Finra 3210 Letter Template

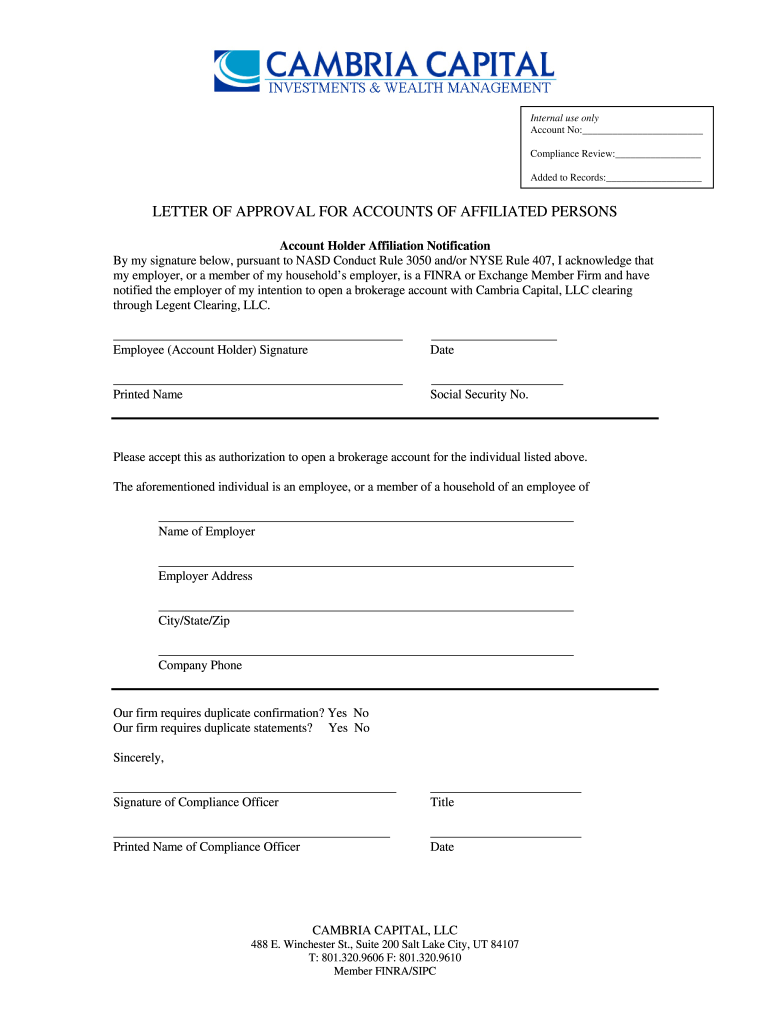

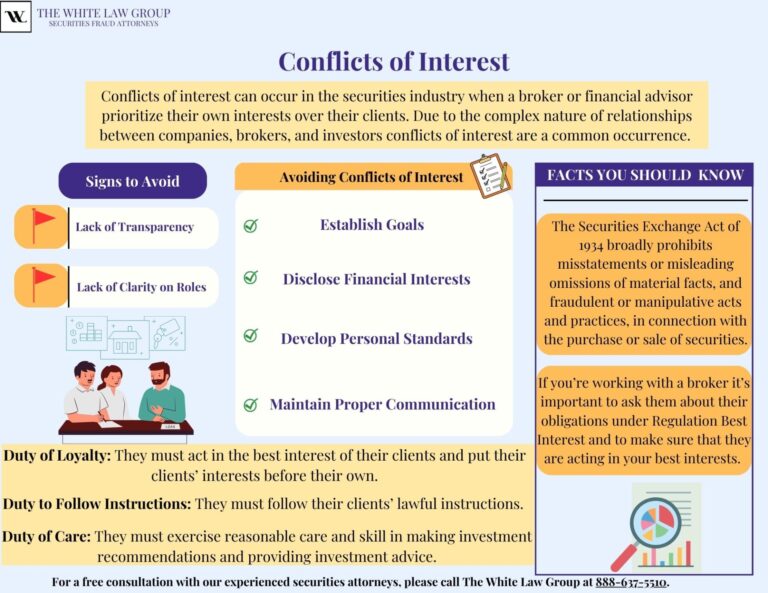

Finra 3210 Letter Template - In april of 2016, the securities and. Up to $40 cash back rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they work for to keep their accounts somewhere else. On april 13, 2016, the u.s. The summary and detailed topics are only available for 40 finra rules and have. Up to $50 cash back the finra 3210 letter rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they work for to keep their accounts. This form serves as an essential tool for associated persons at finra member firms looking to open or maintain brokerage accounts outside their current employer. Finra rule 3210 requires an executing member, upon written request by an employer member, to transmit duplicate copies of confirmations and statements, or the transactional data. The text of new finra rule 3210. Book traversal links for 3210. Rule 3210 now requires an associated person to notify the company and the executing firm in writing, prior to opening a securities account or placing an initial order for the. Up to $40 cash back rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they work for to keep their accounts somewhere else. A 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Book traversal links for 3210. According to the financial industry regulatory authority (finra), all registered representatives of an investment advisory firm must receive written consent before opening or. Finra rule 3210 puts obligations on both firms and financial advisors to ensure that all potential conflicts of interests are declared. Finra rule 3210 replaces nasd rule 3050, incorporated nyse rules 407 and 407a and incorporated nyse rule interpretations 407/01 and 407/02. The text of new finra rule 3210. Finra rule 3210 requires an executing member, upon written request by an employer member, to transmit duplicate copies of confirmations and statements, or the transactional data. In april of 2016, the securities and. This form serves as an essential tool for associated persons at finra member firms looking to open or maintain brokerage accounts outside their current employer. The summary and detailed topics are only available for 40 finra rules and have. Finra rule 3210 replaces nasd rule 3050, incorporated nyse rules 407 and 407a and incorporated nyse rule interpretations 407/01 and 407/02. Finra rule 3210 puts obligations on both firms and financial advisors to ensure that all potential conflicts of interests are declared. On april 13, 2016,. According to the financial industry regulatory authority (finra), all registered representatives of an investment advisory firm must receive written consent before opening or. Finra rule 3210 requires an executing member, upon written request by an employer member, to transmit duplicate copies of confirmations and statements, or the transactional data. Up to $40 cash back rule 3210 requires financial advisors to. On april 13, 2016, the u.s. A 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. This form serves as an essential tool for associated persons at finra member firms looking to open or maintain brokerage accounts outside their current employer. In april of 2016, the securities. The text of new finra rule 3210. On april 13, 2016, the u.s. In april of 2016, the securities and. This form serves as an essential tool for associated persons at finra member firms looking to open or maintain brokerage accounts outside their current employer. Finra rule 3210 replaces nasd rule 3050, incorporated nyse rules 407 and 407a and incorporated. Finra rule 3210 puts obligations on both firms and financial advisors to ensure that all potential conflicts of interests are declared. Book traversal links for 3210. Finra rule 3210 requires an executing member, upon written request by an employer member, to transmit duplicate copies of confirmations and statements, or the transactional data. Up to $50 cash back the finra 3210. Finra rule 3210 replaces nasd rule 3050, incorporated nyse rules 407 and 407a and incorporated nyse rule interpretations 407/01 and 407/02. On april 13, 2016, the u.s. This form serves as an essential tool for associated persons at finra member firms looking to open or maintain brokerage accounts outside their current employer. In april of 2016, the securities and. The. The summary and detailed topics are only available for 40 finra rules and have. According to the financial industry regulatory authority (finra), all registered representatives of an investment advisory firm must receive written consent before opening or. Up to $40 cash back rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they. The summary and detailed topics are only available for 40 finra rules and have. Finra rule 3210 replaces nasd rule 3050, incorporated nyse rules 407 and 407a and incorporated nyse rule interpretations 407/01 and 407/02. According to the financial industry regulatory authority (finra), all registered representatives of an investment advisory firm must receive written consent before opening or. On april. Up to $40 cash back rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they work for to keep their accounts somewhere else. The summary and detailed topics are only available for 40 finra rules and have. Finra rule 3210 puts obligations on both firms and financial advisors to ensure that all. The summary and detailed topics are only available for 40 finra rules and have. Finra rule 3210 replaces nasd rule 3050, incorporated nyse rules 407 and 407a and incorporated nyse rule interpretations 407/01 and 407/02. Finra rule 3210 puts obligations on both firms and financial advisors to ensure that all potential conflicts of interests are declared. Book traversal links for. Finra rule 3210 replaces nasd rule 3050, incorporated nyse rules 407 and 407a and incorporated nyse rule interpretations 407/01 and 407/02. Finra rule 3210 puts obligations on both firms and financial advisors to ensure that all potential conflicts of interests are declared. Book traversal links for 3210. Up to $50 cash back the finra 3210 letter rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they work for to keep their accounts. A 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. The summary and detailed topics are only available for 40 finra rules and have. According to the financial industry regulatory authority (finra), all registered representatives of an investment advisory firm must receive written consent before opening or. On april 13, 2016, the u.s. Up to $40 cash back rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they work for to keep their accounts somewhere else. In april of 2016, the securities and. The text of new finra rule 3210.What is FINRA Rule 3210 Rule 407 Letter? The White Law Group

3210 Letter Template

Pin on templates

Finra 3210 Letter Template Printable Kids Entertainment

Understanding FINRA Rule 3210

What is FINRA Rule 3210? [We'll Sue Your Advisor]

What is FINRA Rule 3210 Rule 407 Letter?

EX3200 EXCITER EX3210 Cover Letter Permissive Change Authorization

3210 letter template Fill out & sign online DocHub

What is FINRA Rule 3210 Rule 407 Letter? The White Law Group

Rule 3210 Now Requires An Associated Person To Notify The Company And The Executing Firm In Writing, Prior To Opening A Securities Account Or Placing An Initial Order For The.

Finra Rule 3210 Requires An Executing Member, Upon Written Request By An Employer Member, To Transmit Duplicate Copies Of Confirmations And Statements, Or The Transactional Data.

This Form Serves As An Essential Tool For Associated Persons At Finra Member Firms Looking To Open Or Maintain Brokerage Accounts Outside Their Current Employer.

Related Post:

![What is FINRA Rule 3210? [We'll Sue Your Advisor]](https://www.secatty.com/wp-content/uploads/2021/08/3210-letter.jpg)