Debt Repayment Plan Template

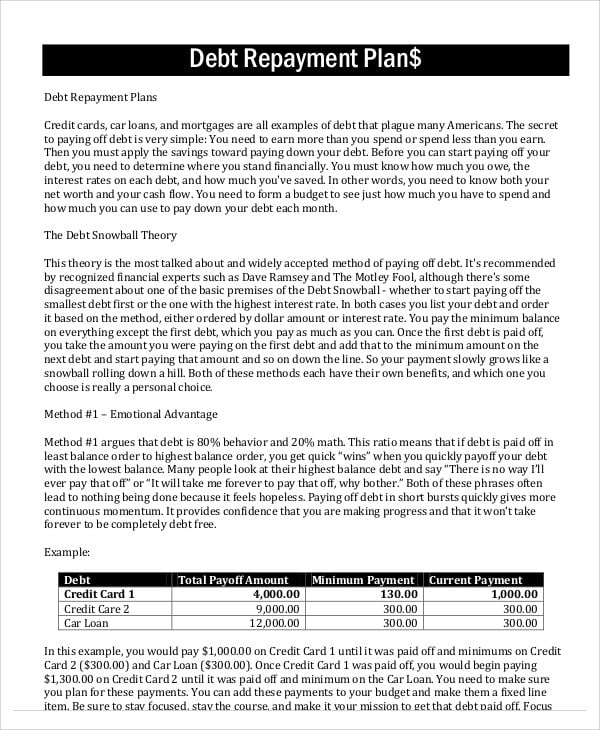

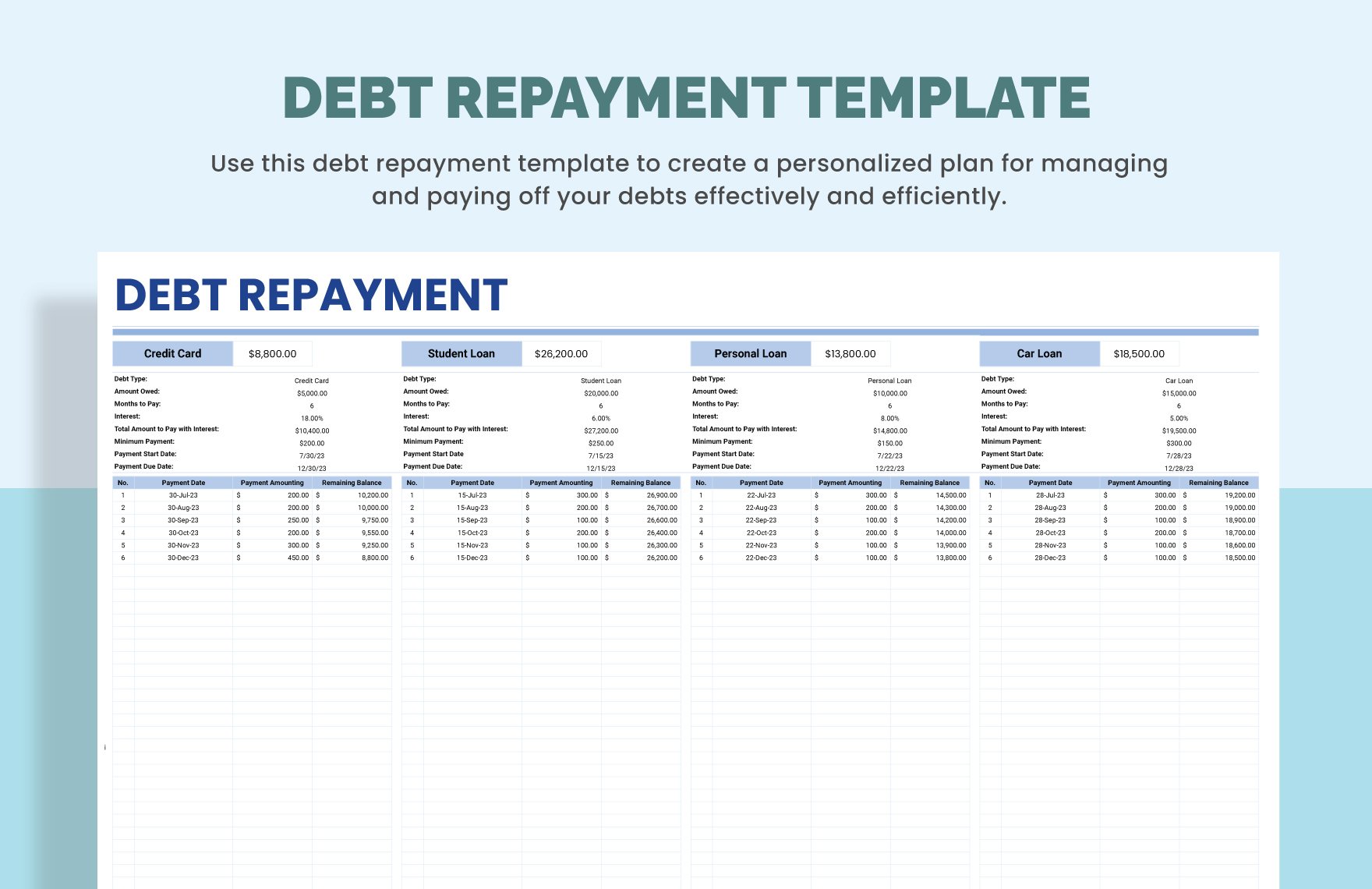

Debt Repayment Plan Template - By setting clear terms and maintaining open lines of communication,. Discover effective debt repayment plans and strategies with our collection of legal documents. Download a free debt payoff planner template to organize and track your debts, choose a debt payoff method, and plan your payments. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. See the benefits of using this tool and. The set includes a debt overview sheet, a debt payoff tracking. This template helps you organize all your debts in one place, set achievable goals, and create a clear plan to pay off debt faster. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. It outlines specific goals, schedules, and methods to ensure that. Download this debt repayment planner template design in word, google docs, pdf, apple pages format. Discover effective debt repayment plans and strategies with our collection of legal documents. To make student loan repayment. With this tool, you’ll have a clear and organized overview of your debt, including the total amounts owed, interest rates, minimum payments, and due dates. A payment plan template is a crucial document for structuring financial agreements that ensure timely debt repayment. Download a free debt payoff planner template to organize and track your debts, choose a debt payoff method, and plan your payments. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. Having an effective repayment plan. Approximately 43 million americans have outstanding federal student loan debt, and many of these borrowers struggle to repay their loans. You can also make extra payments. Columns and rows have been professionally designed so that you only. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. With this tool, you’ll have a clear and organized overview of your debt, including the total amounts owed, interest rates, minimum payments, and due dates. Check it out here for a free download. See the benefits of using this tool. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. By setting clear terms and maintaining open lines of communication,. With this tool, you’ll have a clear and organized overview of your debt, including the total amounts owed, interest rates, minimum payments, and due dates. Columns and rows have been professionally designed so that. It helps a person who owes multiple accounts pay off the smallest. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. Download a free debt payoff planner template to organize and track your debts, choose a debt payoff method, and plan your payments. These spreadsheets work best with the. Download a free debt payoff planner template to organize and track your debts, choose a debt payoff method, and plan your payments. Check it out here for a free download. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. Download this debt repayment planner template design in word, google. By implementing a structured repayment approach, the plan aims to enhance financial stability and operational efficiency. These spreadsheets work best with the debt snowball method. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. The set includes a debt overview sheet, a debt payoff tracking. See the benefits of using this tool and. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. These spreadsheets work best with the debt snowball method. Having an effective repayment plan. It helps a person who owes multiple accounts pay off the smallest. With this tool, you’ll have a clear and organized overview of your debt, including. Columns and rows have been professionally designed so that you only. This template helps you organize all your debts in one place, set achievable goals, and create a clear plan to pay off debt faster. By setting clear terms and maintaining open lines of communication,. These spreadsheets work best with the debt snowball method. Download this debt repayment planner template. These spreadsheets work best with the debt snowball method. See the benefits of using this tool and. Download this debt repayment planner template design in word, google docs, pdf, apple pages format. You can also make extra payments. Download a free debt payoff planner template to organize and track your debts, choose a debt payoff method, and plan your payments. The set includes a debt overview sheet, a debt payoff tracking. You can also make extra payments. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. With this tool, you’ll have a clear and organized overview of your debt, including the total amounts owed, interest rates, minimum payments, and due dates. These spreadsheets. Check it out here for a free download. To make student loan repayment. Discover effective debt repayment plans and strategies with our collection of legal documents. You can also make extra payments. By implementing a structured repayment approach, the plan aims to enhance financial stability and operational efficiency. With this tool, you’ll have a clear and organized overview of your debt, including the total amounts owed, interest rates, minimum payments, and due dates. It outlines specific goals, schedules, and methods to ensure that. Download this debt repayment planner template design in word, google docs, pdf, apple pages format. To make student loan repayment. You can also make extra payments. Discover effective debt repayment plans and strategies with our collection of legal documents. See the benefits of using this tool and. By implementing a structured repayment approach, the plan aims to enhance financial stability and operational efficiency. Download a free debt payoff planner template to organize and track your debts, choose a debt payoff method, and plan your payments. Check it out here for a free download. A payment plan template is a crucial document for structuring financial agreements that ensure timely debt repayment. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. These spreadsheets work best with the debt snowball method. Having an effective repayment plan. Columns and rows have been professionally designed so that you only.How to Use a Debt Repayment Plan Worksheet

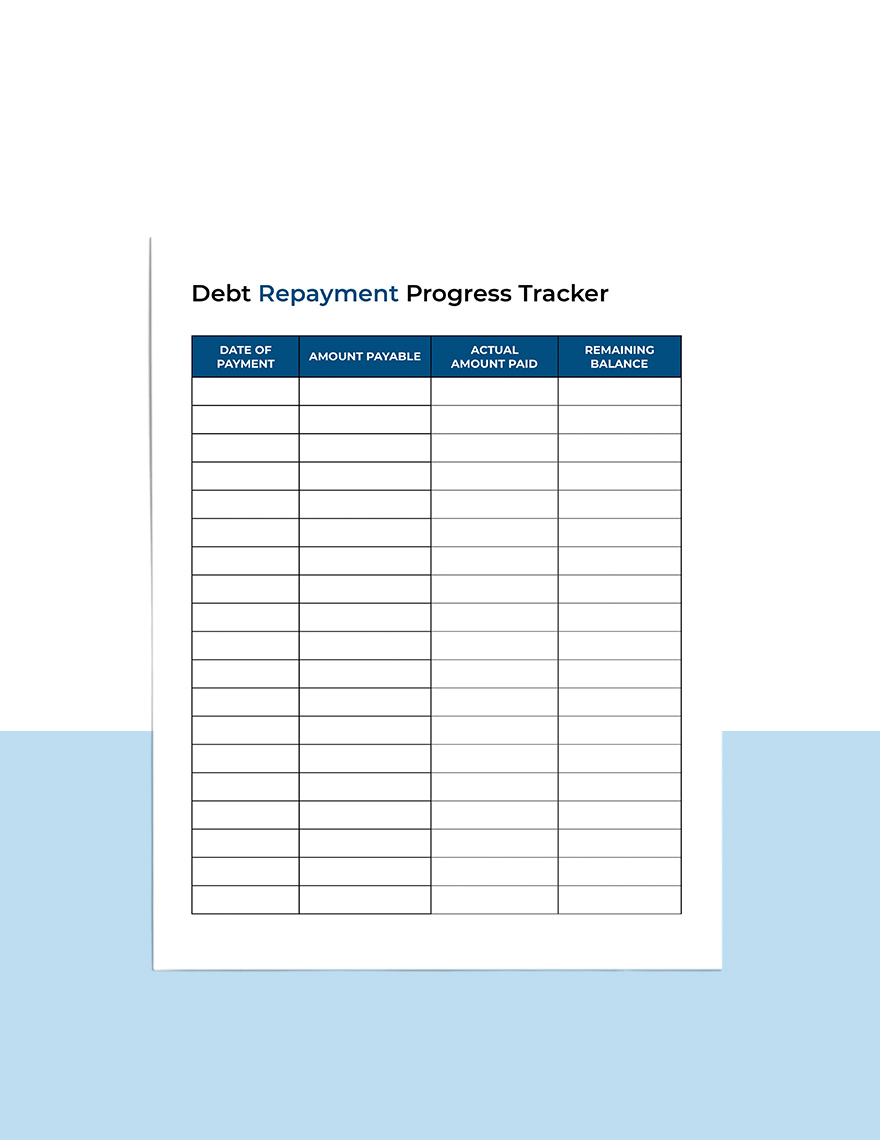

Debt Repayment Plan Template Master of Documents

Debt Repayment Plan PowerPoint Template How to plan, Debt repayment

similar to a budgeting template, this free debt repayment plan template

Debt Repayment Planner Template in Word, Pages, Google Docs, PDF

22+ Payment Plan Templates Word, PDF

Free Printable Debt Repayment Plan

Debt Repayment Printables Simply Stacie

Debt Repayment Plan Overview and Individual Credit tracker Etsy

Debt Repayment Template in Excel, Google Sheets Download

Approximately 43 Million Americans Have Outstanding Federal Student Loan Debt, And Many Of These Borrowers Struggle To Repay Their Loans.

By Setting Clear Terms And Maintaining Open Lines Of Communication,.

It Helps A Person Who Owes Multiple Accounts Pay Off The Smallest.

Exceltemplates.com Is Your Ultimate Source Of Debt Payoff Spreadsheet, That Are Always Completely Free!

Related Post:

/debtrepaymentplanworksheet-56a337565f9b58b7d0d0fb38.jpg)