1099 Contract Template

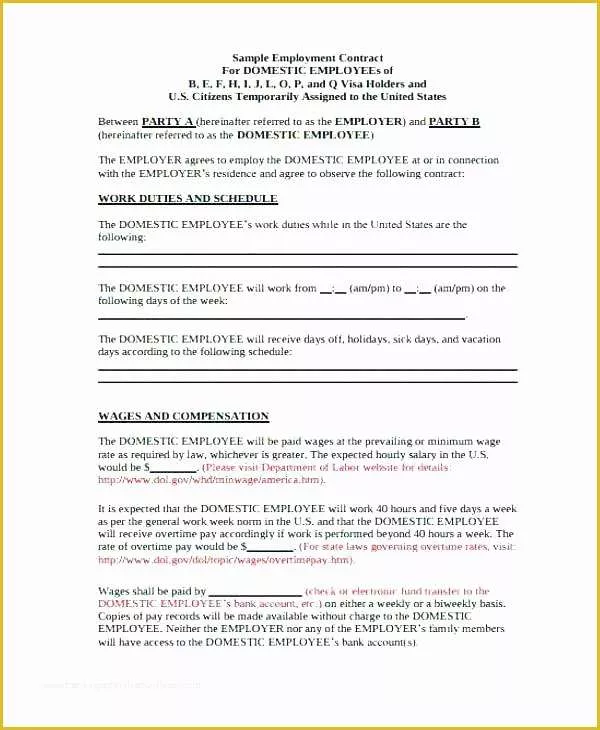

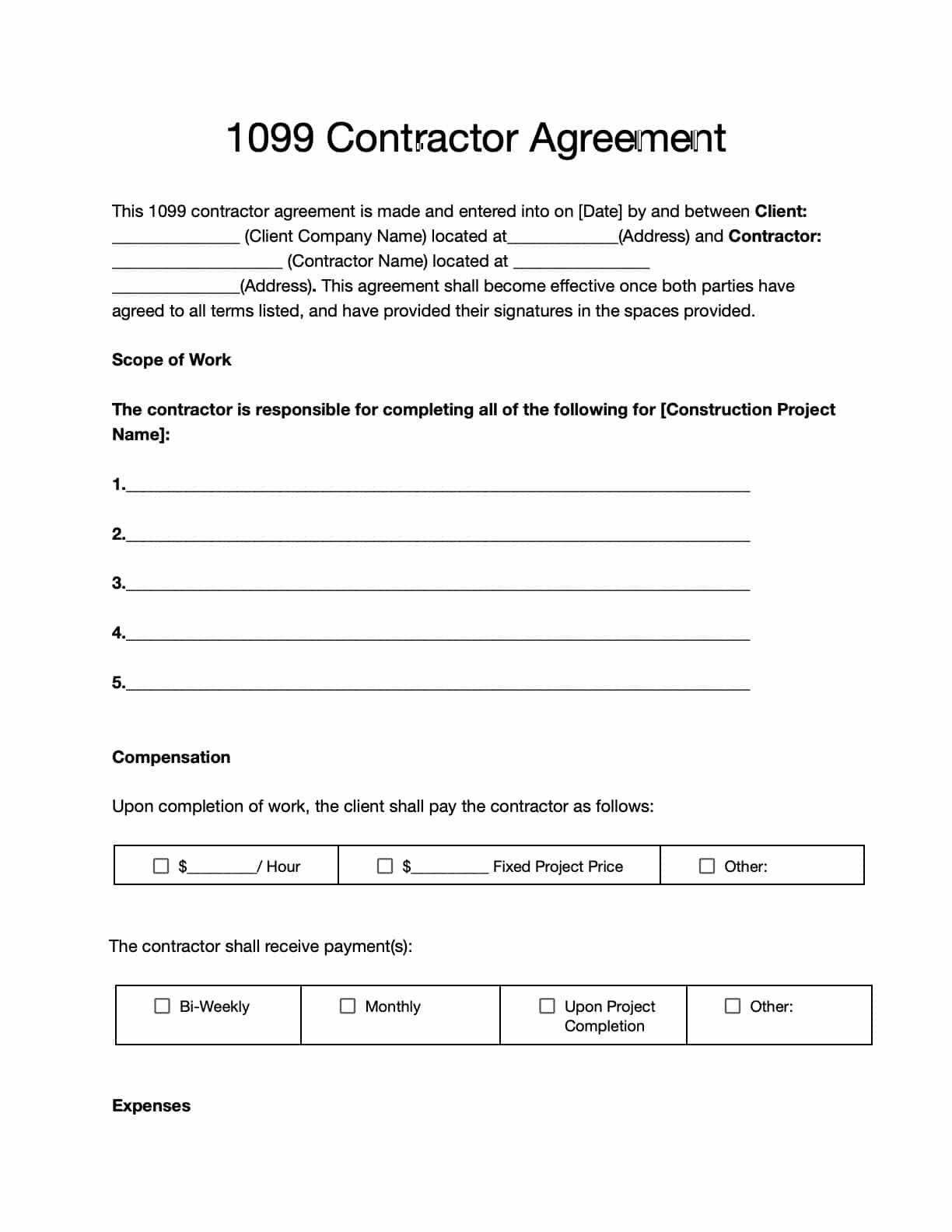

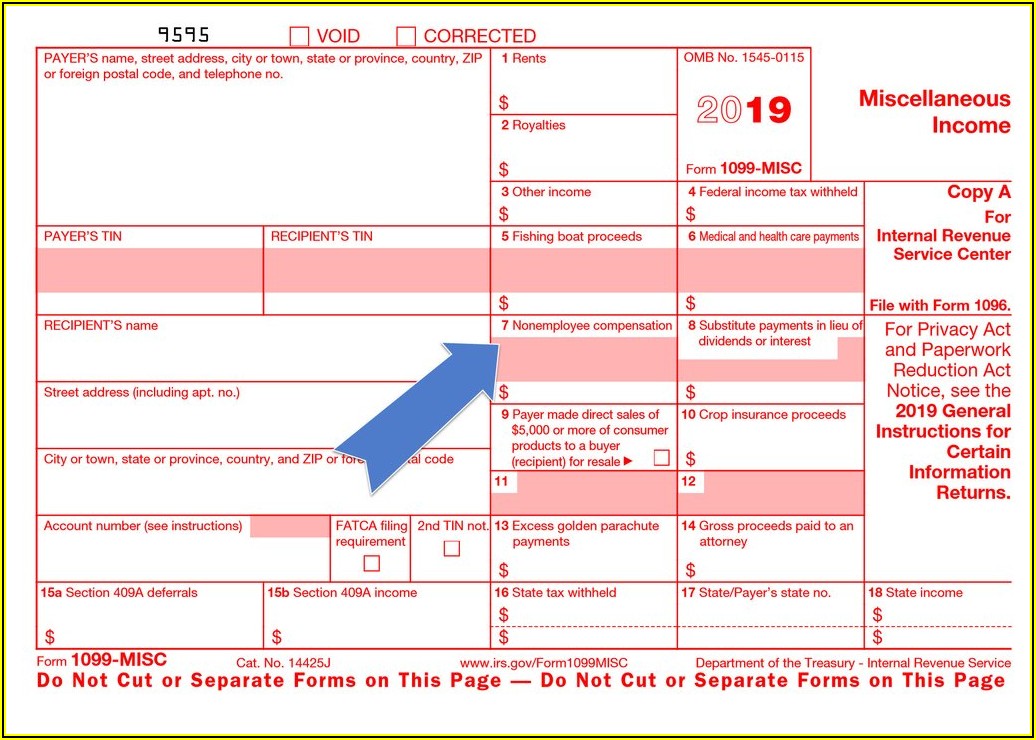

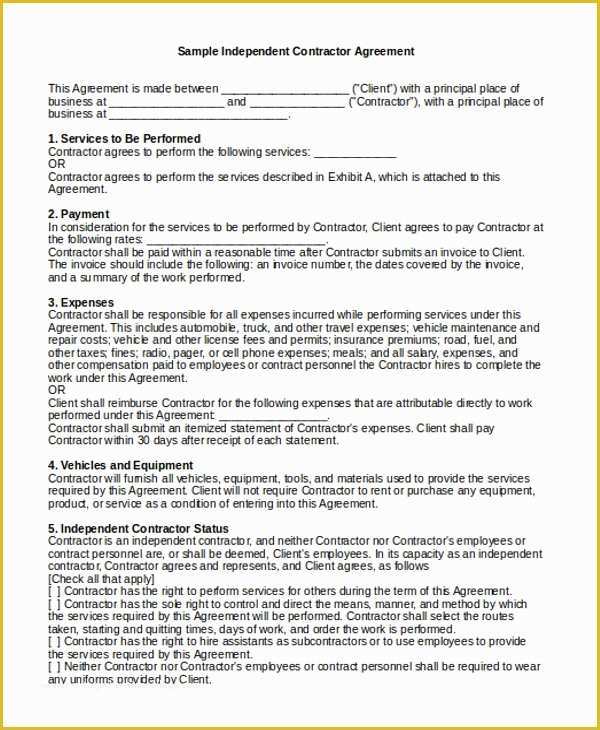

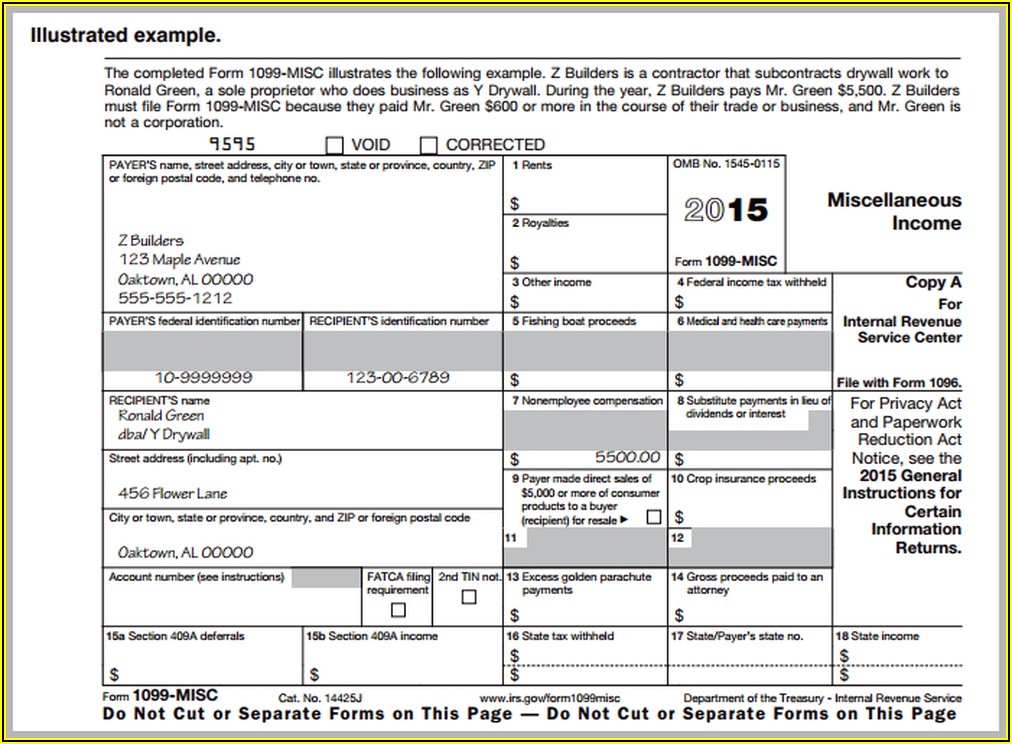

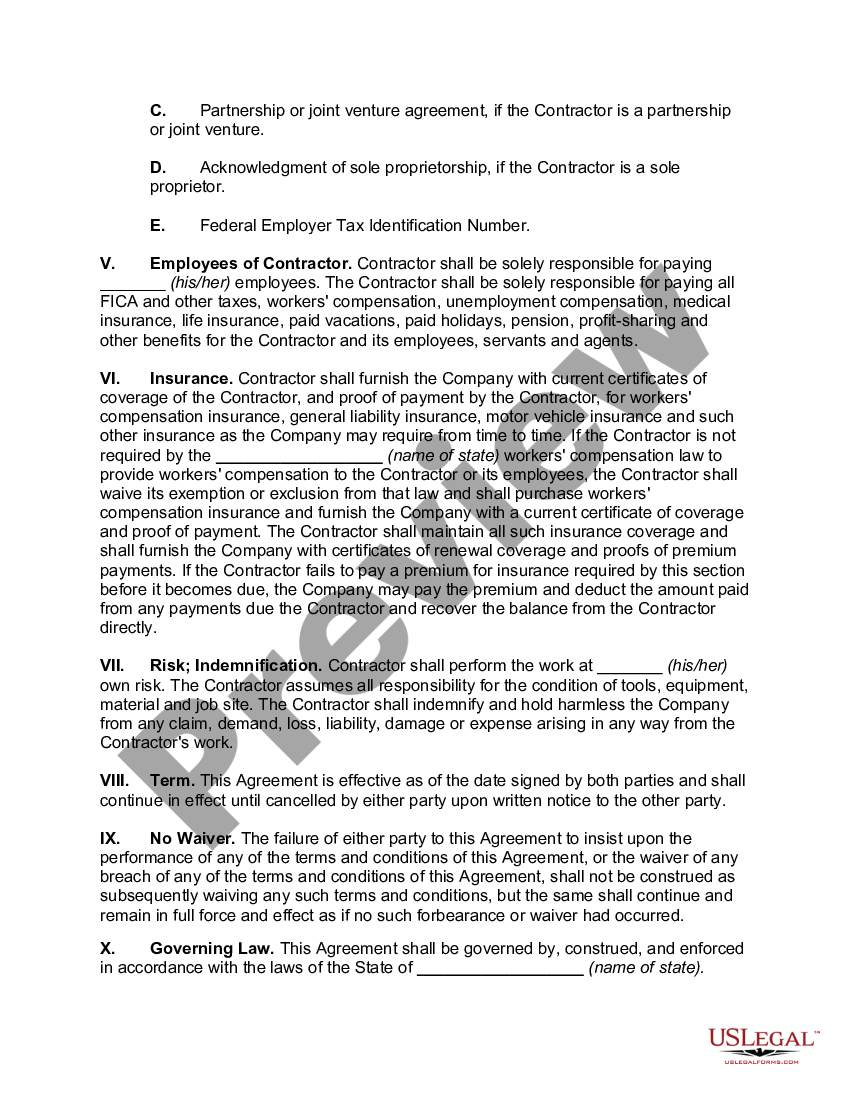

1099 Contract Template - The client employs the contractor as an independent contractor, and the contractor. For 1099 contracts, the contractor is responsible for managing and paying taxes on any income earned through this contract. There are nearly two dozen different kinds of 1099 forms, and each. This independent contractor agreement (“agreement”) is entered into between _____________________ (“contractor”), with an address of. A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. It's important to work with your legal counsel to draft a contractor agreement template that can be easily utilized across your contractor workforce and customized to protect your business from. Save progress and finish on any device,. Download free pdf, word, or opendocument templates for independent contractor agreements. Learn how to hire, pay, and file taxes for 1099 contractors by state, profession, or type. Start a contract to hire a freelancer now with an independent contractor agreement. Download a free template created by lawyers for. There are nearly two dozen different kinds of 1099 forms, and each. Create your own free, comprehensive document online now with our smart legal. Download free pdf, word, or opendocument templates for independent contractor agreements. A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. Download completed copies of form 1099 series information returns. In legal and administrative contexts, 1099 verification letters are critical. Start a contract to hire a freelancer now with an independent contractor agreement. Further, while employers pay withholding tax on behalf of their employees, independent contractors pay their withholding tax to local and federal authorities according to internal. It's important to work with your legal counsel to draft a contractor agreement template that can be easily utilized across your contractor workforce and customized to protect your business from. You can use irs form. Enter information into the portal or upload a file with a downloadable template in iris. Start a contract to hire a freelancer now with an independent contractor agreement. It also explains how to use the form to report various types of income and withholding, and how to. For 1099 contracts, the contractor is responsible for. An independent contractor agreement is a legal agreement between an independent contractor and their client. Create your own free, comprehensive document online now with our smart legal. For 1099 contracts, the contractor is responsible for managing and paying taxes on any income earned through this contract. Start a contract to hire a freelancer now with an independent contractor agreement. The. Download completed copies of form 1099 series information returns. Learn how to hire, pay, and file taxes for 1099 contractors by state, profession, or type. This independent contractor agreement (“agreement”) is entered into between _____________________ (“contractor”), with an address of. Download free pdf, word, or opendocument templates for independent contractor agreements. Learn the differences between 1099 and w2 employees, and. In legal and administrative contexts, 1099 verification letters are critical. Download a free template created by lawyers for. Also called a 1099 agreement, or a business contract, this document details. Further, while employers pay withholding tax on behalf of their employees, independent contractors pay their withholding tax to local and federal authorities according to internal. Enter information into the portal. Enter information into the portal or upload a file with a downloadable template in iris. Also called a 1099 agreement, or a business contract, this document details. Save progress and finish on any device,. Learn how to hire, pay, and file taxes for 1099 contractors by state, profession, or type. Download a free template created by lawyers for. They substantiate reported income during irs audits, clarify business relationships, and prevent tax. As an independent contractor, you will need to file taxes at the end of the year if your income exceeds $600 in a calendar year in accordance with the irs rules. Learn how to hire, pay, and file taxes for 1099 contractors by state, profession, or type.. You can use irs form. For 1099 contracts, the contractor is responsible for managing and paying taxes on any income earned through this contract. Download completed copies of form 1099 series information returns. Seller’s investment in life insurance contract. Learn the differences between 1099 and w2 employees, and what to include in your contract with independent contractors. Answer a few simple questions to make your document in minutes. Save progress and finish on any device,. Nothing in this agreement shall indicate the contractor is a partner, agent, or employee of the client. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. This independent contractor agreement (“agreement”). This independent contractor agreement (“agreement”) is entered into between _____________________ (“contractor”), with an address of. Learn the differences between 1099 and w2 employees, and what to include in your contract with independent contractors. The client shall not withhold any taxes from the contractor's. Save progress and finish on any device,. For 1099 contracts, the contractor is responsible for managing and. A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. There are nearly two dozen different kinds of 1099 forms, and each. Each 1099 form has specific boxes for distinct types of payments. Download free pdf, word, or opendocument templates for independent contractor agreements.. Start a contract to hire a freelancer now with an independent contractor agreement. There are nearly two dozen different kinds of 1099 forms, and each. Download completed copies of form 1099 series information returns. Nothing in this agreement shall indicate the contractor is a partner, agent, or employee of the client. Learn the differences between 1099 and w2 employees, and what to include in your contract with independent contractors. Download a free template created by lawyers for. The client employs the contractor as an independent contractor, and the contractor. Create your own free, comprehensive document online now with our smart legal. Also called a 1099 agreement, or a business contract, this document details. Further, while employers pay withholding tax on behalf of their employees, independent contractors pay their withholding tax to local and federal authorities according to internal. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. It's important to work with your legal counsel to draft a contractor agreement template that can be easily utilized across your contractor workforce and customized to protect your business from. A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. This independent contractor agreement (“agreement”) is entered into between _____________________ (“contractor”), with an address of. Enter information into the portal or upload a file with a downloadable template in iris. In legal and administrative contexts, 1099 verification letters are critical.Independent Contractor Agreement 1099 Contract Template 1099 New Hire

Free 1099 Employee Contract Template

Contractors Agreement Template

1099 Employee Contract Template

Printable Independent Contractor 1099 Form Printable Forms Free Online

1099 Employee Contract Template

1099 Employee Contract Template

Contract Independent Contractor Agreement With 1099 Form US Legal Forms

Printable Independent Contractor 1099 Form Printable Forms Free Online

19 New Sample 1099 Contractor Agreement

For 1099 Contracts, The Contractor Is Responsible For Managing And Paying Taxes On Any Income Earned Through This Contract.

Seller’s Investment In Life Insurance Contract.

Download Free Pdf, Word, Or Opendocument Templates For Independent Contractor Agreements.

It Also Explains How To Use The Form To Report Various Types Of Income And Withholding, And How To.

Related Post: