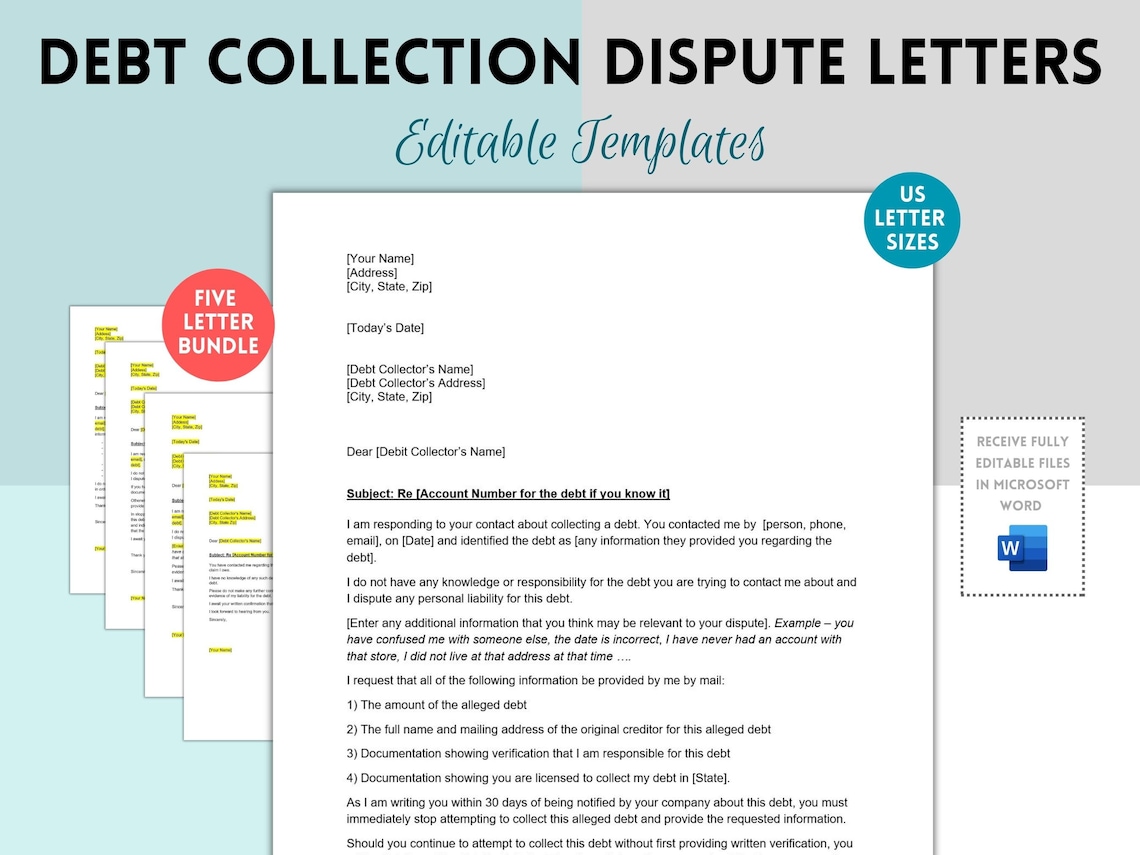

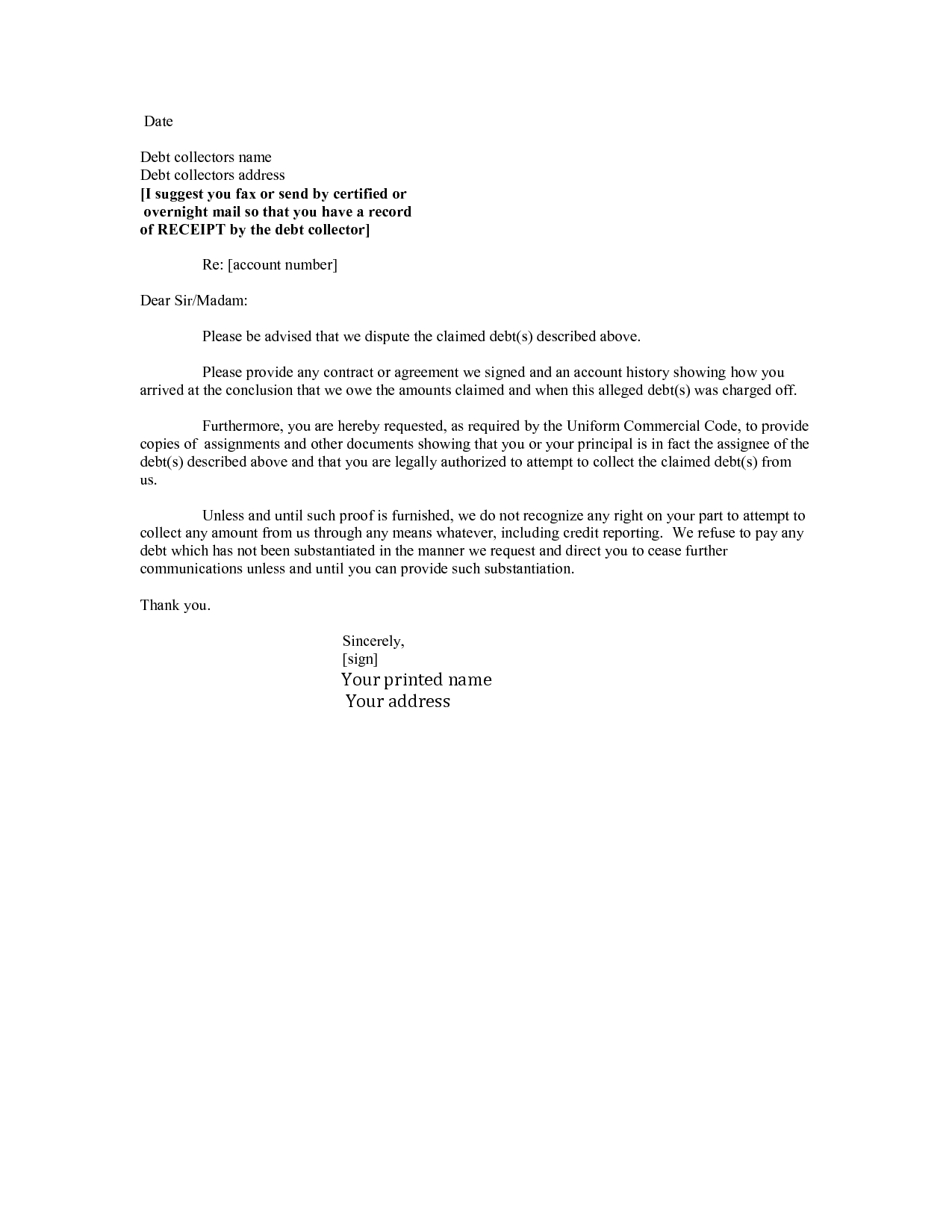

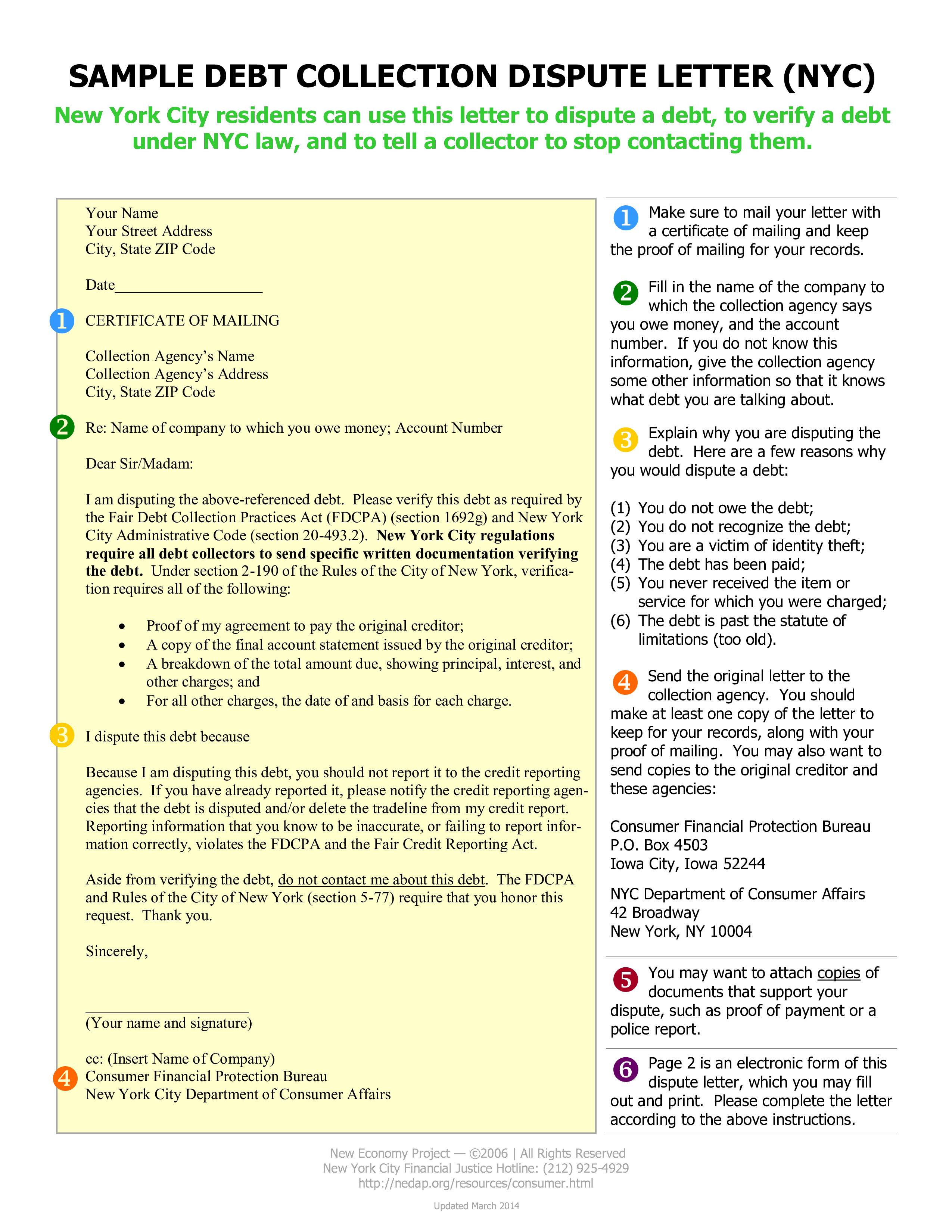

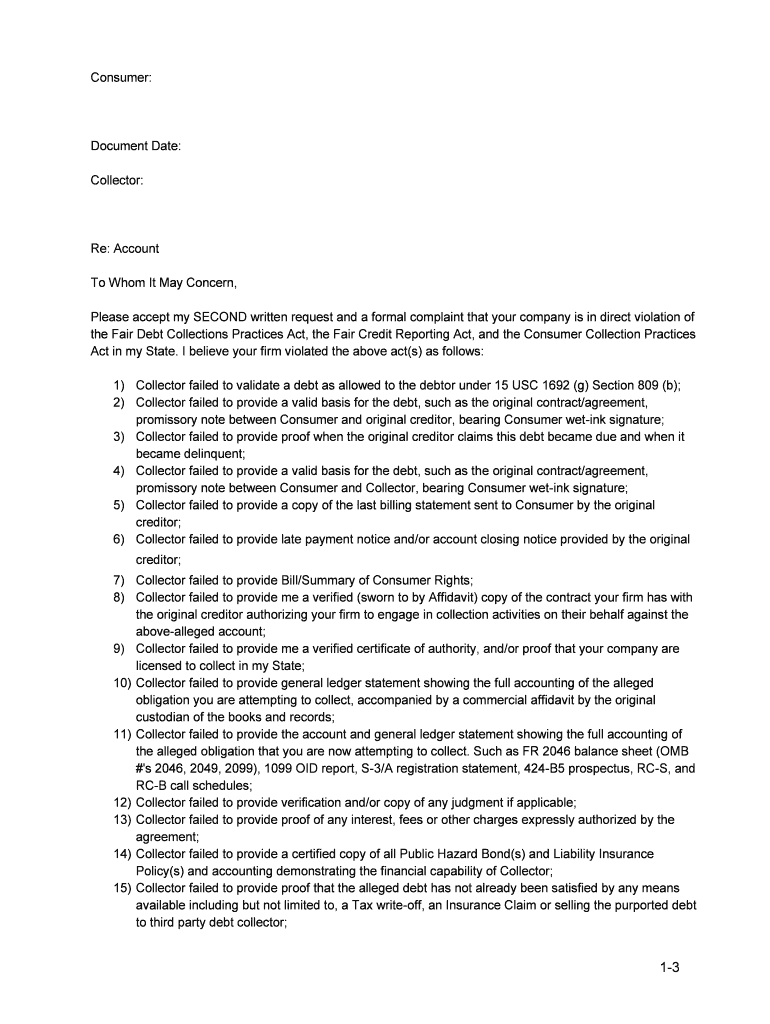

Debt Collection Dispute Letter Template

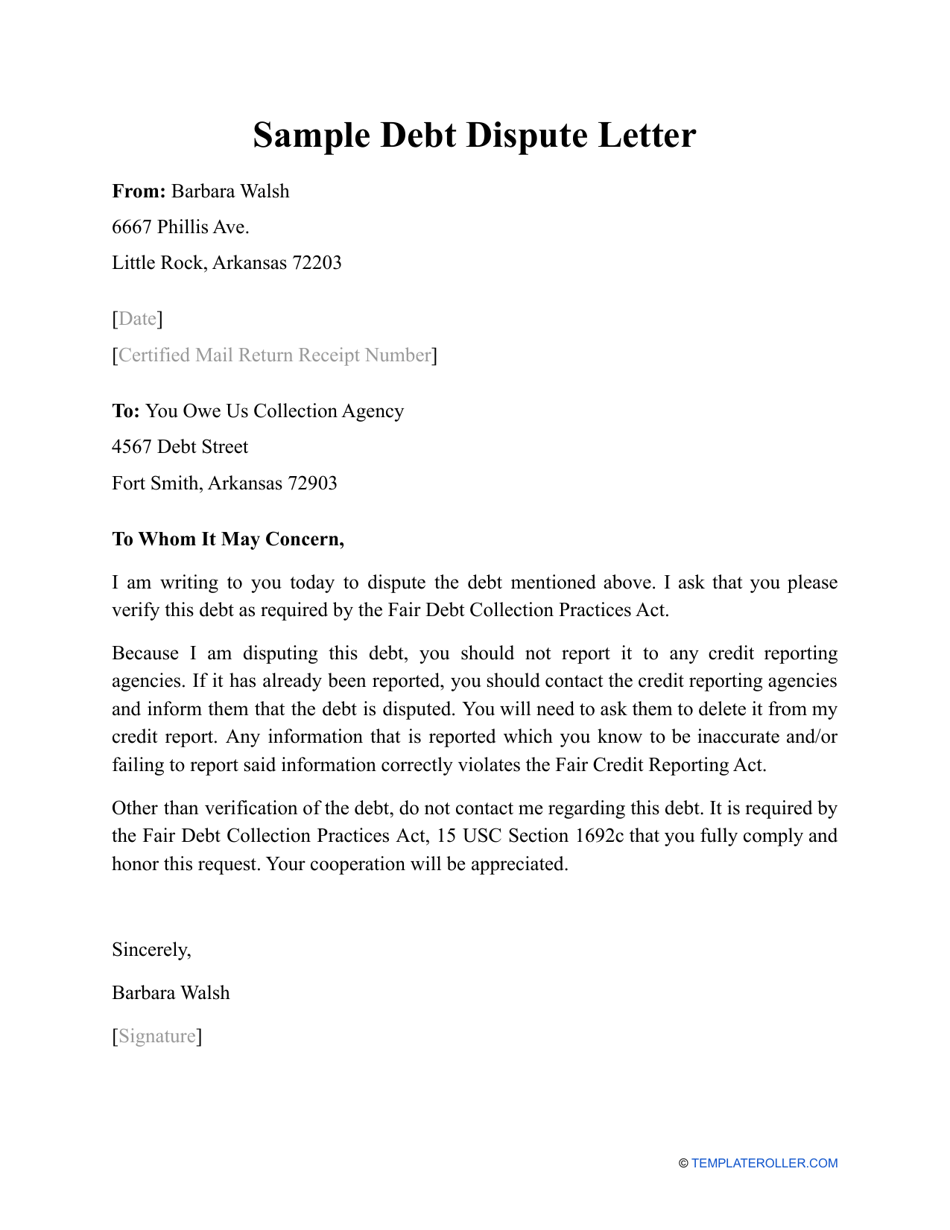

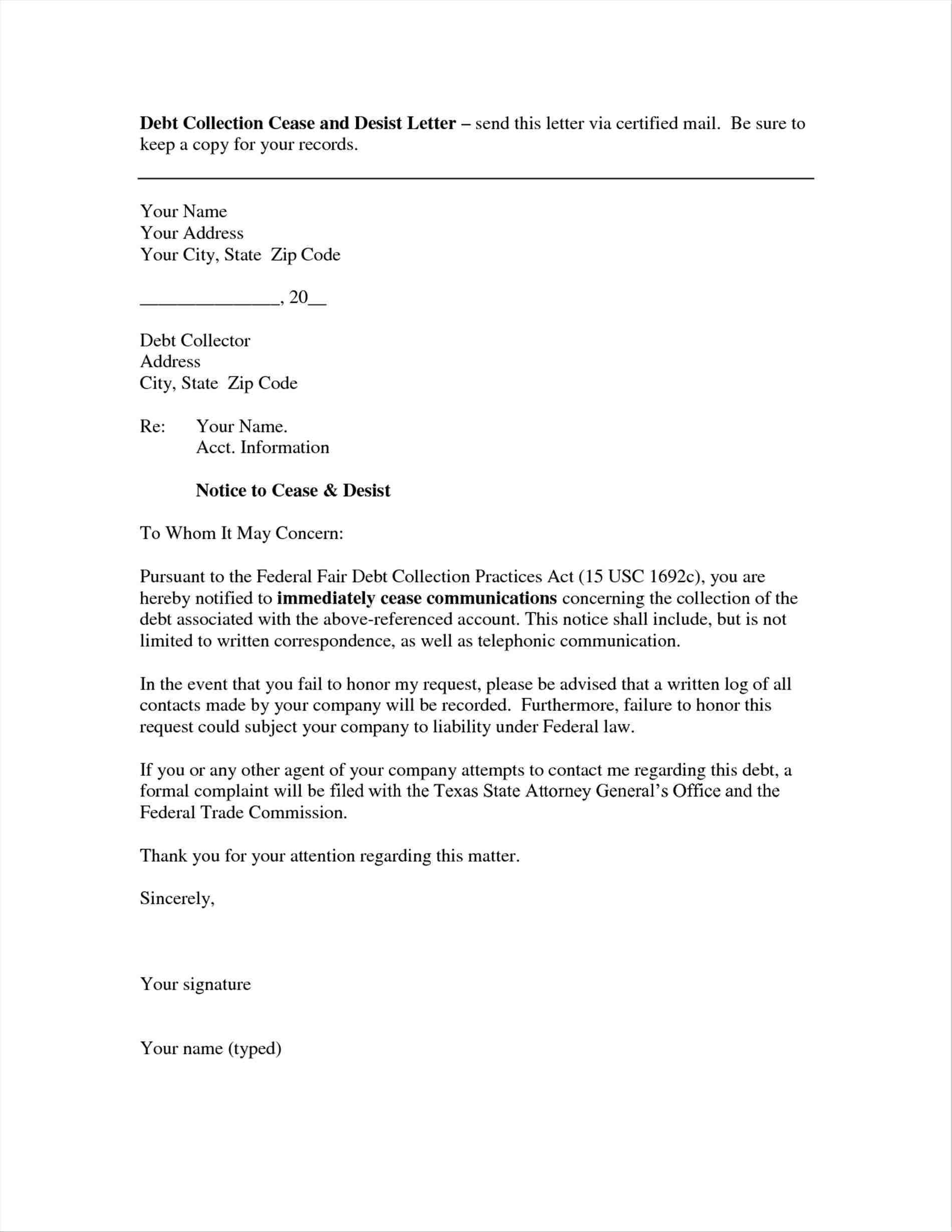

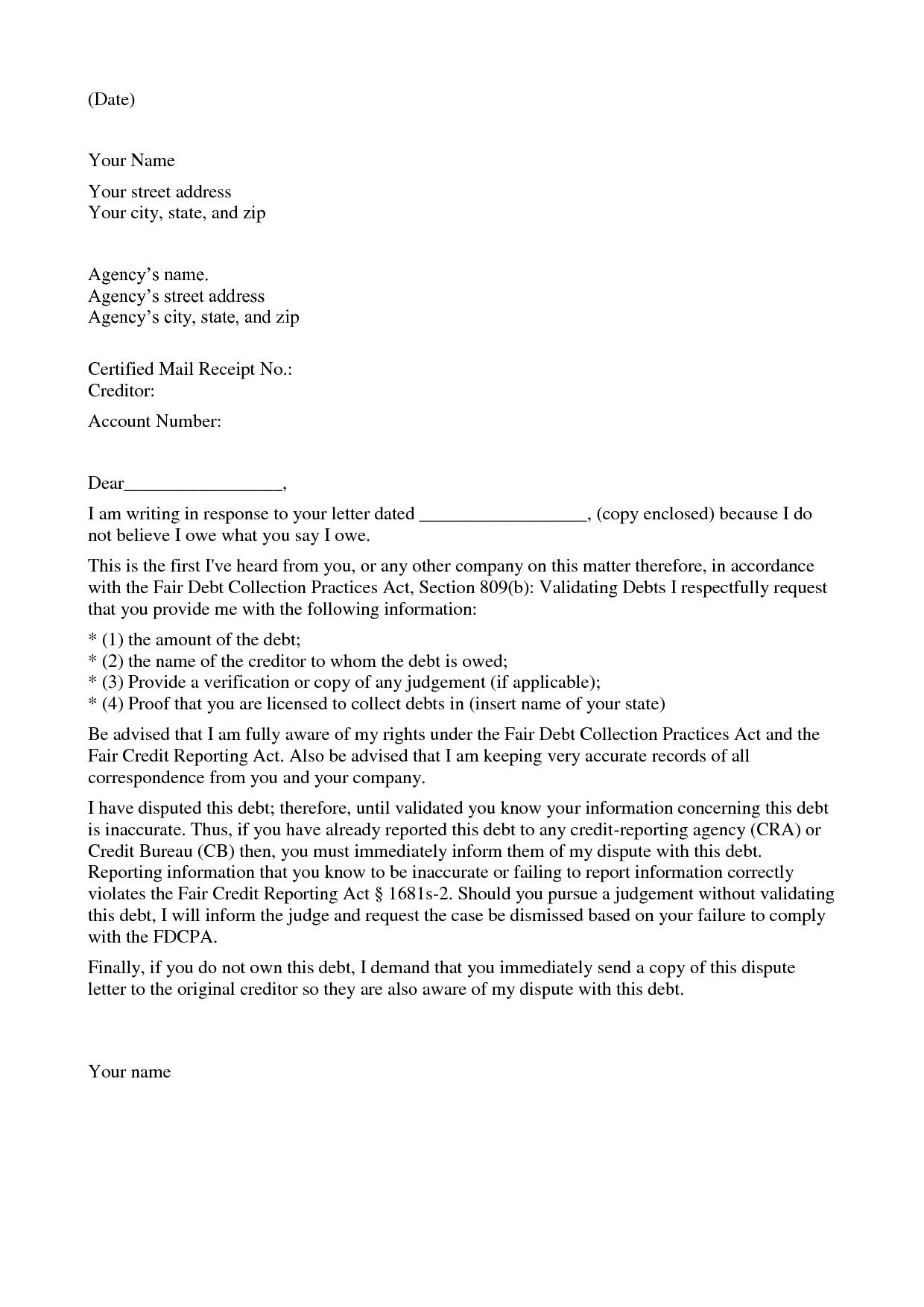

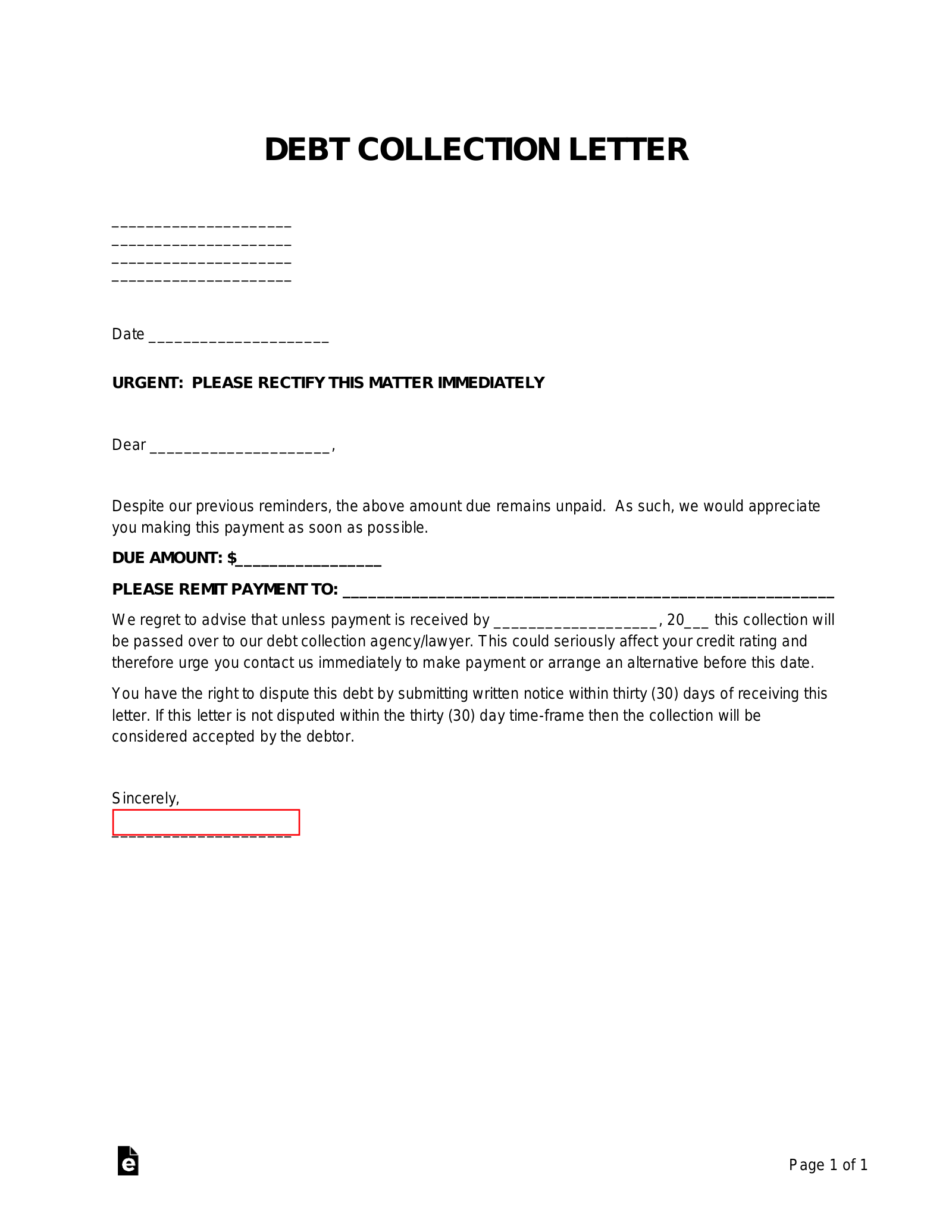

Debt Collection Dispute Letter Template - Below are three unique and detailed templates for disputing a debt with a collection agency. Therefore, until validated you know your information concerning this debt is inaccurate. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. Be sure to keep a copy of your letter and. I also request verification, validation, and the name and address of the original. I have disputed this debt; Each template includes a short introductory paragraph and is structured to. Use this letter to dispute a debt and to tell a collector to stop contacting you. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Therefore, until validated you know your information concerning this debt is inaccurate. Each template includes a short introductory paragraph and is structured to. Sample initial debt dispute letter: Be sure to keep a copy of your letter and. If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a. I also request verification, validation, and the name and address of the original. Use this letter to dispute a debt and to tell a collector to stop contacting you. I have disputed this debt; Use this letter to dispute a debt and to tell a collector to stop contacting you. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. Sample initial debt dispute letter: Therefore, until validated you know your information. Below are three unique and detailed templates for disputing a debt with a collection agency. Each template includes a short introductory paragraph and is structured to. Sample initial debt dispute letter: Therefore, until validated you know your information concerning this debt is inaccurate. The following page is a sample of a letter that you can send to a collection agency. I have disputed this debt; Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Sample initial debt dispute letter: Below are three unique and detailed templates for disputing a debt with a collection agency. If you send this letter within 30 days from the date you first receive a debt collection letter,. I have disputed this debt; Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. If a consumer does not think the. Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do something about it. Sample initial debt dispute letter: With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. Use this letter to dispute a debt. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. By following the steps outlined in this guide. Below are three unique and detailed templates for disputing a debt with a collection agency. I have disputed this debt;. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. Therefore, until validated you know your information concerning this debt is inaccurate. Each template includes a short introductory paragraph and is structured to. The following page is a sample of a letter that you can send to a. If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a. I have disputed this debt; Therefore, until validated you know your information concerning this debt is inaccurate. If a consumer does not think the debt. Each template includes a short introductory paragraph and is structured to. Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do something about it. Be sure to keep a copy of your letter and. Therefore, until validated you know your information concerning this debt is inaccurate. I have disputed this debt; Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do something about it. Be sure to keep a copy of your letter and. By following the steps outlined in this guide. Sample initial debt dispute letter: Below are three unique and detailed templates for disputing a debt with a collection agency. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. I also request verification, validation, and the name and address of the original. Be sure to keep a copy of your letter and. Each template includes a short introductory paragraph and is structured to. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a. Therefore, until validated you know your information concerning this debt is inaccurate. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Sample initial debt dispute letter: If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. Below are three unique and detailed templates for disputing a debt with a collection agency. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c.Sample Letter For Disputing A Debt Collection Notice For for Debt

Professional Debt Collection Dispute Letter Template, Notice Letter

Debt Dispute Letter Template Collection Letter Template Collection

免费 Collection Dispute Letter 样本文件在

Collection Dispute Letter Template

Free Credit Report Dispute Letter Template PDF & Word

Sample Debt Dispute Letter Fill Out, Sign Online and Download PDF

Debt Dispute Letter Template Collection Letter Template Collection

Debt Dispute Letter Template Collection Letter Template Collection

Debt Collection Letter Templates Letter Debt Collection Temp

Use This Letter To Dispute A Debt And To Tell A Collector To Stop Contacting You.

I Have Disputed This Debt;

By Following The Steps Outlined In This Guide.

Don’t Just Accept The Conversation Quickly Deteriorating Into Verbal Harassment And Abuse, Do Something About It.

Related Post: