Non Profit Receipt Template

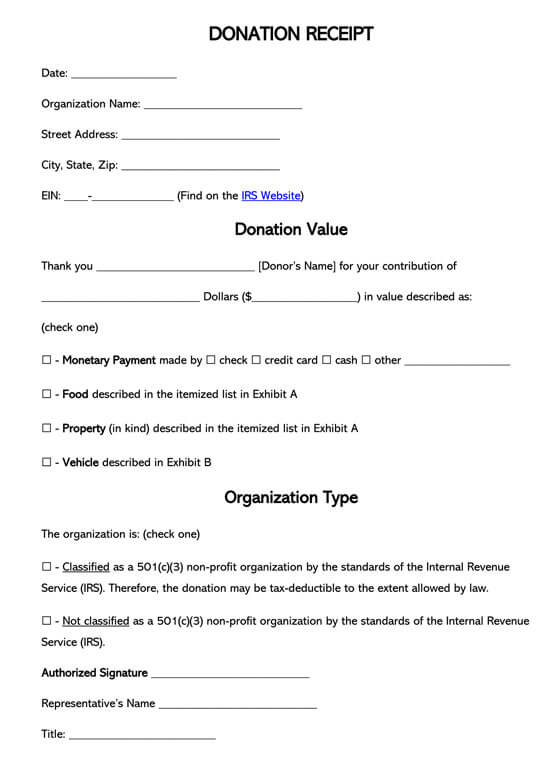

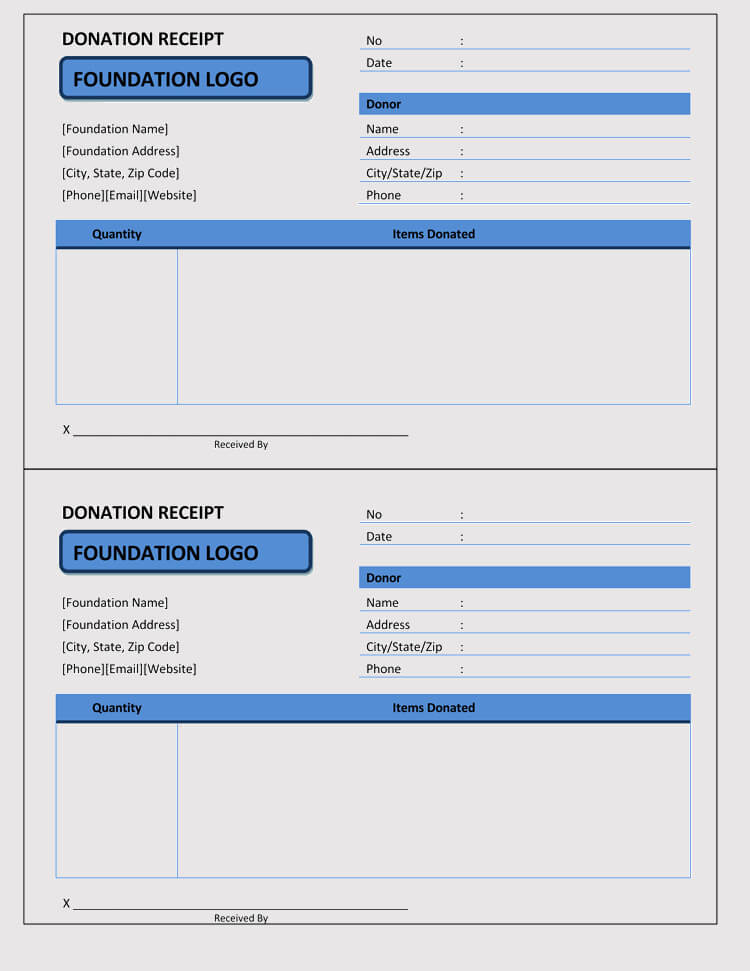

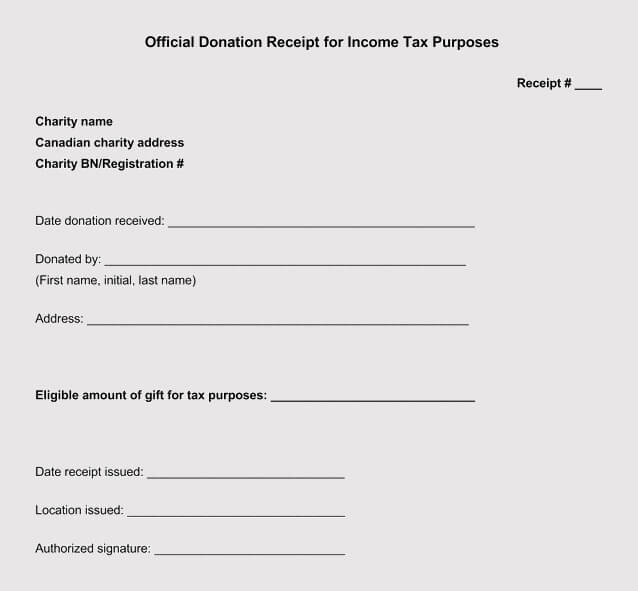

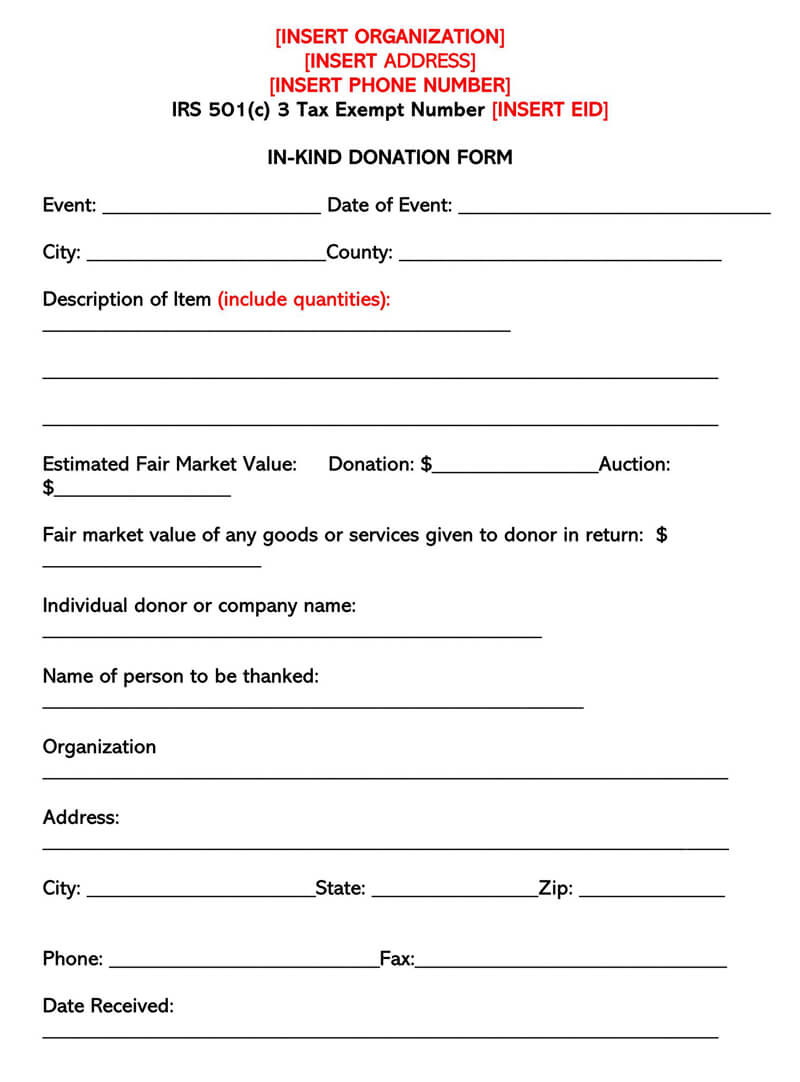

Non Profit Receipt Template - Donation receipt templates are a necessity when it comes to charitable donations. These will make your work easy and will also create a good impression. Get simple, free templates that can be used for any donation or gift here. It allows you to create and customize the draft of your receipt contents. Get a free nonprofit donation receipt template for every giving scenario. We’ll share our top 5. To create a donation receipt that complies with tax regulations, you’ll want to use a cash donation receipt template or a customizable receipt template. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return at the end. Financial statements help in making informed. A donation receipt is an official. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. We’ll share our top 5. It allows you to create and customize the draft of your receipt contents. Below are the examples for the different types of receipts for you to choose from. Donation receipt templates are essential tools for any organization involved in charitable activities. Get a free nonprofit donation receipt template for every giving scenario. Therefore, it is imperative to record how many. Donation receipt templates are a necessity when it comes to charitable donations. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. A donation receipt is an official. Get a free nonprofit donation receipt template for every giving scenario. Financial statements help in making informed. A donation receipt is an official. Below are the examples for the different types of receipts for you to choose from. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Get simple, free templates that can be used for any donation or gift here. To create a donation receipt that complies with tax regulations, you’ll want to use a cash donation receipt template or a customizable receipt template. Donation receipt templates are a necessity when it comes to charitable donations. Get a free nonprofit donation receipt template for every giving. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. We’ll share our top 5. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Donation receipt templates are essential tools for any organization involved in charitable activities. Get. Below we have listed some of the best nonprofit donation receipt templates we could find. These will make your work easy and will also create a good impression. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return. Get a free nonprofit donation receipt template for every giving scenario. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return at the end. These will make your work easy and will also create a good impression. Below. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. Made to meet us & canada requirements. These will make your work easy and will also create a good impression. A nonprofit receipt template is a helpful document used to create. These will make your work easy and will also create a good impression. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. A donation receipt is an official. Donation receipt templates are essential tools for any organization involved in charitable activities. Financial statements help in making informed. Below are the examples for the different types of receipts for you to choose from. Made to meet us & canada requirements. Therefore, it is imperative to record how many. It allows you to create and customize the draft of your receipt contents. Get simple, free templates that can be used for any donation or gift here. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. It allows you to create and customize the draft of your receipt contents. Below are the examples for the different types of receipts for you to choose from. We’ll share our top 5. These will make your work easy and will also create a good impression. Donation receipt templates are essential tools for any organization involved in charitable activities. Below we have listed some of the best nonprofit donation receipt templates we could find. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. Below are the. Made to meet us & canada requirements. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. To create a donation receipt that complies with tax regulations, you’ll want to use a cash donation receipt template or a customizable receipt template. Below we have listed some of the best nonprofit donation receipt templates we could find. Donation receipt templates are a necessity when it comes to charitable donations. It allows you to create and customize the draft of your receipt contents. We’ll share our top 5. These will make your work easy and will also create a good impression. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Donation receipt templates are essential tools for any organization involved in charitable activities. A donation receipt is an official. Get a free nonprofit donation receipt template for every giving scenario. Get simple, free templates that can be used for any donation or gift here. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return at the end.10 Donation Receipt Templates Free Samples, Examples & Format

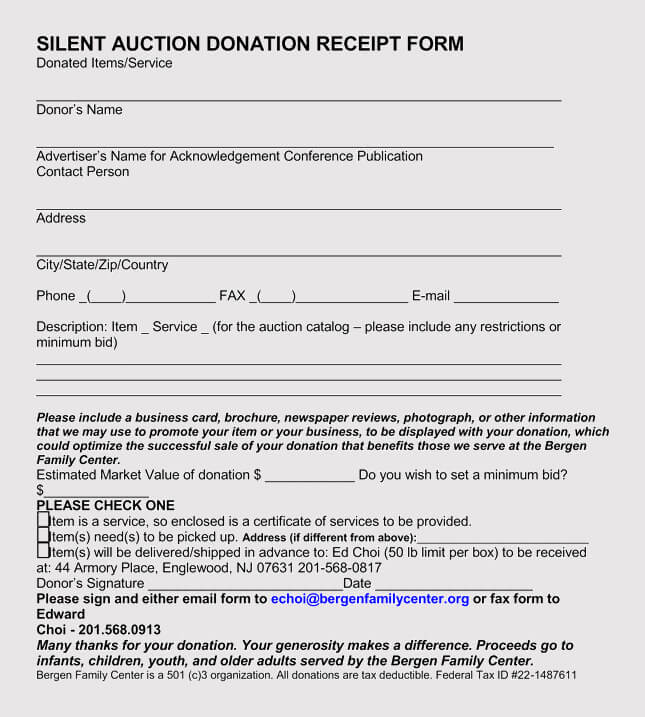

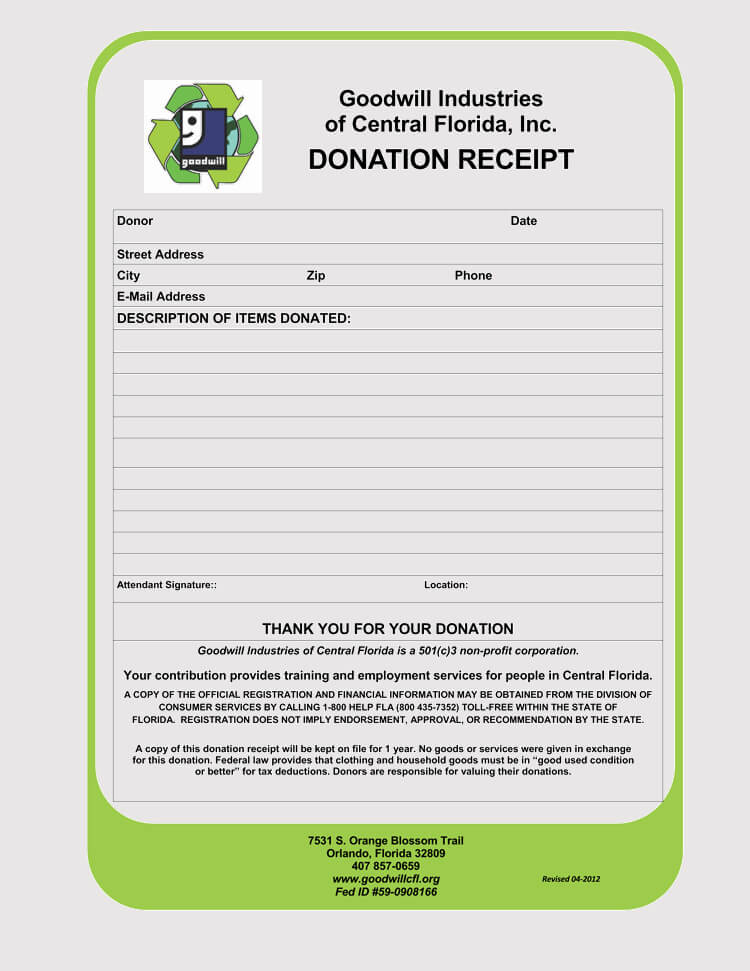

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Free 501(c)(3) Donation Receipt Templates Word PDF

46 Free Donation Receipt Templates (501c3, NonProfit)

46 Free Donation Receipt Templates (501c3, NonProfit)

Non Profit Donation Receipt Templates at

Free Nonprofit (Donation) Receipt Templates (Forms)

46 Free Donation Receipt Templates (501c3, NonProfit)

Free Donation Receipt Templates

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

Below Are The Examples For The Different Types Of Receipts For You To Choose From.

A Nonprofit Receipt Template Is A Helpful Document Used To Create A Form Of Receipt States That A Benefactor Has Been Donated A Certain Value To A Beneficiary.

Therefore, It Is Imperative To Record How Many.

Financial Statements Help In Making Informed.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-02.jpg)