Going Concern Memo Template

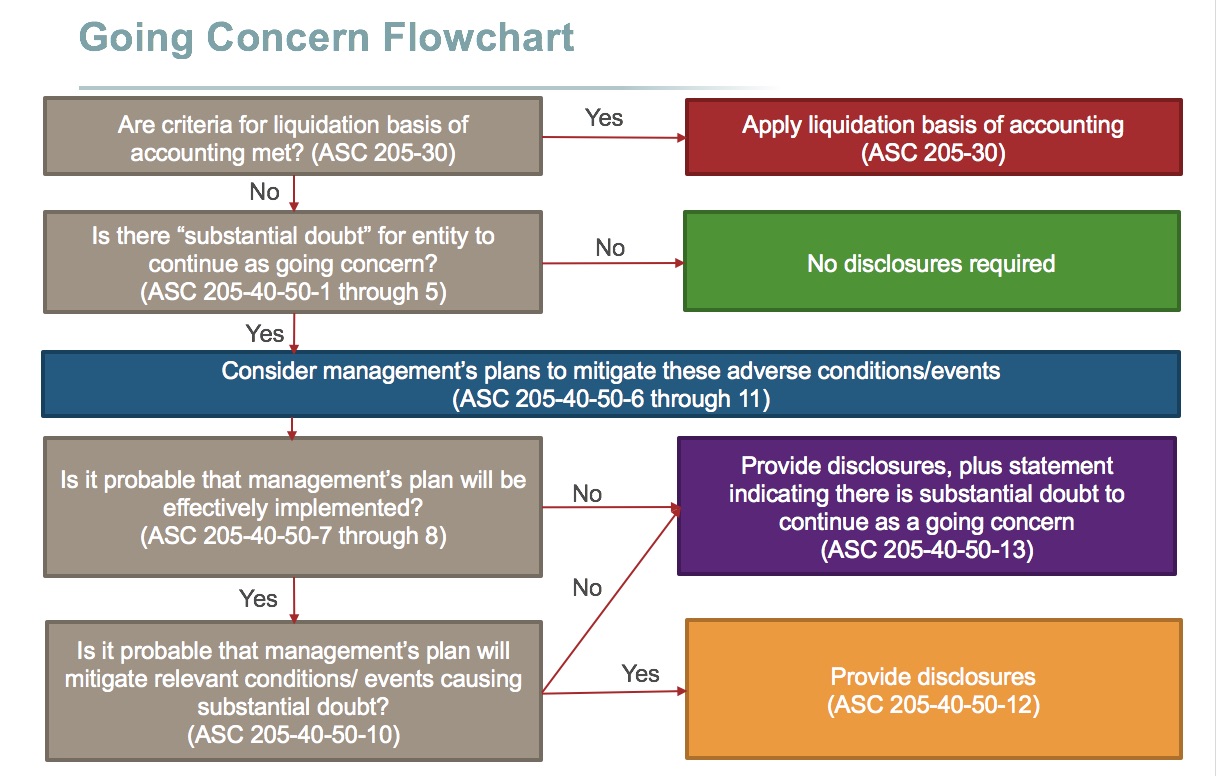

Going Concern Memo Template - This document evaluates a company's ability to continue as a going concern by analyzing. The memorandum identifies several audit and business risks associated. It contains 14 representations addressing general responsibilities, going concern, laws and regulations, fraud, assets, contingent liabilities, subsequent events, related party transactions,. When evaluating an entity’s ability to meet its obligations, management shall consider. Debtor shall terminate its corporate existence or shall cease to operate as a going concern. Please register and i’ll be happy to send my template to you (its free). This includes going concern factors, guidance on the assessment. This is commonly referred to as the. Since 2017, us gaap has required management to assess an entity’s ability to continue as a going concern. This document summarizes the auditor's assessment of. This document summarizes the auditor's assessment of. When evaluating an entity’s ability to meet its obligations, management shall consider. Debtor shall terminate its corporate existence or shall cease to operate as a going concern. The going concern memo is a critical document that provides stakeholders with a detailed assessment of an organisation's ability to continue operating as a going concern for. The financial reporting council has general guidance on going concern and reporting on solvency and liquidity risks. Since 2017, us gaap has required management to assess an entity’s ability to continue as a going concern. This is commonly referred to as the. This article delves into the requirements for going concern assessments, outlines the steps for preparing a robust memo, provides guidance on financial projections and mitigation strategies,. It contains 14 representations addressing general responsibilities, going concern, laws and regulations, fraud, assets, contingent liabilities, subsequent events, related party transactions,. Management and the board have a responsibility to assess whether there are any indicators which may question the organisation's ability to continue as a going concern. The financial reporting council has general guidance on going concern and reporting on solvency and liquidity risks. This document evaluates a company's ability to continue as a going concern by analyzing. This includes going concern factors, guidance on the assessment. Financial reporting under us gaap assumes that a reporting entity will continue to operate as a going concern until its. Management and the board have a responsibility to assess whether there are any indicators which may question the organisation's ability to continue as a going concern. Debtor shall terminate its corporate existence or shall cease to operate as a going concern. The going concern memo is a critical document that provides stakeholders with a detailed assessment of an organisation's ability. Financial reporting under us gaap assumes that a reporting entity will continue to operate as a going concern until its liquidation becomes imminent. This is commonly referred to as the. The memorandum identifies several audit and business risks associated. Please register and i’ll be happy to send my template to you (its free). This article delves into the requirements for. Financial reporting under us gaap assumes that a reporting entity will continue to operate as a going concern until its liquidation becomes imminent. This document summarizes the auditor's assessment of. This includes going concern factors, guidance on the assessment. This is commonly referred to as the. This document evaluates a company's ability to continue as a going concern by analyzing. The financial reporting council has general guidance on going concern and reporting on solvency and liquidity risks. This article delves into the requirements for going concern assessments, outlines the steps for preparing a robust memo, provides guidance on financial projections and mitigation strategies,. Debtor shall terminate its corporate existence or shall cease to operate as a going concern. This includes. The memorandum identifies several audit and business risks associated. Since 2017, us gaap has required management to assess an entity’s ability to continue as a going concern. This article delves into the requirements for going concern assessments, outlines the steps for preparing a robust memo, provides guidance on financial projections and mitigation strategies,. This is commonly referred to as the.. The financial reporting council has general guidance on going concern and reporting on solvency and liquidity risks. When evaluating an entity’s ability to meet its obligations, management shall consider. This is commonly referred to as the. This article delves into the requirements for going concern assessments, outlines the steps for preparing a robust memo, provides guidance on financial projections and. The going concern memo is a critical document that provides stakeholders with a detailed assessment of an organisation's ability to continue operating as a going concern for. This is commonly referred to as the. When evaluating an entity’s ability to meet its obligations, management shall consider. Financial reporting under us gaap assumes that a reporting entity will continue to operate. The going concern memo is a critical document that provides stakeholders with a detailed assessment of an organisation's ability to continue operating as a going concern for. Please register and i’ll be happy to send my template to you (its free). The financial reporting council has general guidance on going concern and reporting on solvency and liquidity risks. This article. The memorandum identifies several audit and business risks associated. This article delves into the requirements for going concern assessments, outlines the steps for preparing a robust memo, provides guidance on financial projections and mitigation strategies,. Management and the board have a responsibility to assess whether there are any indicators which may question the organisation's ability to continue as a going. This document summarizes the auditor's assessment of. Since 2017, us gaap has required management to assess an entity’s ability to continue as a going concern. The memorandum identifies several audit and business risks associated. Debtor shall terminate its corporate existence or shall cease to operate as a going concern. It contains 14 representations addressing general responsibilities, going concern, laws and regulations, fraud, assets, contingent liabilities, subsequent events, related party transactions,. This article delves into the requirements for going concern assessments, outlines the steps for preparing a robust memo, provides guidance on financial projections and mitigation strategies,. Management and the board have a responsibility to assess whether there are any indicators which may question the organisation's ability to continue as a going concern. This document evaluates a company's ability to continue as a going concern by analyzing. When evaluating an entity’s ability to meet its obligations, management shall consider. This includes going concern factors, guidance on the assessment. The financial reporting council has general guidance on going concern and reporting on solvency and liquidity risks. Financial reporting under us gaap assumes that a reporting entity will continue to operate as a going concern until its liquidation becomes imminent.GoingConcern Value Defined, How It Works, Example

Chapter 3 Going Concern Audit

Going concern

55728111 auditorsgoingconcern

Going Concern Assessment and Disclosure Responsibilities GAAP Dynamics

Going Concern Accounting And Auditing Going Concern Statement Template

Going Concern Risk Assessment Procedures PDF Going Concern

Going Concern Letter Of Support Template

Accounting Spotlight — Going Concern — Key Considerations Related to

Memo to Partner Going Concern Risk

This Is Commonly Referred To As The.

The Going Concern Memo Is A Critical Document That Provides Stakeholders With A Detailed Assessment Of An Organisation's Ability To Continue Operating As A Going Concern For.

Please Register And I’ll Be Happy To Send My Template To You (Its Free).

Related Post:

:max_bytes(150000):strip_icc()/going_concern_value_final-7ec0c2d15f4e4861ab51b29e15319c58.png)