Collection Agency Debt Dispute Letter Template

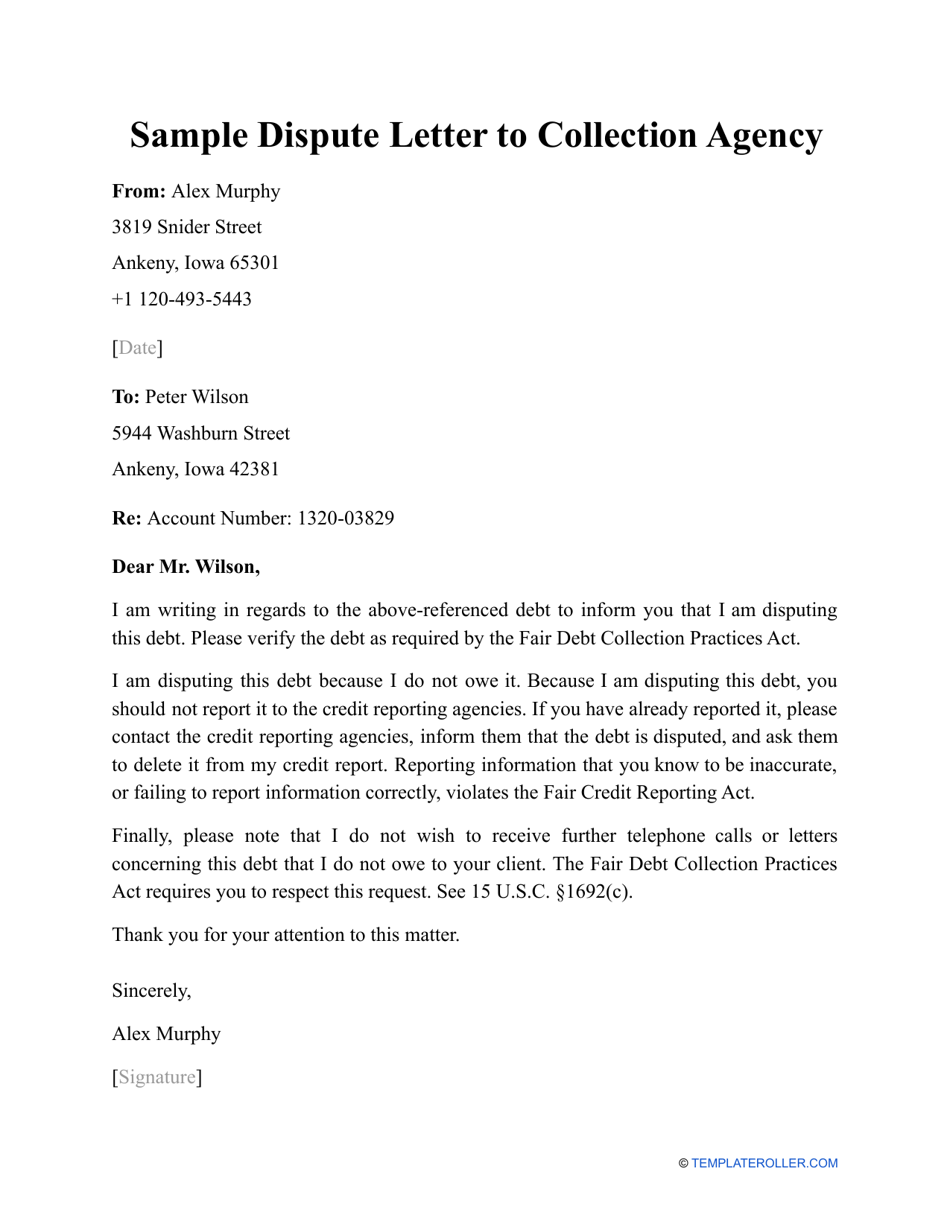

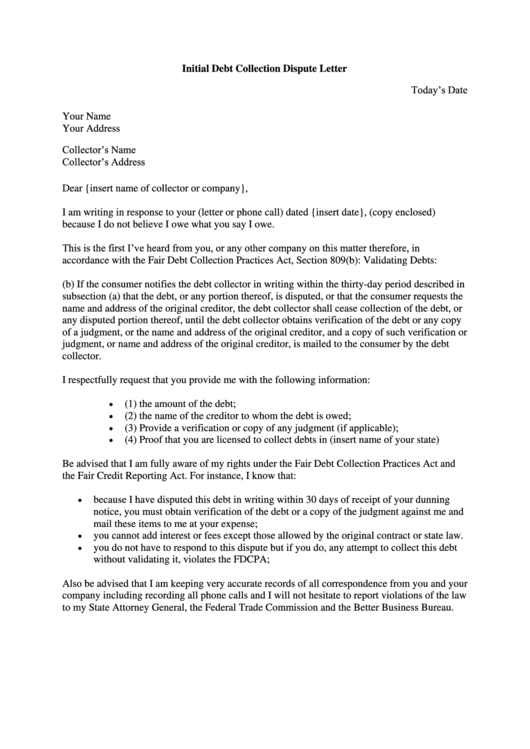

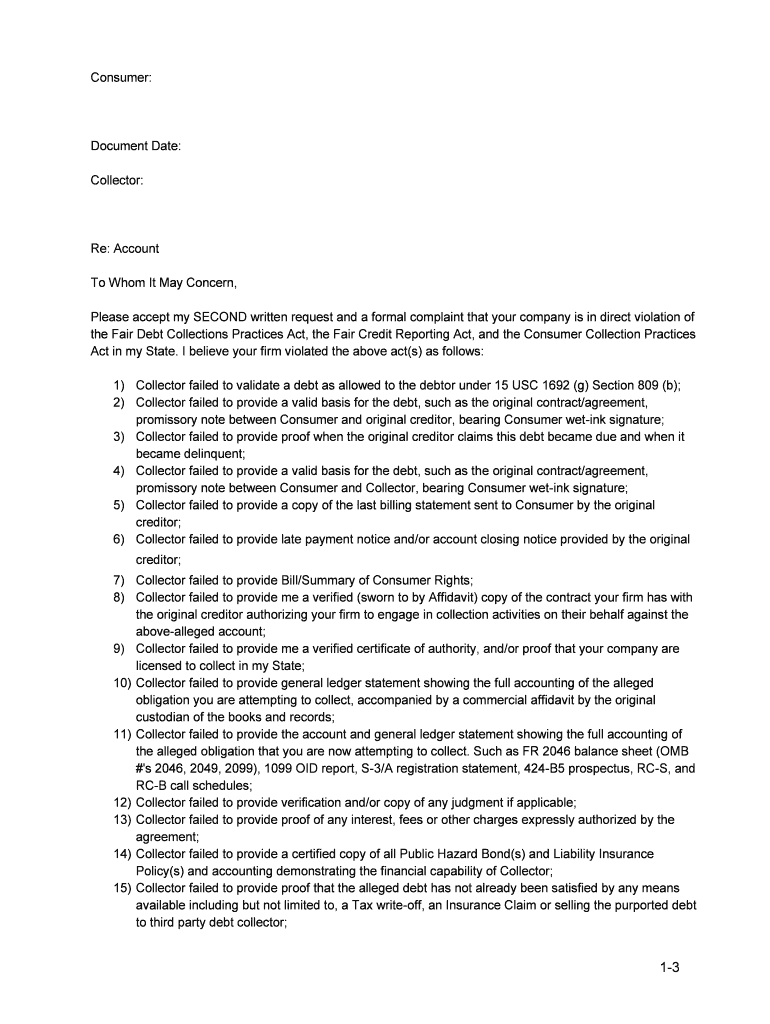

Collection Agency Debt Dispute Letter Template - Use this letter to complain to debt collection agencies who are pursuing you when you do not owe the debt. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. I am asserting my rights under the federal and state fair debt collection practices acts and the fair credit reporting act, including these rights: Best practices for attorneys sending demand letters attorneys handling debt collection must ensure their demand letters comply with the fair debt collection practices act (fdcpa). It helps initiate a process where a collection agency will identify errors, resolve disputes, or look for additional information to validate the debt. Below are three unique and detailed templates for disputing a debt with a collection agency. Be sure to keep a copy of your letter and always send a letter like this “certified with a return receipt”. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. Each template includes a short introductory paragraph and is structured to help you effectively communicate your dispute. Use this free debt dispute letter template to formally dispute a debt and protect your rights in dealing with creditors. In this article, we’ll explore the ins and outs of creating a collection agency dispute letter template and offer tips on how to make it as effective as. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. This blank is 100% printable and editable. If you believe the debt is invalid or there are errors, write a dispute letter to the debt collector. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collec tion activities until it verifies the debt. Be sure to keep a copy of your letter and always send a letter like this “certified with a return receipt”. I am writing to dispute the validity of the debt associated with [account number], which i have been contacted about by your agency. I am asserting my rights under the federal and state fair debt collection practices acts and the fair credit reporting act, including these rights: Here are key best practices to follow: Use this letter to dispute a debt and to tell a collector to stop contacting you. If you need help with the mailing, just ask at any post ofice. If you're finding yourself in a bit of a pickle with a debt collection agency, you're not alone many people face disputes over debts they might not even owe. It helps initiate a process where a collection agency will identify errors, resolve disputes, or look for additional. Simplify the process of disputing debt collection efforts. Here are key best practices to follow: (2) the name of the creditor to whom the debt is owed; A collection dispute letter is a written communication sent by a business to a collection agency to check the accuracy and genuineness of a debt. If you've received a notice from a debt. Each template includes a short introductory paragraph and is structured to help you effectively communicate your dispute. Use this letter to dispute a debt and to tell a collector to stop contacting you. If you find yourself in a situation where you need to dispute a debt, a dispute letter can be a powerful tool to fight back against unfair. It helps initiate a process where a collection agency will identify errors, resolve disputes, or look for additional information to validate the debt. I am writing to dispute the validity of the debt associated with [account number], which i have been contacted about by your agency. If you've received a notice from a debt collector, but have reason to believe. If you find yourself in a situation where you need to dispute a debt, a dispute letter can be a powerful tool to fight back against unfair or inaccurate claims made by collection agencies. In this article, we’ll explore the ins and outs of creating a collection agency dispute letter template and offer tips on how to make it as. Use this letter to complain to debt collection agencies who are pursuing you when you do not owe the debt. Use this free debt dispute letter template to formally dispute a debt and protect your rights in dealing with creditors. If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. Here are key best practices to follow: You can choose to send a letter in your own name or in joint names. The following page is a sample of a letter that you can send to a. Send a written dispute letter: Start customizing without restrictions now! Each template includes a short introductory paragraph and is structured to help you effectively communicate your dispute. If you need help with the mailing, just ask at any post ofice. Get the free collection agency debt dispute letter in a couple of clicks! I am aware of my rights under the fair debt collection practices act (fdcpa) and the fair credit reporting act (fcra) and i. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. By following the steps outlined in this guide and utilizing the provided. In this article, we’ll explore the ins and outs of creating a collection agency dispute letter template and offer tips on how to make it as effective as. Use this letter to dispute a debt and to tell a collector to stop contacting you. I am asserting my rights under the federal and state fair debt collection practices acts and. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. Use this free debt dispute letter template to formally dispute a debt and protect your rights in dealing with creditors. Contact us for advice before using this letter. Use this letter to complain to debt collection agencies who are pursuing you when you do not owe the debt. Therefore, until validated you know your information concerning this debt is inaccurate. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. Discover our free debt collection dispute letter template, available in ms word and google docs formats. This blank is 100% printable and editable. Start customizing without restrictions now! Below are three unique and detailed templates for disputing a debt with a collection agency. If you're finding yourself in a bit of a pickle with a debt collection agency, you're not alone many people face disputes over debts they might not even owe. I am aware of my rights under the fair debt collection practices act (fdcpa) and the fair credit reporting act (fcra) and i. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. When a debt is sold to a collection agency,. It helps initiate a process where a collection agency will identify errors, resolve disputes, or look for additional information to validate the debt. If you believe the debt is invalid or there are errors, write a dispute letter to the debt collector.Initial Debt Collection Dispute Letter printable pdf download

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Debt Dispute Letter Debt with Dispute Letter To Creditor Template

Debt Collection Dispute Letter, Debt Dispute Letter, Debt Collection

Collection Agency Debt Dispute Letter Template

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

Professional Debt Collection Dispute Letter Template Etsy in 2024

How to Write a Collection Dispute Letter? [With Template]

Collection Dispute Letter Templates at

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

Here Are Key Best Practices To Follow:

(3) A Statement That Unless The Consumer, Within Thirty Days After Receipt Of The Notice, Disputes The Validity Of.

I Have Disputed This Debt;

Best Practices For Attorneys Sending Demand Letters Attorneys Handling Debt Collection Must Ensure Their Demand Letters Comply With The Fair Debt Collection Practices Act (Fdcpa).

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17-790x1022.jpg)

![How to Write a Collection Dispute Letter? [With Template]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2022/06/Sample-Letter-for-Debt-Collection-Dispute.png)