Balance Sheet Account Reconciliation Template Excel

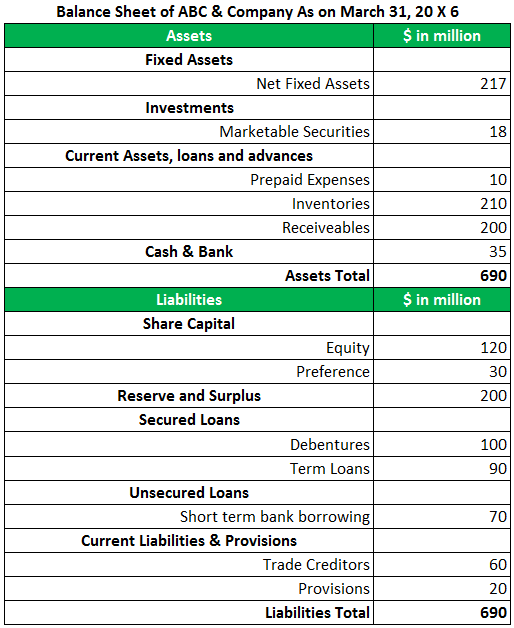

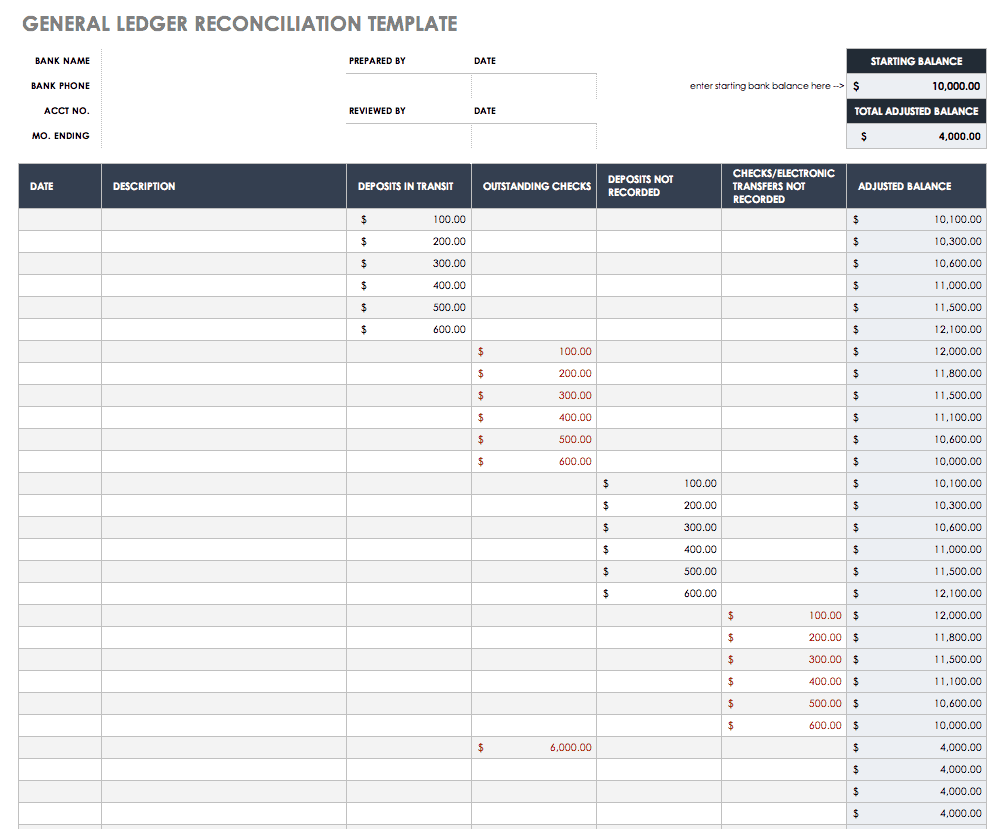

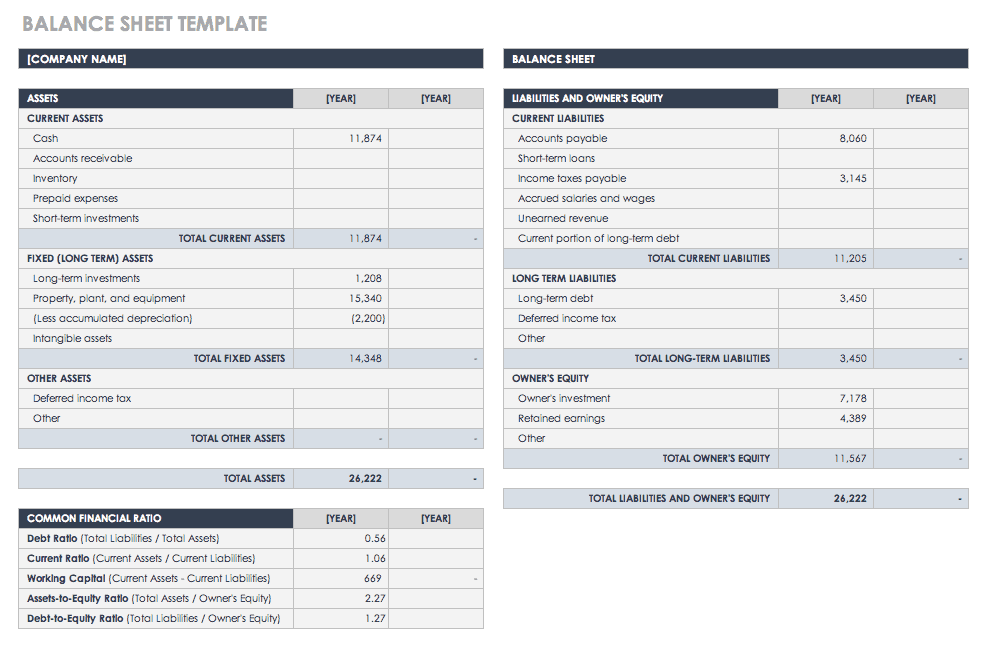

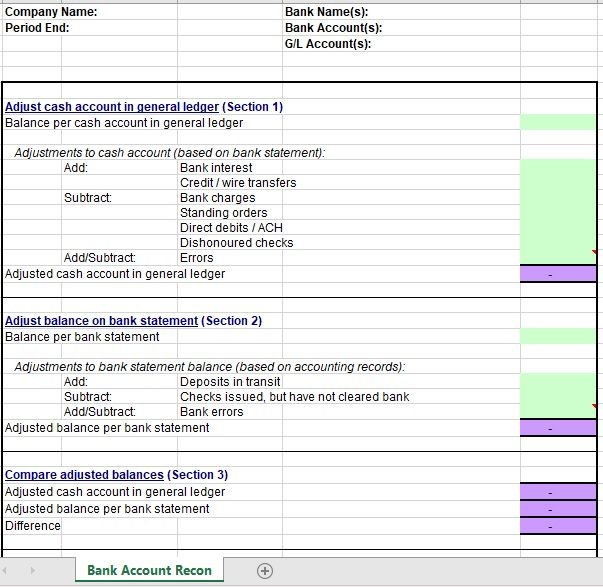

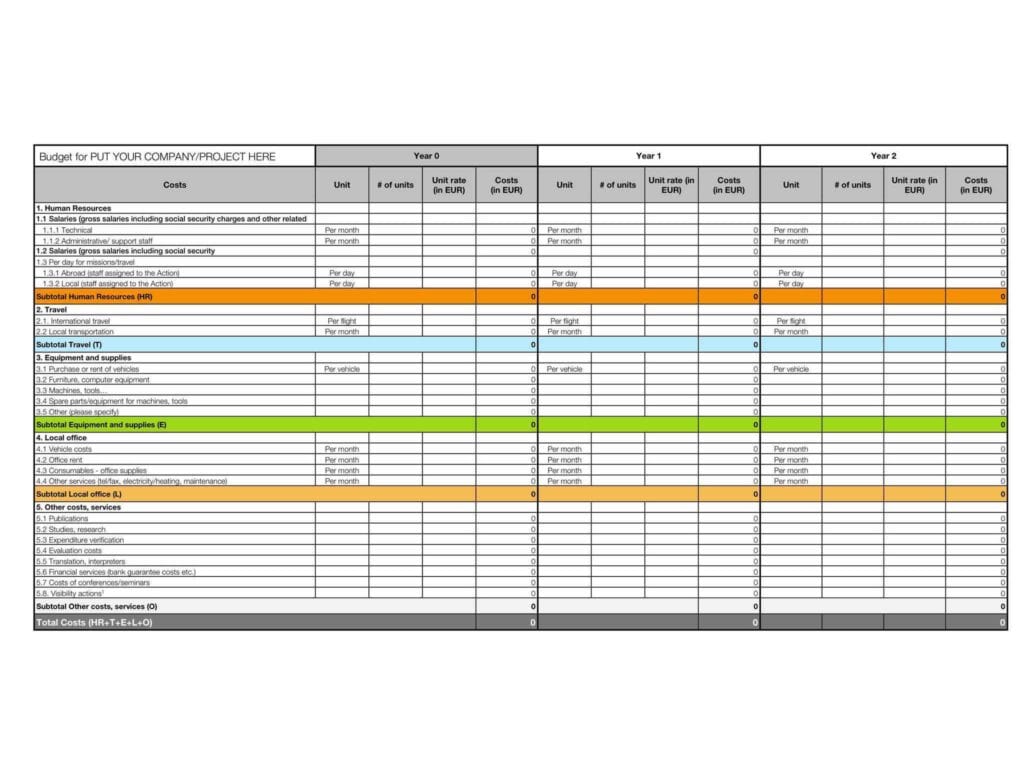

Balance Sheet Account Reconciliation Template Excel - For example, you might compare. Reconciliation of accounts provides accurate annual accounts which all businesses must maintain, helps in establishing relationships with suppliers, and helps in avoiding late. Download this reconciliation balance sheet template that is designed to track and monitor financial account information. View our free and editable balance reconciliation templates for excel or google sheets. One of the most used reconciliation sheets are for checking. Excel reconciliation templates streamline financial record matching and error detection. Here’s a simple way to set up your accounts receivable sheet in excel: Optimize your financial reconciliation with our excel reconciliation templates. The goal here is to document and share those com. The next step is crucial, but is easy to overlook: Create a customized balance sheet account reconciliation excel template with ai. In this process, you will compare the total amount of the outstanding bills that your customers owe with the actual payments received in the. View our free and editable account reconciliation templates for excel or google sheets. Optimize your financial reconciliation with our excel reconciliation templates. Follow the steps, schedule, and roles and responsibilities for quarterly. Designed by former accountants and auditors for accuracy and efficiency. View our free and editable balance reconciliation templates for excel or google sheets. Excel reconciliation templates streamline financial record matching and error detection. Use the example tab and create an example reconciliation to accompany the account. Download this reconciliation balance sheet template that is designed to track and monitor financial account information. In this process, you will compare the total amount of the outstanding bills that your customers owe with the actual payments received in the. Without a solid base, everything else can come crumbling down. Fire up excel and create a. Verify that the beginning balance in your. Teams know exactly when reconciliations are expected, making it easier to identify and. The template includes lines for assets such as cash, accounts receivable, inventory, and investments, along with liabilities, including accounts payable, loans, and. This can be used as a reference point for future reconciliations. Balance sheet reconciliation is the process of verifying that the balances in your company's general ledger match the corresponding account balances in supporting. The next step is. Create a customized balance sheet account reconciliation excel template with ai. These balance reconciliation spreadsheet templates are easy to modify and you can customize the. Download this reconciliation balance sheet template that is designed to track and monitor financial account information. Optimize your financial reconciliation with our excel reconciliation templates. Use the example tab and create an example reconciliation to. In this process, you will compare the total amount of the outstanding bills that your customers owe with the actual payments received in the. The goal here is to document and share those com. Fire up excel and create a. For example, you might compare. These account reconciliation spreadsheet templates are easy to modify and you can customize the. The next step is crucial, but is easy to overlook: Without a solid base, everything else can come crumbling down. Balance sheet reconciliation is the process of verifying that the balances in your company's general ledger match the corresponding account balances in supporting. Teams know exactly when reconciliations are expected, making it easier to identify and fix discrepancies early in. Without a solid base, everything else can come crumbling down. This general ledger reconciliation template in excel enables finance and accounting teams at tech companies to: Reconciliation of accounts provides accurate annual accounts which all businesses must maintain, helps in establishing relationships with suppliers, and helps in avoiding late. Download this reconciliation balance sheet template that is designed to track. Depending on your organization’s preferences, this might be microsoft excel or a google sheet. View our free and editable balance reconciliation templates for excel or google sheets. The next step is crucial, but is easy to overlook: For example, you might compare. Verify that the beginning balance in your. Up to 50% cash back to help you out, we've compiled a list of the best excel format balance sheet reconciliation templates available. Download this reconciliation balance sheet template that is designed to track and monitor financial account information. Account reconciliation excel templates streamline financial reporting by automating balance comparisons between bank statements and internal records. Here’s a simple way. The goal here is to document and share those com. Fire up excel and create a. Up to 50% cash back to help you out, we've compiled a list of the best excel format balance sheet reconciliation templates available. This can be used as a reference point for future reconciliations. Learn how to reconcile balance sheet account balances using excel. One of the most used reconciliation sheets are for checking. Reconciliation of accounts provides accurate annual accounts which all businesses must maintain, helps in establishing relationships with suppliers, and helps in avoiding late. This can be used as a reference point for future reconciliations. Account reconciliation excel templates streamline financial reporting by automating balance comparisons between bank statements and internal. Fire up excel and create a. View our free and editable balance reconciliation templates for excel or google sheets. Verify that the beginning balance in your. The template includes lines for assets such as cash, accounts receivable, inventory, and investments, along with liabilities, including accounts payable, loans, and. One of the most used reconciliation sheets are for checking. Reconciliation of accounts provides accurate annual accounts which all businesses must maintain, helps in establishing relationships with suppliers, and helps in avoiding late. For example, you might compare. Excel reconciliation templates streamline financial record matching and error detection. • clearly call out discrepancies on the balance sheet by documenting variances. Use the example tab and create an example reconciliation to accompany the account. Balance sheet reconciliation is the process of verifying that the balances in your company's general ledger match the corresponding account balances in supporting. Without a solid base, everything else can come crumbling down. Depending on your organization’s preferences, this might be microsoft excel or a google sheet. Follow the steps, schedule, and roles and responsibilities for quarterly. Account reconciliation excel templates streamline financial reporting by automating balance comparisons between bank statements and internal records. Teams know exactly when reconciliations are expected, making it easier to identify and fix discrepancies early in the reporting cycle.Balance Sheet Reconciliation Template In Excel

Free Account Reconciliation Templates Smartsheet

Free Account Reconciliation Templates Smartsheet

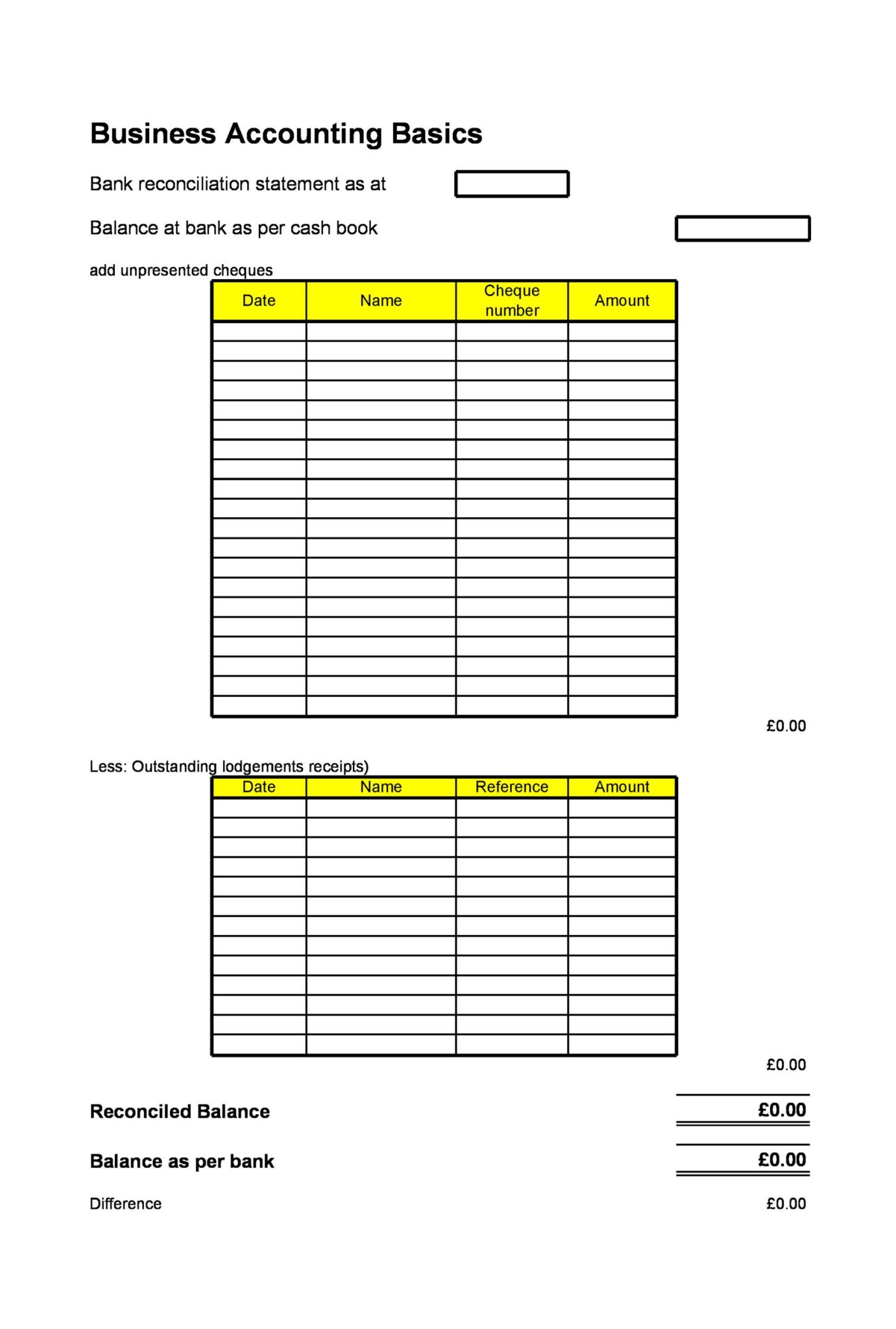

20+ Free Bank Reconciliation Sheet Templates Printable Samples

55 Useful Bank Reconciliation Template RedlineSP

Free Excel Bank Reconciliation Template Download

5 Account Reconciliation Template Excel Excel Templates

Balance Sheet Account Reconciliation Template

sample balance sheet reconciliation template —

Free Account Reconciliation Templates Smartsheet

Optimize Your Financial Reconciliation With Our Excel Reconciliation Templates.

View Our Free And Editable Account Reconciliation Templates For Excel Or Google Sheets.

This Can Be Used As A Reference Point For Future Reconciliations.

In This Process, You Will Compare The Total Amount Of The Outstanding Bills That Your Customers Owe With The Actual Payments Received In The.

Related Post: