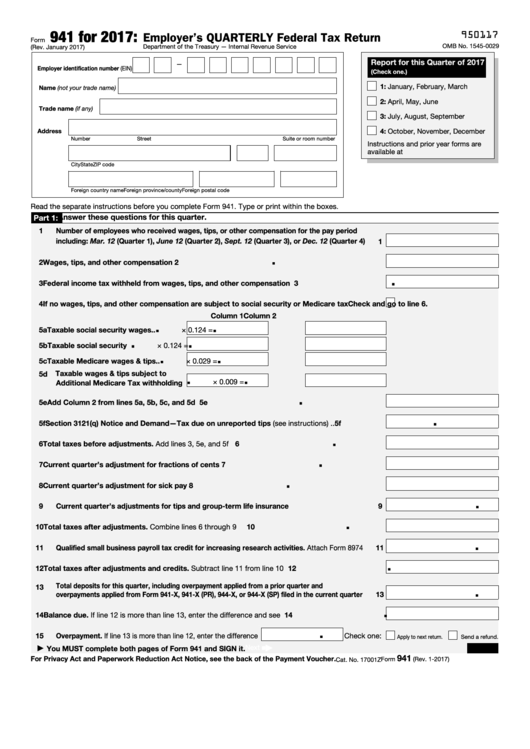

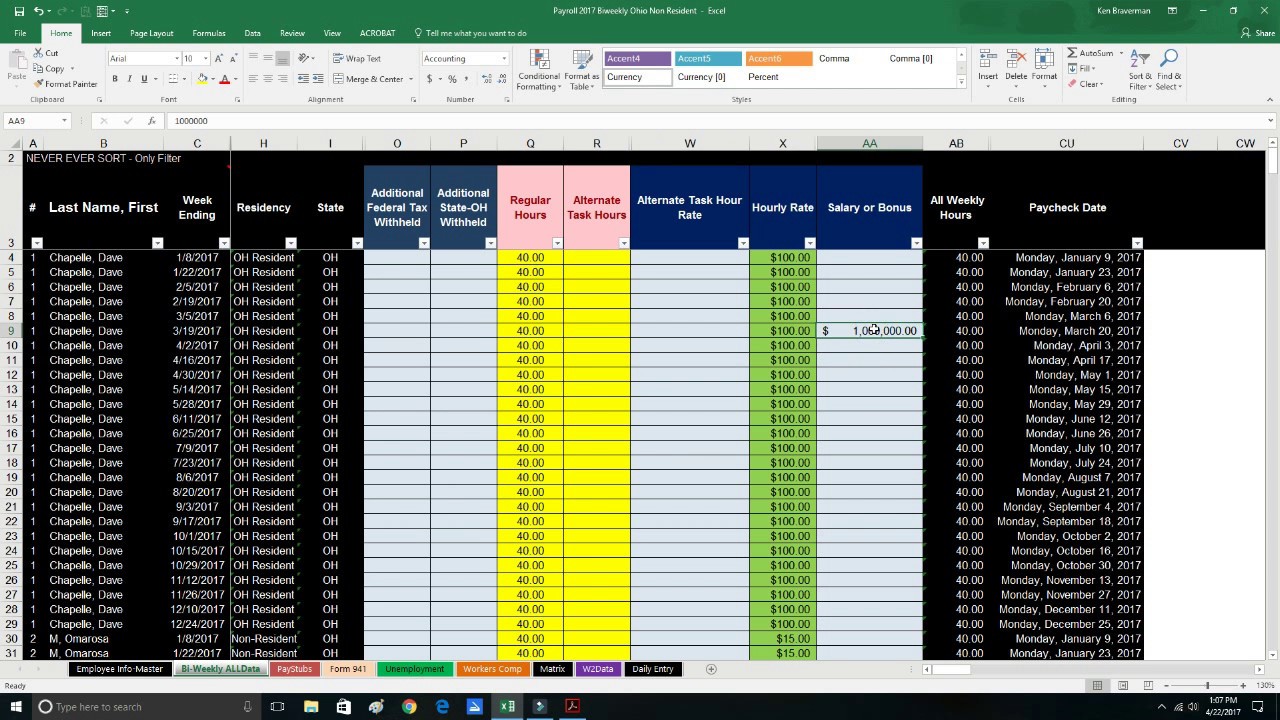

941 Reconciliation Template Excel

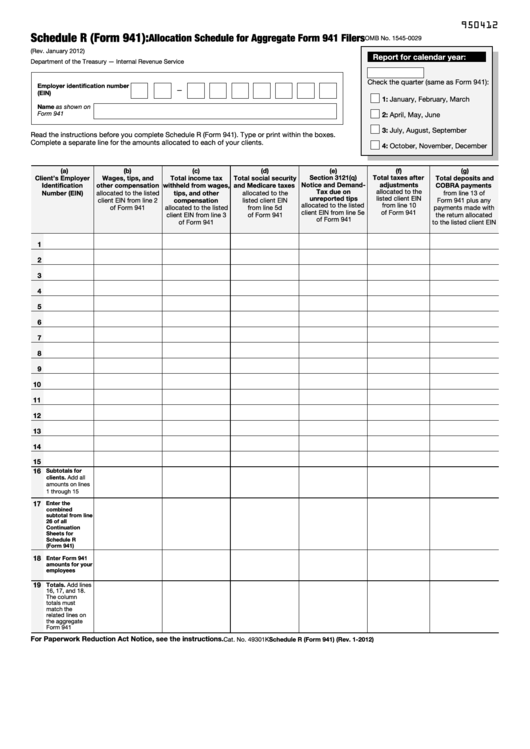

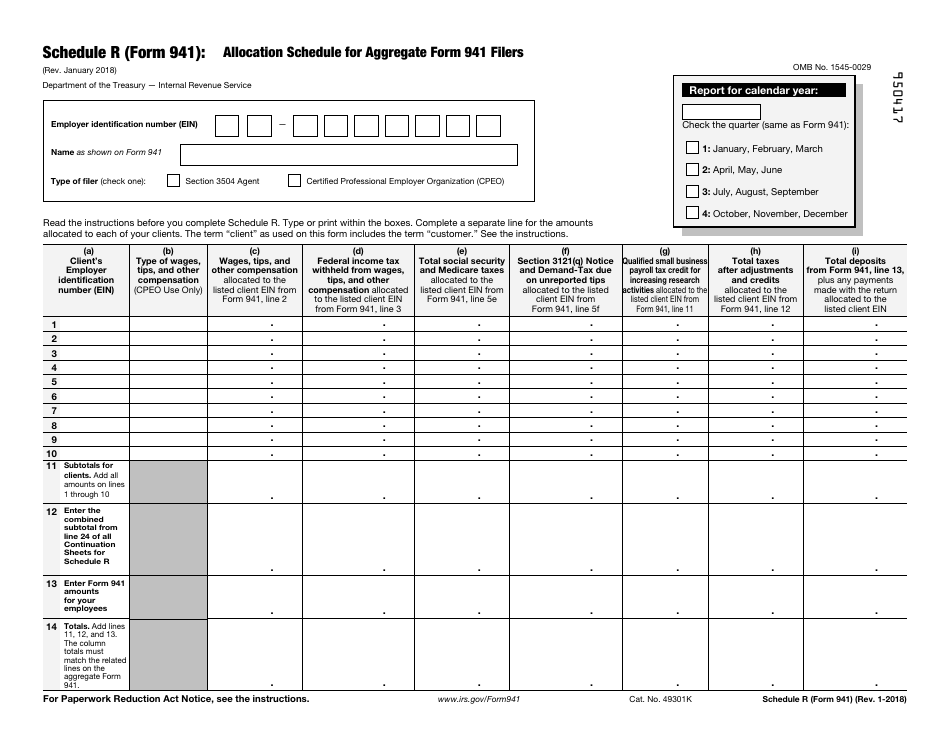

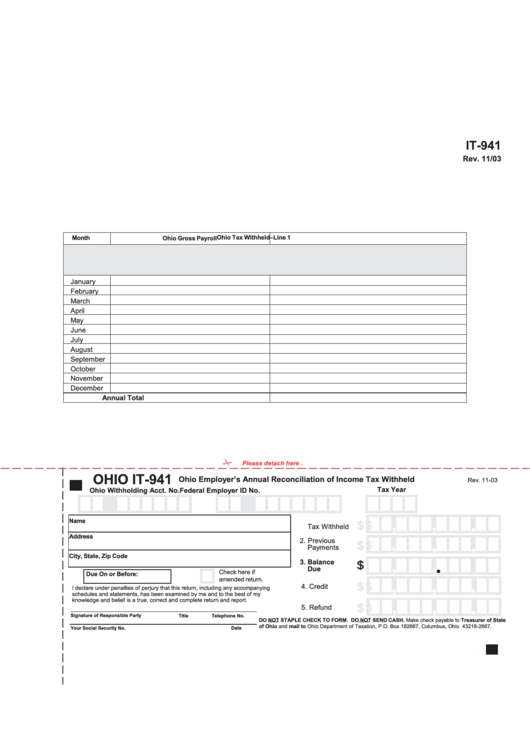

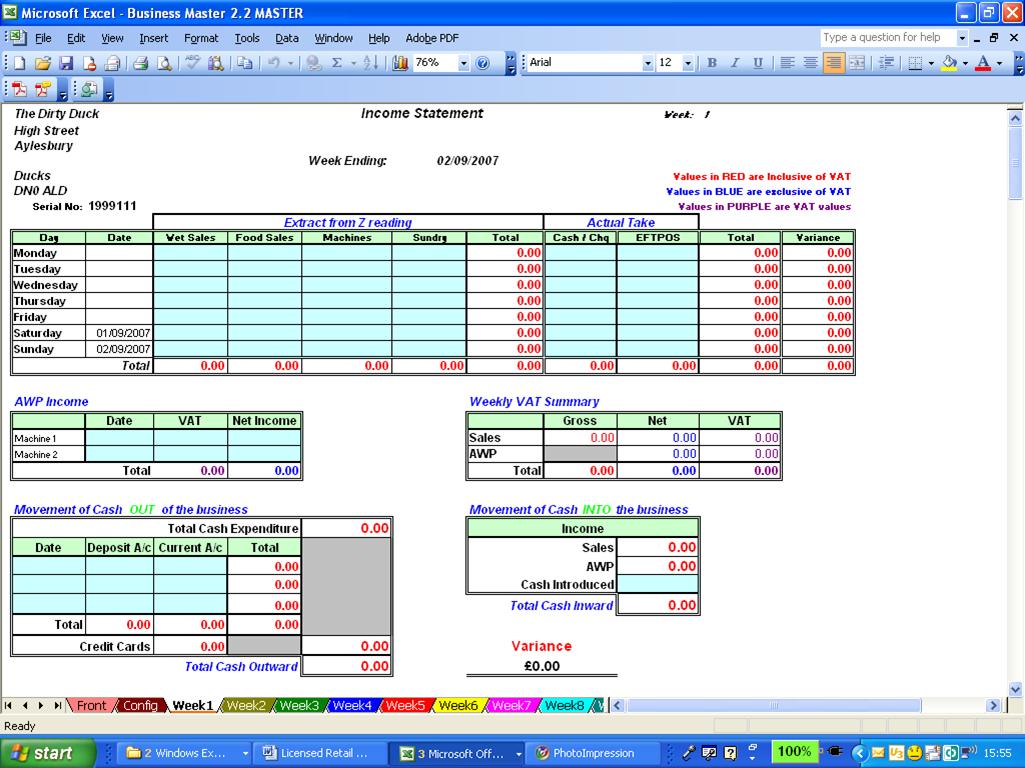

941 Reconciliation Template Excel - I've attached an excel workbook i used to use for balancing federal wages and taxes. Use on any account, petty cash, ledger, or other purposes. Reconciliation of the total labor dollars reported on the 941s. In column 1, enter employees’ total wages, sick pay, and taxable fringe benefits subject to social security taxes from the quarter. Below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. Make reconciliation documents with template.net's free reconciliation templates excel. You can use this worksheet to reconcile quarterly reports, annual 941 report, employee tax summary, and payroll history. For example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs. Multiply column 1 by 0.124 (or. Run a report that shows annual payroll amounts. W2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Find out how to use spreadsheets, softwar… I've attached an excel workbook i used to use for balancing federal wages and taxes. Compare those figures with the totals reported on all four 941s for the year. Reconciliation of the total labor dollars reported on the 941s. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941 b? Multiply column 1 by 0.124 (or. Up to $50 cash back the 941 reconciliation template in excel is a tool that helps businesses reconcile their quarterly payroll tax form 941 with their payroll records. You can use this worksheet to reconcile quarterly reports, annual 941 report, employee tax summary, and payroll history. Using the 941 forms, transfer totals for each category listed by. Ofm strongly suggests that you reconcile at the end of each. This may seem like a. Below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941 b?. What are the changes in form 941 for 2023? Multiply column 1 by 0.124 (or. Find out how to use spreadsheets, softwar… For the fiscal year ending: Ofm strongly suggests that you reconcile at the end of each. Reconciliation of the total labor dollars reported on the 941s. Find out how to use spreadsheets, softwar… Up to $50 cash back the 941 reconciliation template in excel is a tool that helps businesses reconcile their quarterly payroll tax form 941 with their payroll records. After you print the reports (as part of the year end checklist),. A 941 reconciliation. Find out how to use spreadsheets, softwar… A 941 reconciliation excel template streamlines quarterly federal tax return preparation by automating calculations and reducing errors. Use on any account, petty cash, ledger, or other purposes. Ofm strongly suggests that you reconcile at the end of each. Download our 941 form excel template to import multiple 941. You can use this worksheet to reconcile quarterly reports, annual 941 report, employee tax summary, and payroll history. For example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs. Compare those figures with the totals reported on all four 941s for the year.. Download our 941 form excel template to import multiple 941. For example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs. The template systematically compares payroll. A 941 reconciliation excel template streamlines quarterly federal tax return preparation by automating calculations and reducing errors.. In column 1, enter employees’ total wages, sick pay, and taxable fringe benefits subject to social security taxes from the quarter. After you print the reports (as part of the year end checklist),. Download our 941 form excel template to import multiple 941. Up to $50 cash back the 941 reconciliation template in excel is a tool that helps businesses. Download our 941 form excel template to import multiple 941. The template systematically compares payroll. Most employers must report employees' wages paid and taxes withheld plus their. This powerful tool combines the functionality of excel with advanced ai capabilities to create. It includes detailed instructions to ensure payroll records match federal reporting. Up to $50 cash back the 941 reconciliation template in excel is a tool that helps businesses reconcile their quarterly payroll tax form 941 with their payroll records. In column 1, enter employees’ total wages, sick pay, and taxable fringe benefits subject to social security taxes from the quarter. Use on any account, petty cash, ledger, or other purposes. Ofm. The template systematically compares payroll. Most employers must report employees' wages paid and taxes withheld plus their. W2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: In column 1, enter employees’ total wages, sick pay, and taxable fringe benefits subject to social security taxes from the quarter. Streamline your financial reconciliation process with our reconciliation excel template. This powerful tool combines the functionality of excel with advanced ai capabilities to create. Find out how to use spreadsheets, softwar… Below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. Learn how to reconcile form 941, employer’s quarterly federal tax return, and why it is important for your small business. Make reconciliation documents with template.net's free reconciliation templates excel. W2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Run a report that shows annual payroll amounts. Use on any account, petty cash, ledger, or other purposes. Download our 941 form excel template to import multiple 941. Using the 941 forms, transfer totals for each category listed by. Reconciliation of the total labor dollars reported on the 941s. Compare those figures with the totals reported on all four 941s for the year. For example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs. You can use this worksheet to reconcile quarterly reports, annual 941 report, employee tax summary, and payroll history. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941 b? To the total dollars reported in the general ledger labor accounts.941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel prntbl.concejomunicipaldechinu.gov.co

941 Reconciliation Template Excel prntbl.concejomunicipaldechinu.gov.co

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation To General Ledger Template prntbl

941 X Worksheet 2 Excel

It Includes Detailed Instructions To Ensure Payroll Records Match Federal Reporting.

In Column 1, Enter Employees’ Total Wages, Sick Pay, And Taxable Fringe Benefits Subject To Social Security Taxes From The Quarter.

Streamline Your Financial Reconciliation Process With Our Reconciliation Excel Template Generator.

After You Print The Reports (As Part Of The Year End Checklist),.

Related Post: