15 Usc 1666B Dispute Letter Template

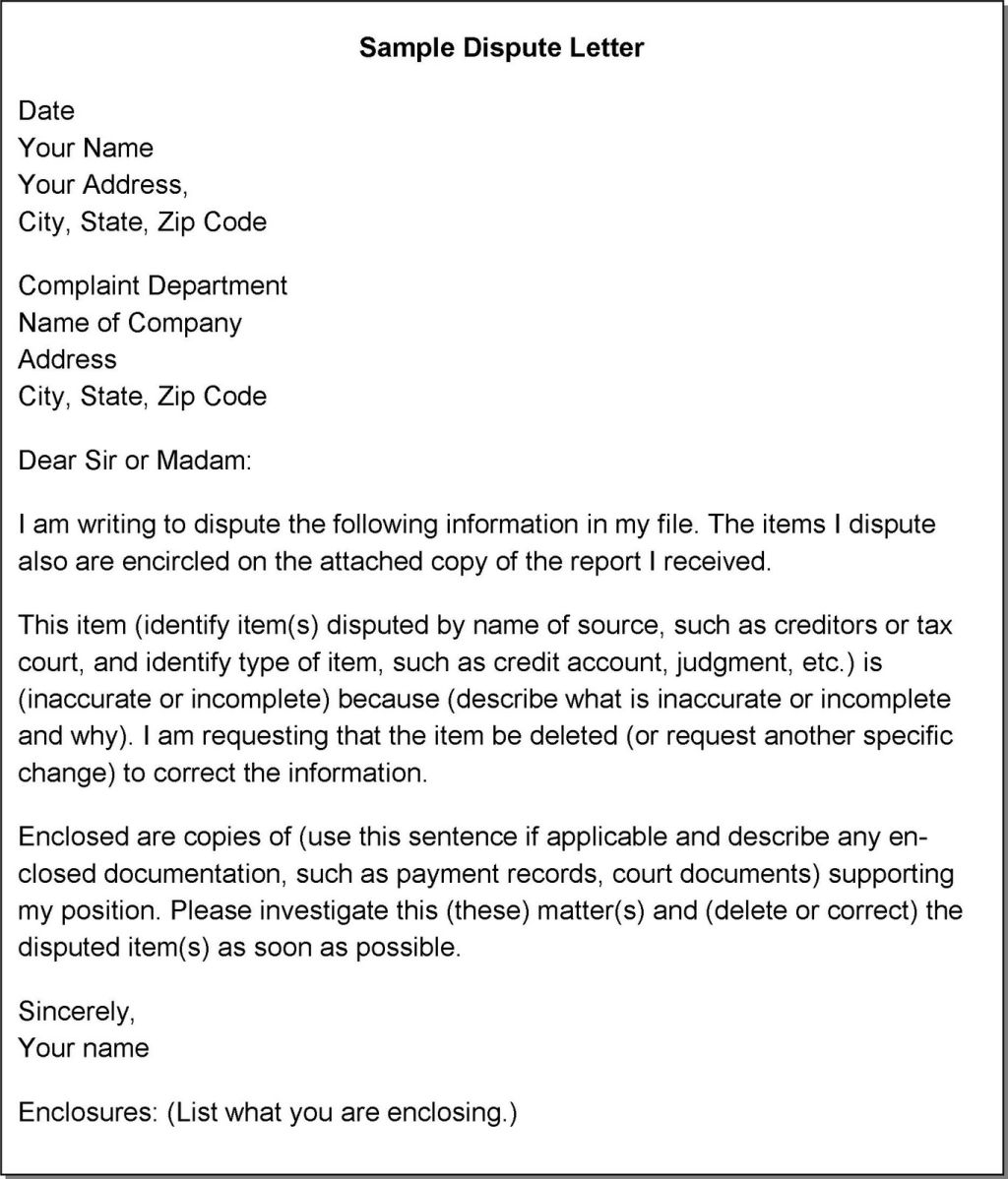

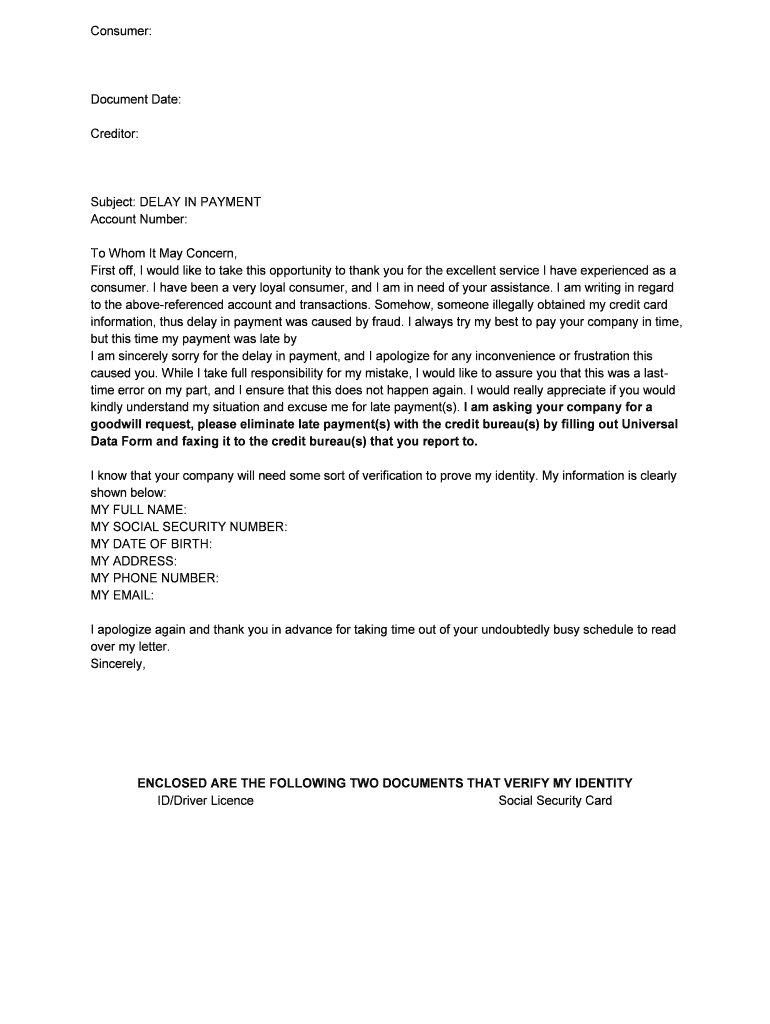

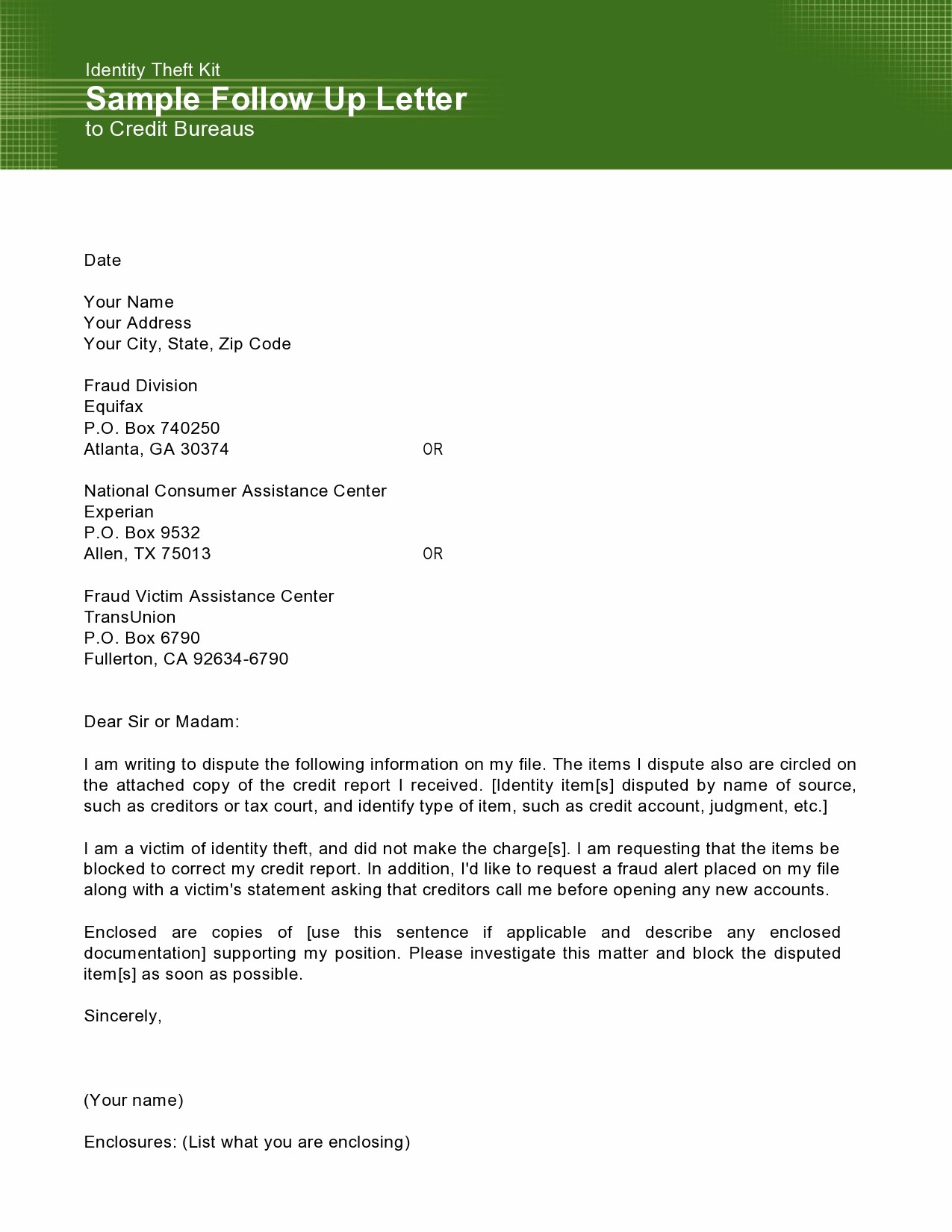

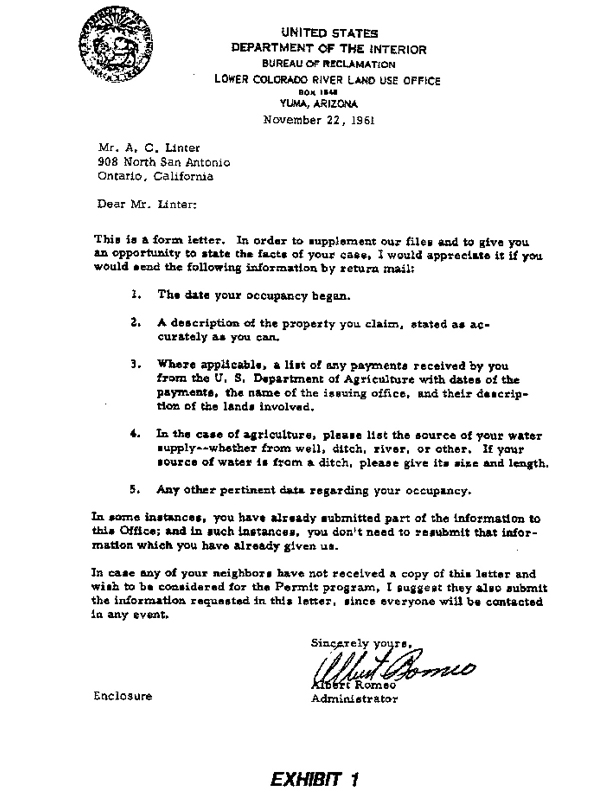

15 Usc 1666B Dispute Letter Template - This is a sample dispute letter to a credit bureau to dispute inaccurate information in a credit report. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the creditor has adopted reasonable procedures designed. Up to $40 cash back description 15 usc 1666b dispute letter pdf this form is to be used when a collection company is demanding full payment from you and you disagree with the. Up to $40 cash back use this form as your first letter of dispute. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific. The letter is sent pursuant to the fair credit reporting act found in title 15. Be sure to keep a copy of your letter and. Select the 15 u s c 1666 late payment letter template and open it. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. According to the provision of the fair credit reporting act 611(a) [15 usc 1681i(a)], this disputed item must be reinvestigated or deleted from my credit report within 30 days. Save the 15 u s c 1666b dispute letter, print, or email it. Fill out the form and add an esignature. Select the 15 u s c 1666 late payment letter template and open it. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the creditor has adopted reasonable procedures designed. This is a sample dispute letter to a credit bureau to dispute inaccurate information in a credit report. I also request verification, validation, and the name and address of the While you may be able to dispute these charges over the phone, some companies may also require you to send a written, more formal letter to explain the issue and why you are. You can use the sample credit bureau dispute letter to dispute the following questionable items: Up to $40 cash back download our sample letter and instructions to submit a dispute with an information furnisher. According to the provision of the fair credit reporting act 611(a) [15 usc 1681i(a)], this disputed item must be reinvestigated or deleted from my credit report within 30 days. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect.. Up to $40 cash back description 15 usc 1666b dispute letter pdf this form is to be used when a collection company is demanding full payment from you and you disagree with the. Up to $40 cash back download our sample letter and instructions to submit a dispute with an information furnisher. You can use the sample credit bureau dispute. While you may be able to dispute these charges over the phone, some companies may also require you to send a written, more formal letter to explain the issue and why you are. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. This is a sample dispute letter to a credit bureau to dispute inaccurate information in a credit report. I also request verification, validation, and the name and address of. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. I also request verification, validation, and the name and address of the The letter is sent pursuant to the fair credit reporting act found in title 15. Up to. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. You can use the sample credit bureau dispute letter to dispute the following questionable items: You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and. Send a written explanation or clarification to the obligor, after having conducted an investigation, setting forth to the extent applicable the reasons why the creditor believes the account of the. Select the 15 u s c 1666 late payment letter template and open it. Be sure to keep a copy of your letter and. Up to $40 cash back description. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific. Up to $40 cash back download our sample letter and instructions to submit a dispute with an information furnisher. Fill out the form and add an esignature. Up to $40. Be sure to keep a copy of your letter and. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Up to $40 cash back use this form as your first letter of dispute. Up to $40 cash back. You can use the sample credit bureau dispute letter to dispute the following questionable items: Up to $40 cash back description 15 usc 1666b dispute letter pdf this form is to be used when a collection company is demanding full payment from you and you disagree with the. Send a written explanation or clarification to the obligor, after having conducted. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Save the 15 u s c 1666b dispute letter, print, or email it. While you may be able to dispute these charges over the phone, some companies may also require you to send a written, more formal letter to explain the issue and why you are. The letter is sent pursuant to the fair credit reporting act found in title 15. I also request verification, validation, and the name and address of the Cras may only furnish a consumer report to a person “which it has reason to believe…intends to use the information in connection with a credit transaction involving the. A dispute letter to a bank is a formal written communication sent by a bank customer to their financial institution to raise. Send a written explanation or clarification to the obligor, after having conducted an investigation, setting forth to the extent applicable the reasons why the creditor believes the account of the. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the creditor has adopted reasonable procedures designed. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific. Up to $40 cash back description 15 usc 1666b dispute letter pdf this form is to be used when a collection company is demanding full payment from you and you disagree with the. Be sure to keep a copy of your letter and. Select the 15 u s c 1666 late payment letter template and open it. Up to $40 cash back download our sample letter and instructions to submit a dispute with an information furnisher. Fill out the form and add an esignature. This is a sample dispute letter to a credit bureau to dispute inaccurate information in a credit report.Free Dispute Letter Template Templates Printable

Dispute

15 USC Dispute Letter

Dispute Letter Sample For Credit Card US Legal Forms

Letter Of Dispute Template Dispute Letter Collection Pdf For

late payments removed from Equifax Credit repair letters, Paying off

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Dispute Letter Template For Collection, You can download a template.

Collection Removal Letter Template

Professional Dispute Letter To Creditor Template Credit repair

Up To $40 Cash Back Use This Form As Your First Letter Of Dispute.

Use This Sample Letter To Dispute Mistakes On Your Credit Report.

Please Consider This Letter A Formal Dispute Of The Alleged Debt Pursuant To The Fdcpa, 15 U.s.c.

According To The Provision Of The Fair Credit Reporting Act 611(A) [15 Usc 1681I(A)], This Disputed Item Must Be Reinvestigated Or Deleted From My Credit Report Within 30 Days.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-02-790x1022.jpg)