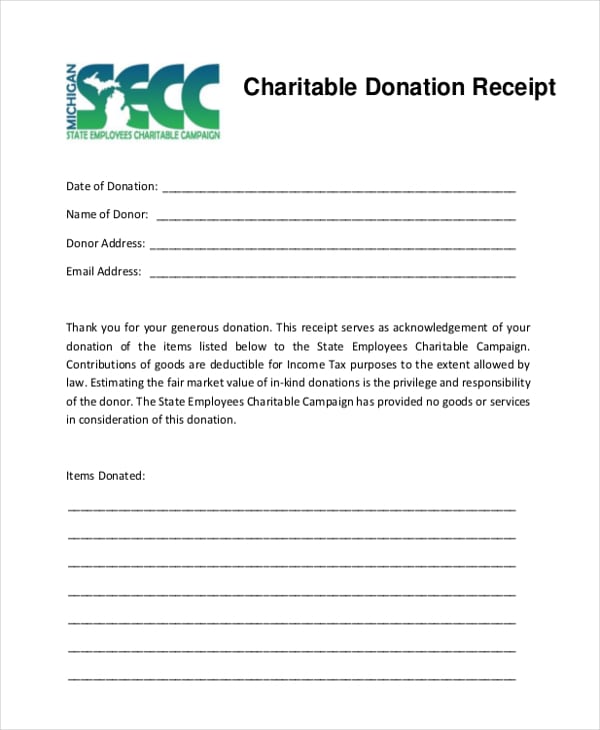

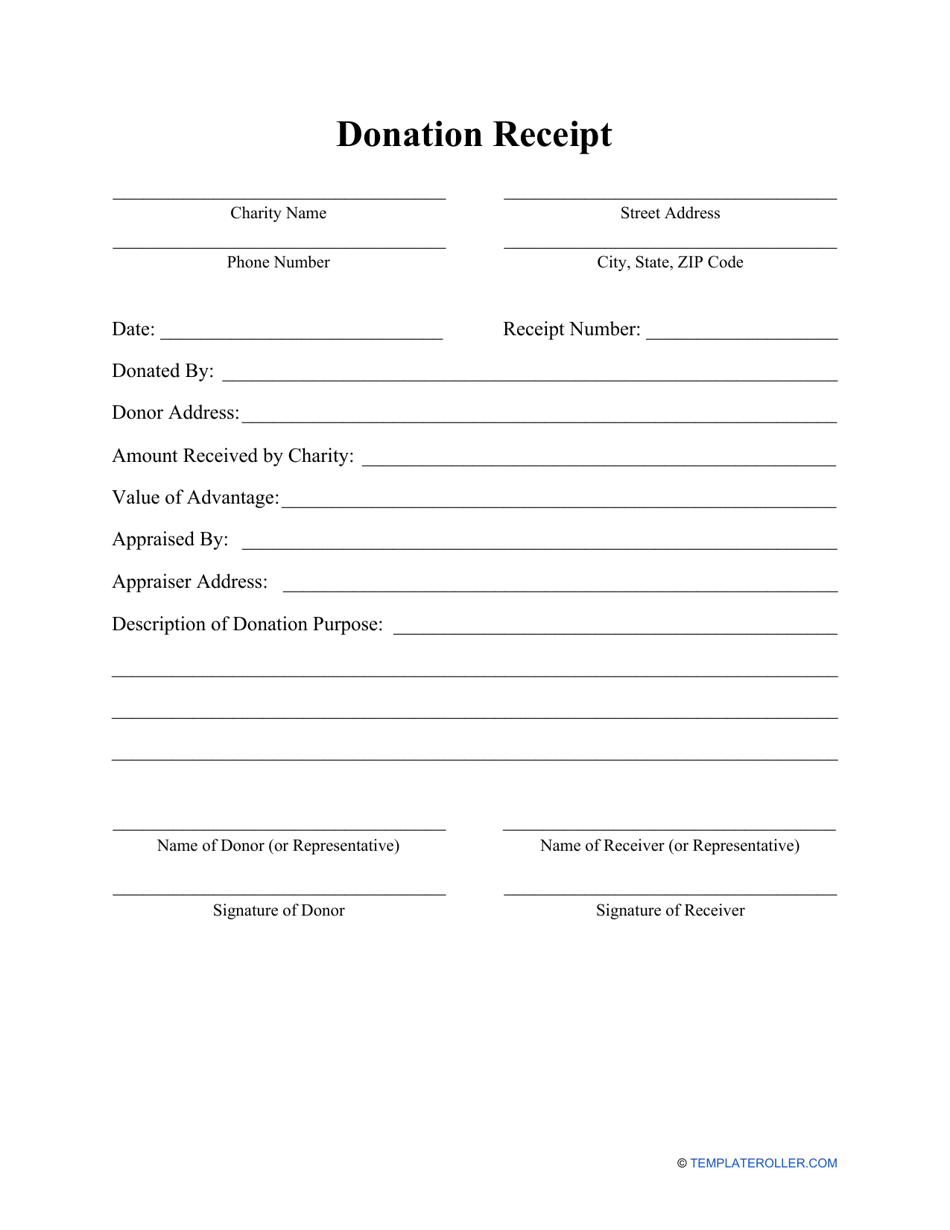

Charitable Donation Receipt Template

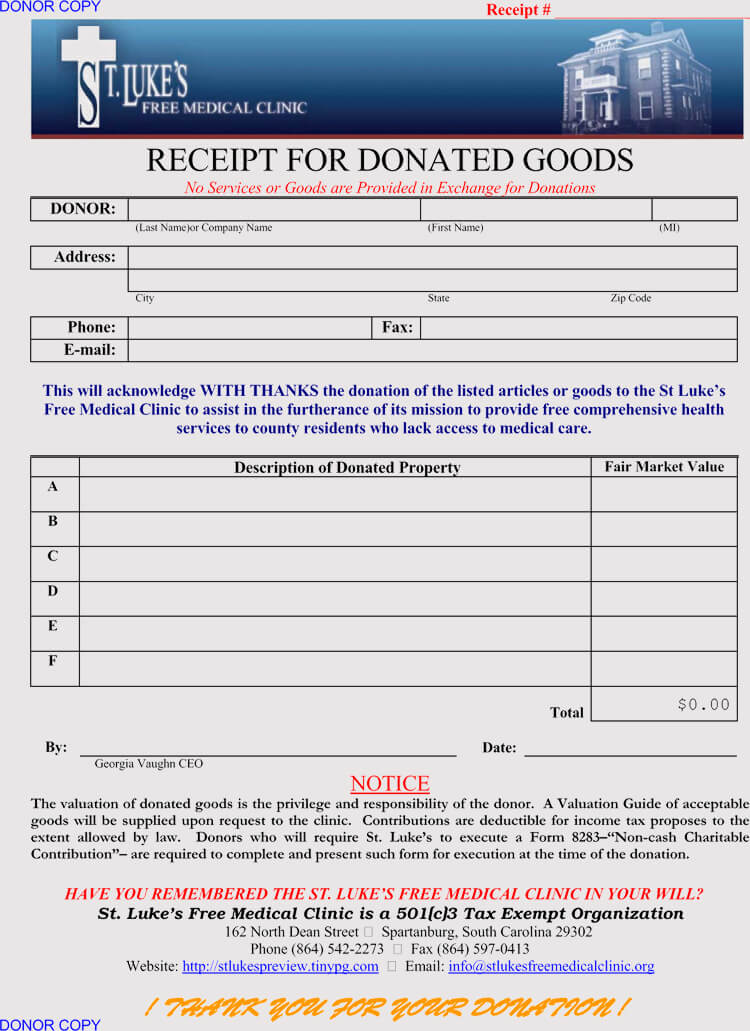

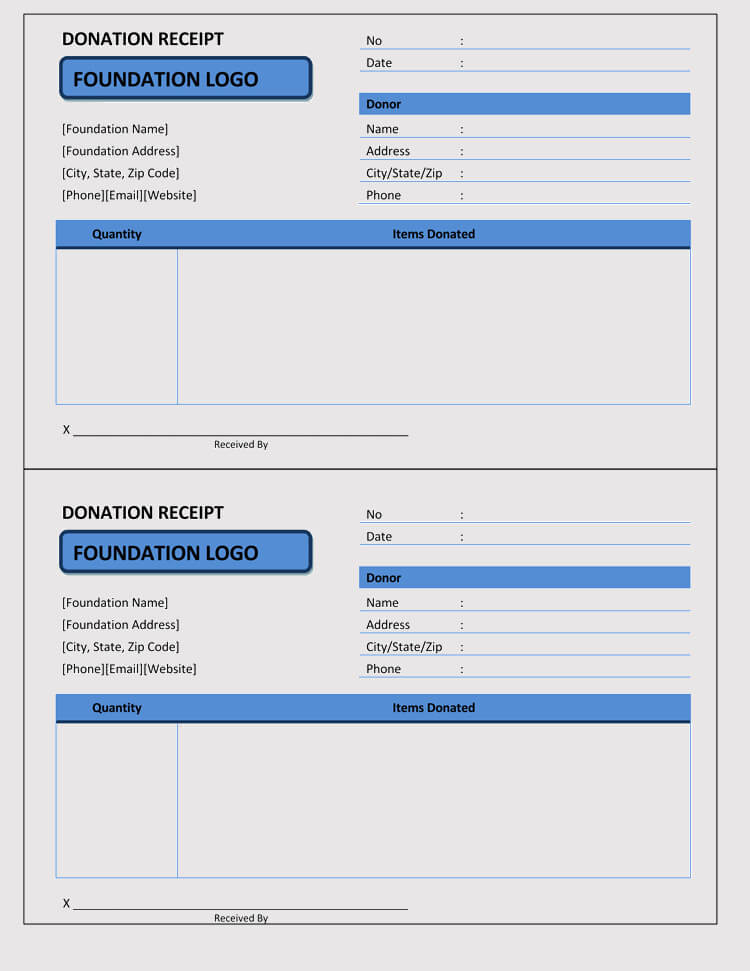

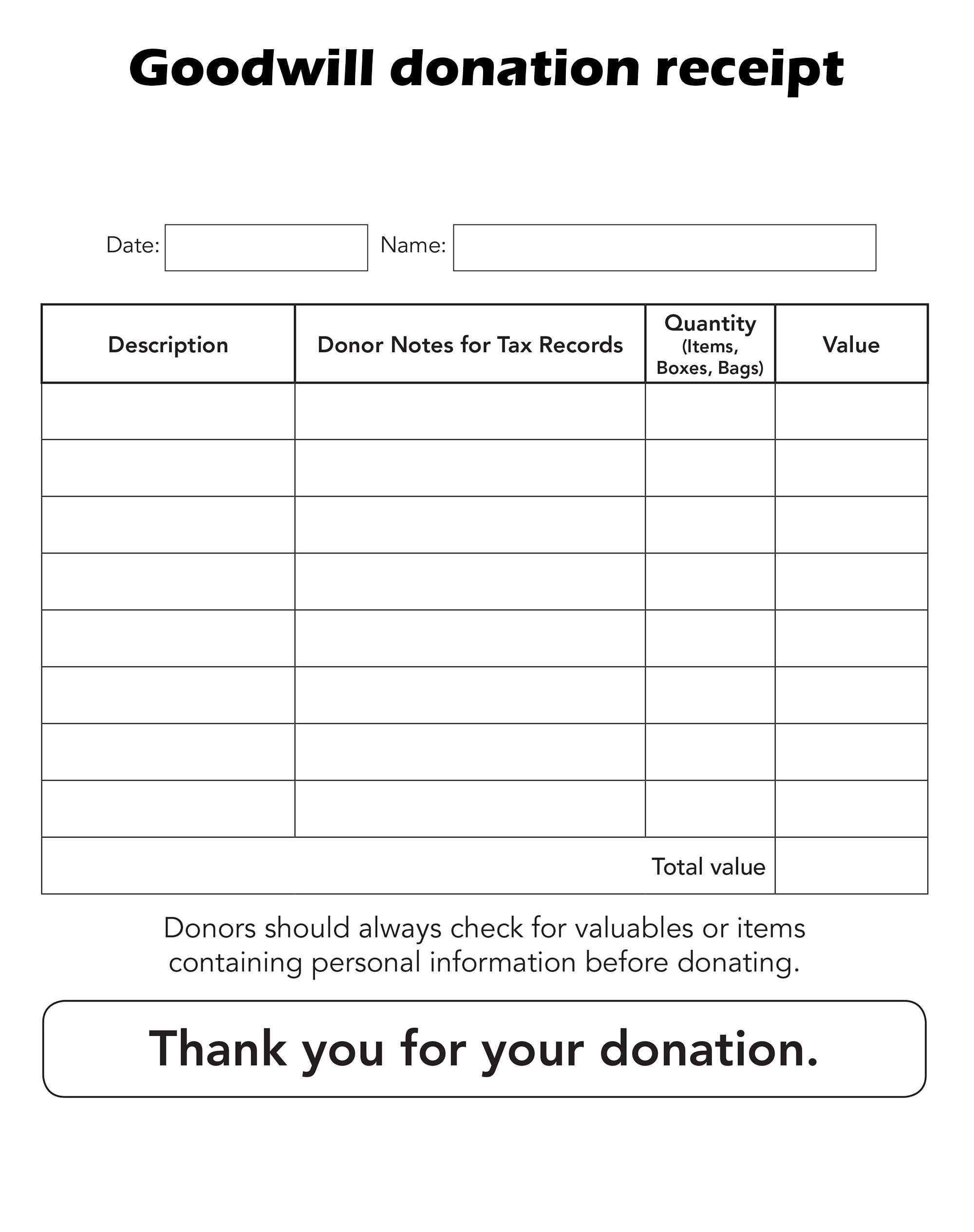

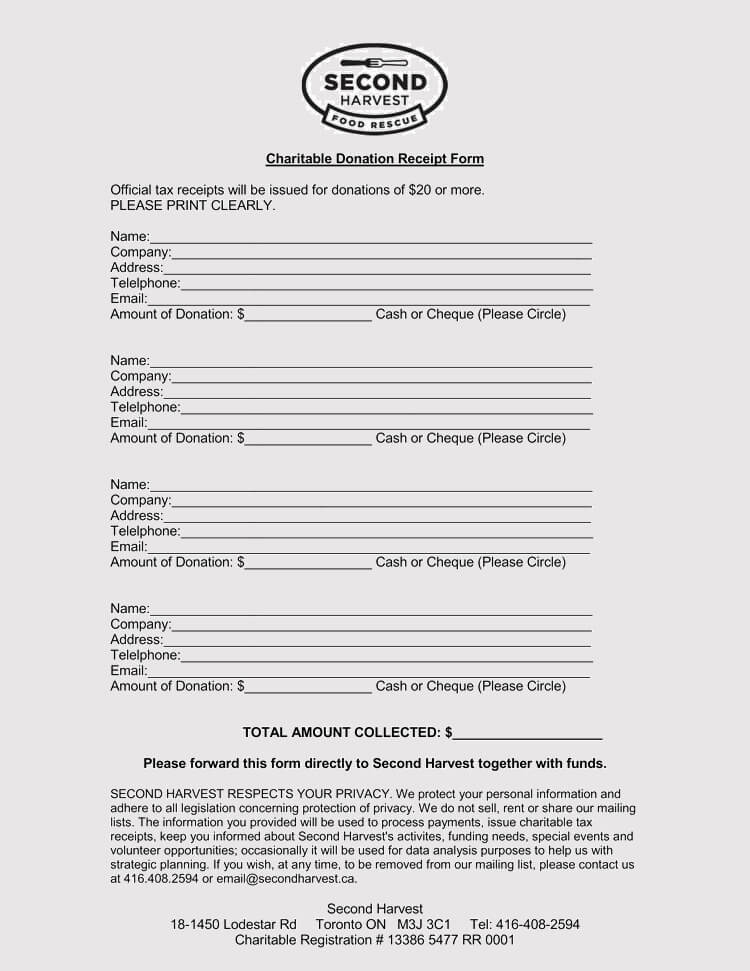

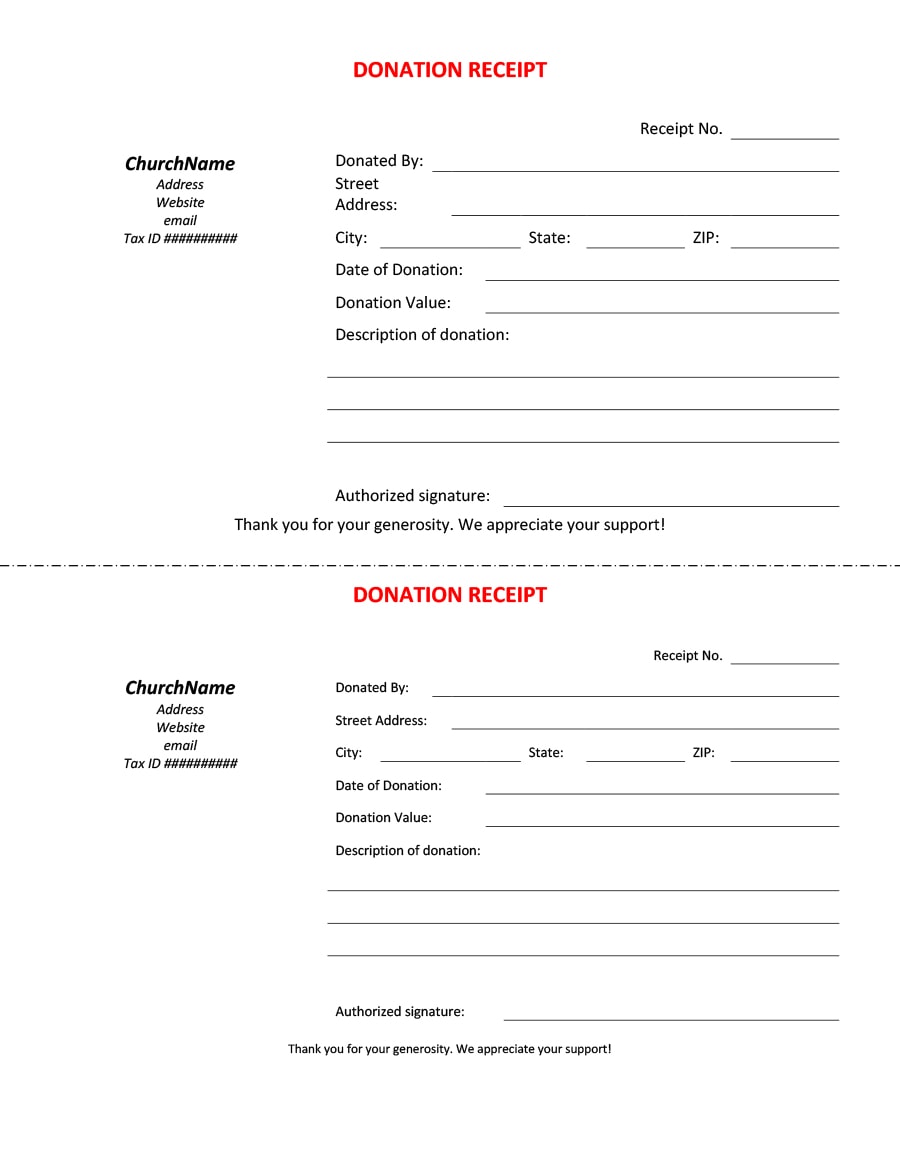

Charitable Donation Receipt Template - Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim a tax deduction. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing's value. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. An american heart association donation receipt is a document used to show proof of a contribution when disclosing donations in order to receive a tax deduction. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim a tax deduction. An american heart association donation receipt is a document used to show proof of a contribution when disclosing donations in order to receive a tax deduction. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing's value. A church donation receipt is a record of a charitable donation made to a church. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing's value. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. The receipt proves the transaction's authenticity to the government should the donor wish to deduct the contribution from their total income. A church donation receipt is a record of a charitable donation made to. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. The receipt proves the transaction's authenticity to the government should the donor wish to deduct the contribution from their total income. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim a tax deduction. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation receipt to prove the validity of the donation. Primarily, the receipt is used by organizations for filing purposes and. A church donation receipt is a record of a charitable donation made to a church. The american heart association is a 501(c)(3) charity, which means that all donations are tax deductible as the association is federally tax exempt. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation receipt to prove the. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation receipt to prove the validity of the donation. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. The american heart association is a 501(c)(3). A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim a tax deduction. An american heart association donation receipt is a document used to show proof of a contribution when disclosing donations in order to receive a tax deduction. A vehicle donation receipt, also known as a vehicle donation bill. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. A donation receipt is used by companies and individuals in order to provide proof that. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to. The receipt proves the transaction's authenticity to the government should the donor wish to deduct the contribution from their total income. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. The american heart association is a 501(c)(3) charity, which means that all donations are tax deductible as the association is federally tax exempt. A church donation receipt is a record of a charitable donation made to a church. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim a tax deduction. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing's value. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. An american heart association donation receipt is a document used to show proof of a contribution when disclosing donations in order to receive a tax deduction. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation receipt to prove the validity of the donation.5 Charitable Donation Receipt Templates formats, Examples in Word Excel

Printable Donation Receipt Template

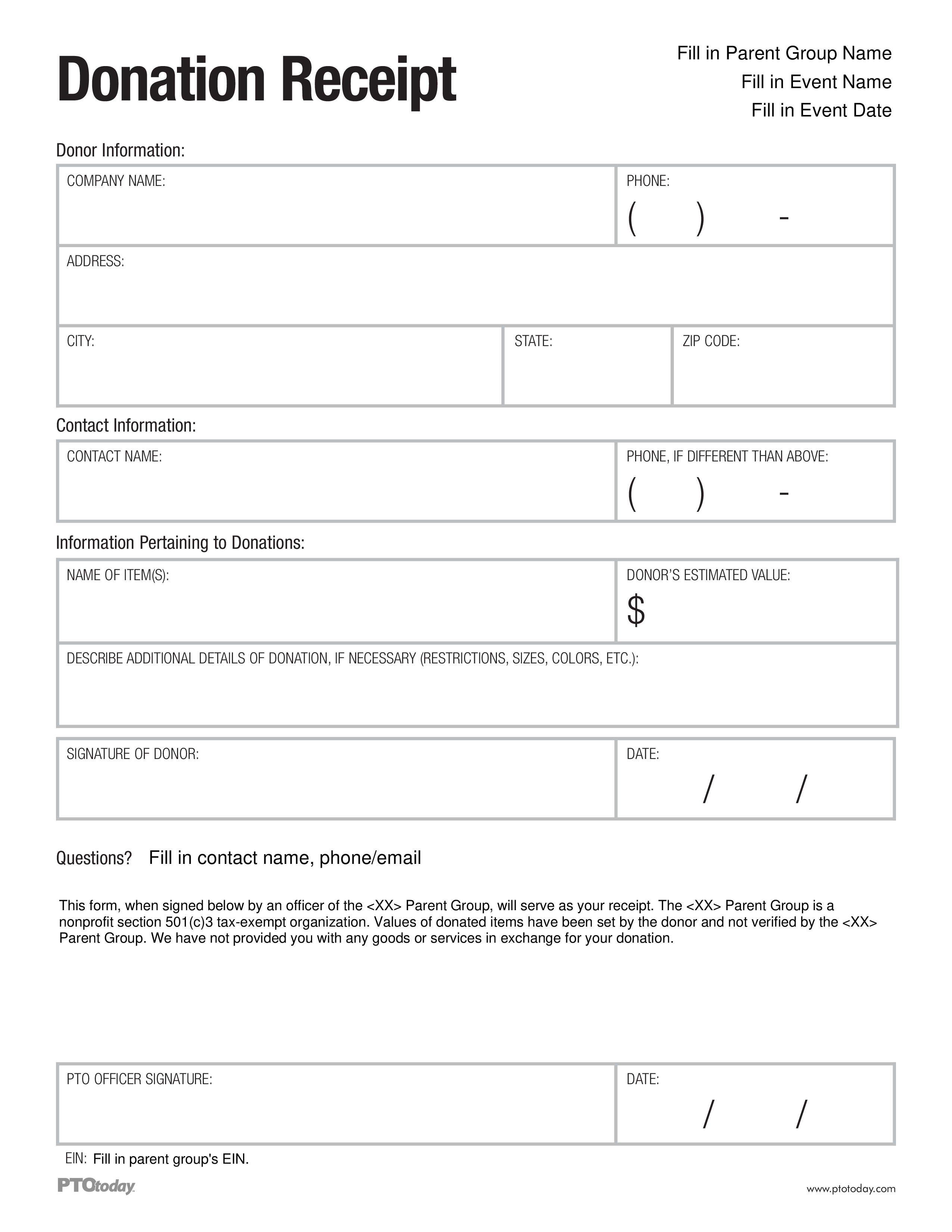

Free Printable Donation Receipt Template Printable Templates Your Go

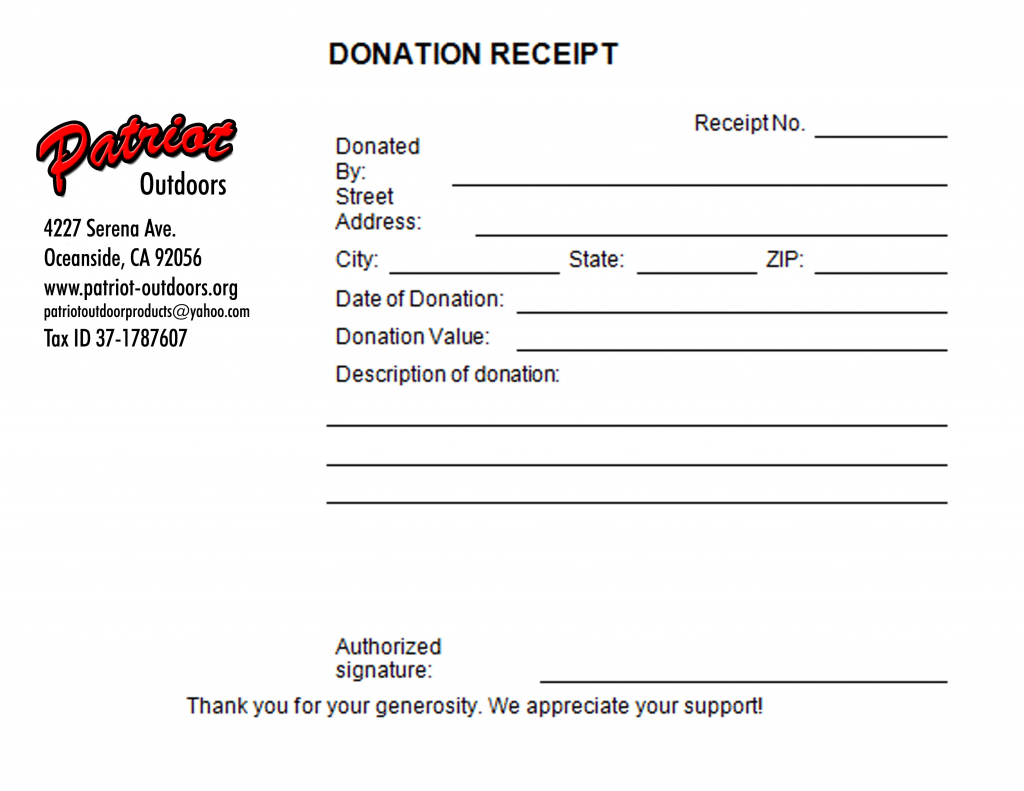

501c3 Donation Receipt Template Printable [Pdf & Word]

46 Free Donation Receipt Templates (501c3, NonProfit)

46 Free Donation Receipt Templates (501c3, NonProfit)

Charitable Donation List Template

46 Free Donation Receipt Templates (501c3, NonProfit)

5 Charitable Donation Receipt Templates Free Sample Templates

Printable Donation Receipt Template

A Vehicle Donation Receipt, Also Known As A Vehicle Donation Bill Of Sale, Is A Formal Record That Documents The Charitable Gift Of An Automobile.

A Donation Receipt Is Used To Claim A Tax Deduction For Clothing And Household Property Itemized On An Individual's Taxes.

Primarily, The Receipt Is Used By Organizations For Filing Purposes And Individual Taxpayers To Provide A Deduction On Their State And Federal (Irs) Income Tax.

Related Post:

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-PDF.jpg)