Inquiry Removal Letter Template

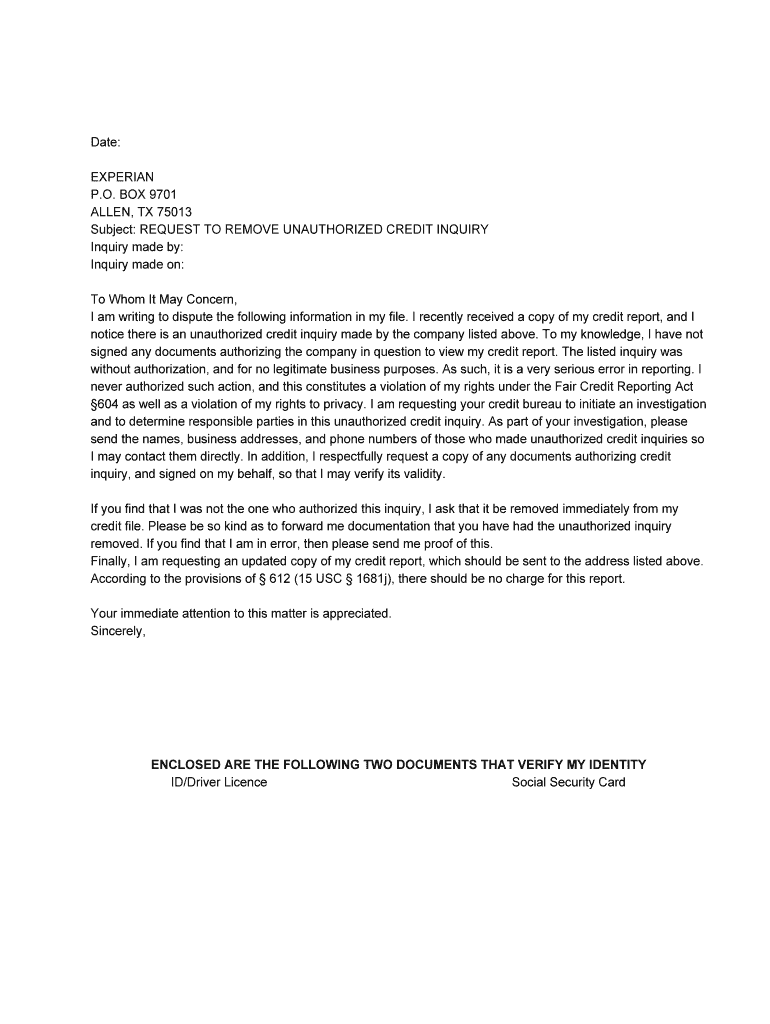

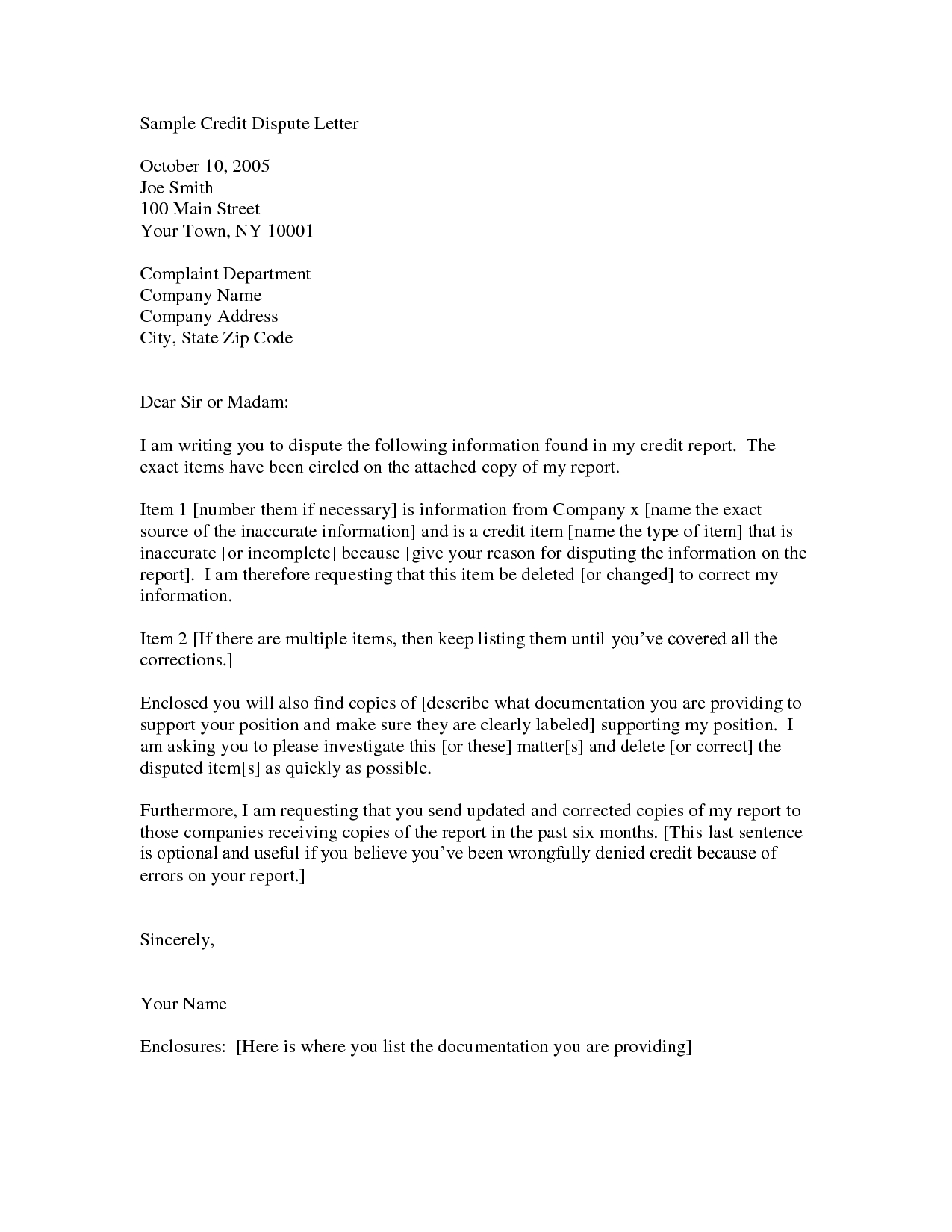

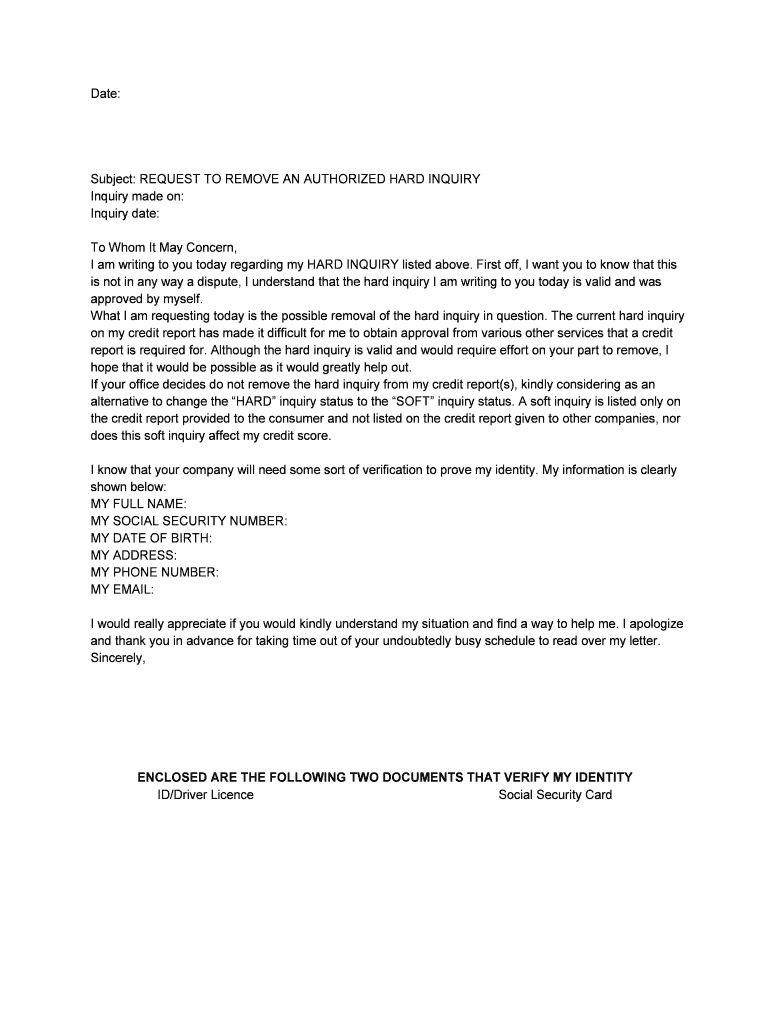

Inquiry Removal Letter Template - Removing false inquiries from your report requires you to: By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my credit report. A credit inquiry removal letter is used to alert the credit bureaus of an unauthorized inquiry and request that it be removed. Why removing inquiries matters and how it can improve your credit score. This includes the date of the inquiry, the name of the creditor, and any supporting documents. Edit your hard inquiry removal letter pdf online. Accurately locate them in your credit report. You can send this sample letter to a credit bureau requesting to remove inquiries from your credit report. Please ensure that this information is updated within the. You can send this sample letter to a credit bureau requesting to remove inquiries from your credit report. Removing false inquiries from your report requires you to: Up to 40% cash back send 604 inquiry removal letter pdf via email, link, or fax. Please ensure that this information is updated within the. Why removing inquiries matters and how it can improve your credit score. Procedures for disputing hard inquiries include contacting credit bureaus such as experian, equifax, or. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. The full text of the letter is below. This includes the date of the inquiry, the name of the creditor, and any supporting documents. This letter requests the removal of unauthorized credit inquiries from the recipient's credit report. The full text of the letter is below. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. Edit your hard inquiry removal letter pdf online. If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my credit report. It notes three. A simple, yet effective letter to. What is a letter of interest? A letter of interest (also called a “prospecting letter,” “letter of inquiry,” or “statement of inquiry”) shows your general interest in working at a. Upon receipt, it is the credit bureaus duty to investigate. Removing false inquiries from your report requires you to: Please ensure that this information is updated within the. This letter requests the removal of unauthorized credit inquiries from the recipient's credit report. Collect all relevant information about the credit inquiry you wish to remove. If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my credit report. Below we’ve provided some tips. A simple, yet effective letter to. It notes three specific unauthorized inquiries and requests documentation showing authorization,. Procedures for disputing hard inquiries include contacting credit bureaus such as experian, equifax, or. What is a letter of interest? In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit. Collect all relevant information about the credit inquiry you wish to remove. Procedures for disputing hard inquiries include contacting credit bureaus such as experian, equifax, or. A simple, yet effective letter to. This letter requests the removal of unauthorized credit inquiries from the recipient's credit report. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore. A simple, yet effective letter to. Timely removal of erroneous inquiries can help improve creditworthiness. What is a letter of interest? Please ensure that this information is updated within the. Procedures for disputing hard inquiries include contacting credit bureaus such as experian, equifax, or. This letter requests the removal of unauthorized credit inquiries from the recipient's credit report. Since it is against federal law (fair credit reporting act—15 usc § 1681n (a) (1) (b) for an entity to view a customer’s credit report without a “permissible purpose,” i am writing. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report,. A simple, yet effective letter to. The full text of the letter is below. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit inquiry, and provide a detailed step. Why removing inquiries matters and how it can improve your credit score. Removing false inquiries from your. Make sure that you use fax or certified mail in order to ensure your. Procedures for disputing hard inquiries include contacting credit bureaus such as experian, equifax, or. A letter of interest (also called a “prospecting letter,” “letter of inquiry,” or “statement of inquiry”) shows your general interest in working at a. Removing false inquiries from your report requires you. A simple, yet effective letter to. It notes three specific unauthorized inquiries and requests documentation showing authorization,. Up to 40% cash back send 604 inquiry removal letter pdf via email, link, or fax. Edit your hard inquiry removal letter pdf online. Why removing inquiries matters and how it can improve your credit score. A simple, yet effective letter to. This includes the date of the inquiry, the name of the creditor, and any supporting documents. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. Collect all relevant information about the credit inquiry you wish to remove. A credit inquiry removal letter is used to alert the credit bureaus of an unauthorized inquiry and request that it be removed. Timely removal of erroneous inquiries can help improve creditworthiness. Submit a formal removal letter to the major credit bureaus. You can also download it, export it or print it out. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. A letter of interest (also called a “prospecting letter,” “letter of inquiry,” or “statement of inquiry”) shows your general interest in working at a. This letter requests the removal of unauthorized credit inquiries from the recipient's credit report. It notes three specific unauthorized inquiries and requests documentation showing authorization,. Upon receipt, it is the credit bureaus duty to investigate. A simple, yet effective letter to. Why removing inquiries matters and how it can improve your credit score. The full text of the letter is below.Inquiry Removal Letter Template Printable Word Searches

Hard Inquiry Removal Letter Printable

Hard Inquiry Removal Letter Printable

Credit Inquiry Removal Letter Template

Hard Inquiry Removal Credit Dispute Letter Template DIY Credit Repair

Hard Credit Inquiry Removal Letter Draft Destiny

Inquiry Removal Letters Inquiry Removal Letter 1 PDF

Credit Inquiry Removal Letter Template

Hard Inquiry Removal DIY Credit Dispute Letter Template Effective

Credit Inquiry Removal Letter Pdf Fill Online, Printable, Fillable

Please Ensure That This Information Is Updated Within The.

Procedures For Disputing Hard Inquiries Include Contacting Credit Bureaus Such As Experian, Equifax, Or.

Removing False Inquiries From Your Report Requires You To:

You Can Send This Sample Letter To A Credit Bureau Requesting To Remove Inquiries From Your Credit Report.

Related Post: