Business Debt Schedule Template

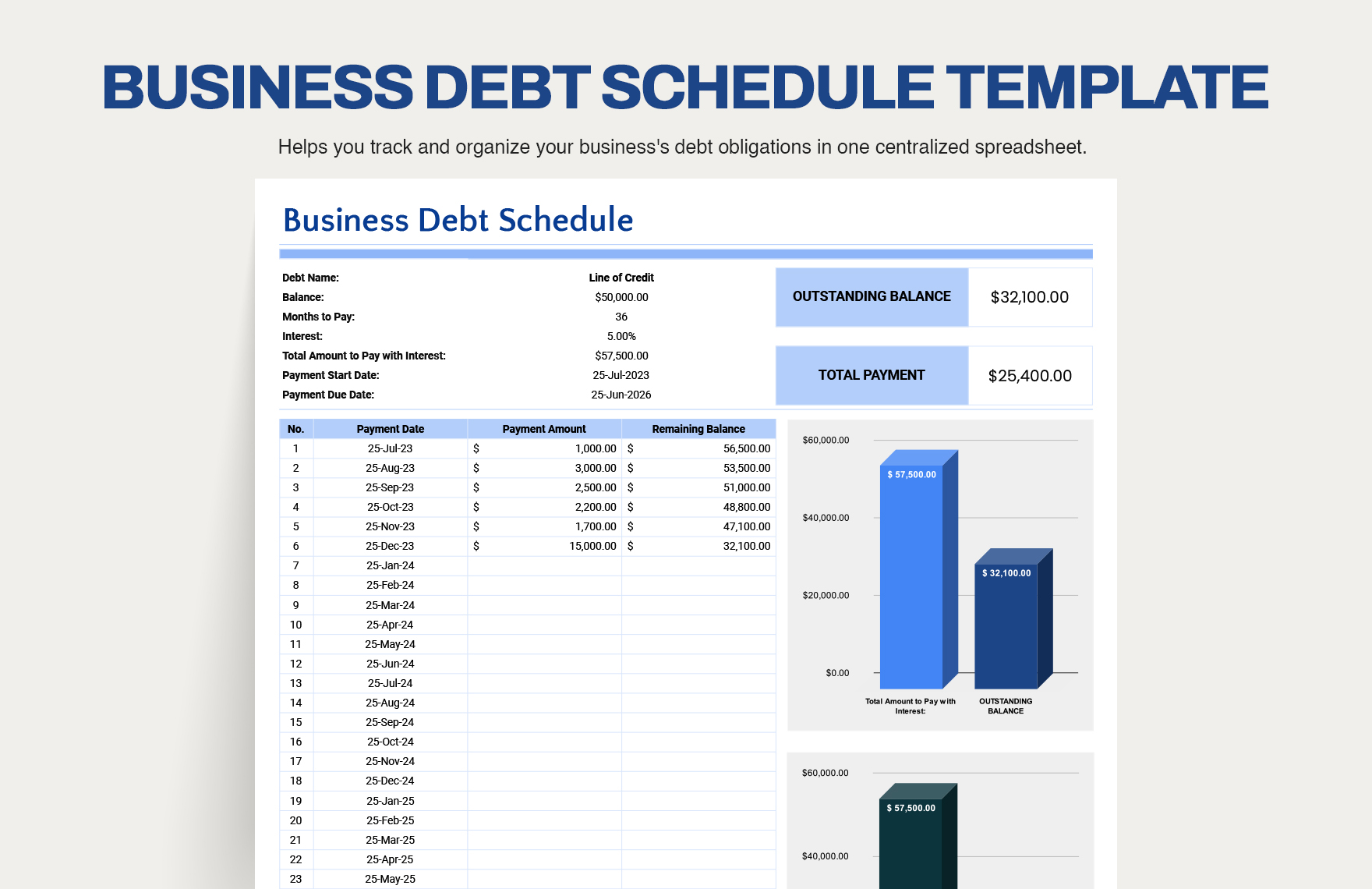

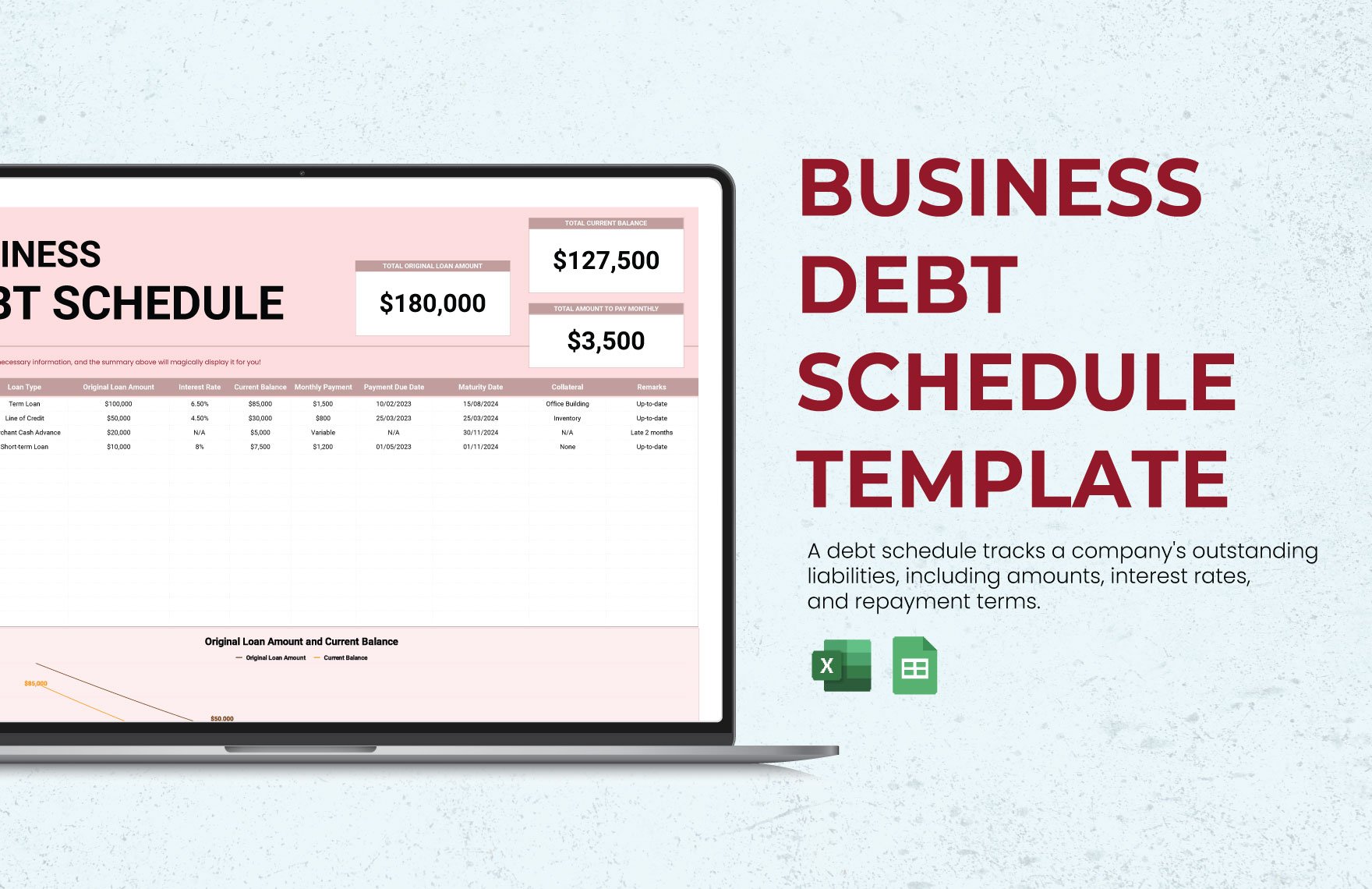

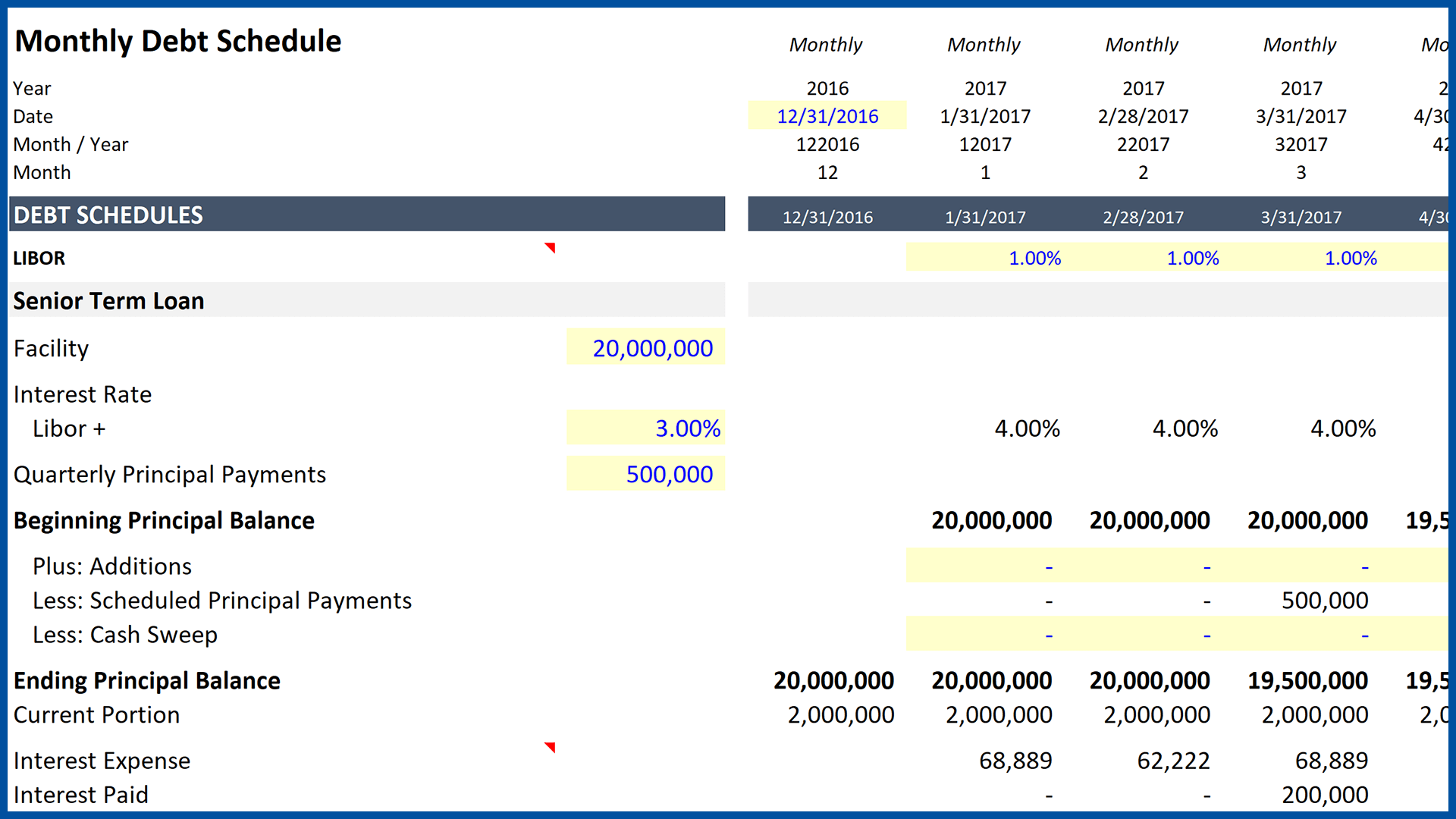

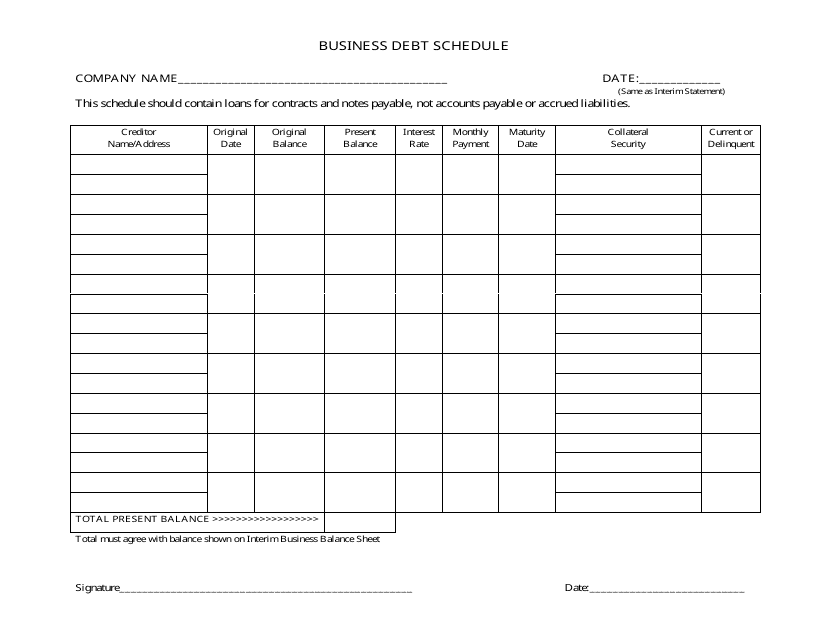

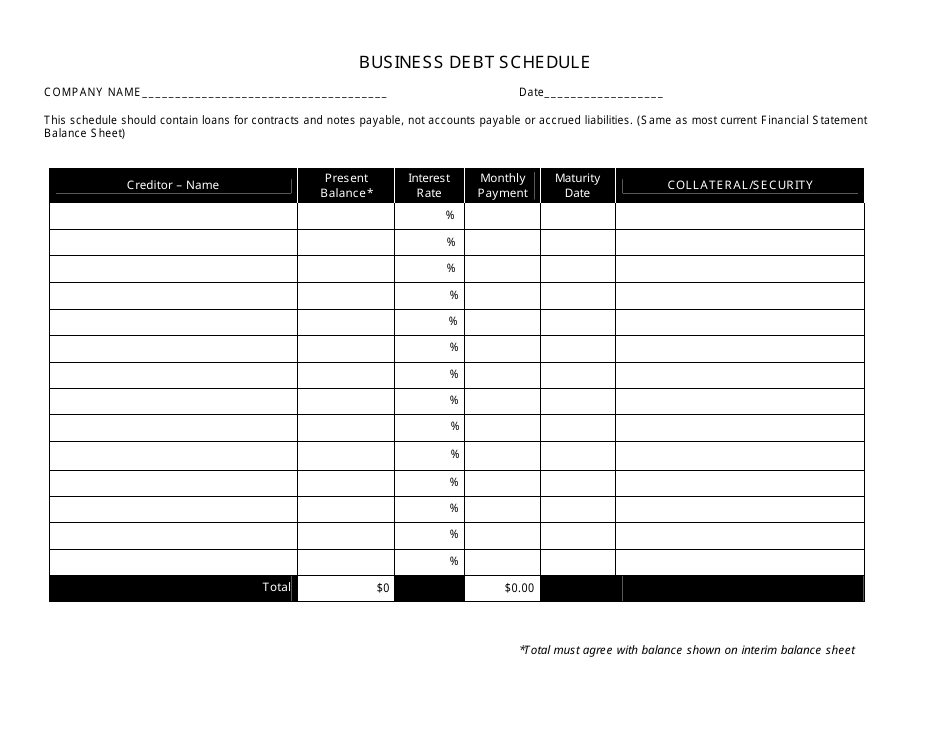

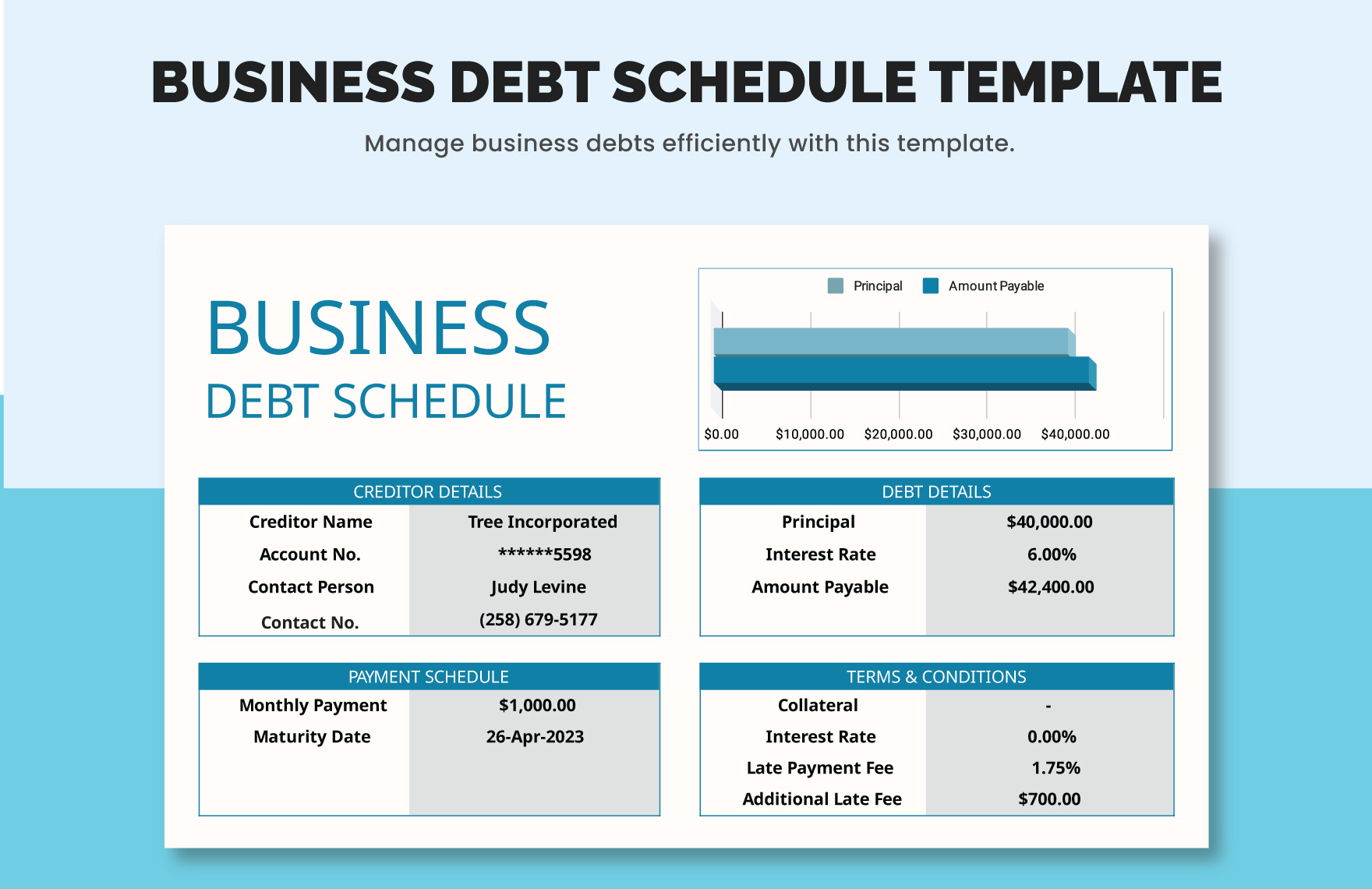

Business Debt Schedule Template - Current balance should match the current See a sample debt schedule template and get tips on how to use it for your business. To use a company debt schedule template, enter the relevant information about each debt, such as the amount, interest rate, and payment schedule. A business debt schedule template is a tool that helps businesses keep track of their outstanding debts. This template will guide you in detailing a company’s. Some business advisors suggest listing the. It should correspond to your interim balance sheet. Learn what a business debt schedule is, why you need one and how to make one. With a business debt schedule template, you can monitor monthly debt payments, track multiple loans simultaneously, calculate total debt obligations, manage payment due dates, and. A debt schedule excel template is a financial modeling tool that tracks and analyzes a company's debt obligations, interest payments, and principal repayments over time. It organizes and categorizes the various debts a business may have, such. A debt schedule excel template is a financial modeling tool that tracks and analyzes a company's debt obligations, interest payments, and principal repayments over time. See a sample debt schedule template and get tips on how to use it for your business. This schedule should list loans, contracts and notes payable, not accounts payable or accrued liabilities. With a business debt schedule template, you can monitor monthly debt payments, track multiple loans simultaneously, calculate total debt obligations, manage payment due dates, and. A business debt schedule is an instrument that helps businesses analyze, evaluate, and envision debts. Some business advisors suggest listing the. A business debt schedule is a table that lists your monthly debt payments in order of maturity. This template will guide you in detailing a company’s. To use a company debt schedule template, enter the relevant information about each debt, such as the amount, interest rate, and payment schedule. It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. A debt schedule excel template is a financial modeling tool that tracks and analyzes a company's debt obligations, interest payments, and principal repayments over time. This schedule should list loans, contracts and notes payable, not accounts payable. Business debt schedule please include the following information on all installment debts, notes, contracts and mortgages. A business debt schedule is an instrument that helps businesses analyze, evaluate, and envision debts. New business debt schedule template created date: Please provide the following information on all installment debts, credit card. Current balance should match the current It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. If no debt, fill out the top portion. This template allows you to record debt and interest payments over time. A business debt schedule template is a tool that helps businesses keep track of their outstanding debts.. To use a company debt schedule template, enter the relevant information about each debt, such as the amount, interest rate, and payment schedule. If no debt, fill out the top portion. With our business debt schedule templates, you can easily organize and track your outstanding debts. Download our debt schedule template and learn to effectively manage and analyze your company’s. See a sample debt schedule template and get tips on how to use it for your business. Business debt schedule please include the following information on all installment debts, notes, contracts and mortgages. Some business advisors suggest listing the. A debt schedule permits businesses to make calculated decisions about paying off. A business debt schedule is a table that lists. See a sample debt schedule template and get tips on how to use it for your business. A debt schedule excel template is a financial modeling tool that tracks and analyzes a company's debt obligations, interest payments, and principal repayments over time. New business debt schedule template created date: If no debt, fill out the top portion. With a business. If asked, download our free business debt schedule template to get started. This template allows you to record debt and interest payments over time. Download our debt schedule template and learn to effectively manage and analyze your company’s debt profile. A debt schedule permits businesses to make calculated decisions about paying off. New business debt schedule template created date: If asked, download our free business debt schedule template to get started. This schedule should list loans, contracts and notes payable, not accounts payable or accrued liabilities. Some business advisors suggest listing the. A business debt schedule template is a tool that helps businesses keep track of their outstanding debts. To use a company debt schedule template, enter the relevant. If asked, download our free business debt schedule template to get started. New business debt schedule template created date: Download wso's free debt schedule model template below! Download our debt schedule template and learn to effectively manage and analyze your company’s debt profile. If no debt, fill out the top portion. Business debt schedule please include the following information on all installment debts, notes, contracts and mortgages. Current balance should match the current These customizable templates allow you to categorize and prioritize your debts,. It organizes and categorizes the various debts a business may have, such. Some business advisors suggest listing the. Business debt schedule please include the following information on all installment debts, notes, contracts and mortgages. Learn what a business debt schedule is, why you need one and how to make one. Download wso's free debt schedule model template below! A debt schedule permits businesses to make calculated decisions about paying off. It should correspond to your interim balance sheet. A business debt schedule is a table that lists your monthly debt payments in order of maturity. A business debt schedule template is a tool that helps businesses keep track of their outstanding debts. This schedule should list loans, contracts and notes payable, not accounts payable or accrued liabilities. See a sample debt schedule template and get tips on how to use it for your business. It organizes and categorizes the various debts a business may have, such. Please provide the following information on all installment debts, credit card. New business debt schedule template created date: With our business debt schedule templates, you can easily organize and track your outstanding debts. This template will guide you in detailing a company’s. These customizable templates allow you to categorize and prioritize your debts,. A business debt schedule is an instrument that helps businesses analyze, evaluate, and envision debts.Business Trip Schedule Template in Excel, Google Sheets Download

Debt schedule template Fill out & sign online DocHub

Business Debt Schedule Template Excel prntbl.concejomunicipaldechinu

Business Debt Schedule Template Excel prntbl.concejomunicipaldechinu

Business Debt Schedule Template Fill Out, Sign Online and Download

Blank Business Debt Schedule Form Fill Out and Print PDFs

Business Debt Schedule Template

EXCEL TEMPLATES Debt Schedule Template Excel

Business Debt Schedule Template Excel

Business Debt Schedule Template Excel prntbl.concejomunicipaldechinu

Current Balance Should Match The Current

If Asked, Download Our Free Business Debt Schedule Template To Get Started.

A Debt Schedule Excel Template Is A Financial Modeling Tool That Tracks And Analyzes A Company's Debt Obligations, Interest Payments, And Principal Repayments Over Time.

If No Debt, Fill Out The Top Portion.

Related Post: