Home Loan Letter Of Explanation Template

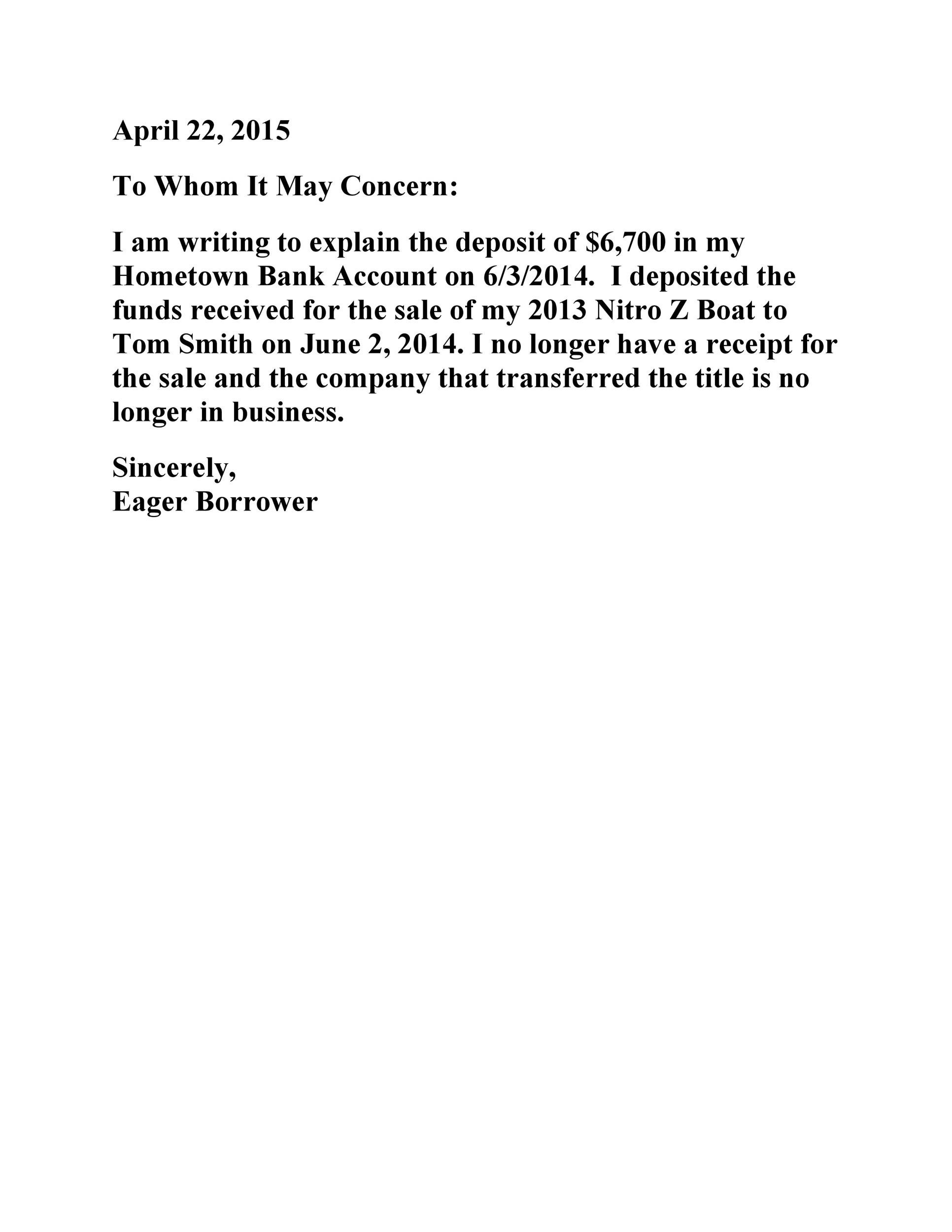

Home Loan Letter Of Explanation Template - In this comprehensive guide, we will cover when and why these. In this article, we'll guide you through the essential elements of a loan default explanation letter that conveys honesty and accountability. It is of utmost importance not to take it personally and to stay as truthful as. A letter of explanation can allow you to clarify any complications, including glitches in your credit history or employment, to help you qualify for a home loan. The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. Follow these steps to create a letter of explanation for mortgage: Knowing how to write a letter of explanation is important if you hope to acquire a loan for a house, as the document provides clarification about your credit report or bank. Quickly download a free sample letter of explanation for mortgage in pdf or word format. Mortgage loan number (or property address) to whom it may concern,. Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: (click the image to open a pdf version.) remember to include your mailing address, phone. In this comprehensive guide, we will cover when and why these. Mortgage lenders request a document named a letter of explanation when they want more details regarding your financial situation. A letter of explanation can be a key to qualifying for home loan funding. If an underwriter requests a letter of explanation, welcome it as an opportunity to clarify your. This article will explain what a mortgage letter of explanation is, why you need one, how it will help you if you have any discrepancies on your application, what information your lender needs to. For instance, a lender may ask for a letter of explanation for derogatory credit before. Greet the recipient (preferably, by name) and write down your own name. It is of utmost importance not to take it personally and to stay as truthful as. Mortgage lenders request a document named a letter of explanation when they want more details regarding your financial situation. Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender. Our 'free letter of explanation for loan' template is here to assist you. A letter of explanation can allow you to clarify any complications,. In this comprehensive guide, we will cover when and why these. Easily explain any discrepancies in your mortgage application. Knowing how to write a letter of explanation is important if you hope to acquire a loan for a house, as the document provides clarification about your credit report or bank. Quickly download a free sample letter of explanation for mortgage. (click the image to open a pdf version.) remember to include your mailing address, phone. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: Greet the recipient (preferably, by name) and write down your own name. Easily. It is of utmost importance not to take it personally and to stay as truthful as. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender. If an underwriter requests a letter of explanation, welcome. Our 'free letter of explanation for loan' template is here to assist you. Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: A letter of explanation can be a key to qualifying for home loan funding. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. This. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. This article will explain what a mortgage letter of explanation is, why you need one, how it will help you if you have any discrepancies on your application, what information your lender needs to. So, grab a cup of coffee, and let's.. If an underwriter requests a letter of explanation, welcome it as an opportunity to clarify your. Our 'free letter of explanation for loan' template is here to assist you. It is of utmost importance not to take it personally and to stay as truthful as. The exact content will vary based on your situation, but here’s a general letter template. To write a letter of explanation for mortgage you will need to see from the lender’s notice what the subject is. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. Follow these steps to create a letter of explanation for mortgage: A letter of explanation can allow you to clarify any. A letter of explanation might be requested. Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: Mortgage lenders request a document named a letter of explanation when they want more details regarding your financial situation. Greet the recipient (preferably, by name) and write down your own name. Our 'free letter of explanation for loan' template. In this article, we'll guide you through the essential elements of a loan default explanation letter that conveys honesty and accountability. A letter of explanation is a short document you would send to a recipient such as a lender. And this guide will tell. Why do mortgage lenders ask for letters of explanation, and do you have a sample template. A letter of explanation is a short document you would send to a recipient such as a lender. Quickly download a free sample letter of explanation for mortgage in pdf or word format. Knowing how to write a letter of explanation is important if you hope to acquire a loan for a house, as the document provides clarification about your credit report or bank. A letter of explanation might be requested. In this article, we'll guide you through the essential elements of a loan default explanation letter that conveys honesty and accountability. Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. Our 'free letter of explanation for loan' template is here to assist you. For instance, a lender may ask for a letter of explanation for derogatory credit before. Easily explain any discrepancies in your mortgage application. Mortgage loan number (or property address) to whom it may concern,. (click the image to open a pdf version.) remember to include your mailing address, phone. This article will explain what a mortgage letter of explanation is, why you need one, how it will help you if you have any discrepancies on your application, what information your lender needs to. So, grab a cup of coffee, and let's. Why do mortgage lenders ask for letters of explanation, and do you have a sample template we can use to get started?” the letter of explanation (or loe for short) is a common part of the.Mortgage Letter of Explanation (How to Write + sample).

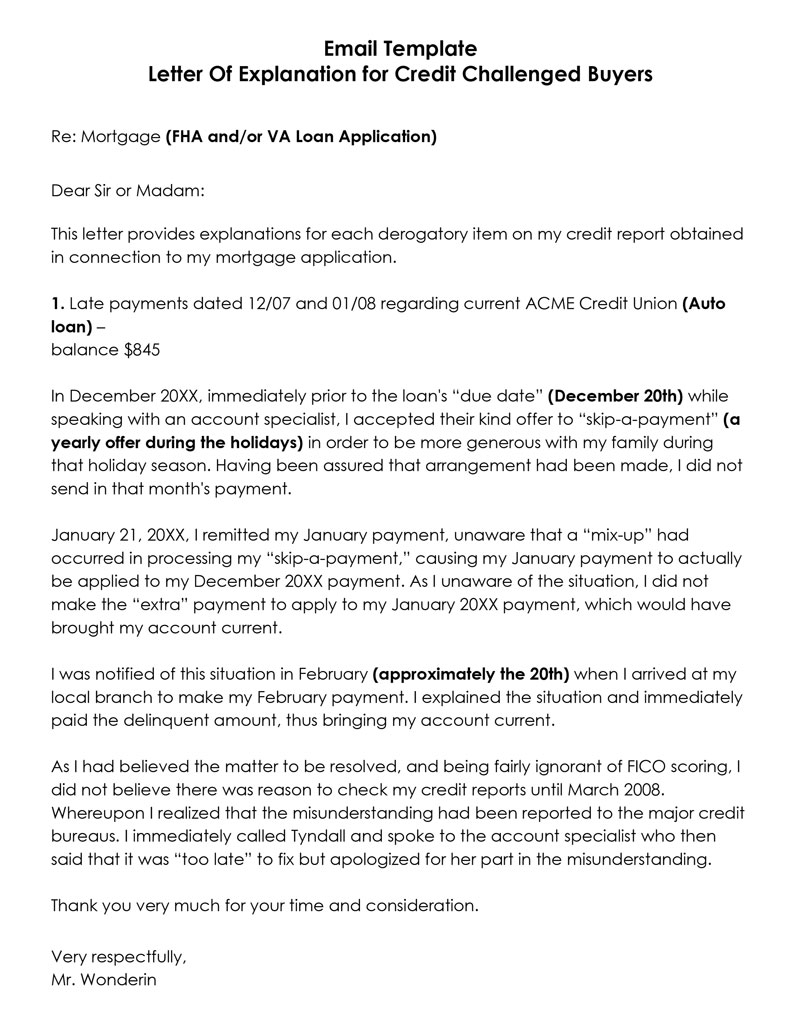

Free Printable Letter Of Explanation Templates [PDF, Word] Mortgage

Letter Of Explanation Template Letter Explanation Mortgage S

48 Letters Of Explanation Templates (Mortgage, Derogatory Credit...)

48 Letters Of Explanation Templates (Mortgage, Derogatory Credit...)

48 Letters Of Explanation Templates (Mortgage, Derogatory Credit...)

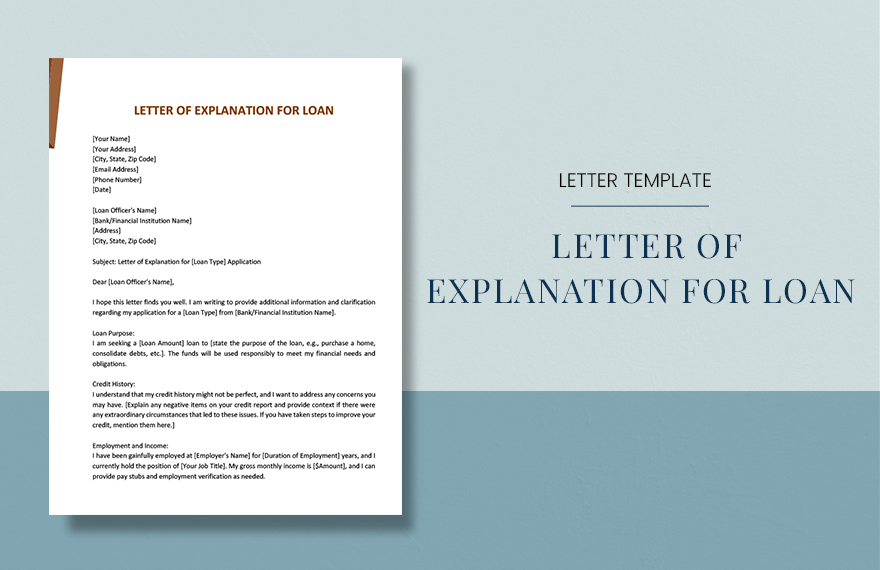

Letter of Explanation For Loan in Word, PDF, Google Docs, Pages

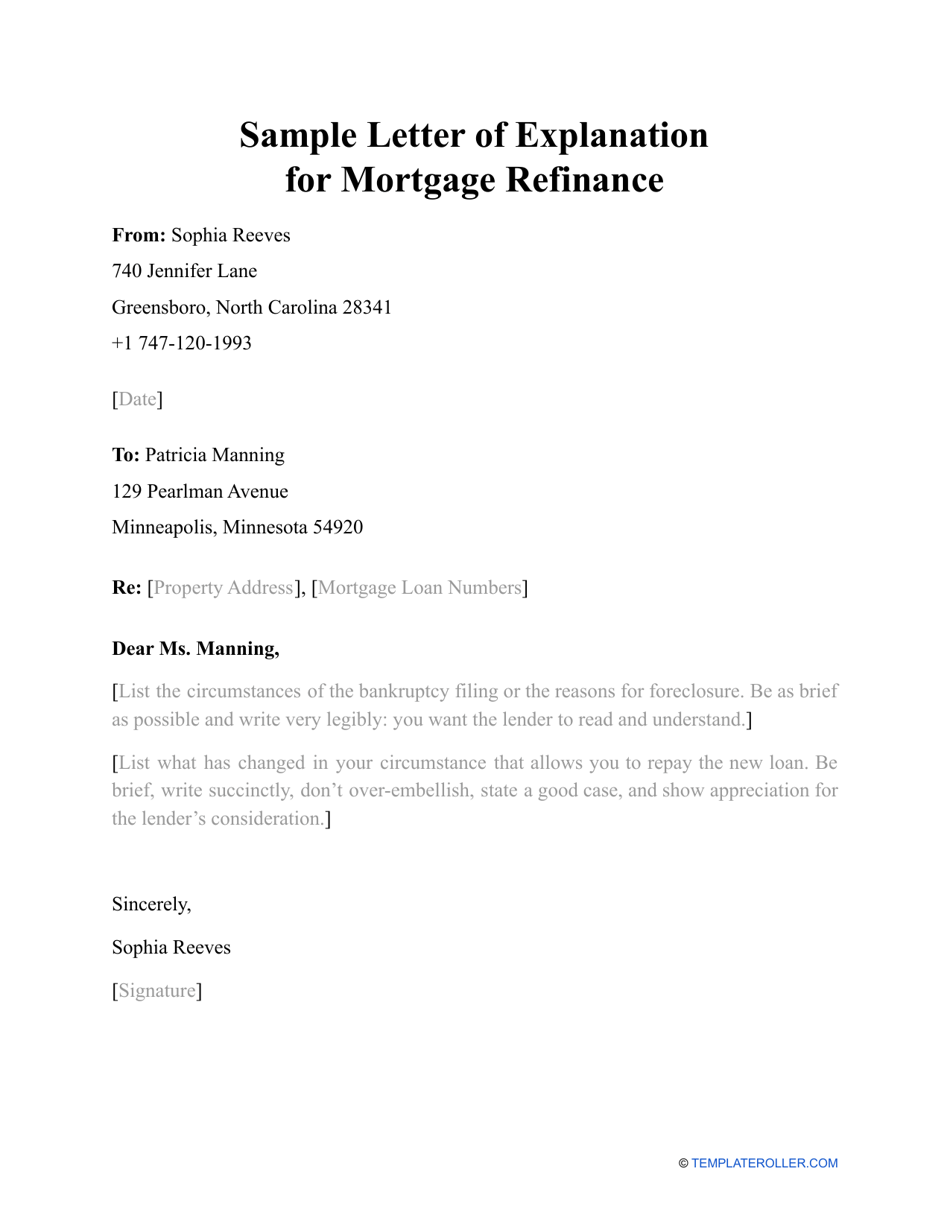

Sample Letter of Explanation for Mortgage Refinance Download Printable

48 Letters Of Explanation Templates (Mortgage, Derogatory Credit...)

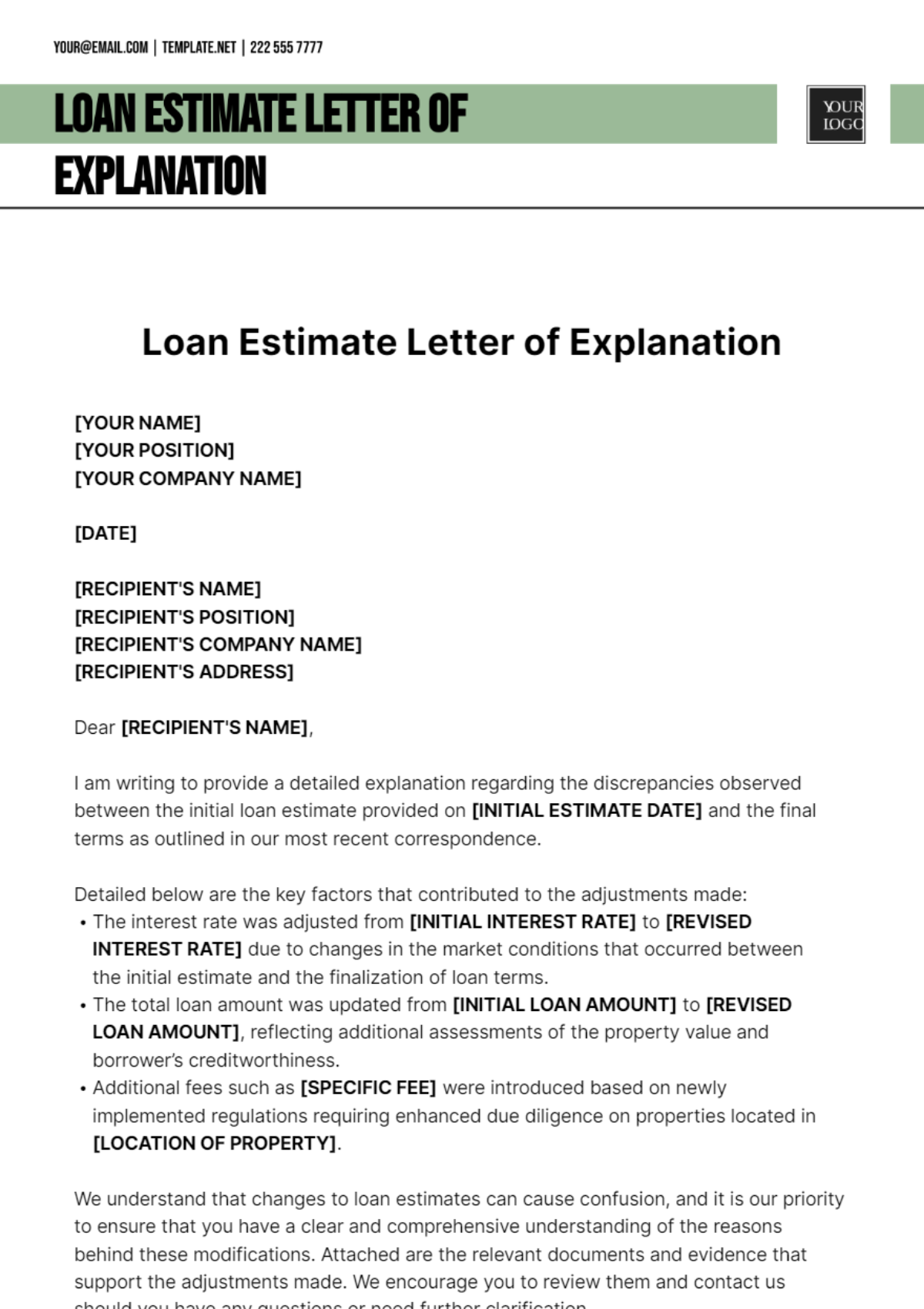

Free Loan Estimate Letter Of Explanation Template Edit Online

Greet The Recipient (Preferably, By Name) And Write Down Your Own Name.

Follow These Steps To Create A Letter Of Explanation For Mortgage:

In This Comprehensive Guide, We Will Cover When And Why These.

A Letter Of Explanation Can Allow You To Clarify Any Complications, Including Glitches In Your Credit History Or Employment, To Help You Qualify For A Home Loan.

Related Post:

![Free Printable Letter Of Explanation Templates [PDF, Word] Mortgage](https://www.typecalendar.com/wp-content/uploads/2023/05/letter-of-explanation-mortgage.jpg)