Credit Collection Letter Template

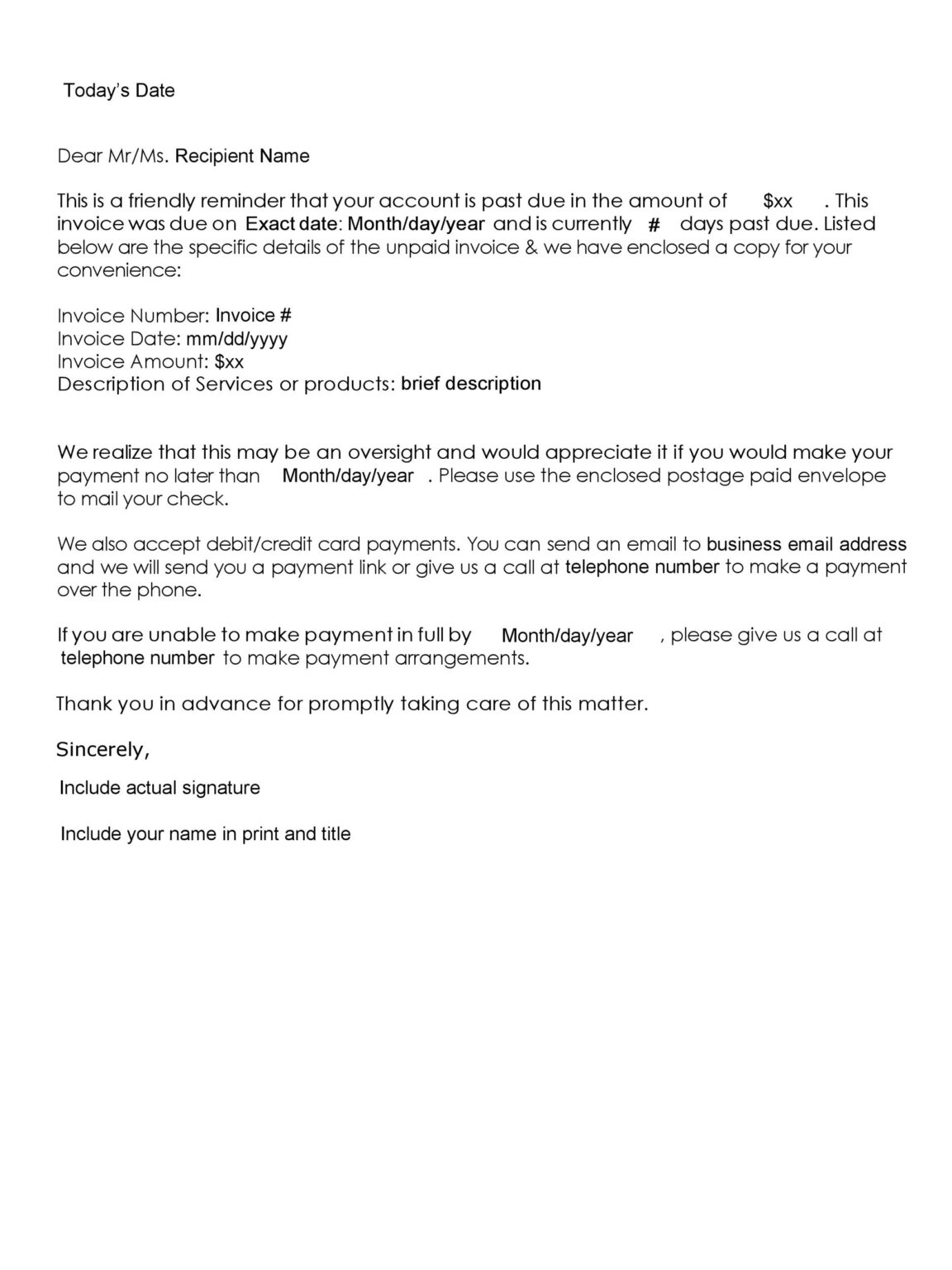

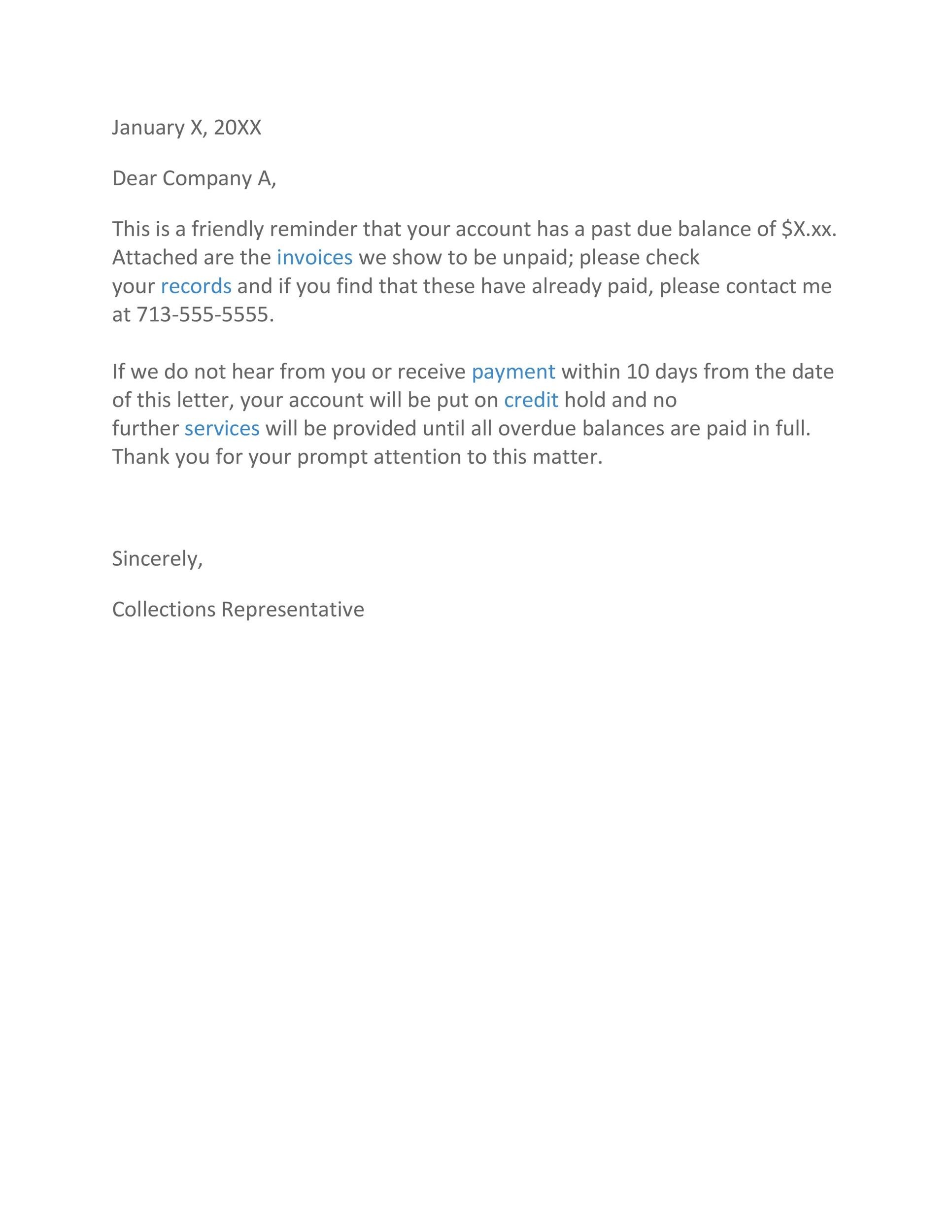

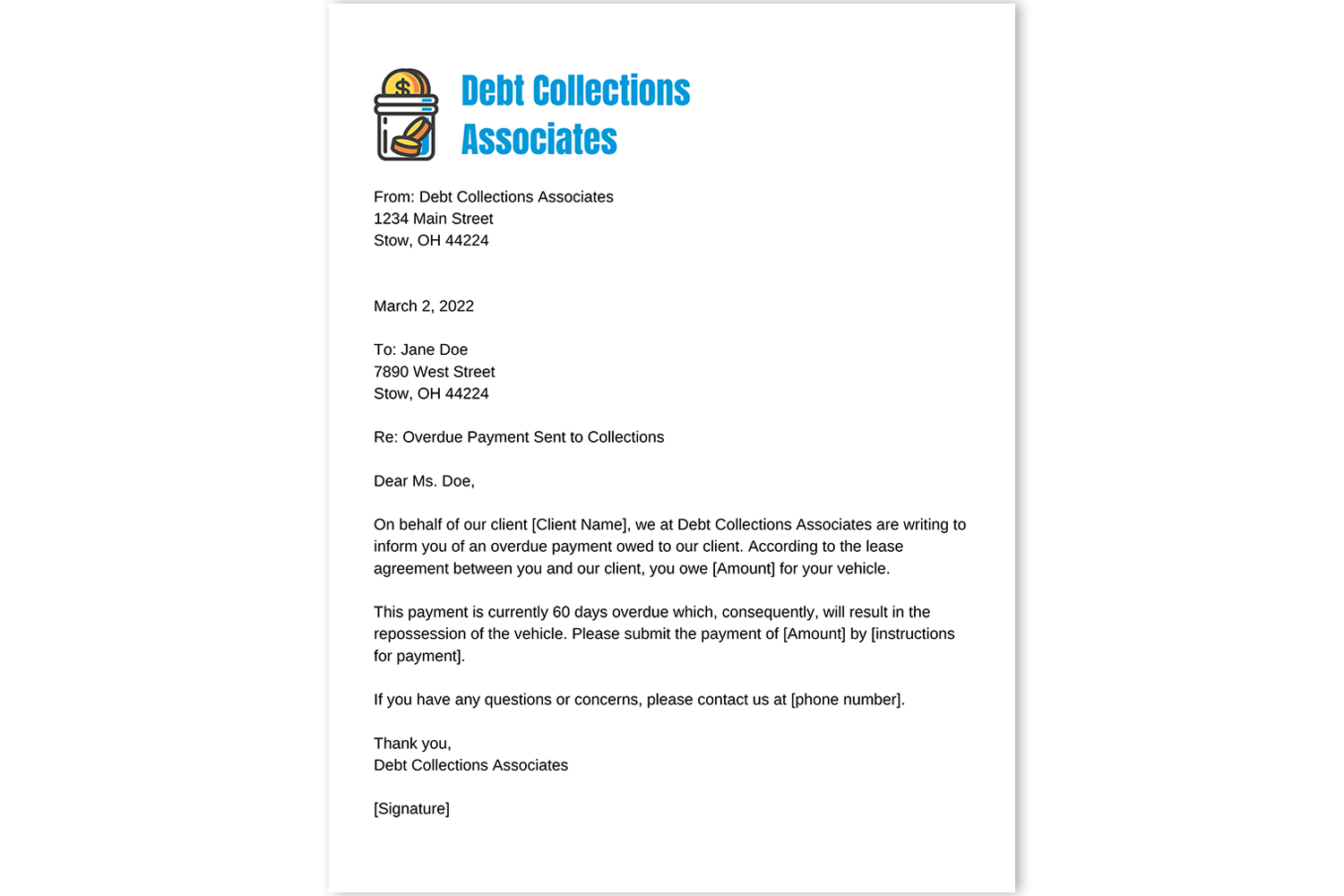

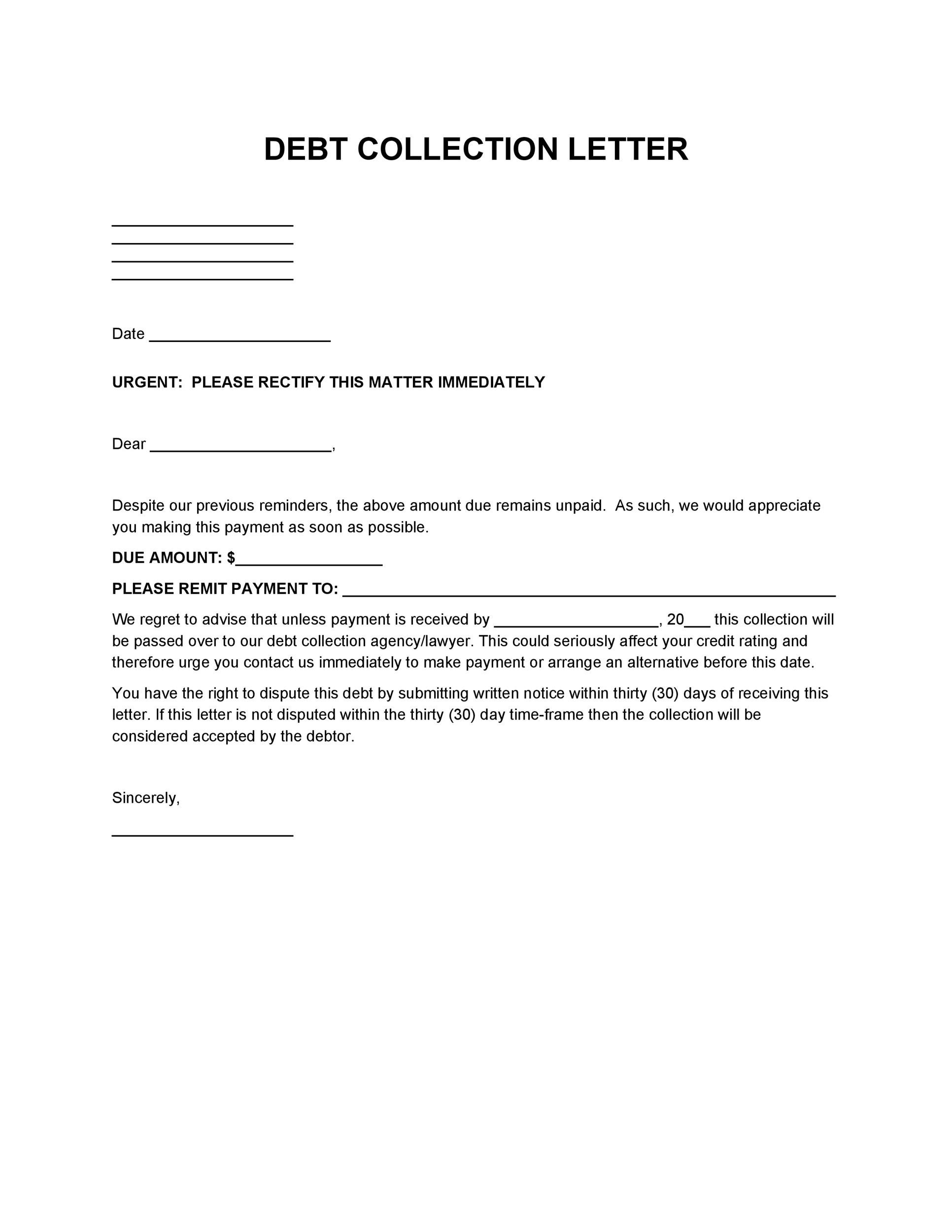

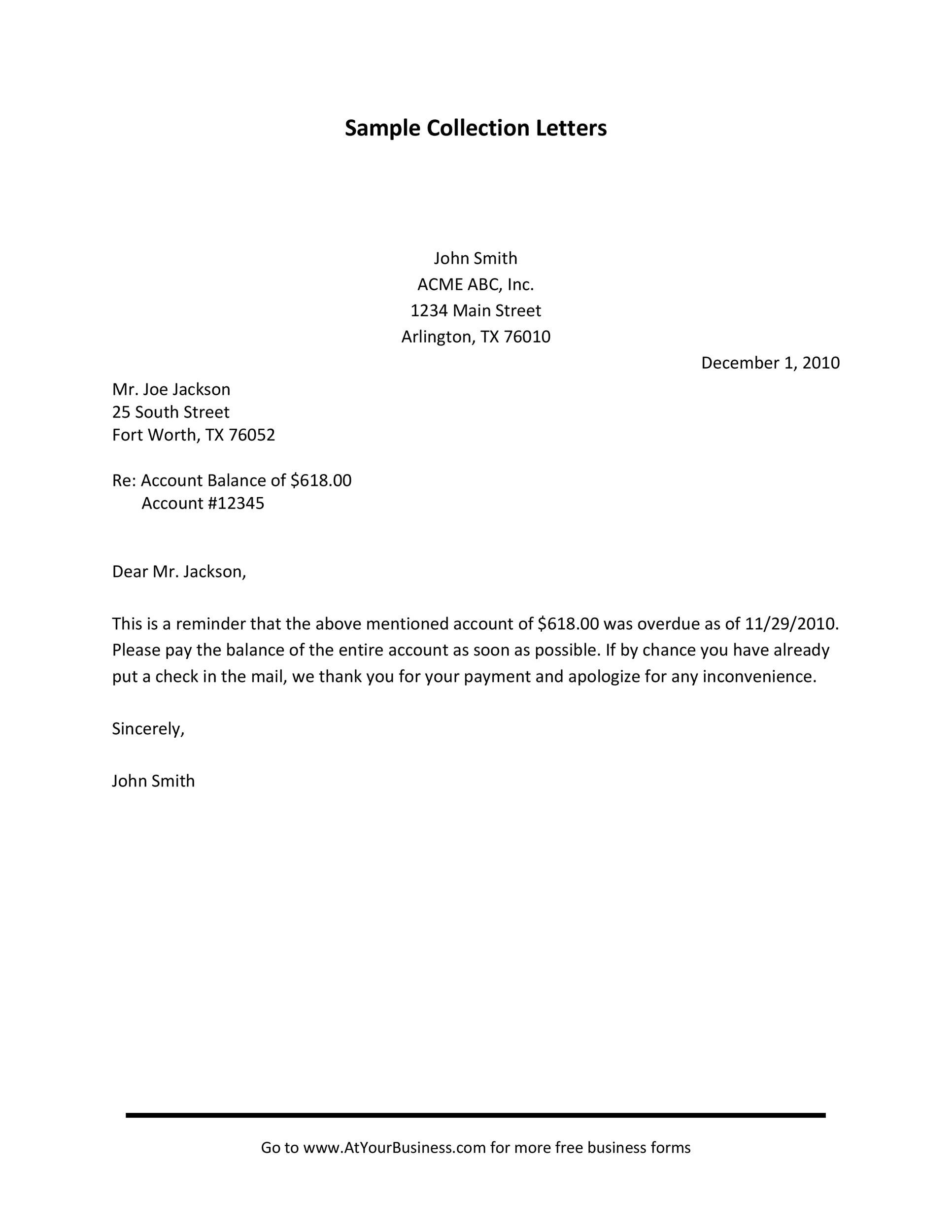

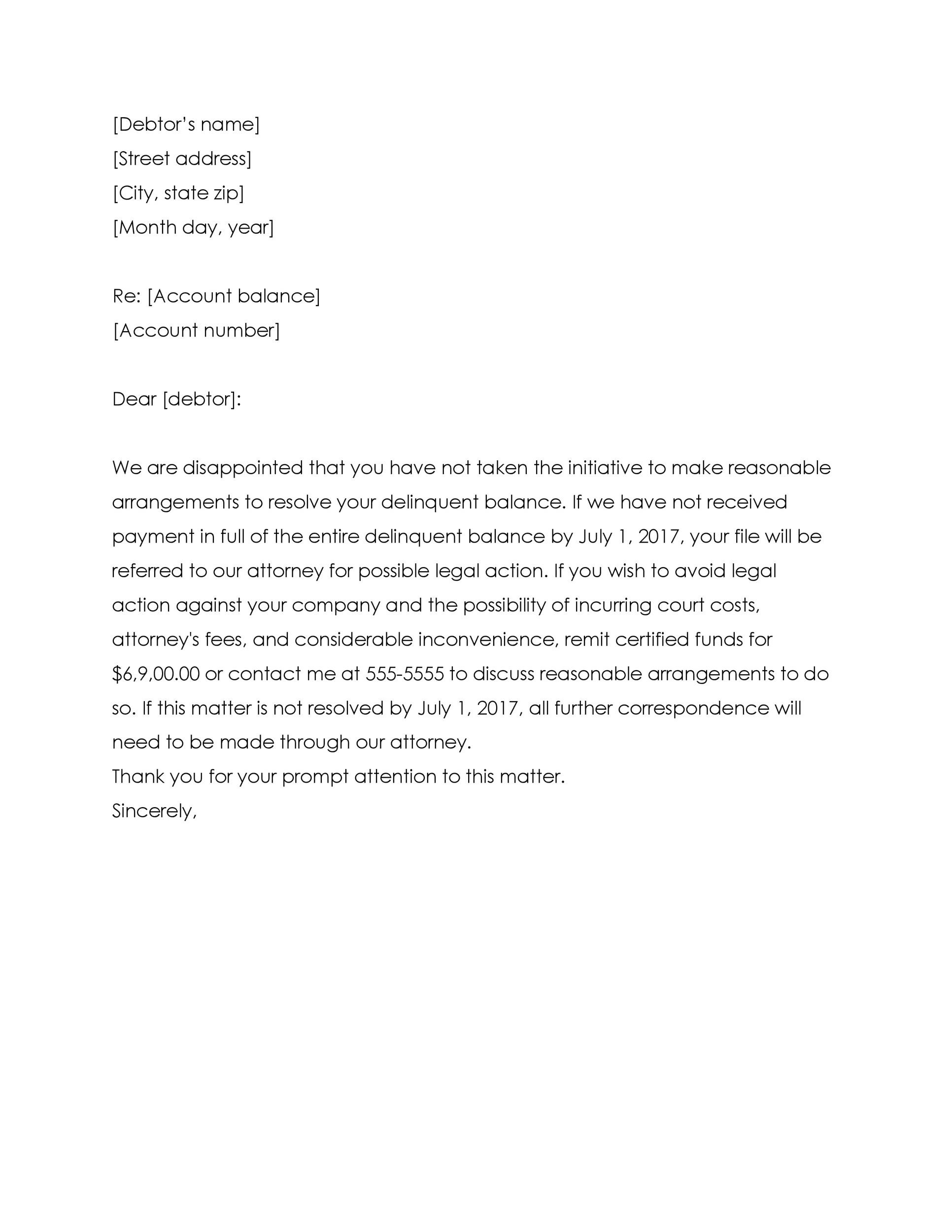

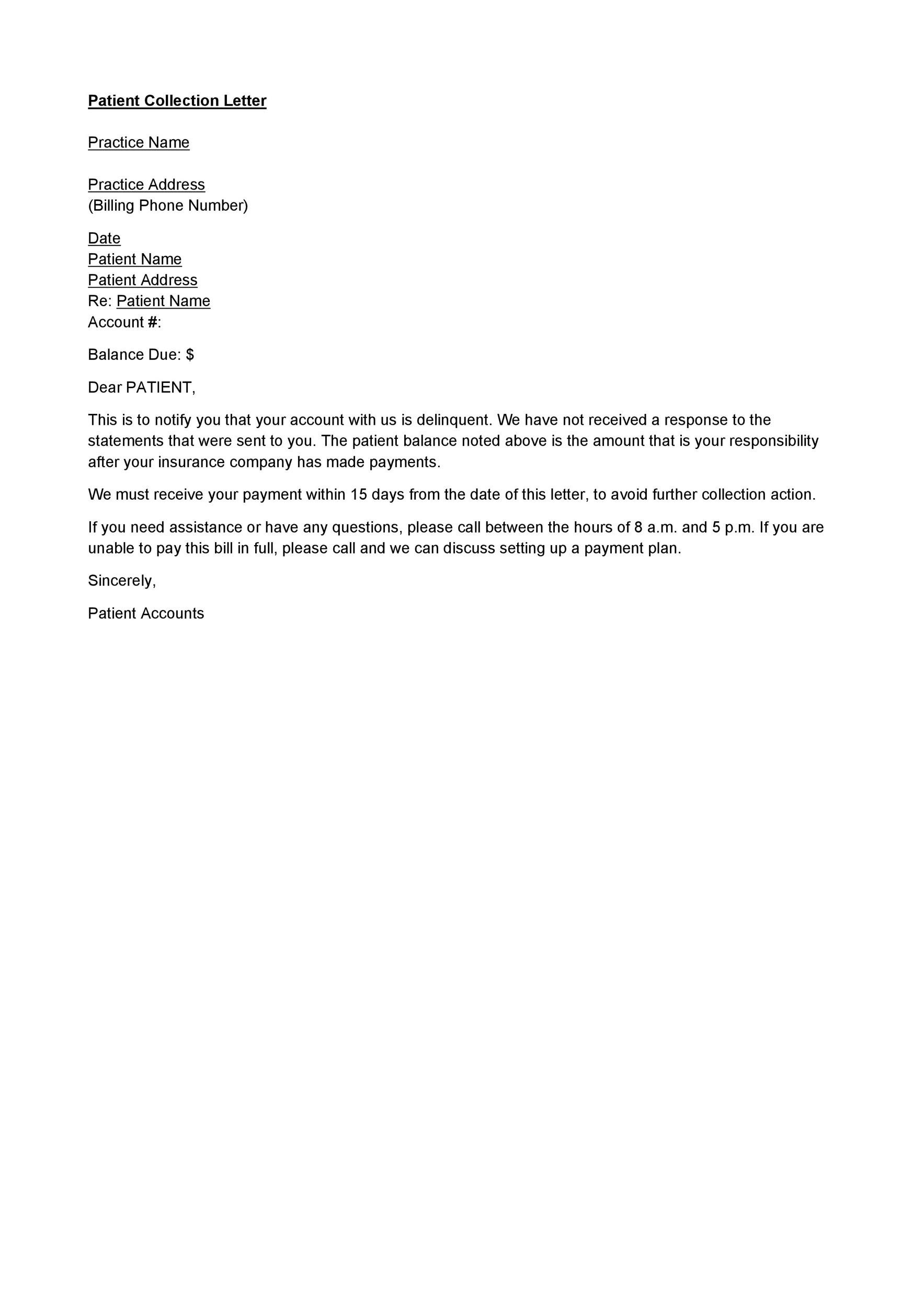

Credit Collection Letter Template - Use this template letter to make an initial debt settlement offer if the debt is still with the original creditor. As a debt collector or the official representative of a debt collection agency, you would create a collection letter template and send it when asking for payment for an obligation or in case of overdue bills. A debt collection letter is a document mailed by a creditor (or collection agency) to a debtor demanding payment for an unpaid balance. Download, fill in and print debt collection letter pdf online here for free. They can help you craft a letter that serves its intended purpose: Writing a letter to collect payments from your customer is very important. There are four different collection letters that you will have to send to your clients before hiring a collection agency or recording it as a bad debt expense. Writing a collection letter sample requires that one follows the right steps and includes the right tone to inform your clients that a debt is owed and is past due. 5 how do i write a collection letter? Download and print these collection letter templates. 7 how to write a dispute letter to a collection agency? These letters serve as a notification of the unpaid balance, a reminder of the obligation, and a request for payment. We regret to advise that unless payment is received by (mm/dd/yyyy) this collection will be passed over to our debt collection agency / lawyer. Download and print these collection letter templates. Download debt.com’s settlement offer template » Sample collection letters and templates are helpful to businesses and organizations that need to collect debts but wish to remain professional. This letter is sent to credit bureaus and requests they verify the information about the collection account. I’m working with them to find a solution. You should follow the tips given below to write a professional credit and collection letter: Writing a letter to the credit bureaus or a debt collection agency can be daunting. A demand letter is a formal written notice sent by a creditor or a collection agency to a debtor, requesting payment of an outstanding debt. Use this template letter to make an initial debt settlement offer if the debt is still with the original creditor. Writing a letter to the credit bureaus or a debt collection agency can be daunting.. We regret to advise that unless payment is received by (mm/dd/yyyy) this collection will be passed over to our debt collection agency / lawyer. The letter can serve as a general reminder or can be used to inform the recipient that legal action will be taken against them soon. These sample letters are meant to give you ideas on how. As a debt collector or the official representative of a debt collection agency, you would create a collection letter template and send it when asking for payment for an obligation or in case of overdue bills. They can help you craft a letter that serves its intended purpose: Sample collection letters and templates are helpful to businesses and organizations that. We regret to advise that unless payment is received by (mm/dd/yyyy) this collection will be passed over to our debt collection agency / lawyer. Read on below to find out what every letter should say in order to collect payment as soon as possible. 2 what is a collection letter? To collect the funds you are owed. Use this template. The letter can serve as a general reminder or can be used to inform the recipient that legal action will be taken against them soon. Learn how to write a collection letter and view examples of collection letters to send customers before resorting to a collection agency. These letters serve as a notification of the unpaid balance, a reminder of. The letter can serve as a general reminder or can be used to inform the recipient that legal action will be taken against them soon. Writing a collection letter sample requires that one follows the right steps and includes the right tone to inform your clients that a debt is owed and is past due. Download debt.com’s settlement offer template. These letters serve as a notification of the unpaid balance, a reminder of the obligation, and a request for payment. Utilizing debt collection letter templates. The letter can serve as a general reminder or can be used to inform the recipient that legal action will be taken against them soon. 5 how do i write a collection letter? The purpose. For all debt collection letters, it is important that. To collect the funds you are owed. Our debt collection letter templates can be easily downloaded and customized for your use. 7 how to write a dispute letter to a collection agency? Updated sample letters that can be sent to credit bureaus, collection agencies, creditors, and others when repairing your credit. Utilizing debt collection letter templates. These letters serve as a notification of the unpaid balance, a reminder of the obligation, and a request for payment. This approach often leads to better outcomes and helps maintain a positive relationship. Clearly state your request and include supporting documents, such as benefit statements or asset exemption. Letters are a powerful tool to use. A demand letter is a formal written notice sent by a creditor or a collection agency to a debtor, requesting payment of an outstanding debt. Sample collection letters and templates are helpful to businesses and organizations that need to collect debts but wish to remain professional. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors and protects. We regret to advise that unless payment is received by (mm/dd/yyyy) this collection will be passed over to our debt collection agency / lawyer. The debtor is then given a stated time to act on or dispute the debt. Our debt collection letter templates can be easily downloaded and customized for your use. Utilizing debt collection letter templates. Download and print these collection letter templates. I’m working with them to find a solution. Writing a letter to the credit bureaus or a debt collection agency can be daunting. The role of a demand letter in debt collection. Letters are a powerful tool to use in communicating with creditors, debt collectors, and other businesses. This could seriously affect your credit rating and therefore urge you contact us immediately to make payment or. For all debt collection letters, it is important that. Sample collection letters and templates are helpful to businesses and organizations that need to collect debts but wish to remain professional. The letter can serve as a general reminder or can be used to inform the recipient that legal action will be taken against them soon. Different payment methods (credit card, bank transfer, etc.) by providing these options, i’m not just demanding payment; Writing a collection letter sample requires that one follows the right steps and includes the right tone to inform your clients that a debt is owed and is past due. Read on below to find out what every letter should say in order to collect payment as soon as possible.10 sample collection letters examples format and how to write sample

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

50 Collection letter Example RedlineSP

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

4 Effective and Ethical Debt Collection Letter Examples — Etactics

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

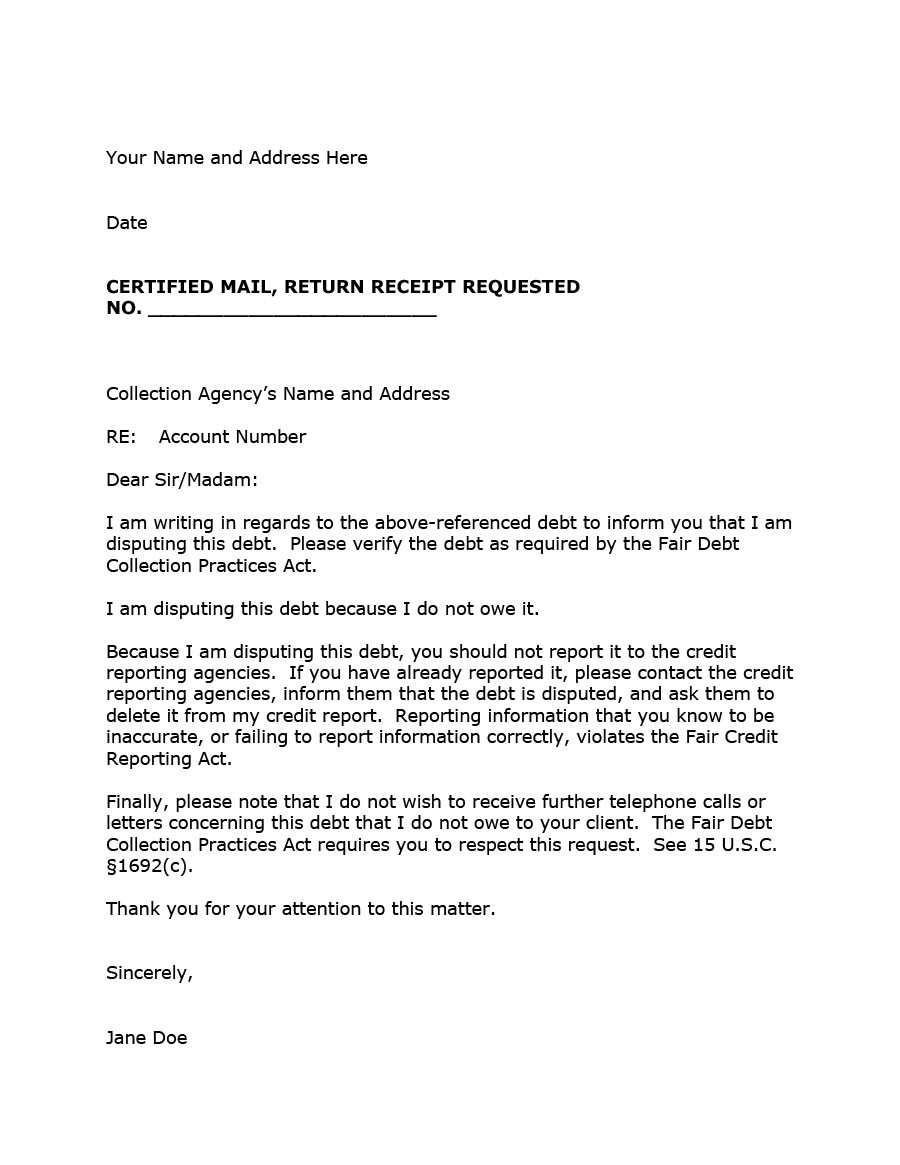

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

7 How To Write A Dispute Letter To A Collection Agency?

This Letter Is Sent To Credit Bureaus And Requests They Verify The Information About The Collection Account.

This Approach Often Leads To Better Outcomes And Helps Maintain A Positive Relationship.

They Can Help You Craft A Letter That Serves Its Intended Purpose:

Related Post: