Irrevocable Trust Template Georgia

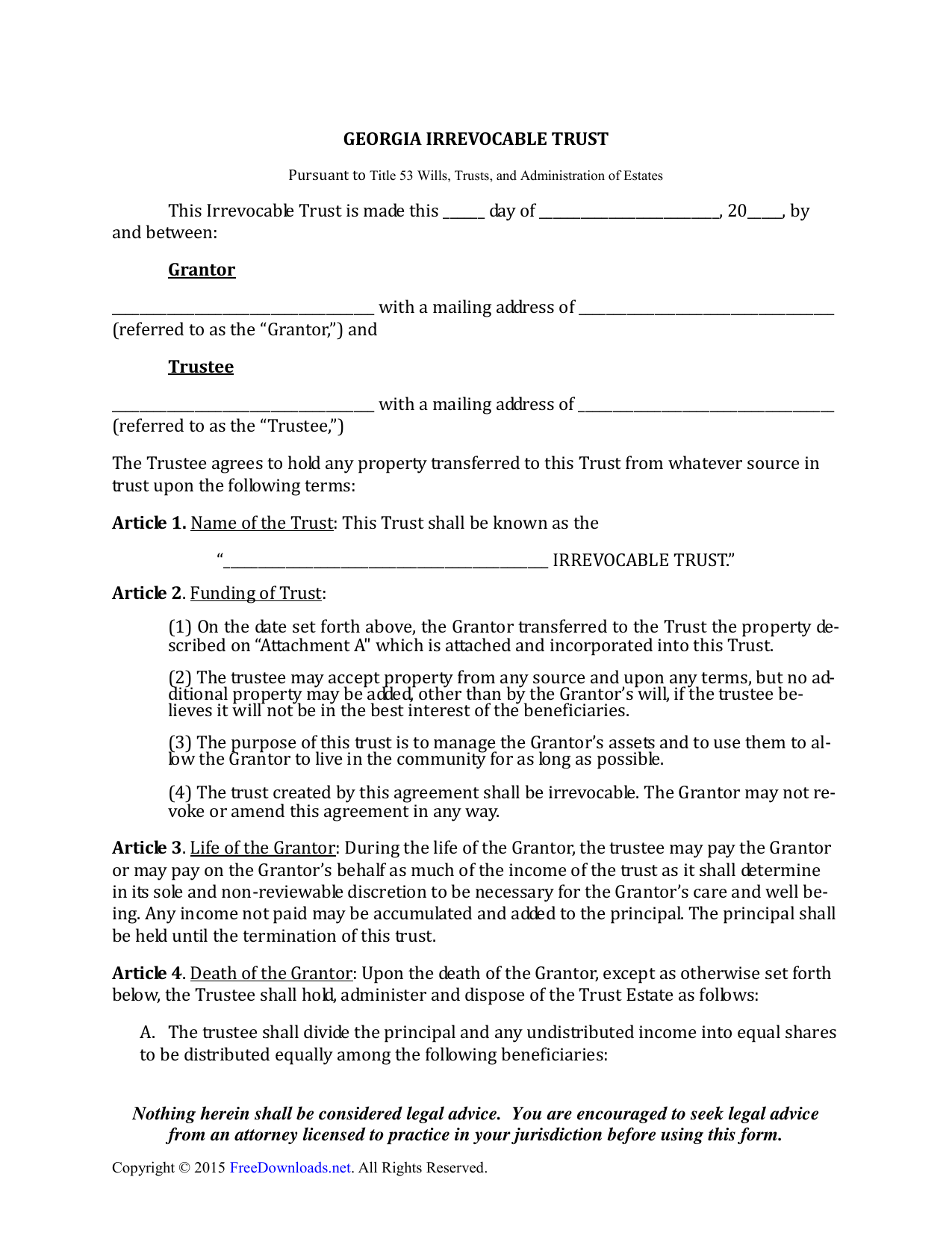

Irrevocable Trust Template Georgia - This irrevocable trust agreement is made this [day] day of [month], [year], between [name], of [address], city of [city], state of [state], herein referred to as grantor, and [name], of [address],. An irrevocable trust offers significant benefits, including the following: Because the grantor relinquishes control of the assets, these trusts can be used to minimize estate taxes. Creating an irrevocable trust in georgia involves specific legal steps to ensure its validity. An irrevocable living trust is a legal. The process begins with the grantor transferring assets into the trust, relinquishing. Assets placed in an irrevocable trust are usually. Using georgia trust forms, you are able to give real estate, personal property. Learn about the creation, management, and benefits of irrevocable trusts in georgia, including trustee roles and tax implications. Irrevocable trusts are crucial in estate. Up to $40 cash back a corpus of a file is assets that a grantor moves with an irrevocable or revocable trust. But, there are exceptions under certain circumstances. Using georgia trust forms, you are able to give real estate, personal property. An irrevocable trust offers significant benefits, including the following: Because the grantor relinquishes control of the assets, these trusts can be used to minimize estate taxes. Up to $40 cash back some types of irrevocable trusts include an irrevocable life insurance trust, irrevocable family trust, medicaid income trust, special needs trust, and charitable trust. Explore the essentials of irrevocable living trusts in georgia, including setup, benefits, tax implications, and modification options. Irrevocable trusts are crucial in estate. Up to $40 cash back in an irrevocable living trust, once the assets are placed into the trust, they cannot be removed or changed without the permission of the beneficiaries or a court. The georgia department of community health is the residuary beneficiary to the extent of the total medical assistance paid on behalf of the grantor by the state of georgia. Creating an irrevocable trust in georgia involves specific legal steps to ensure its validity. Using georgia trust forms, you are able to give real estate, personal property. An irrevocable living trust is a legal. This irrevocable trust agreement is made this [day] day of [month], [year], between [name], of [address], city of [city], state of [state], herein referred to as. Up to $40 cash back georgia general form of irrevocable trust agreement is a legally binding document that establishes guidelines and terms for creating an irrevocable trust in the. The process begins with the grantor transferring assets into the trust, relinquishing. Explore the essentials of irrevocable living trusts in georgia, including setup, benefits, tax implications, and modification options. The georgia. The process begins with the grantor transferring assets into the trust, relinquishing. An irrevocable trust offers significant benefits, including the following: In georgia, an irrevocable trust generally cannot be changed or revoked. This irrevocable trust agreement is made this [day] day of [month], [year], between [name], of [address], city of [city], state of [state], herein referred to as grantor, and. In georgia, an irrevocable trust generally cannot be changed or revoked. Up to $40 cash back a georgia trust agreement — irrevocable is a legally binding contract that sets forth the terms and conditions for creating an irrevocable trust in the state of georgia. Irrevocable trusts are crucial in estate. Learn about the creation, management, and benefits of irrevocable trusts. Using georgia trust forms, you are able to give real estate, personal property. Up to $40 cash back a georgia trust agreement — irrevocable is a legally binding contract that sets forth the terms and conditions for creating an irrevocable trust in the state of georgia. Up to $40 cash back in an irrevocable living trust, once the assets are. Up to $40 cash back a corpus of a file is assets that a grantor moves with an irrevocable or revocable trust. An irrevocable trust offers significant benefits, including the following: Explore the essentials of irrevocable living trusts in georgia, including setup, benefits, tax implications, and modification options. In georgia, an irrevocable trust generally cannot be changed or revoked. An. In georgia, an irrevocable trust generally cannot be changed or revoked. Explore the essentials of irrevocable living trusts in georgia, including setup, benefits, tax implications, and modification options. Using georgia trust forms, you are able to give real estate, personal property. Creating an irrevocable trust in georgia involves specific legal steps to ensure its validity. Learn about the creation, management,. Up to $40 cash back in an irrevocable living trust, once the assets are placed into the trust, they cannot be removed or changed without the permission of the beneficiaries or a court. Up to $40 cash back a georgia trust agreement — irrevocable is a legally binding contract that sets forth the terms and conditions for creating an irrevocable. Creating an irrevocable trust in georgia involves specific legal steps to ensure its validity. Up to $40 cash back in an irrevocable living trust, once the assets are placed into the trust, they cannot be removed or changed without the permission of the beneficiaries or a court. Using georgia trust forms, you are able to give real estate, personal property.. Up to $40 cash back georgia general form of irrevocable trust agreement is a legally binding document that establishes guidelines and terms for creating an irrevocable trust in the. An irrevocable living trust is a legal. Up to $40 cash back a georgia trust agreement — irrevocable is a legally binding contract that sets forth the terms and conditions for. Assets placed in an irrevocable trust are usually. Up to $40 cash back some types of irrevocable trusts include an irrevocable life insurance trust, irrevocable family trust, medicaid income trust, special needs trust, and charitable trust. An irrevocable living trust is a legal. Explore the essentials of irrevocable living trusts in georgia, including setup, benefits, tax implications, and modification options. Because the grantor relinquishes control of the assets, these trusts can be used to minimize estate taxes. But, there are exceptions under certain circumstances. The georgia department of community health is the residuary beneficiary to the extent of the total medical assistance paid on behalf of the grantor by the state of georgia. This irrevocable trust agreement is made this [day] day of [month], [year], between [name], of [address], city of [city], state of [state], herein referred to as grantor, and [name], of [address],. Using georgia trust forms, you are able to give real estate, personal property. If all beneficiaries agree, they can alter the trust’s. In georgia, an irrevocable trust generally cannot be changed or revoked. Up to $40 cash back in an irrevocable living trust, once the assets are placed into the trust, they cannot be removed or changed without the permission of the beneficiaries or a court. The process begins with the grantor transferring assets into the trust, relinquishing. Up to $40 cash back a georgia trust agreement — irrevocable is a legally binding contract that sets forth the terms and conditions for creating an irrevocable trust in the state of georgia. Up to $40 cash back a corpus of a file is assets that a grantor moves with an irrevocable or revocable trust. Creating an irrevocable trust in georgia involves specific legal steps to ensure its validity.Free Irrevocable Living Trust Agreement PDF 28KB 9 Page(s)

Free Revocable Living Trust Form PDF & Word

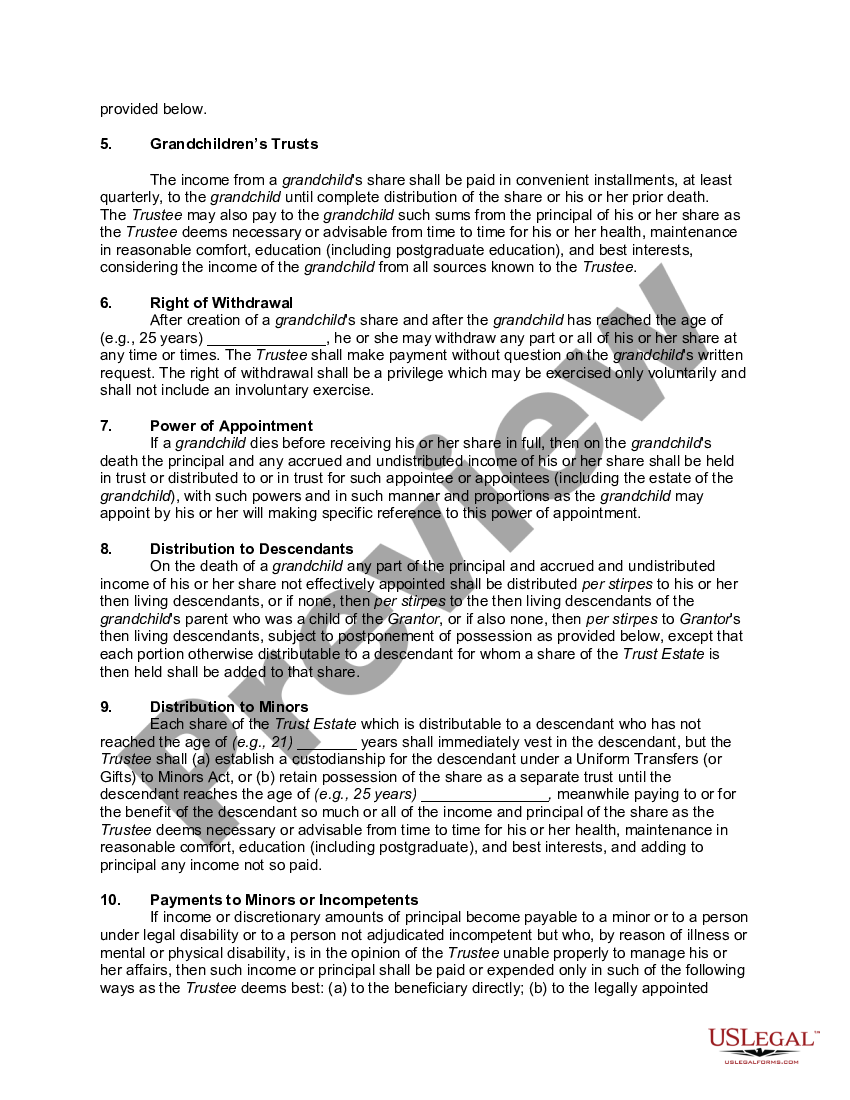

Irrevocable Pot Trust Agreement Pot Trust Sample US Legal Forms

Irrevocable Living Trust in Hurban Law, LLC

Living Trust for Husband and Wife with Minor and or Adult

Irrevocable Trust Sample Complete with ease airSlate SignNow

Irrevocable Trust Agreement for Benefit of Trustor's Children

Irrevocable Living Trust Trust Law Trustee

Download Irrevocable Living Trust Form PDF RTF Word

Irrevocable Trust in Hurban Law, LLC

Learn About The Creation, Management, And Benefits Of Irrevocable Trusts In Georgia, Including Trustee Roles And Tax Implications.

An Irrevocable Trust Offers Significant Benefits, Including The Following:

Irrevocable Trusts Are Crucial In Estate.

Up To $40 Cash Back Georgia General Form Of Irrevocable Trust Agreement Is A Legally Binding Document That Establishes Guidelines And Terms For Creating An Irrevocable Trust In The.

Related Post: