Florida Court Summons Credit Card Debt Template

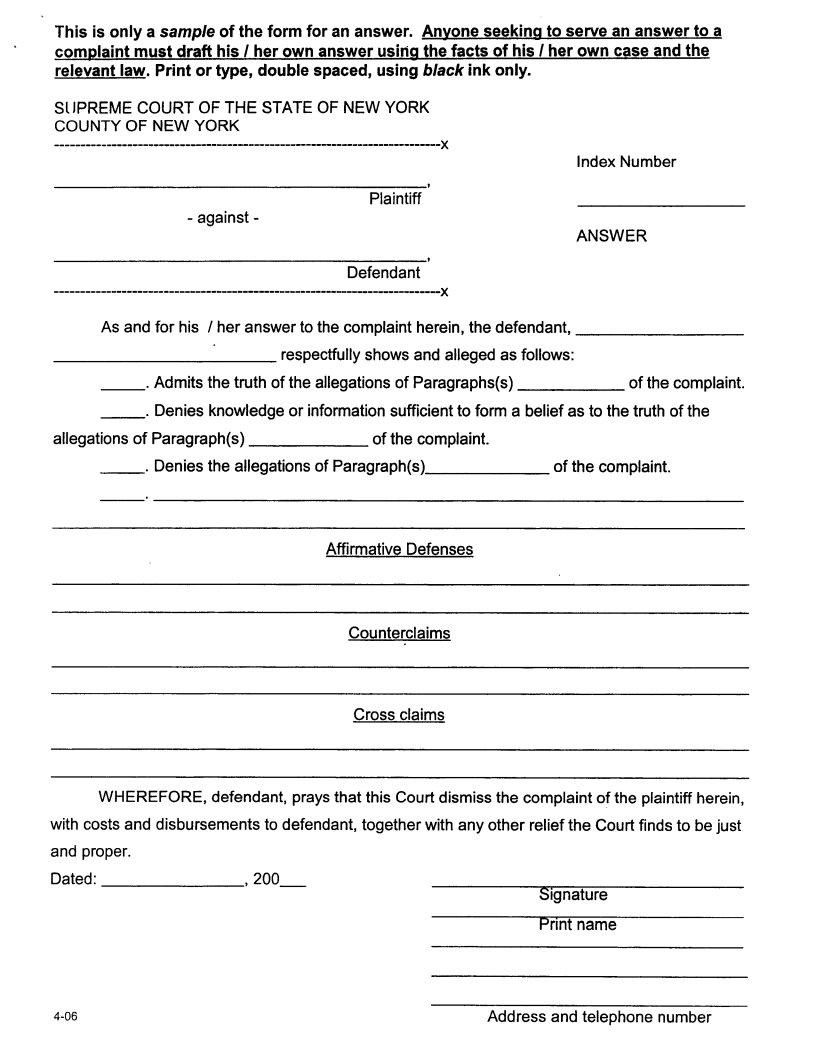

Florida Court Summons Credit Card Debt Template - Take a florida debt relief options calculator that helps you understand your options. To respond to the debt collector’s lawsuit in florida, you simply need to file an answer with the county court. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. In a nutshell, you will have to file an answer by responding to each and every allegation contained in the complaint as either admitted or denied and you may state your. What does it mean to respond to a debt collection lawsuit in florida? Here's a sample answer to a summons for a credit card debt lawsuit. Of the summons and complaint, you can assert this defense. When writing the answer, you only need to admit or deny each allegation. First off, getting a summons for unpaid credit card. This has to be in writing and generally, you have to answer within 20 to 30 days of receiving the summons. If you receive a summons and complaint from a debt collector or creditor, it means you’re being sued for unpaid debt. When you receive a summons for debt collection, it’s important to take action. What does it mean to respond to a debt collection lawsuit in florida? How to answer a florida court summons for debt collection. Set up the pleading (your answer) in the same manner that the plaintiff set up the complaint. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. Formally answer the summons with the court. Of the summons and complaint, you can assert this defense. File it with the court and attorney by the deadline. Here's a sample answer to a summons for a credit card debt lawsuit. When writing the answer, you only need to admit or deny each allegation. This has to be in writing and generally, you have to answer within 20 to 30 days of receiving the summons. How to answer a florida court summons for debt collection. Take a florida debt relief options calculator that helps you understand your options. Let's discuss how. When you receive a summons for debt collection, it’s important to take action. If you receive a summons and complaint from a debt collector or creditor, it means you’re being sued for unpaid debt. A court summons is a legal document issued by a florida court, notifying you of a lawsuit filed against you by a creditor or debt collector.. To respond to a debt lawsuit, you need to take three steps. A court summons is a legal document issued by a florida court, notifying you of a lawsuit filed against you by a creditor or debt collector. What does it mean to respond to a debt collection lawsuit in florida? First off, getting a summons for unpaid credit card.. Formally answer the summons with the court. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. When writing the answer, you only need to admit or deny each allegation. Here's a sample answer to a summons for a credit card debt lawsuit. In a nutshell, you will have to file an. Respond to every paragraph in the complaint. Take a florida debt relief options calculator that helps you understand your options. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. To respond to the debt collector’s lawsuit in florida, you simply need to file an answer with the county court. Let's discuss. Set up the pleading (your answer) in the same manner that the plaintiff set up the complaint. Respond to every paragraph in the complaint. What does it mean to respond to a debt collection lawsuit in florida? To respond to the debt collector’s lawsuit in florida, you simply need to file an answer with the county court. Formally answer the. File it with the court and attorney by the deadline. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. A court summons is a legal document issued by a florida court, notifying you of a lawsuit filed against you by a creditor or debt collector. Formally answer the summons with the. Here are the initial steps you should take in order to submit a summons response. Here's a sample answer to a summons for a credit card debt lawsuit. What does it mean to respond to a debt collection lawsuit in florida? First off, getting a summons for unpaid credit card. Let's discuss how to handle this and walk you through. Take a florida debt relief options calculator that helps you understand your options. It’s important to respond to (or answer) the lawsuit. First off, getting a summons for unpaid credit card. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. When you receive a summons for debt collection, it’s important to. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. It’s important to respond to (or answer) the lawsuit. Take a florida debt relief options calculator that helps you understand your options. A court summons is a legal document issued by a florida court, notifying you of a lawsuit filed against you. File it with the court and attorney by the deadline. Respond to every paragraph in the complaint. This has to be in writing and generally, you have to answer within 20 to 30 days of receiving the summons. It’s important to respond to (or answer) the lawsuit. Set up the pleading (your answer) in the same manner that the plaintiff set up the complaint. Here's a sample answer to a summons for a credit card debt lawsuit. Let's discuss how to handle this and walk you through a sample answer to a summons for credit card debt, so you know exactly what to do. Take a florida debt relief options calculator that helps you understand your options. First off, getting a summons for unpaid credit card. What does it mean to respond to a debt collection lawsuit in florida? Here are the initial steps you should take in order to submit a summons response. How to answer a florida court summons for debt collection. Debt.com provides expert guidance on how to answer a civil summons for credit card debt, including advice on how to reach a settlement outside of court to avoid legal action. Formally answer the summons with the court. In a nutshell, you will have to file an answer by responding to each and every allegation contained in the complaint as either admitted or denied and you may state your. A court summons is a legal document issued by a florida court, notifying you of a lawsuit filed against you by a creditor or debt collector.Template Sample Answer To Summons For Credit Card Debt

Debt Summons Answer Template

Answer To Debt Collection Lawsuit Template Card Template

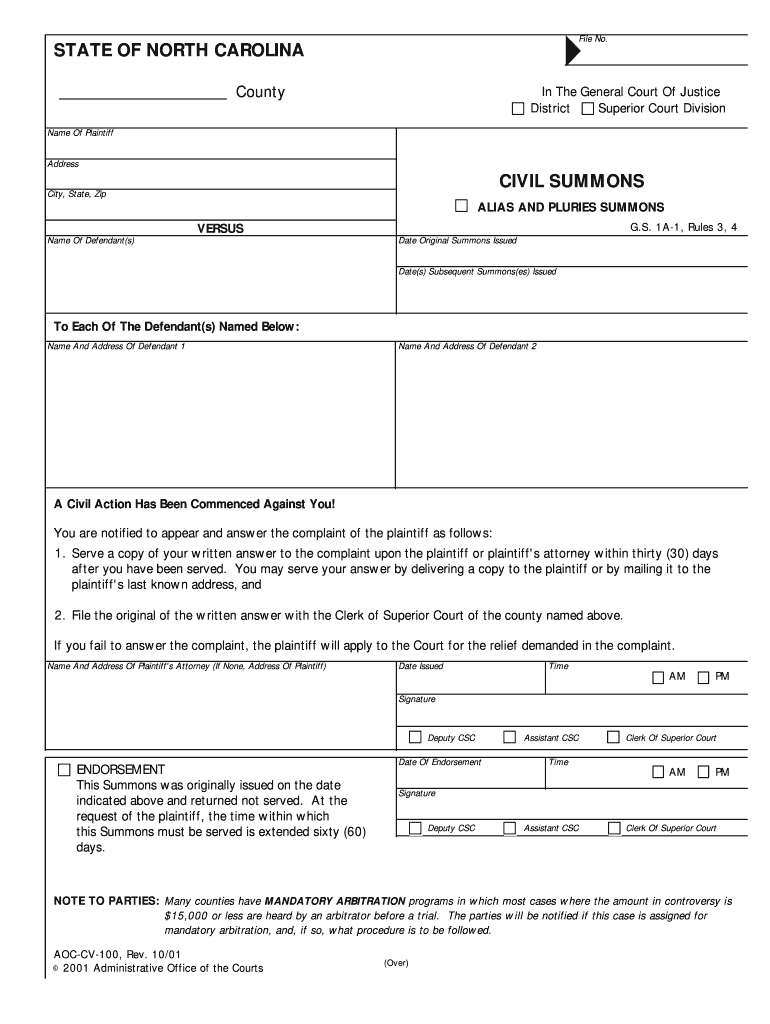

summons and complaint Doc Template pdfFiller

Template Sample Answer To Summons For Credit Card Debt

How to Answer a Civil Summons for Credit Card Debt The Free Financial

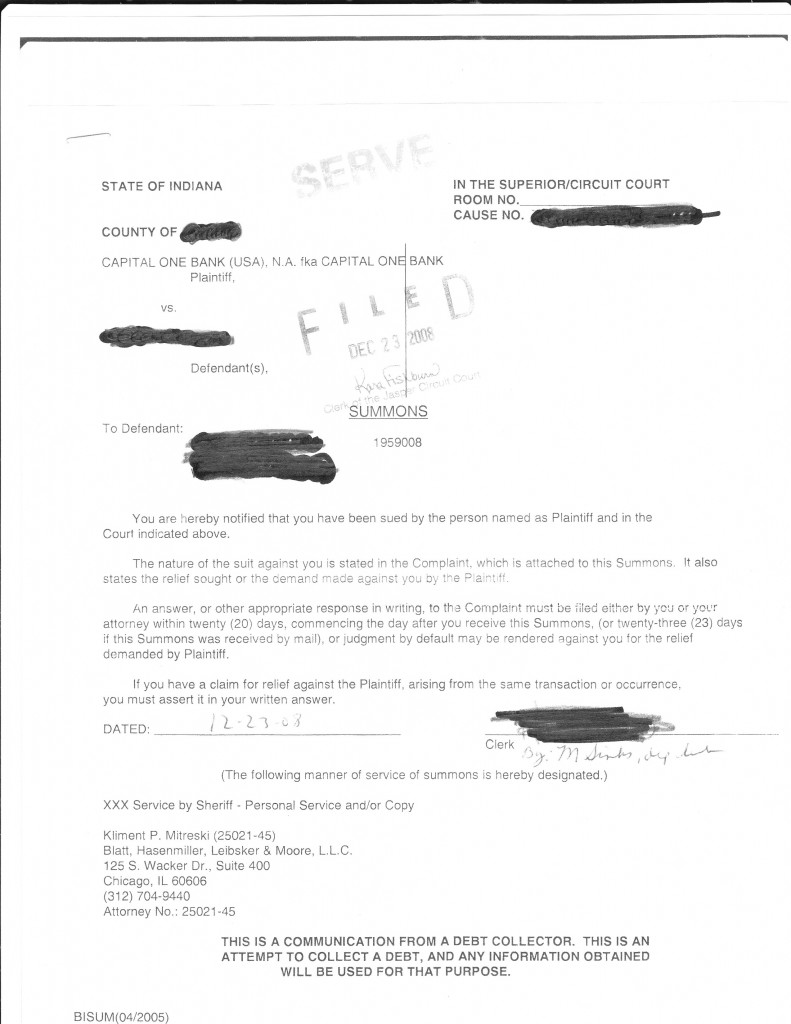

Debt Collection Summons Answer Letter

Example Of Summons Response Letter

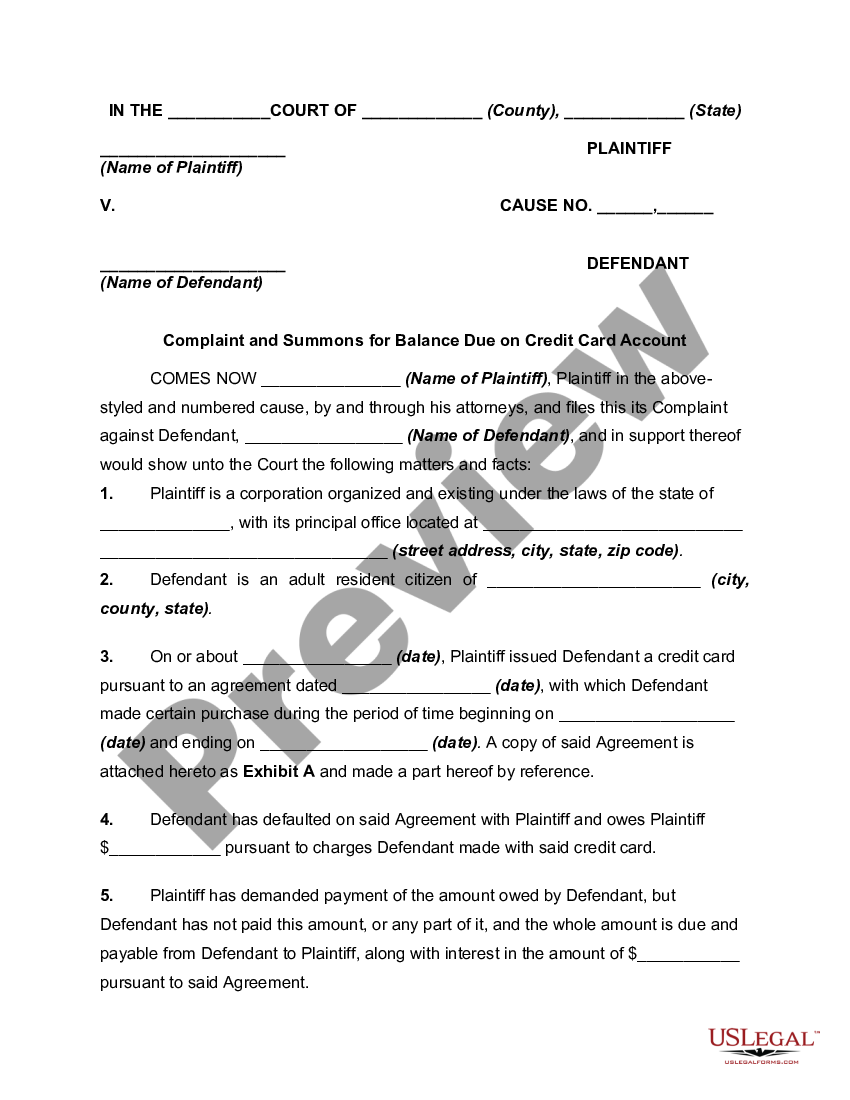

Complaint and Summons for Balance Due on Credit Card Account Summons

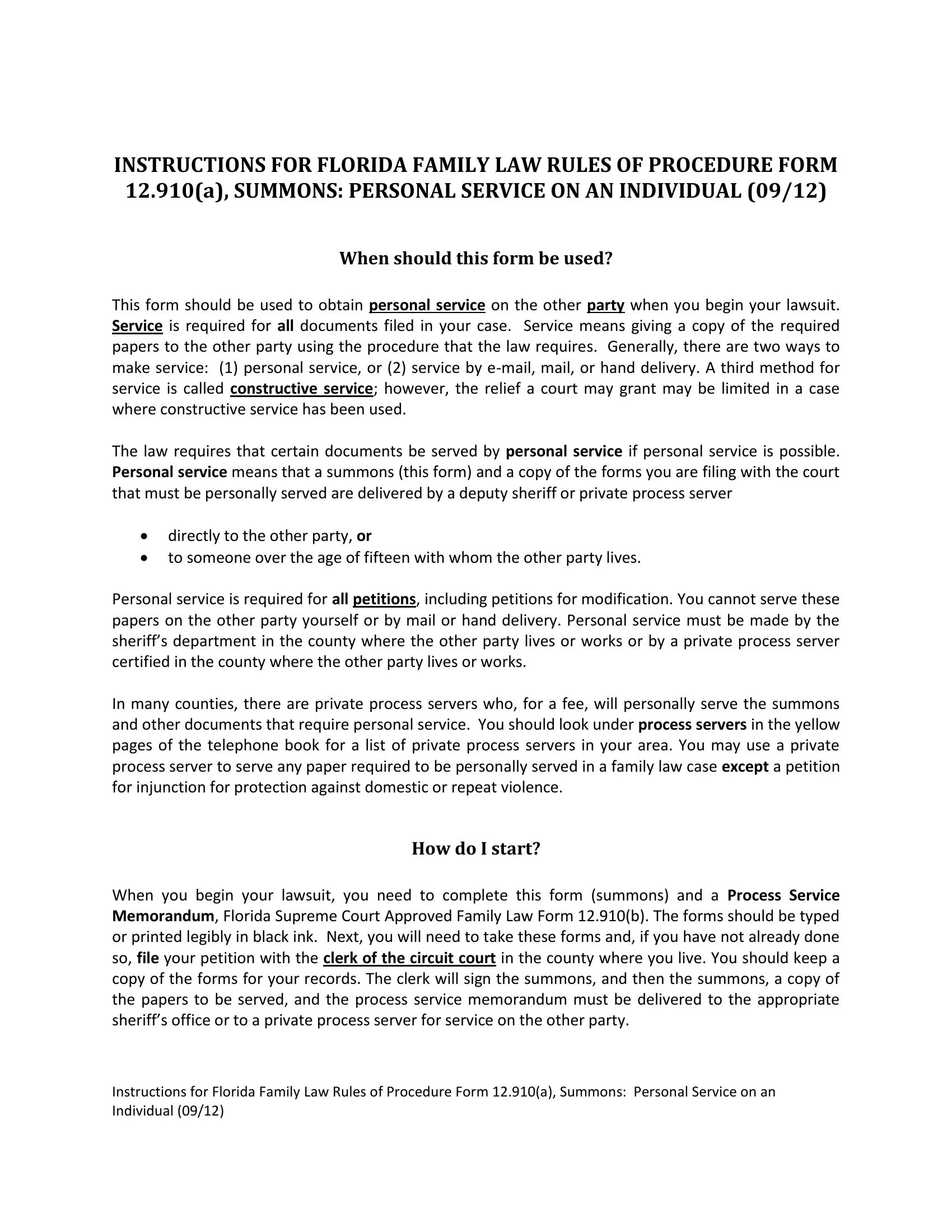

Form Fl Summons ≡ Fill Out Printable PDF Forms Online

When You've Been Sued Over A Credit Card Debt, The Plaintiff Usually Hopes That You'll Ignore The Lawsuit.

Respond To A Credit Card Debt Summons By Drafting A Concise Answer, Denying Claims, And Listing Defenses.

Of The Summons And Complaint, You Can Assert This Defense.

To Respond To A Debt Lawsuit, You Need To Take Three Steps.

Related Post: