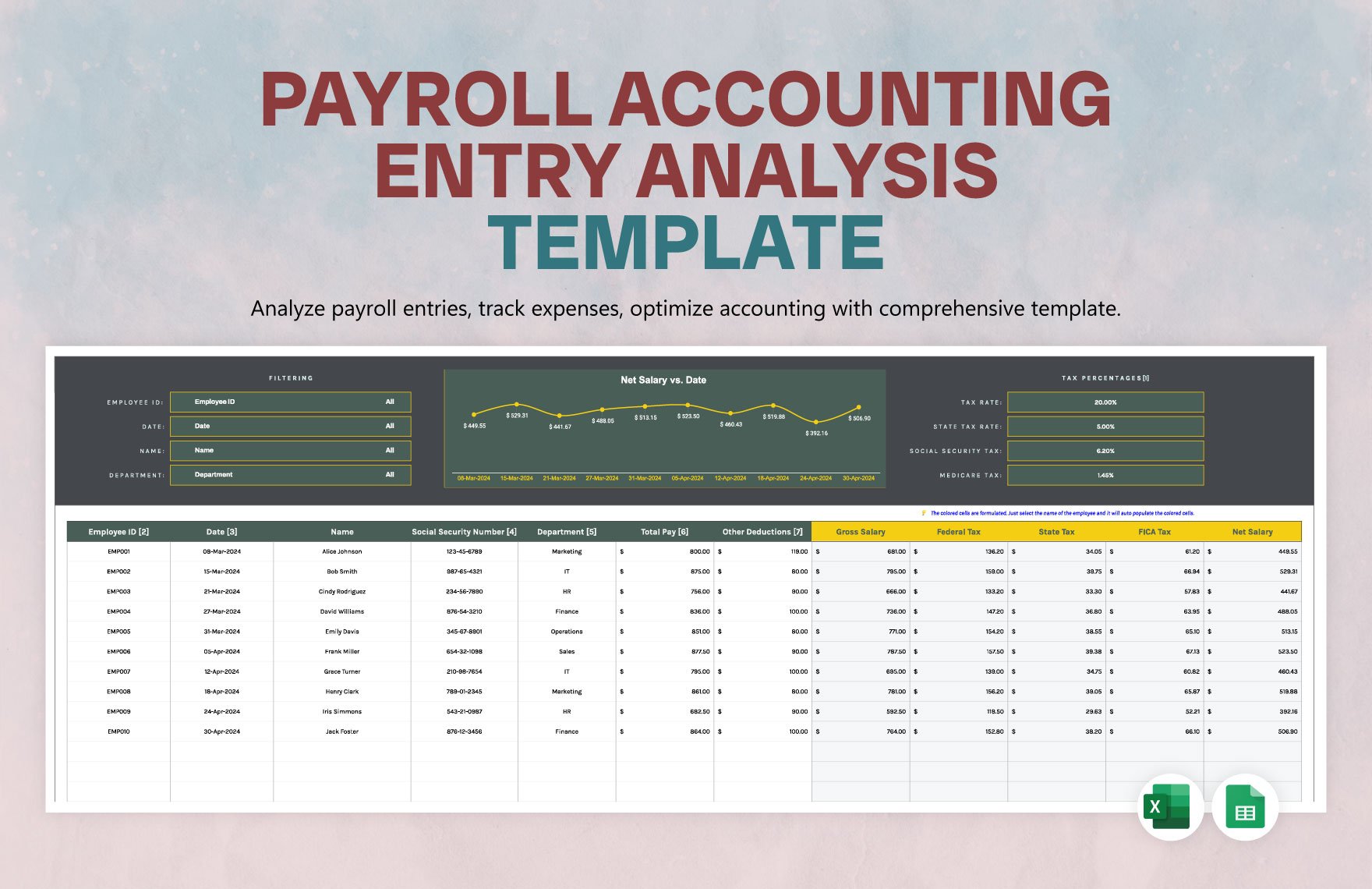

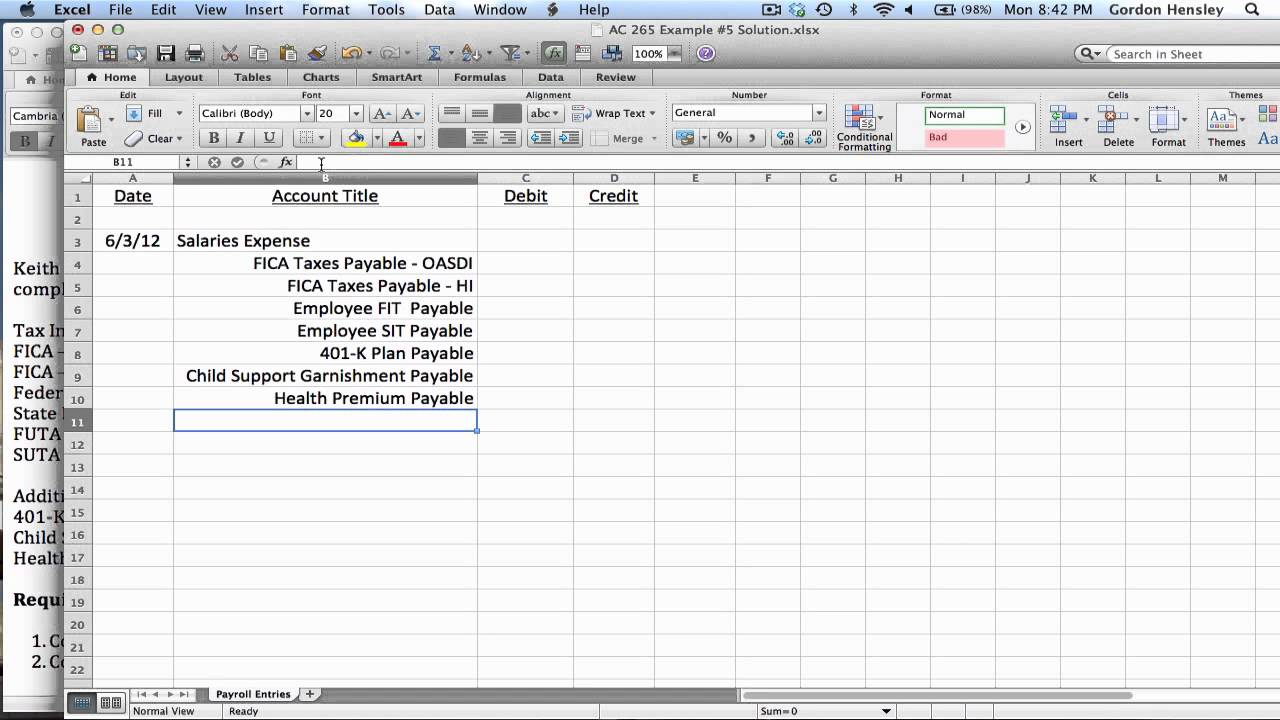

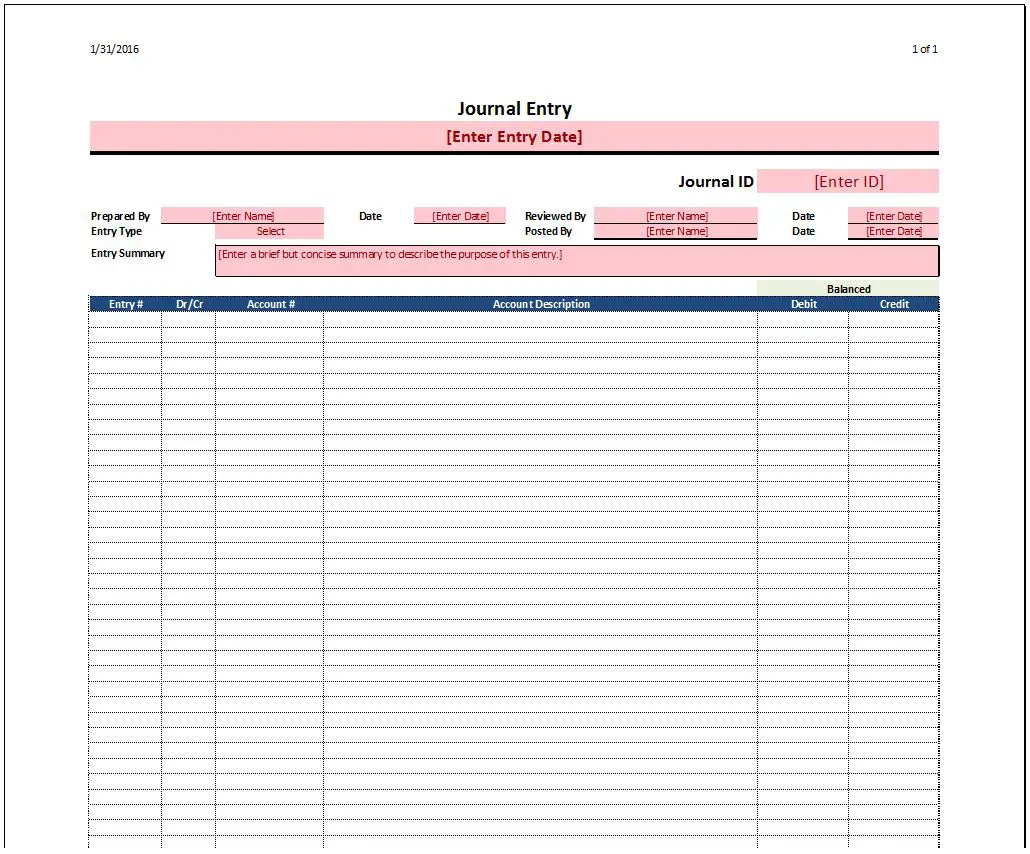

Payroll Journal Entry Template - Usually, it includes salaries, wages and other benefits. They might outline gross wages, accrued. Putting that template in excel can help you make sure your debits equal your credits. Get in touch with us right now. They provide an ongoing record of the company’s payroll obligations and expenses. Unlike cash accounting, which records. Payroll journal entries reflect the wages, salaries, and taxes paid in each pay period. Learn how to record payroll expenses and taxes in your general ledger with a payroll journal entry. 2,231 journal entry rules jobs available on indeed.com. It involves verifying that payroll system amounts match those in the general ledger and resolving discrepancies such as calculation errors, incorrect tax withholdings, or. By properly recording these entries, businesses should. Recording payroll expense and payroll liabilities. Get in touch with us right now. Unlike cash accounting, which records. In this piece, we'll explore what payroll journal entries are, their main types, and best practices for recording them accurately and compliantly. See an example of a payroll journal entry for a manufacturing company with. Use browseinfo to celebrate corporate achievements. Though some systems that incorporate more or less automation may not. There are a few type of payroll journal entries to consider: It records all payroll transactions within a company, ensuring every aspect of. Though some systems that incorporate more or less automation may not. Recording payroll expense and payroll liabilities. By properly recording these entries, businesses should. Understanding these payroll accounting entries, including accrued payroll entries and the standard journal entry for payroll, is key for accurate reporting and smart decisions. What is a payroll journal entry? Below are examples of journal entries related to payroll liabilities. There are a few type of payroll journal entries to consider: See an example of a payroll journal entry for a manufacturing company with. Payroll journal entries are listings in your general ledger. They provide an ongoing record of the company’s payroll obligations and expenses. Learn how to record payroll expenses and taxes in your general ledger with a payroll journal entry. Below are examples of journal entries related to payroll liabilities. There are a few type of payroll journal entries to consider: It involves verifying that payroll system amounts match those in the general ledger and resolving discrepancies such as calculation errors, incorrect tax. Learn how to build a je template, map data, and find new payroll elements. Get in touch with us right now. Standardize your recurring payroll journal entries. The accountant then should only have to paste in the appropriate data such as production volumes, energy usage, payroll hours, or whatever metric drives the specific entry. Though some systems that incorporate more. Use browseinfo to celebrate corporate achievements. See an example of a payroll journal entry for a manufacturing company with. 2,231 journal entry rules jobs available on indeed.com. Payroll journal entries are the accounting method for recording employee compensation. What is a payroll journal entry? Unlike cash accounting, which records. Below are examples of journal entries related to payroll liabilities. Learn how to record payroll expenses and taxes in your general ledger with a payroll journal entry. Standardize your recurring payroll journal entries. Payroll journal entries are crucial for accurately tracking employee compensation and related taxes and benefits. The accountant then should only have to paste in the appropriate data such as production volumes, energy usage, payroll hours, or whatever metric drives the specific entry. Get in touch with us right now. Standardize your recurring payroll journal entries. Payroll journal entries are the accounting method for recording employee compensation. Unlike cash accounting, which records. Apply to data entry clerk, customer service representative, enrollment manager and more! See an example of a payroll journal entry for a manufacturing company with. Recording payroll expense and payroll liabilities. Also known as an initial recording, this first entry is very important. Though some systems that incorporate more or less automation may not. Standardize your recurring payroll journal entries. Payroll journal entries reflect the wages, salaries, and taxes paid in each pay period. Usually, it includes salaries, wages and other benefits. They provide an ongoing record of the company’s payroll obligations and expenses. Use browseinfo to celebrate corporate achievements. Payroll journal entries are listings in your general ledger. Use our professional odoo customization services to improve your business. Payroll processing requires you to complete a number of steps, which are presented below. Learn how to record payroll expenses and taxes in your general ledger with a payroll journal entry. What is a payroll journal entry? 2,231 journal entry rules jobs available on indeed.com. Learn how to record payroll transactions using a payroll journal entry, a method of accrual accounting. Use our professional odoo customization services to improve your business. Putting that template in excel can help you make sure your debits equal your credits. Usually, it includes salaries, wages and other benefits. They might outline gross wages, accrued. Use browseinfo to celebrate corporate achievements. Also known as an initial recording, this first entry is very important. Though some systems that incorporate more or less automation may not. Learn how to build a je template, map data, and find new payroll elements. They provide an ongoing record of the company’s payroll obligations and expenses. Payroll processing requires you to complete a number of steps, which are presented below. By properly recording these entries, businesses should. They show how much you paid your workers during a chosen time period. Payroll journal entries reflect the wages, salaries, and taxes paid in each pay period. There are a few type of payroll journal entries to consider:Payroll reports myPay Solutions Thomson Reuters

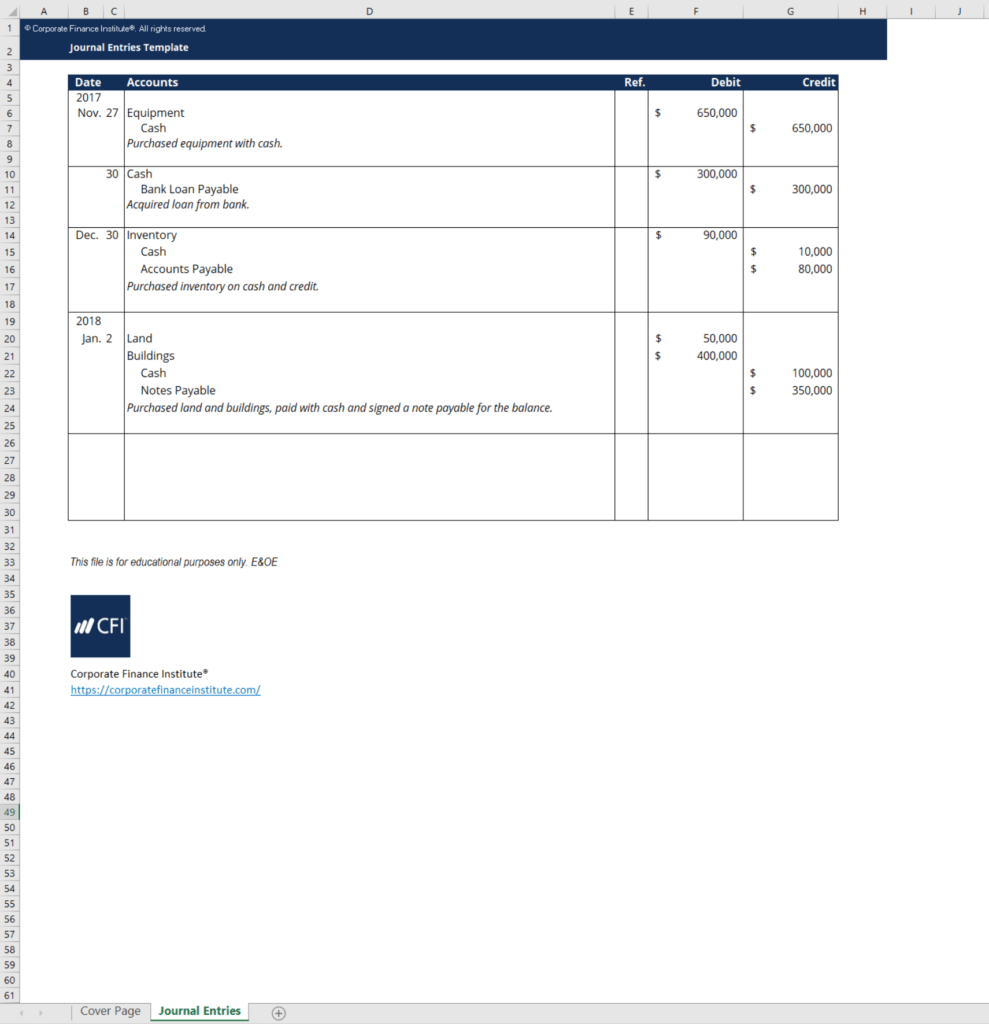

Payroll Journal Entry Template Excel Template 2 Resume Examples

Employee Payroll Accounting Settlement Tracking Template in Excel

Payroll Register Template

Sample Payroll Journal Entry

Payroll Journal Entry Template Excel Template 2 Resume Examples

Journal Entry Template

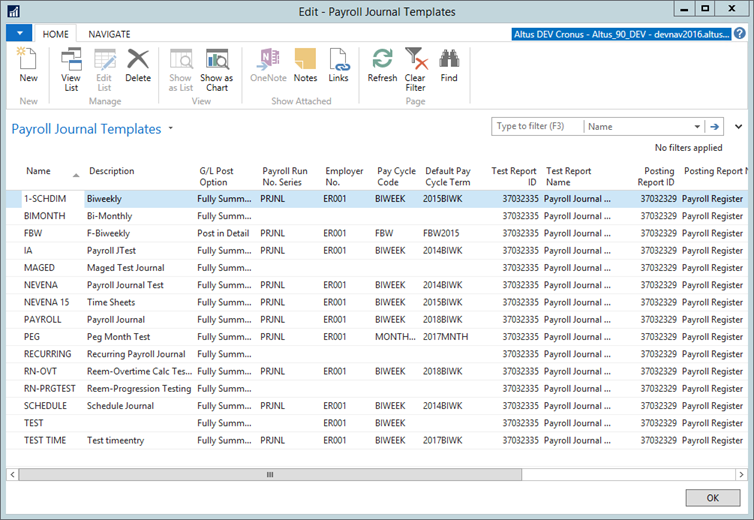

Record payroll transactions manually QuickBooks Community

Journal Entry Template Download Free Excel Template

Performing Payroll Periodic Activities · Customer SelfService

It Records All Payroll Transactions Within A Company, Ensuring Every Aspect Of.

Standardize Your Recurring Payroll Journal Entries.

The Accountant Then Should Only Have To Paste In The Appropriate Data Such As Production Volumes, Energy Usage, Payroll Hours, Or Whatever Metric Drives The Specific Entry.

Recording Payroll Expense And Payroll Liabilities.

Related Post: