Cap Table Template Excel New Round

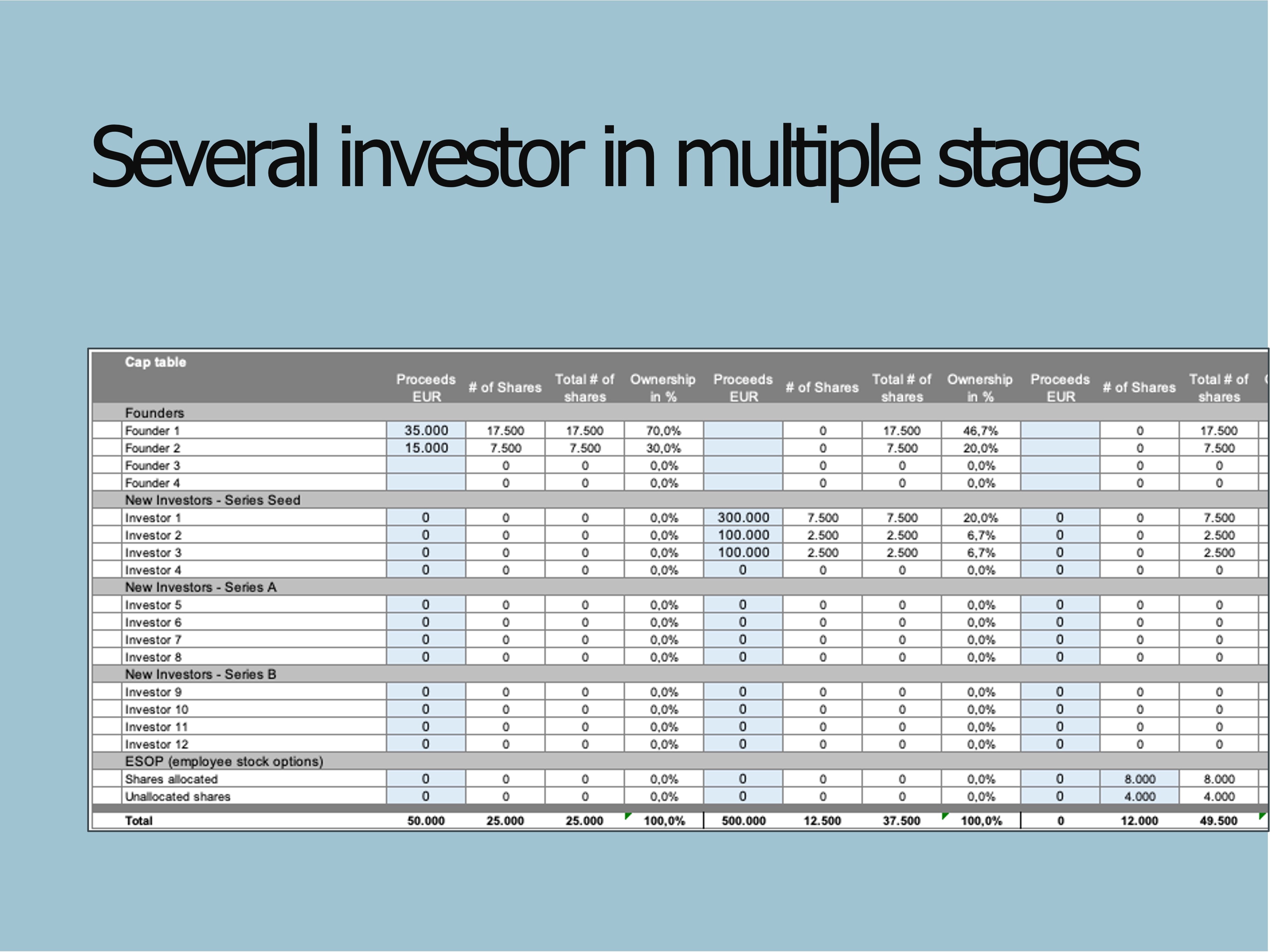

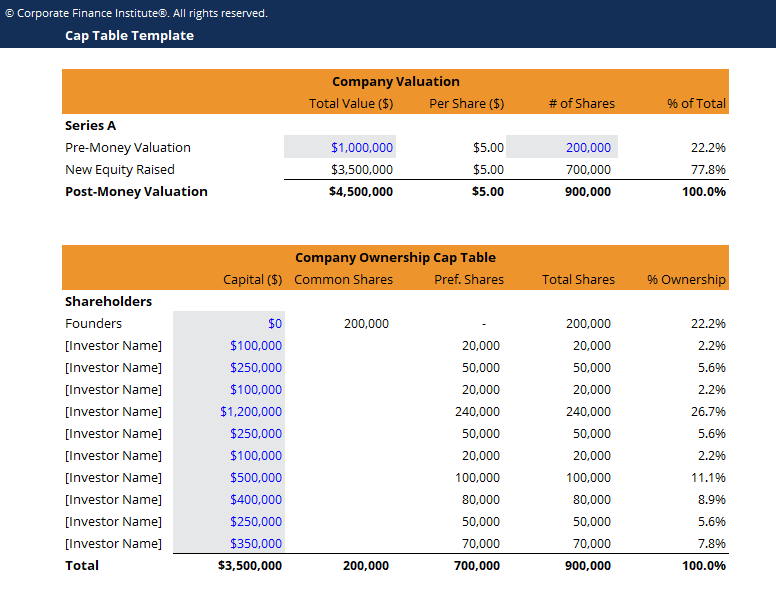

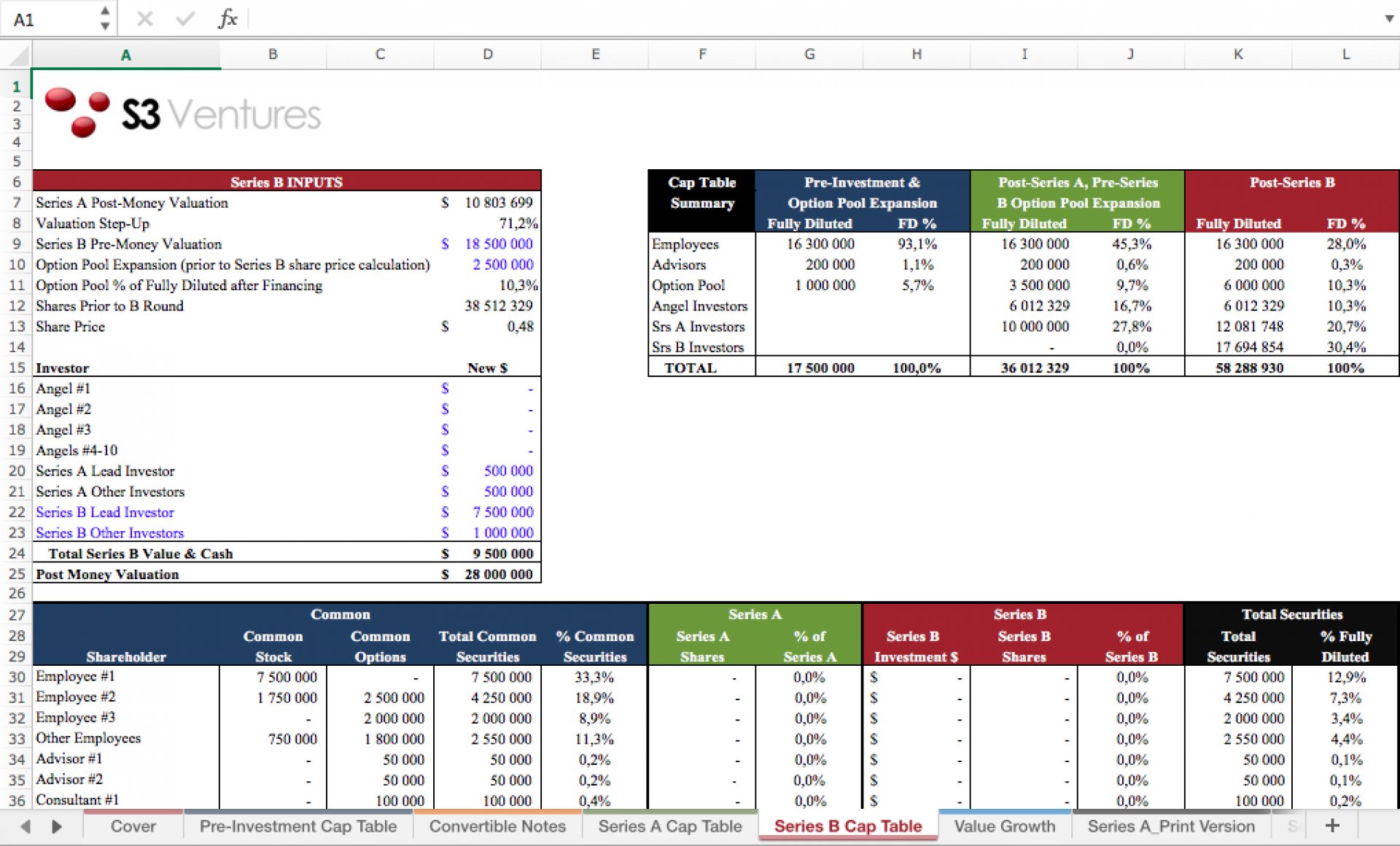

Cap Table Template Excel New Round - You can use this free template to calculate ownership, track you capitalization table, or to simply project dilution for. Startups normally maintain cap tables on. To explain how a cap table works. In this cap table guide, we will answer the question of what is a cap table for a startup?, its importance to a startup’s operation and provide you with a cap table template for google. A comprehensive excel template that can be used to understand the effect on your cap table when raising money through a convertible note or new round. Keep track of the ownership of your company with our free cap table excel template. Track ownership percentages and share quantities before new investment rounds. The tool is also great for lawyers to manage. Explore cap table template to understand its structure and how it can assist you in managing your equity. Enables you know who owns what of a startup. The tool is also great for lawyers to manage. Track ownership percentages and share quantities before new investment rounds. To explain how a cap table works. A comprehensive excel template that can be used to understand the effect on your cap table when raising money through a convertible note or new round. You can use this free template to calculate ownership, track you capitalization table, or to simply project dilution for. Core cap table example, used to model 1+ rounds of issuing equity to investors (new and proratas to existing investors), as well as converting premoney and postmoney safes, convertible. Don’t start from scratch with this free startup cap table template. Detailed cap table excel model for startups, lawyers and investors to track financing rounds. Enables you know who owns what of a startup. A simple template to look at how raising new funds (convertible note and/or new equity round) will dilute existing shareholders. Startups normally maintain cap tables on. A cap table basically lists all the owners of a company and the percentage of the company each owns. Download a cap table template for microsoft excel & google sheets. You can use this free template to calculate ownership, track you capitalization table, or to simply project dilution for. Keep track of the ownership. A comprehensive excel template that can be used to understand the effect on your cap table when raising money through a convertible note or new round. Keep track of the ownership of your company with our free cap table excel template. Download free cap table template. In this cap table guide, we will answer the question of what is a. Download a cap table template for microsoft excel & google sheets. Keep track of the ownership of your company with our free cap table excel template. Startups normally maintain cap tables on. Explore cap table template to understand its structure and how it can assist you in managing your equity. Core cap table example, used to model 1+ rounds of. Don’t start from scratch with this free startup cap table template. To explain how a cap table works. Download free cap table template. In this cap table guide, we will answer the question of what is a cap table for a startup?, its importance to a startup’s operation and provide you with a cap table template for google. Startups normally. Core cap table example, used to model 1+ rounds of issuing equity to investors (new and proratas to existing investors), as well as converting premoney and postmoney safes, convertible. A cap table basically lists all the owners of a company and the percentage of the company each owns. Detailed cap table excel model for startups, lawyers and investors to track. A cap table basically lists all the owners of a company and the percentage of the company each owns. A comprehensive excel template that can be used to understand the effect on your cap table when raising money through a convertible note or new round. You can use this free template to calculate ownership, track you capitalization table, or to. Download free cap table template. Core cap table example, used to model 1+ rounds of issuing equity to investors (new and proratas to existing investors), as well as converting premoney and postmoney safes, convertible. You can use this free template to calculate ownership, track you capitalization table, or to simply project dilution for. To explain how a cap table works.. Track ownership percentages and share quantities before new investment rounds. A simple template to look at how raising new funds (convertible note and/or new equity round) will dilute existing shareholders. A comprehensive excel template that can be used to understand the effect on your cap table when raising money through a convertible note or new round. A cap table basically. Detailed cap table excel model for startups, lawyers and investors to track financing rounds. A comprehensive excel template that can be used to understand the effect on your cap table when raising money through a convertible note or new round. A cap table basically lists all the owners of a company and the percentage of the company each owns. Download. To explain how a cap table works. Download free cap table template. A cap table basically lists all the owners of a company and the percentage of the company each owns. In this cap table guide, we will answer the question of what is a cap table for a startup?, its importance to a startup’s operation and provide you with. Explore cap table template to understand its structure and how it can assist you in managing your equity. Download a cap table template for microsoft excel & google sheets. In this cap table guide, we will answer the question of what is a cap table for a startup?, its importance to a startup’s operation and provide you with a cap table template for google. Core cap table example, used to model 1+ rounds of issuing equity to investors (new and proratas to existing investors), as well as converting premoney and postmoney safes, convertible. A simple template to look at how raising new funds (convertible note and/or new equity round) will dilute existing shareholders. The tool is also great for lawyers to manage. A comprehensive excel template that can be used to understand the effect on your cap table when raising money through a convertible note or new round. Enables you know who owns what of a startup. A cap table basically lists all the owners of a company and the percentage of the company each owns. Our cap table excel template makes it easy to track ownership, dilution and value of equity in each round of investment by founders, investors and employees. Don’t start from scratch with this free startup cap table template. To explain how a cap table works. Download free cap table template. Track ownership percentages and share quantities before new investment rounds.Cap Table Capitalization Table Investors Table Excel Template Etsy

Capitalization Table

Cap Table Template Excel, Simple Cap Table

Cap Table Capitalization Table Investors Table Excel Template

Capitalization Table Template Download Free Excel Template

Cap Table Excel Model Template Eloquens

Capital Table Template

Capitalization Table Template Excel

Free Excel Cap Table Template Easily Download Now!

Capatilization Table Excel Template Quickly Create Accurate

You Can Use This Free Template To Calculate Ownership, Track You Capitalization Table, Or To Simply Project Dilution For.

Detailed Cap Table Excel Model For Startups, Lawyers And Investors To Track Financing Rounds.

Keep Track Of The Ownership Of Your Company With Our Free Cap Table Excel Template.

Startups Normally Maintain Cap Tables On.

Related Post: