Bank Rec Template Excel

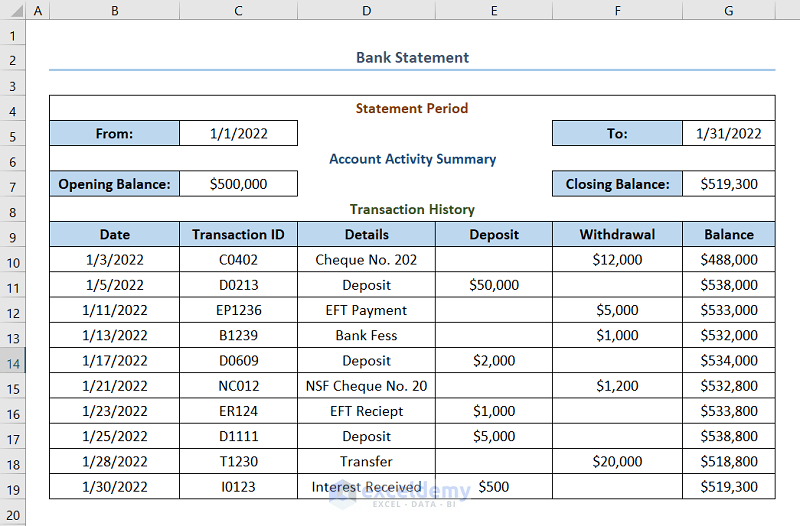

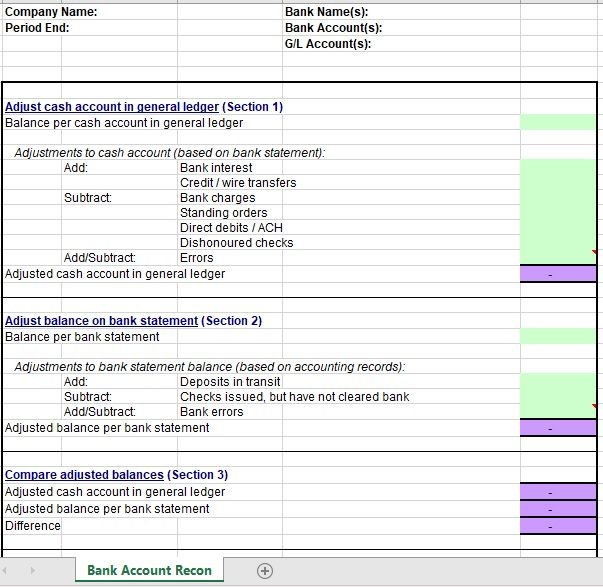

Bank Rec Template Excel - This can cut hours or even days off the monthly close, depending on how. This template streamlines the process of reconciling your bank statements and accounts in microsoft excel. It can be a collaborative one too. To perform the bank reconciliation process, you will need to check the financial records you have of bank and cash transactions and compare the bank statement sent over by the bank that. Operating expense is calculated as. Charges that appear on your statement but weren't previously recorded in your books. Download bank reconciliation excel template. Here’s how to do a bank reconciliation in excel: Items that need to be considered when reconciling your bank. Download this spreadsheet template just once, and be able to use it to reconcile your bank statement every month. Bank reconciliation is an important process for companies to do in order to check if there are any differences between the records of the company and the records of the bank. These instructions will provide the buyer with a list of important terms and conditions to be included in the letter of credit that you are. Calculate the accounting rate of return for the investment based on the given information. This can cut hours or even days off the monthly close, depending on how. Collaborating and sharing your excel file. Use easily customizable templates to bring your personal style or business branding to your invoices. Operating expense = 30% *. To perform the bank reconciliation process, you will need to check the financial records you have of bank and cash transactions and compare the bank statement sent over by the bank that. Charges that appear on your statement but weren't previously recorded in your books. From household and personal budgets to banking for. To perform the bank reconciliation process, you will need to check the financial records you have of bank and cash transactions and compare the bank statement sent over by the bank that. Guide for requesting an export letter of credit. Items that need to be considered when reconciling your bank. It can be a collaborative one too. Bank reconciliation is. This template streamlines the process of reconciling your bank statements and accounts in microsoft excel. Find a customizable design template for your budget and bring some eye—splashing aesthetics to your next budget—based project. Collaborating and sharing your excel file. Our free, customizable bank reconciliation excel template helps you match financial data on your bank statement and cash book and identify. Our free, customizable bank reconciliation excel template helps you match financial data on your bank statement and cash book and identify mismatches and erroneous. Excel isn’t just a personal tool; This template streamlines the process of reconciling your bank statements and accounts in microsoft excel. To perform the bank reconciliation process, you will need to check the financial records you. Items that need to be considered when reconciling your bank. Operating expense is calculated as. It can be a collaborative one too. Download bank reconciliation excel template. Download this spreadsheet template just once, and be able to use it to reconcile your bank statement every month. Excel isn’t just a personal tool; Download bank reconciliation excel template. To perform the bank reconciliation process, you will need to check the financial records you have of bank and cash transactions and compare the bank statement sent over by the bank that. Our free, customizable bank reconciliation excel template helps you match financial data on your bank statement and. From budgets to loan calculators, find templates that help take the guesswork out of. Bank reconciliation is an important process for companies to do in order to check if there are any differences between the records of the company and the records of the bank. Charges that appear on your statement but weren't previously recorded in your books. Use easily. Find a customizable design template for your budget and bring some eye—splashing aesthetics to your next budget—based project. From budgets to loan calculators, find templates that help take the guesswork out of. Interest the bank has added to your account that needs to be. To perform the bank reconciliation process, you will need to check the financial records you have. Excel isn’t just a personal tool; Calculate the accounting rate of return for the investment based on the given information. Download this spreadsheet template just once, and be able to use it to reconcile your bank statement every month. Download bank reconciliation excel template. If you’re managing finances with a partner or family, sharing your. Use easily customizable templates to bring your personal style or business branding to your invoices. Our free, customizable bank reconciliation excel template helps you match financial data on your bank statement and cash book and identify mismatches and erroneous. This can cut hours or even days off the monthly close, depending on how. Items that need to be considered when. These instructions will provide the buyer with a list of important terms and conditions to be included in the letter of credit that you are. Download this spreadsheet template just once, and be able to use it to reconcile your bank statement every month. Collaborating and sharing your excel file. Calculate the accounting rate of return for the investment based. Bank reconciliation is an important process for companies to do in order to check if there are any differences between the records of the company and the records of the bank. Download bank reconciliation excel template. Operating expense = 30% *. This can cut hours or even days off the monthly close, depending on how. Excel isn’t just a personal tool; If you’re managing finances with a partner or family, sharing your. Find a customizable design template for your budget and bring some eye—splashing aesthetics to your next budget—based project. To perform the bank reconciliation process, you will need to check the financial records you have of bank and cash transactions and compare the bank statement sent over by the bank that. From budgets to loan calculators, find templates that help take the guesswork out of. Here’s how to do a bank reconciliation in excel: These instructions will provide the buyer with a list of important terms and conditions to be included in the letter of credit that you are. Use easily customizable templates to bring your personal style or business branding to your invoices. Items that need to be considered when reconciling your bank. Charges that appear on your statement but weren't previously recorded in your books. From household and personal budgets to banking for. Calculate the accounting rate of return for the investment based on the given information.How to Do Bank Reconciliation in Excel (with Easy Steps)

Excel Bank Reconciliation Form

Free Excel Bank Reconciliation Template Download

Free Bank Reconciliation Template in Excel

Bank Reconciliation Excel Template

Monthly Bank Reconciliation Statement Format in Excel

20+ Free Bank Reconciliation Sheet Templates Printable Samples

20+ Free Bank Reconciliation Sheet Templates Printable Samples

6 Excel Bank Reconciliation Template Excel Templates

Bank Reconciliation Statement in Excel Format

This Template Streamlines The Process Of Reconciling Your Bank Statements And Accounts In Microsoft Excel.

It Can Be A Collaborative One Too.

Our Free, Customizable Bank Reconciliation Excel Template Helps You Match Financial Data On Your Bank Statement And Cash Book And Identify Mismatches And Erroneous.

Collaborating And Sharing Your Excel File.

Related Post: